PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849963

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849963

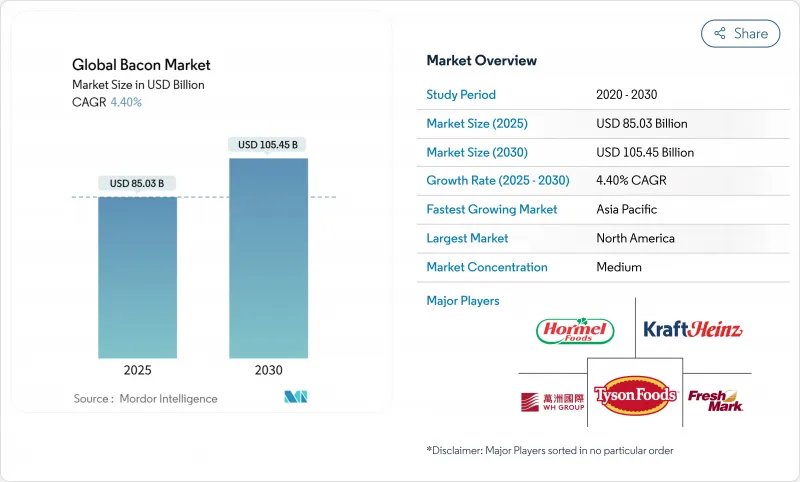

Bacon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bacon market size is expected to grow from USD 85.03 billion in 2025 to USD 105.45 billion by 2030, at a CAGR of 4.40%.

The market growth is driven by bacon's established position as a breakfast food and its increasing use as a flavor enhancer in various dishes. The expansion of quick-service restaurants (QSRs) globally has significantly contributed to bacon consumption, particularly in sandwiches, burgers, and other menu items. Rising disposable incomes in urban Asian markets have led to increased Western food adoption, including bacon-based products. Product innovations, including low-sodium variants, flavored options, and pre-cooked products, have expanded consumer choices and convenience. The market shows distinct regional patterns, with mature Western markets focusing on premium products, artisanal preparations, and organic variants, while emerging economies experience volume-driven growth through modern retail channels and growing foodservice sectors. These trends reflect the influence of evolving consumer preferences, retail development, and changing dietary habits across different regions.

Global Bacon Market Trends and Insights

Rising Demand For Protein-Rich and Savory Foods Drives Demand

Protein consumption patterns across emerging markets demonstrate accelerating demand for high-quality animal proteins, with bacon benefiting from its concentrated protein content and umami-rich flavor profile. Brazil's pork production is forecasted to increase by 2% in 2025 to 4.73 million metric tons in 2025, driven by lower feed costs and strong external demand, according to the United States Department of Agriculture . The protein premiumization trend particularly benefits bacon producers, as consumers increasingly view bacon as a flavor enhancer rather than merely a breakfast item. Asian markets show a remarkable appetite for Western protein formats, with Thailand's foodservice sector sourcing 30-35% of products through imports, including significant volumes of United States beef and bacon in 2024, according to the United States Department of Agriculture . This dietary evolution creates sustained demand momentum, particularly in urban centers where disposable income growth enables premium protein purchases. The combined effect of higher protein aspirations, umami-driven taste preferences, and premiumization of meal occasions underpins a durable uptick in bacon consumption across varied demographics.

Product Innovation With Flavors and Healthier Options Drives Growth

Innovation cycles in bacon manufacturing accelerated significantly in 2024, with major producers launching differentiated products targeting health-conscious consumers and flavor experimentation. Hormel Foods introduced Oven-Ready Thick-Cut Bacon with simplified cooking methods in September 2024. In a similar vein, in March 2024, Applegate Farms released Fully Cooked Sunday Bacon, specifically targeting health-conscious demographics, highlighting a shift in the industry, i.e., wellness trends can coexist with bacon consumption, leading to reimagined product formulations. Brands are ramping up research and development investments, delving into reduced sodium content, natural curing agents, and cleaner ingredient lists, all in a bid to align with shifting consumer expectations. Further, the innovation pipeline extends beyond flavor and ingredient enhancements to include advancements in processing technologies, with companies investing in automated packaging systems such as JLS Automation's Harrier bacon draft loading system, introduced in May 2025, which improves food safety and reduces labor costs. These technological advances enable producers to deliver consistent quality while meeting diverse consumer preferences, creating competitive differentiation in an otherwise commoditized market.

Health Concerns Related To High Fat Content Hinders Demand

In 2024, the Food Safety and Inspection Service (FSIS) heightened its regulatory scrutiny. This came on the heels of FSIS issuing public health warnings about bacon products surpassing sodium nitrite regulatory limits, underscoring ongoing health concerns that hinder market growth. The United Kingdom's mandatory nutritional labeling requirements influence consumer purchasing decisions, creating pressure for manufacturers to develop reformulated products that maintain taste while reducing health-negative attributes. Bacon's positioning as a flavor enhancer rather than primary protein source partially mitigates health concerns through portion control, yet sustained medical evidence linking processed meat consumption to cardiovascular disease creates persistent headwinds. According to the American Journal of Clinical Nutrition, consuming processed meat elevates the risk of mortality and significant cardiovascular events, in contrast to those who abstain from such meats. Companies respond through product innovation, developing lower-sodium and nitrite-free variants, though these alternatives often command premium pricing that limits mass market adoption.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Quick-Service and Fast-Food Restaurants Boosts Demand

- Retail Expansion in Emerging Markets Drives Sales

- Rising Adoption of Vegan and Plant-Based Diets Slows Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Standard bacon maintains market leadership with 56.66% share in 2024, while ready-to-eat bacon commands the fastest growth trajectory at 6.77% CAGR through 2030. This dynamic reflects fundamental shifts in consumer behavior toward convenience-oriented food solutions, where time constraints increasingly outweigh traditional preparation preferences. Standard bacon's dominant position stems from its versatility across cooking applications and established consumer familiarity, yet ready-to-eat variants capture premium pricing through value-added processing and packaging innovations. Retail stores are allocating more shelf space to ready-to-eat products that feature resealable packaging, microwave-ready options, and controlled portions to improve consumer convenience.

The convenience segment benefits from foodservice adoption, where precooked bacon reduces kitchen labor costs and preparation time while maintaining consistent quality standards. Ready-to-eat products enable manufacturers to capture higher margins while addressing operational efficiency demands from restaurant chains and institutional buyers. Manufacturers and quick-service restaurant (QSR) chains have formed strategic partnerships to develop customized bacon products that meet specific menu requirements. The segment's growth trajectory suggests sustained consumer willingness to pay premiums for convenience, creating opportunities for continued product innovation and market expansion.

Pork holds a dominant 92.77% market share in 2024, reflecting bacon's traditional pork-based production and established supply chain networks. Beef bacon demonstrates the highest growth potential with a 5.51% CAGR through 2030, supported by dietary diversification and religious requirements in various markets. This growth indicates consumer acceptance of bacon alternatives that deliver similar taste experiences while meeting specific dietary needs. Turkey and chicken bacon occupy niche segments, primarily targeting health-conscious consumers seeking reduced-fat options. Rising awareness of clean-label and ethically sourced meats is also prompting consumers to explore alternative bacon formats.

Beef bacon's growth stems from its premium market position and distinct flavor profile, attracting consumers interested in alternative protein options. In Muslim-majority countries, religious dietary guidelines create consistent demand for non-pork alternatives, strengthening beef bacon's market presence. While established processing infrastructure and cost advantages support pork bacon's market position, beef bacon's growth indicates sufficient market demand to support dedicated production facilities. Foodservice operators such as The Cheese Cake Factory in Middle Eastern countries are increasingly integrating beef bacon into diverse menu offerings, enhancing its visibility and mainstream acceptance.

The Bacon Market Report is Segmented by Product Type (Standard Bacon and Ready-To-Eat Bacon), Meat Type (Pork, Beef, and Other Meat Types), Cut Type (Sliced Bacon, Bacon Bits/Crumbled Bacon, and More), Distribution Channel (Retail and Foodservice), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds a dominant 38.51% market share in 2024, supported by established bacon consumption patterns and a comprehensive foodservice infrastructure that makes bacon a consistent menu item across restaurants. The region leverages well-developed supply chains, modern processing technologies, and strong consumer acceptance that enables both mass-market and premium product sales. Further, in 2024, the United States exported a record 3.03 million metric tons (mt) of pork and pork variety meat, valued at USD 8.63 billion . The mature market environment limits volume growth, pushing companies to focus on product innovation and premium segment development.

Asia-Pacific demonstrates the highest growth rate at 6.43% CAGR through 2030, reflecting the effects of urbanization and increasing Western food adoption on traditional protein consumption. According to the United States Department of Agriculture, China's pork import is expected to remain stable, mainly due to flat domestic consumption and ample production. Further, the Japanese food processing sector shows increasing demand for pre-prepared foods, driven by an aging population and convenience preferences. In Southeast Asia, as disposable incomes rise and modern retail channels expand, the demand for value-added meat products, such as flavored and precooked bacon, is surging.

European markets experience growth limitations despite traditional bacon consumption and advanced food processing capabilities, due to increased input costs, environmental regulations, and animal health concerns. Regulatory requirements increase operational expenses while environmental compliance necessitates production system changes that affect operational efficiency. The Middle East and Africa present growth potential through economic development and urbanization, with product development and marketing addressing specific cultural and religious requirements. South America, with Brazil at the forefront, is expanding its pork production and export capabilities through cost-effective operations, enhanced processing facilities, and rising global demand for pork products.

- Hormel Foods Corporation

- Tyson Foods Inc.

- WH Group Limited

- JBS S.A.

- The Kraft Heinz Company

- Fresh Mark Inc.

- Maple Leaf Foods

- Seaboard Corporation

- Danish Crown A/S

- BRF S.A.

- Clemens Food Group

- SunPork Group

- NH Foods Ltd.

- HKScan

- Applegate Farms

- Karro Food Group

- Indiana Packers Corporation (Mitsubishi Corporation)

- Vion Food Group

- SugarCreek Packing Company

- Itoham Yonekyu Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand For Protein-Rich and Savory Foods Drives Demand

- 4.2.2 Product Innovation With Flavors and Healthier Options Drives Growth

- 4.2.3 Growth of Quick-Service and Fast-Food Restaurants Boosts Demand

- 4.2.4 Retail Expansion in Emerging Markets Drives Sales

- 4.2.5 Expansion of Ready-to-Eat and Convenience Foods Boosts Demand for Bacon

- 4.2.6 Increasing Popularity of Western Cuisines Worldwide Surges Demand

- 4.3 Market Restraints

- 4.3.1 Health Concerns Related to High Fat Content Hinders Demand

- 4.3.2 Rising Adoption of Vegan and Plant-Based Diets Slows Demand

- 4.3.3 Growing Awareness of Animal Welfare and Ethics Restricts Growth

- 4.3.4 Availability of Meat Alternatives Reduces Bacon Demand

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Advancements

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Standard Bacon

- 5.1.2 Ready-to-Eat Bacon

- 5.2 By Meat Type

- 5.2.1 Pork

- 5.2.2 Beef

- 5.2.3 Other Meat Types

- 5.3 By Cut Type

- 5.3.1 Sliced Bacon

- 5.3.2 Bacon Bits/Crumbled Bacon

- 5.3.3 Bacon Rashers/Whole Slabs

- 5.3.4 Pre-Cooked Bacon

- 5.4 By Distribution Channel

- 5.4.1 Retail

- 5.4.1.1 Supermarkets/Hypermarkets

- 5.4.1.2 Convenience Stores

- 5.4.1.3 Specialty and Butcher Shops

- 5.4.1.4 Online Retail Stores

- 5.4.1.5 Other Distribution Channels

- 5.4.2 Foodservice

- 5.4.1 Retail

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Hormel Foods Corporation

- 6.4.2 Tyson Foods Inc.

- 6.4.3 WH Group Limited

- 6.4.4 JBS S.A.

- 6.4.5 The Kraft Heinz Company

- 6.4.6 Fresh Mark Inc.

- 6.4.7 Maple Leaf Foods

- 6.4.8 Seaboard Corporation

- 6.4.9 Danish Crown A/S

- 6.4.10 BRF S.A.

- 6.4.11 Clemens Food Group

- 6.4.12 SunPork Group

- 6.4.13 NH Foods Ltd.

- 6.4.14 HKScan

- 6.4.15 Applegate Farms

- 6.4.16 Karro Food Group

- 6.4.17 Indiana Packers Corporation (Mitsubishi Corporation)

- 6.4.18 Vion Food Group

- 6.4.19 SugarCreek Packing Company

- 6.4.20 Itoham Yonekyu Holdings Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK