PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849967

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849967

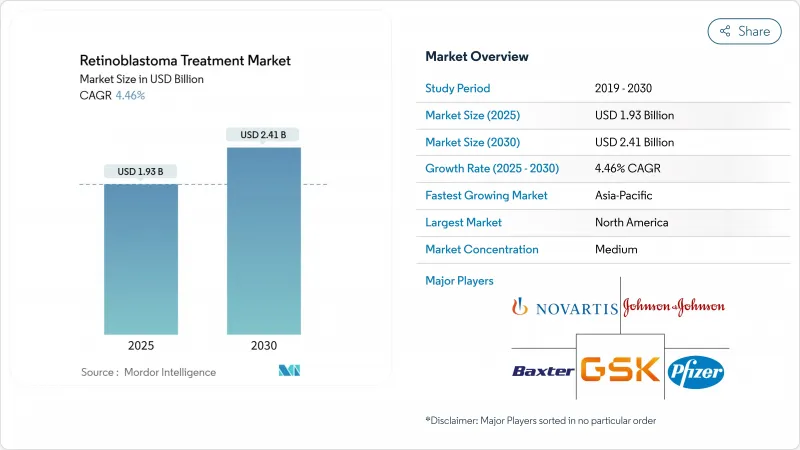

Retinoblastoma Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Retinoblastoma Treatment Market size is estimated at USD 1.93 billion in 2025, and is expected to reach USD 2.41 billion by 2030, at a CAGR of 4.46% during the forecast period (2025-2030).

Shifts toward precision chemotherapeutic delivery, newborn RB1 screening, and streamlined orphan-drug reimbursement sustain momentum even as wide survival gaps persist between high- and low-income regions. Intra-arterial chemotherapy now rivals systemic regimens after achieving 97% technical success, prompting device makers to scale temperature-stable formulations for export to emerging economies. Earlier genetic testing lifts hereditary case detection and feeds long-term surveillance demand, while policy clarity in the United States and Europe stabilizes pricing. Asia-Pacific posts the strongest growth as China and India expand pediatric oncology capacity and awareness campaigns trigger faster referrals.

Global Retinoblastoma Treatment Market Trends and Insights

Rising Incidence & Earlier Genetic Diagnosis

Enhanced genetic screening protocols drive market expansion as healthcare systems identify retinoblastoma cases earlier in disease progression. Newborn RB1 screening shortened median diagnosis age from 30.5 months to under 12 months in developed systems, lifting eye-preservation above 80% and enlarging the hereditary patient pool. Bilateral presentations now comprise 46.7% of referrals at specialty centers, expanding the retinoblastoma market for long-term imaging and counseling services. This diagnostic acceleration translates directly into improved treatment outcomes, with eye preservation rates exceeding 80% when intervention occurs before extraocular spread.

Increasing Success of Ophthalmic Artery Chemosurgery

Across 658 procedures, intra-arterial chemotherapy achieved 97% catheter success and 78.6% eye salvage with complications below 1.1%. Alternative carotid routes widen eligibility when ophthalmic access is difficult, and global training programs accelerate adoption, adding depth to the retinoblastoma market for catheter systems. Alternative delivery routes through external carotid arteries provide equivalent efficacy when primary ophthalmic artery access proves challenging, ensuring treatment accessibility across diverse anatomical presentations. The technique's success has catalyzed specialized training programs globally, with catheterization success rates improving from 80% to 89.2% over recent years.

High Cost of Multimodal Therapy

Combined protocol costs exceed USD 100,000 per patient and sit outside public coverage in many LMICs. Indonesia still lacks national reimbursement for intra-arterial therapy despite strong clinical data.Gene therapy financing presents additional complexity, with high upfront costs necessitating innovative payment models including risk-sharing arrangements and outcome-based contracts to ensure patient access while maintaining healthcare system sustainability. The economic burden extends beyond direct treatment costs to include specialized facility requirements, trained personnel, and long-term follow-up care, particularly challenging for healthcare systems with limited pediatric oncology infrastructure.

Other drivers and restraints analyzed in the detailed report include:

- Growing Public-Private Awareness Campaigns

- Rare-Disease Reimbursement & Orphan-Drug Incentives

- Post-Treatment Vision-Loss Risk Deterring Caregivers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chemotherapy retains primacy, holding 28.46% of total spending in the retinoblastoma market in 2024, thanks to entrenched protocols and insurer familiarity. Targeted and gene-based options grow at 8.33% CAGR, fueled by p53-MDMX and HDAC inhibitors that deliver higher intraocular concentrations when given subconjunctivally. The retinoblastoma market size for targeted modalities is projected to rise steadily as safety profiles improve, allowing therapy in infants. Radiation segments contract as secondary-malignancy risk deters use, especially for hereditary patients.

Intra-arterial chemotherapy dominates innovation narratives. Eye salvage reaches 78.6% in complex eyes, and overall survival remains 100% in specialized centers, cementing its role as a frontline option. Demand for micro-catheters and chilled melphalan injectables enlarges the global retinoblastoma market footprint despite persistent cold-chain gaps in emerging countries.

The Retinoblastoma Market Report is Segmented by Treatment Type (Surgery, Radiation Therapy, Laser Therapy, Cryotherapy, and More), Type of Retinoblastoma (Non-Hereditary Retinoblastoma, Hereditary Retinoblastoma), Type of Staging (Intraocular And, Extraocular), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 37.48% of the retinoblastoma market in 2024, supported by broad insurance coverage for orphan drugs and specialized ocular-oncology units. Eye-preservation exceeds 85%, yet only 1,646 pediatric eye specialists cover a population of 76 million children, leaving rural gaps that tele-oncology projects attempt to bridge.

Europe mirrors survival outcomes, but reimbursement reviews often span four years, slowing the diffusion of targeted agents. Asia-Pacific is the fastest-growing region at 9.23% CAGR; China and India now host more than 50 dedicated centers combined, though catheter labs and cold-chain infrastructure lag outside tier-one cities. India's roughly 1,500 new cases yearly highlight volume opportunity, but survival ranges from 75.7% to 92% depending on socioeconomic status. Government grants subsidize AI-based screening pilots designed to cut median diagnosis delay from 7.4 months to under 4 months by 2030.

The Middle East, Africa, and Latin America progress steadily yet still record higher extraocular incidence. Philanthropic referrals to regional hubs in Jordan, Pakistan, and South Africa treat several hundred children annually, but visa and cost barriers curb the scale. Portable angiography units and outcome-linked drug-donation schemes are gaining traction as companies seek to widen the retinoblastoma market footprint in underserved territories.

- Baxter

- Bristol-Myers Squibb

- Zydus Group

- GlaxoSmithKline

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Teva Pharmaceutical Industries

- Innovation Pharmaceuticals

- Icon Bioscience Inc.

- Phio Pharmaceuticals

- Roche

- Aura Biosciences Inc.

- Regeneron Pharmaceuticals

- Santen Pharmaceuticals

- Bayer

- Castle Biosciences Inc.

- Qilu Pharmaceutical Co., Ltd.

- Aadi Bioscience Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence & Earlier Genetic Diagnosis

- 4.2.2 Increasing Success of Ophthalmic Artery Chemosurgery (OAC)

- 4.2.3 Growing Public-Private Awareness Campaigns

- 4.2.4 Rare-Disease Reimbursement & Orphan-Drug Incentives

- 4.2.5 AI-Enabled Smartphone Fundus Screening in LMICs

- 4.2.6 Global Philanthropic Cross-Subsidy Drug Programs

- 4.3 Market Restraints

- 4.3.1 High Cost of Multimodal Therapy

- 4.3.2 Post-Treatment Vision-Loss Risk Deterring Caregivers

- 4.3.3 Shortage of Pediatric Ocular-Oncology Specialists

- 4.3.4 Cold-Chain Gaps for Intra-Arterial Chemo Devices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Treatment Type

- 5.1.1 Surgery

- 5.1.2 Radiation Therapy

- 5.1.2.1 External Beam

- 5.1.2.2 Brachytherapy

- 5.1.3 Laser Therapy

- 5.1.4 Cryotherapy

- 5.1.5 Chemotherapy

- 5.1.5.1 Systemic IV

- 5.1.5.2 Intra-arterial

- 5.1.6 Targeted & Gene-based Therapy

- 5.1.7 Bone-Marrow/Stem-Cell Transplant

- 5.2 By Type of Retinoblastoma

- 5.2.1 Non Hereditary Retinoblastoma

- 5.2.2 Hereditary Retinoblastoma

- 5.3 By Type of Staging

- 5.3.1 Intraocular

- 5.3.2 Extraocular

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Baxter International Inc.

- 6.3.2 Bristol-Myers Squibb Co.

- 6.3.3 Cadila Pharmaceuticals

- 6.3.4 GlaxoSmithKline plc

- 6.3.5 Johnson & Johnson

- 6.3.6 Merck & Co., Inc.

- 6.3.7 Novartis AG

- 6.3.8 Pfizer Inc.

- 6.3.9 Teva Pharmaceutical Industries Ltd.

- 6.3.10 Innovation Pharmaceuticals Inc.

- 6.3.11 Icon Bioscience Inc.

- 6.3.12 Phio Pharmaceuticals Corp.

- 6.3.13 F. Hoffmann-La Roche Ltd.

- 6.3.14 Aura Biosciences Inc.

- 6.3.15 Regeneron Pharmaceuticals Inc.

- 6.3.16 Santen Pharmaceutical Co., Ltd.

- 6.3.17 Bayer AG

- 6.3.18 Castle Biosciences Inc.

- 6.3.19 Qilu Pharmaceutical Co., Ltd.

- 6.3.20 Aadi Bioscience Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment