PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849971

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849971

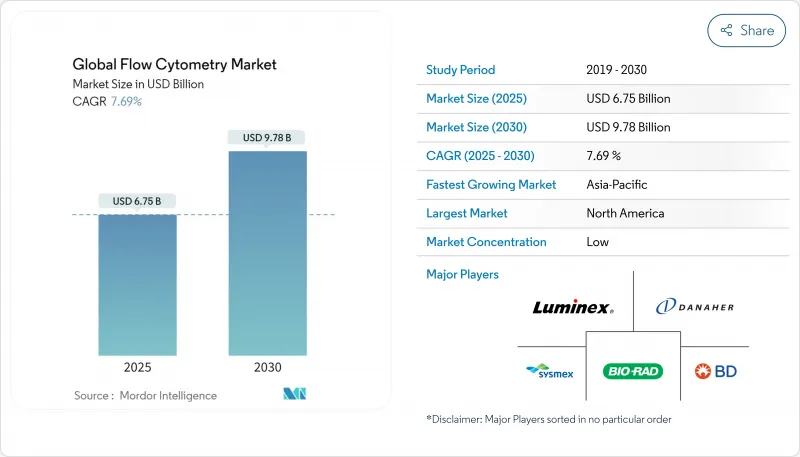

Global Flow Cytometry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Flow Cytometry Market size is estimated at USD 6.75 billion in 2025, and is expected to reach USD 9.78 billion by 2030, at a CAGR of 7.69% during the forecast period (2025-2030).

Rising demand for single-cell analytics in translational research and the steady migration of high-parameter platforms into regulated laboratories underpin this expansion. Hospital consolidation in North America is sustaining instrument refresh cycles, while Asian biotechnology clusters are fuelling incremental unit sales. Intelligent software that automates panel design and gating is lowering the expertise threshold, opening fresh revenue streams in community laboratories. Vendors continue to differentiate through spectral optics, acoustic-focusing, and image-enabled sorters that compress turnaround times and expand analyte menus, positioning flow cytometry as an essential companion to multi-omics workflows.

Global Flow Cytometry Market Trends and Insights

Growing adoption in stem-cell and regenerative-medicine workflows

Stem-cell laboratories rely on flow cytometry to enumerate CD34+ hematopoietic stem cells directly from minimally processed blood, reducing graft adequacy variability and accelerating transplantation decisions. Umbilical cord-blood banks have scaled globally as standardized cytometric assays safeguard inventory quality. Accurate quantification of immunologic reconstitution after transplant further solidifies cytometry's role in long-term patient monitoring. The procedure's direct-measurement protocol trims processing steps, enabling same-day release decisions that shorten hospitalization. As gene-edited stem-cell therapies move toward commercialization, demand for rapid in-process characterization is set to intensify, widening the installed base across cell-therapy manufacturing centers. These factors collectively reinforce the flow cytometry market trajectory among regenerative-medicine stakeholders.

Increasing adoption in clinical diagnostics

Flow cytometry now underpins immunophenotyping panels for leukemia, lymphoma, and primary-immune disorders. FDA clearance of a 13-color clinical cytometer in March 2024 reduced validation hurdles for community pathology labs. Integration with bi-directional LIS connectivity cuts manual transcription errors and satisfies accreditation requirements. Oncology testing volumes are rising as minimal residual disease assays become routine, expanding reagent consumption and service contracts. Infectious-disease labs use high-parameter panels to track rare cell subsets during viral outbreaks, a capability highlighted during recent respiratory pathogen surveillance. These clinical expansions continue to anchor recurring revenue streams and lift the aggregate flow cytometry market.

Other drivers and restraints analyzed in the detailed report include:

- Advances in tools and techniques

- Expanding clinical applications through companion diagnostics

- Lack of skilled cytometrists driving outsourcing to reference labs

- Data-management and cybersecurity concerns with cloud-based workflows

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software revenue is rising fastest at a 10.34% CAGR as laboratories prioritize intelligent analytics that trim analysis times. The flow cytometry market size for instruments remained the largest in 2024, with a 34.90% segment share secured by constant upgrades in detector sensitivity and spectral resolution. Vendors package integrated ecosystems where turnkey analysis suites lock in recurring licensing fees and encourage reagent loyalty. Analysts expect incremental growth as cloud-hosted applications reach midsized hospitals that had previously been priced out of high-parameter workflows. Meanwhile, reagents and consumables benefit from expanded dye libraries that lengthen panel lists, sustaining installed-base pull-through. These interdependent trends illustrate how software ascendance complements, rather than cannibalizes, hardware revenue across the flow cytometry market.

Instrument sales climb further as real-time imaging modules win adoption among immuno-oncology groups demanding morphological confirmation. Spectral sorters that retain viability during high-speed isolation of rare subsets are penetrating cell-therapy manufacturing suites. The co-evolution of reagent chemistries optimized for full-spectrum detection fosters vendor lock-in and drives compound annual growth above historical trajectories. Continued funding for algorithm innovation signals that intuitive analysis will remain a competitive differentiator, anchoring the long-term revenue outlook for integrated product portfolios.

Cell-based methods accounted for 72.30% of 2024 revenue, underscoring their foundational role in immunophenotyping and cell-therapy quality control. Bead-based assays, however, are on a 9.80% CAGR path as multiplex cytokine quantification gains favor in translational research. The flow cytometry market share lead of cell-based platforms stems from unmatched single-cell resolution, yet hybrid instruments capable of running both bead and cell protocols on the same optical train now appeal to budget-constrained core facilities. Imaging modules and acoustic-focusing refinements further blur segment lines by adding morphological or high-throughput benefits without abandoning fluorescence detection standards.

Advances in acoustic wave alignment decrease coefficient of variation at elevated event rates, allowing screening groups to process compound libraries faster. Image-enabled spectral sorters provide researchers with immediate visual confirmation of phenotypes, enhancing confidence in downstream functional assays. These converging capabilities encourage laboratories to upgrade rather than delay purchases, propelling the flow cytometry market.

The Flow Cytometry Market Report Segments by Product and Services (Instrument, Kit and Reagent, and More), by Technology (Cell-Based Flow Cytometry, Bead-Based Flow Cytometry and More ), by Application (Clinical Diagnostics, Drug Discovery and Diagnostics and More), by End-User (Hospitals and Clinics, Pharmaceutical & Biotechnology Companies, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed the largest share at 41.20% in 2024, aided by mature reimbursement frameworks and deep oncology clinical-trial pipelines. Continuous instrument refresh cycles, clinical laboratory accreditation mandates, and FDA clearance of a next-generation 13-color cytometer have strengthened procurement confidence. National cancer institutes increasingly mandate high-parameter immunophenotyping for cell-therapy protocols, reinforcing reagent consumption and service subscriptions. Vendor collaborations with reference laboratories further speed diffusion of complex assays into mid-tier community hospitals, sustaining the flow cytometry market.

Asia-Pacific is the fastest-growing region, tracking an 8.96% CAGR over 2025-2030. Government funding packages aimed at precision medicine and infectious-disease readiness have stimulated laboratory expansions across China, Japan, and South Korea. A new 50,000-square-foot production site in China illustrates manufacturers' commitment to local demand and global supply-chain resilience. Local biotech start-ups, focused on CAR-T and iPSC therapies, seek full-spectrum profiling to accelerate candidate validation, bolstering the regional flow cytometry market.

Europe maintains steady growth as centralized healthcare systems invest in high-parameter instruments for national cancer screening programs. Regional research grants encourage spectral-flow method development in academic centers, driving reagent diversification. A partnership between a key vendor and Spanish genomics institutions is expected to spawn advanced immunology applications, reinforcing instrument utilisation rates cytekbio.com. Compliance with GDPR and evolving IVDR requirements keeps demand high for software modules with robust data-privacy features, channeling additional revenue into the European flow cytometry market.

- BD Biosciences (Becton, Dickinson and Company)

- Sysmex Partec

- Thermo Fisher Scientific (Invitrogen)

- Beckman Coulter Life Sciences (Danaher)

- Bio-Rad Laboratories

- Agilent Technologies (ACEA)

- Luminex (DiaSorin Group)

- Miltenyi Biotec

- Sony Biotechnology

- Cytek Biosciences

- Enzo Life Sciences

- Merck MilliporeSigma

- Curiox Biosystems

- NanoCellect Biomedical

- Mindray

- On-Chip Biotechnologies

- CytoBuoy B.V.

- Immudex

- Crown Bioscience

- RayBiotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Adoption of Flow Cytometry in Stem-Cell & Regenerative-Medicine Workflows

- 4.2.2 Increasing Adoption in clinical diagnostics

- 4.2.3 Advances in flow cytometry tools and techniques

- 4.2.4 Expanding clinical applications

- 4.2.5 Rising Use of Multi-Parametric Immuno-Oncology Panels in North America

- 4.2.6 Expansion of Cloud-Based Cytometry Analytics Platforms Across Europe

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Cytometrists Driving Outsourcing to Reference Labs

- 4.3.2 Stringent Reagent Registration Rules in EU MDR Impacting Time-to-Market

- 4.3.3 High Capital Costs of Cell-Sorter Platforms Limiting Adoption in Smaller Labs

- 4.3.4 Data-Management & Cybersecurity Concerns with Cloud-Based Workflows

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product & Service

- 5.1.1 Instruments

- 5.1.1.1 Cell Analyzers

- 5.1.1.2 Cell Sorters

- 5.1.2 Reagents & Consumables

- 5.1.2.1 Antibodies

- 5.1.2.2 Dyes & Beads

- 5.1.2.3 Kits & Panels

- 5.1.3 Software

- 5.1.4 Services

- 5.1.1 Instruments

- 5.2 By Technology

- 5.2.1 Cell-Based Flow Cytometry

- 5.2.2 Bead-Based Flow Cytometry

- 5.2.3 Imaging Flow Cytometry

- 5.2.4 Acoustic-Focusing Flow Cytometry

- 5.3 By Application

- 5.3.1 Clinical Diagnostics

- 5.3.1.1 Oncology

- 5.3.1.2 Hematology

- 5.3.1.3 Infectious Diseases

- 5.3.1.4 Organ Transplantation

- 5.3.2 Drug Discovery & Development

- 5.3.3 Stem-Cell Therapy & Regenerative Medicine

- 5.3.4 Immunology

- 5.3.5 Other Research Applications

- 5.3.1 Clinical Diagnostics

- 5.4 By End-User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Pharmaceutical & Biotechnology Companies

- 5.4.3 Contract Research & Reference Laboratories

- 5.4.4 Other End-Users

- 5.5 By Geography (Value, USD)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 BD Biosciences (Becton, Dickinson and Company)

- 6.3.2 Sysmex Partec

- 6.3.3 Thermo Fisher Scientific (Invitrogen)

- 6.3.4 Beckman Coulter Life Sciences (Danaher)

- 6.3.5 Bio-Rad Laboratories

- 6.3.6 Agilent Technologies (ACEA)

- 6.3.7 Luminex (DiaSorin Group)

- 6.3.8 Miltenyi Biotec

- 6.3.9 Sony Biotechnology

- 6.3.10 Cytek Biosciences

- 6.3.11 Enzo Life Sciences

- 6.3.12 Merck MilliporeSigma

- 6.3.13 Curiox Biosystems

- 6.3.14 NanoCellect Biomedical

- 6.3.15 Mindray

- 6.3.16 On-Chip Biotechnologies

- 6.3.17 CytoBuoy B.V.

- 6.3.18 Immudex

- 6.3.19 Crown Bioscience

- 6.3.20 RayBiotech

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment