PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849982

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849982

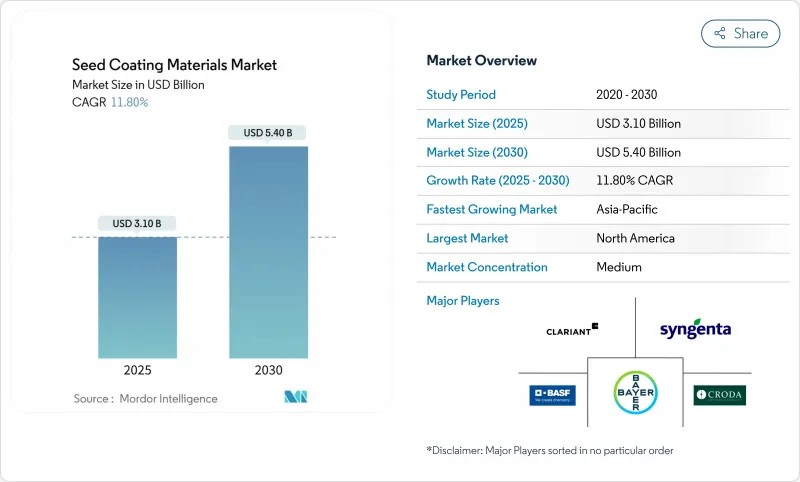

Seed Coating Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The seed coating material market is valued at USD 3.10 billion in 2025 and is forecast to reach USD 5.40 billion by 2030, expanding at an 11.80% CAGR.

Growth is powered by precision-agriculture adoption, stricter environmental regulations, and rapid innovation in polymer as well as bio-based chemistries. European microplastic restrictions are accelerating the pivot toward biodegradable binders, while Brazil's bio-input policies are reinforcing demand for plant-derived and microbial films. Nanotechnology and super-absorbent gels are turning coatings into multifunctional platforms that protect genetics, enhance germination, and improve water efficiency. Asia-Pacific and South America are registering the fastest uptake as growers modernize to manage climate variability and input costs; North America maintains scale leadership through integrated trait and coating packages in corn, soybean, and canola applications.

Global Seed Coating Materials Market Trends and Insights

High-quality seed demand from hybrid and GM seed expansion

More than 30 countries approved commercial GM cultivation by late 2024, including Kenya's BT cotton and Ghana's GM cowpea, widening the premium-seed footprint worldwide. The Environmental Protection Agency cleared new plant-incorporated protectants such as Brevibacillus laterosporus proteins for corn, signaling a smoother pathway for next-generation traits. As genetic value rises, growers seek coatings that ensure uniform emergence, protect high-cost traits, and simplify precision planting, reinforcing demand across the seed coating material market.

Rapid shift toward sustainable agriculture practices

Brazil's bio-inputs segment reached BRL 5 billion (USD 1 billion) in the 2023-2024 season, posting 15% annual growth and proving that biologicals can succeed at scale. Federal Law No. 15 070/2024 now offers a dedicated framework and funding for bio-inputs. Similar policy signals in Europe and the United States are steering investment toward plant-based polymers, starch binders, and microbial films that lower environmental footprints without sacrificing field performance.

Volatile prices of petro-derived binders and pigments

Natural-gas price swings and freight bottlenecks at the Panama and Suez canals have inflated chemical feedstock costs by up to 30%, squeezing margins for synthetic-coating producers. Smaller firms without multi-region supply contracts face the greatest exposure, prompting a pivot toward locally sourced starch binders. Although bio-based inputs carry higher purchase prices today, their cost profile is more stable, nudging procurement away from petroleum-linked materials in the seed coating material market.

Other drivers and restraints analyzed in the detailed report include:

- Continuous innovations in polymer and bio-based film technologies

- Imminent bans on microplastics accelerate eco-friendly coating R and D

- Complex global registration for multi-component formulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polymers generated 38% of 2024 revenue within the seed coating material market. Super-absorbent polymer gels are the fastest-rising ingredient class, surging at a 14.2% CAGR. Binders follow at 29.4%, while additives hold 12%. The ingredient mix is shifting toward starch-based binders, biodegradable polymers, and nanoparticle additives that elevate value capture. Zinc oxide and chitosan complexes have improved germination by 43%, showcasing the potential of nano-enabled coatings. Overall, the seed coating material market size for super-absorbent gels is expected to nearly double by 2030.

Premium pricing is strongest where polymers solve multiple pain points-adhesion, moisture control, and nutrient delivery, in a single pass. Suppliers of starch and hemicellulose binders are winning early contracts, especially in Europe, where buyers seek microplastic-free inputs ahead of 2028 enforcement. In Asia-Pacific, cost-sensitive growers still rely on polyvinyl acetate films, but subsidy programs tied to sustainability are nudging a gradual pivot toward bio-based options. As ingredient portfolios diversify, cross-licensing deals between chemical firms and microbial start-ups are accelerating time-to-market for next-generation formulations inside the seed coating material market.

Film coating captured 55% of 2024 process revenue due to its thin, uniform layers and compatibility with high-speed planters. Pelleting is projected to register a 15.5% CAGR as vegetable, flower, and small-seed acreage grows. Encrusting remains vital for cereals at a 24% share. Automation, real-time sensors, and low-dust formulations are widening performance gaps, helping firms command higher prices in the seed coating material market.

Regional equipment preferences shape process demand: pelleting machines dominate in greenhouse-heavy Netherlands, while drum film coaters lead in North American corn plants. Latin America is upgrading from batch coaters to continuous lines to keep pace with export seed standards, lifting throughput by 25% and trimming coating overuse. Vendors offering Internet-of-Things retrofits-temperature probes, airflow monitors, and feed-rate algorithms-are cutting downtime and cementing service revenues. These enhancements reinforce buyer confidence, supporting the seed coating material market share gains of process innovators.

The Seed Coating Materials Market is Segmented by Ingredient (Binders, Polymers, and Additives), Process (Film Coating, Encrusting, and Pelleting), Function (Seed Protection and Seed Enhancement), Crop Type (Grain and Cereal, Oilseed, and More), Coating Type (Synthetic and Bio-Based), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 35% of the 2024 seed coating material market share, supported by precision planting, trait stacking, and the widespread use of integrated coating packages. Suppliers bundle films, microbials, and lubricants within multi-year seed contracts, locking in steady adoption at a 9% CAGR through 2030. Corn, soybean, and canola account for most treated hectares, and recent vertical integration moves, such as Bayer's Alberta canola facility, keep value in the region. Public-private funding for climate-smart farming also channels acreage toward premium coatings that improve stand establishment and water efficiency.

Asia-Pacific is the fastest-growing region, advancing at an 11.5% CAGR and now representing the second-largest seed coating material market size after North America. China's seed revitalization strategy and India's 6.5 lakh-hectare rise in 2025 summer sowing are scaling demand for hybrid seed treatments. Government subsidies on precision planters and drought-resilient varieties push the adoption of film and pelleting technologies across rice, wheat, and horticulture crops. Local formulators partner with multinational ingredient suppliers to customize starch binders and color additives for regional planting equipment.

South America follows with a 10.8% CAGR, led by Brazil, where bio-inputs grew 15% in 2023-2024 and support eco-labeled coatings for soybean and corn exports. Europe's stringent microplastic ban is reshaping recipes, prompting early movers to secure compliant brands and pass on cost premiums to value-chain partners. Africa posts a 10.2% CAGR, although fragmented regulations slow market penetration; alliances with regional research institutes help suppliers validate microbial coatings under tropical storage conditions. Collectively, these regional dynamics diversify revenue streams while sustaining the global growth outlook for seed treatment technologies.

- Syngenta (Sinochem)

- BASF SE

- Bayer CropScience AG

- Clariant International (Clariant AG)

- Croda International

- Germains Seed Technology (Associated British Foods plc's)

- Precision Laboratories

- Roquette Group

- Brett Young

- Chromatech Incorporated

- Keystone Aniline Corporation (Milliken & Company)

- Lucent BioScience

- Michelman

- Nufarm Ltd.

- Ingredion Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High-quality seed demand from hybrid and GM seed expansion

- 4.2.2 Rapid shift toward sustainable agriculture practices

- 4.2.3 Continuous innovations in polymer and bio-based film technologies

- 4.2.4 Imminent bans on microplastics accelerate eco-friendly coating R and D

- 4.2.5 Adoption of super-absorbent polymers for climate-resilient cropping

- 4.2.6 Carbon-credit programs incentivizing microbial coated seeds

- 4.3 Market Restraints

- 4.3.1 Volatile prices of petro-derived binders and pigments

- 4.3.2 Complex global registration for multi-component formulations

- 4.3.3 Limited shelf-life of biological actives on-seed

- 4.3.4 Costly reformulations to meet upcoming EU-27 microplastic rules

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Ingredient

- 5.1.1 Binders

- 5.1.1.1 Bentonite

- 5.1.1.2 Polyvinyl Acetate

- 5.1.1.3 Polyvinylpyrrolidone

- 5.1.1.4 Methyl Cellulose

- 5.1.1.5 Styrene-Butadiene Rubber

- 5.1.1.6 Acrylics

- 5.1.1.7 Waxes / Wax Emulsions

- 5.1.2 Polymers

- 5.1.2.1 Film-forming Polymers

- 5.1.2.2 Super-absorbent Polymer Gels

- 5.1.3 Additives

- 5.1.3.1 Seed Planting Lubricants (Silicon, Talc, Graphite)

- 5.1.3.2 Fertilizer Enhancers (Micronutrient Dispersant, N-Inhibitor, Solvents)

- 5.1.3.3 Adjuvants

- 5.1.3.4 Colorants

- 5.1.1 Binders

- 5.2 By Process

- 5.2.1 Film Coating

- 5.2.2 Encrusting

- 5.2.3 Pelleting

- 5.3 By Function

- 5.3.1 Seed Protection

- 5.3.2 Seed Enhancement

- 5.4 By Crop Type

- 5.4.1 Grains and Cereals

- 5.4.2 Oilseeds

- 5.4.3 Fruits and Vegetables

- 5.4.4 Other Crops

- 5.5 By Coating Type

- 5.5.1 Synthetic

- 5.5.2 Bio-based

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Spain

- 5.6.3.6 Italy

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 Australia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 Turkey

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Syngenta (Sinochem)

- 6.4.2 BASF SE

- 6.4.3 Bayer CropScience AG

- 6.4.4 Clariant International (Clariant AG)

- 6.4.5 Croda International

- 6.4.6 Germains Seed Technology (Associated British Foods plc's)

- 6.4.7 Precision Laboratories

- 6.4.8 Roquette Group

- 6.4.9 Brett Young

- 6.4.10 Chromatech Incorporated

- 6.4.11 Keystone Aniline Corporation (Milliken & Company)

- 6.4.12 Lucent BioScience

- 6.4.13 Michelman

- 6.4.14 Nufarm Ltd.

- 6.4.15 Ingredion Inc.

7 Market Opportunities and Future Outlook