PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849985

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849985

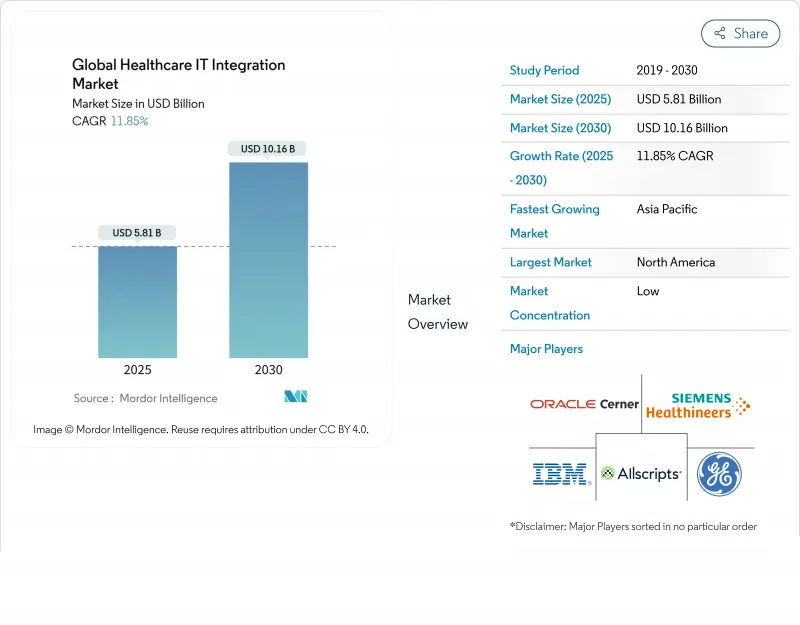

Global Healthcare IT Integration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Healthcare IT Integration Market size is estimated at USD 5.81 billion in 2025, and is expected to reach USD 10.16 billion by 2030, at a CAGR of 11.85% during the forecast period (2025-2030).

Strong growth stems from the need to consolidate fragmented data systems, comply with interoperability mandates, and support value-based care models that depend on friction-free data exchange. Provider consolidation, the steady rise of connected medical devices, and payer-provider convergence amplify demand for robust integration architectures. At the same time, FHIR-driven application programming interfaces (APIs) are redefining technical baselines, forcing both incumbent vendors and new entrants to modernize interface engines, API gateways, and data normalization pipelines. Heightened cyber-security expectations and the search for implementation talent, especially for HL7/FHIR specialists, are shaping investment priorities as organizations balance speed, security, and cost

Global Healthcare IT Integration Market Trends and Insights

Transition to FHIR-based APIs Mandated by US ONC & EU EHDS

The ONC final rule taking effect January 2026 and the EHDS regulation in force since March 2025 compel payers, providers, and vendors to support real-time, patient-authorized data flows built on FHIR resources, accelerating capital outlays for interface engine refreshes, API management, and semantic mapping tools. With 67% of organizations already running FHIR APIs in 2024, the Healthcare IT Integration market must absorb a steep learning curve in mapping legacy HL7v2 feeds to granular FHIR entities, promoting specialist demand even in mature North American settings. Providers unable to comply risk financial penalties and strategic disadvantages, prompting alliances between EHR vendors and niche integrators to co-develop migration accelerators and conformance testing frameworks.

Multi-system Integration Demand from Remote Patient Monitoring Programs

Demand surges as payers reimburse for remote patient monitoring (RPM) and hospital-at-home models. Nearly 50 million US patients use RPM devices, and outcomes improve markedly when monitoring feeds are embedded in EHR workflows-readmissions drop 38% compared with non-integrated deployments . Data flows now span wearables, smartphone apps, and cloud analytics, placing the Healthcare IT Integration market at the core of device-to-EHR orchestration, alert routing, and longitudinal record enrichment. Vendors with pre-built EHR connectors and FHIR-first architectures rank higher on purchasing shortlists, while hospitals tighten technical due-diligence criteria to ensure device data harmonize with quality-reporting metrics.

Implementation Talent Shortage for HL7/FHIR Specialists in Africa

African public and private providers confront delays of 6-12 months on critical projects due to a limited pool of integration engineers versed in HL7 and FHIR semantics healthtechafrica.org. Remote consulting alleviates only part of the gap, because onsite change-management and infrastructure work remain essential. The shortage raises labor costs, stretches go-live schedules, and reduces the addressable Healthcare IT Integration market until capacity-building programs mature. Emerging national eHealth strategies, such as Namibia's, earmark workforce development grants to expand certification programs.

Other drivers and restraints analyzed in the detailed report include:

- Device Integration Needs in Smart Operating Rooms across Middle East

- Increasing Need of Electronic Health Records and Other Healthcare IT Solutions

- Cyber-security Compliance Costs under GDPR & HIPAA Escalate Integration TCO

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services captured 57.56% of Healthcare IT Integration market share in 2024, a level that underlines the knowledge-intensive character of cross-platform interoperability projects. Advisory teams conduct workflow mapping, build interface specifications, run validation scripts, and maintain 24/7 support desks, all of which exceed the scope of off-the-shelf technology. This services heft is expected to persist as FHIR regulations tighten deliverables and as multi-vendor ecosystems demand continuous governance. Large health systems allocate rising operational budgets to managed-integration contracts that guarantee uptime and regulatory audit readiness.

The Products segment is forecast to grow 13.25% CAGR, outpacing overall Healthcare IT Integration market size expansion as interface engines, API gateways, and device-connect software adopt low-code design studios. Infor Cloverleaf alone processes more than 300 million daily transactions across one-third of US hospitals, illustrating how modern engines take over legacy script-heavy brokers. Cloud-based toolchains bundled with pre-validated FHIR implementation guides lower entry thresholds for mid-tier hospitals. Nevertheless, product success remains contingent on service partners who customize configurations and ensure data governance, reinforcing the intertwined growth paths of both segments.

On-premise deployments held 62.45% of Healthcare IT Integration market in 2024, underscoring hospitals' preference for sovereign control over protected health information and direct grasp of network segmentation strategies amid escalating ransomware threats. High breach penalties incentivize chief information security officers to keep mission-critical integration engines behind institutional firewalls, coupled with custom hardware acceleration for message parsing. The Healthcare IT Integration market size attached to on-premise models, therefore, remains material even as cloud adoption climbs.

Cloud-hosted integration is gaining a 12.47% CAGR on the back of cost-effective scaling, elastic compute for peak transaction traffic, and pre-certified compliance blueprints. Hybrid patterns flourish, allowing clinical message routing and storage on-premise while leveraging cloud analytics for secondary use cases. Parallels' 2025 survey reveals 86% of enterprises experimenting with selective workload repatriation to strike an economic balance. For rural providers without Tier 3 data centers, hardened healthcare clouds now provide FHIR sandbox environments that shorten go-live cycles, broadening the total Healthcare IT Integration market.

The Healthcare IT Integration Market Report Segments the Industry Into by Product & Services, by Deployment (on-Premises, Cloud-Based and Hybrid), by Application (Hospital Interface / EHR Integration, Medical Device Integration and More) by End User (Hospitals & Clinics, Diagnostic & Imaging Centers, and More), and Geography (North America, Europe, Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America occupied 43.53% of the Healthcare IT Integration market in 2024, supported by mature EHR ecosystems, rigorous federal mandates, and active M&A pipelines. The ONC Interoperability and Prior Authorization rule anchors regulatory certainty by 2027, compelling both payers and providers to upgrade interface engines for real-time prior-approval data sharing mahealthdata.org. Concurrently, payer-provider convergence projects inject demand for claims-clinical fusion, reinforcing regional growth.

Asia-Pacific is the fastest-expanding territory with a 14.40% CAGR through 2030. Government-backed digitization strategies in Japan, India, and Australia fund broadband health networks, EHR rollouts, and mobile triage platforms. Local vendors collaborate with global interface leaders to localize FHIR profiles in multiple scripts, elevating the Healthcare IT Integration market across urban and remote clinics. Mobile-first care models and high consumer app engagement spur API marketplaces that connect teleconsultation, pharmacy delivery, and chronic-care coaching services in near real time.

Europe's trajectory is shaped by the European Health Data Space regulation, which harmonizes EHR interoperability and patient data portability across EU member states. Anticipated cost savings of EUR 11 billion over 10 years motivate national projects to align legacy systems with the common framework. Vendors must embed consent-management modules and multilingual coding dictionaries into their offerings, expanding addressable Healthcare IT Integration market segments around pan-European tele-specialty networks. Emerging Middle East and South American markets show healthy appetites for smart-hospital inclusion, yet legacy HIS lock-in and uneven skill availability temper roll-outs.

- Oracle

- Lyniate

- Infor

- Epic Systems

- Intersystems

- GE Healthcare

- Koninklijke Philips

- IBM

- Siemens Healthineers

- Allscripts Healthcare Solutions (Altera)

- NextGen Healthcare

- Redox

- Orion Health

- Meditech

- Optum

- Connexall

- Dedalus Group

- Rhapsody Health Solutions

- Qvera

- iNTERFACEWARE

- Change Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Transition to FHIR-based APIs Mandated by US ONC & EU EHDS

- 4.2.2 Multi-system Integration Demand from Remote Patient Monitoring Programs

- 4.2.3 Increasing Need of Electronic Health Records and Other Healthcare IT Solutions

- 4.2.4 Device Integration Needs in Smart Operating Rooms across Middle East

- 4.2.5 Payer-Provider Convergence Requiring Seamless Claims-Clinical Data Fusion in US

- 4.2.6 Surge in M&A Spurring Interface Engine Replacement Cycles in North America

- 4.3 Market Restraints

- 4.3.1 Implementation Talent Shortage for HL7/FHIR Specialists in Africa

- 4.3.2 Cyber-security Compliance Costs under GDPR & HIPAA Escalate Integration TCO

- 4.3.3 Vendor-Locked Legacy HIS Architectures in Public Hospitals across South America

- 4.3.4 ROI Ambiguity for Cross-Platform Integration in Small Physician Practices

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Component

- 5.1.1 Products

- 5.1.1.1 Integration Engines

- 5.1.1.2 Device Integration Software

- 5.1.1.3 iPaaS / API Management Platforms

- 5.1.1.4 EHR / HIE Interface Modules

- 5.1.2 Services

- 5.1.2.1 Implementation & Integration

- 5.1.2.2 Support & Maintenance

- 5.1.2.3 Consulting & Training

- 5.1.1 Products

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud-based

- 5.2.3 Hybrid

- 5.3 By Application

- 5.3.1 Hospital Interface / EHR Integration

- 5.3.2 Medical Device Integration

- 5.3.3 Lab System Integration

- 5.3.4 Pharmacy Integration

- 5.3.5 Revenue Cycle & Claims Integration

- 5.3.6 Population Health & Analytics Integration

- 5.3.7 Others

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Diagnostic & Imaging Centers

- 5.4.3 Payers & TPAs

- 5.4.4 Pharmacies

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Oracle Cerner

- 6.3.2 Lyniate

- 6.3.3 Infor

- 6.3.4 Epic Systems Corporation

- 6.3.5 InterSystems Corporation

- 6.3.6 GE Healthcare

- 6.3.7 Philips Healthcare

- 6.3.8 IBM Corporation

- 6.3.9 Siemens Healthineers

- 6.3.10 Allscripts Healthcare Solutions (Altera)

- 6.3.11 NextGen Healthcare

- 6.3.12 Redox

- 6.3.13 Orion Health

- 6.3.14 MEDITECH

- 6.3.15 Optum

- 6.3.16 Connexall

- 6.3.17 Dedalus Group

- 6.3.18 Rhapsody Health Solutions

- 6.3.19 Qvera

- 6.3.20 iNTERFACEWARE

- 6.3.21 Change Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment