PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849987

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849987

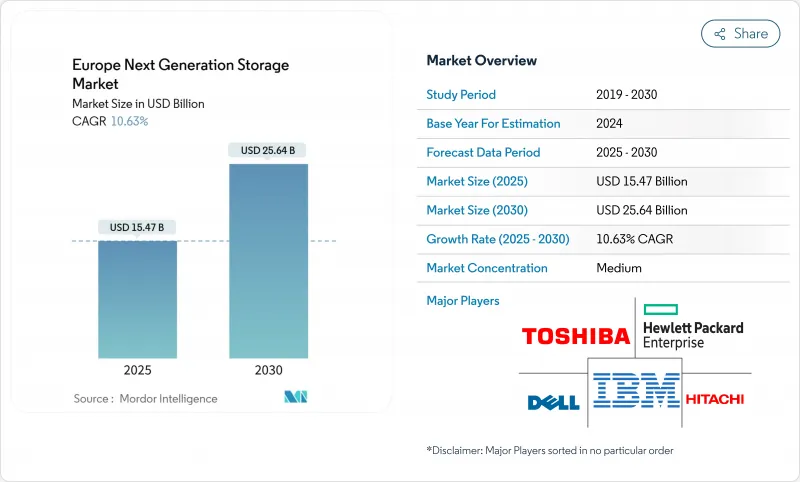

Europe Next Generation Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe next generation storage market size reached USD 15.47 billion in 2025 and is forecast to advance at a 10.6% CAGR to USD 25.64 billion by 2030.

Sustained growth is anchored in the EU Data Act, which comes into force in September 2025 and compels providers to enable effortless cloud switching; enterprises are therefore prioritizing portable, software-defined storage that safeguards data sovereignty. At the same time, AI training and inference workloads are multiplying storage traffic while energy-efficiency rules tighten, giving an edge to flash-based architectures that deliver low latency per watt. Capacity constraints in Frankfurt, London, Amsterdam, Paris and Dublin are pushing operators toward edge deployments, and continued investment in sovereign-cloud projects such as Gaia-X and virt8ra is stimulating demand for interoperable, vendor-agnostic platforms able to span core, cloud and edge footprints. Competitive pressure is intensifying as traditional array vendors recalibrate their portfolios to confront hyperscale cloud innovation, flash-only specialists, and European sovereign-cloud providers.

Europe Next Generation Storage Market Trends and Insights

Exploding Volume of Digital Data

Global data creation is set to triple between 2023 and 2028, and local retention obligations under GDPR mean most of that growth must be stored inside EU borders. Enterprises planning for petabyte-scale capacity are therefore deploying hybrid topologies that couple on-premises arrays with sovereign-cloud extensions, ensuring compliance while keeping latency in check. Spending patterns show a marked tilt toward scalable, software-defined platforms that can ingest diverse file and object workloads without vendor lock-in. The result is a Europe next generation storage market whose expansion rate outpaces global averages as organizations attempt to blend compliance and performance within a single architecture.

Rapid Shift to SSD and NVMe Architectures

Enterprise adoption of PCIe Gen5 NVMe is eliminating the performance gap that once separated on-premises arrays from public-cloud tiers. German manufacturing plants embracing Industry 4.0 have pushed latency budgets below 100 µs, a threshold unattainable for spinning disks. Energy efficiency is now a board-level metric; SSDs consume markedly fewer kilowatt-hours per terabyte than HDDs, helping operators meet the German Energy Efficiency Act's 50% renewable-energy threshold for data centres set for 2027. These dynamics position flash media as a strategic rather than tactical investment across the Europe next generation storage industry.

High Capital Cost of All-Flash and NVMe Arrays

Enterprise SSDs still carry a unit-cost premium as high as 9.9X over HDD capacity. For small and midsize firms, this delta complicates ROI calculations even when flash energy savings are factored in. Hyperscaler uptake is driving near-term price easing, but many European SMEs will continue staging workloads on hybrid tiers that mix QLC flash with high-capacity disk until flash crosses the cost-per-bit threshold.

Other drivers and restraints analyzed in the detailed report include:

- AI / ML Workloads Demanding Ultra-Low Latency

- Hybrid Multi-Cloud Adoption Across EU Enterprises

- Data-Sovereignty Compliance Fragmentation Across EU

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Direct-Attached Storage contributed 45.6% share to Europe next generation storage market size in 2024, underscoring enterprises' preference for predictable latency in mission-critical workloads. Hyper-Converged Infrastructure, however, is forecast to log an 11.6% CAGR, reflecting appetite for scale-out nodes that blend compute, storage and networking into a single policy domain.

Momentum toward hyperconvergence is reinforced by national digitalisation grants in Germany, where manufacturers need on-site processing to analyse sensor data without violating sovereignty rules. Dell Technologies and CoreWeave's rack-level AI platform demonstrates how converged resources can supply 1.4 exaFLOPS alongside petabyte-scale flash, making them an attractive middle ground between monolithic arrays and purely public-cloud tiers.

File and Object-Based Storage captured 65.7% of Europe next generation storage market share in 2024 by delivering RESTful, scale-out repositories for unstructured datasets, from analytics logs to 8K media files. Software-Defined Storage is scaling faster at 12.1% CAGR because it uncouples services from hardware, thereby fulfilling the Data Act's portability ethos.

European banks and insurers are piloting data-mobility orchestrators capable of live-migrating petabyte datasets between sovereign-cloud partners without disrupting transaction latency. Partnerships such as Hitachi Vantara and Hammerspace provide automated classification and movement that preserve metadata integrity, minimizing refactoring pain for legacy apps.

The Europe Next Generation Storage Market Report is Segmented by Storage System (Direct-Attached Storage (DAS), Network-Attached Storage (NAS), and More), Storage Architecture (File and Object-Based Storage, Block Storage, and More), Memory and Media Type (Hard Disk Drive (HDD), NAND Flash, and More), End-User Industry (BFSI, Retail and E-Commerce, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- NetApp

- Hitachi Vantara

- IBM

- Toshiba

- Pure Storage

- DataDirect Networks (DDN)

- Scality

- Fujitsu

- Netgear

- Huawei Technologies

- Samsung Electronics

- Western Digital

- Seagate Technology

- Micron Technology

- Lenovo

- Cisco Systems

- Oracle

- VAST Data

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exploding volume of digital data

- 4.2.2 Rapid shift to SSD and NVMe architectures

- 4.2.3 AI / ML workloads demanding ultra-low latency

- 4.2.4 Hybrid multi-cloud adoption across EU enterprises

- 4.2.5 Edge-computing and 5G micro-data-centre proliferation

- 4.2.6 EU Gaia-X and Data Act enabling sovereign-cloud storage

- 4.3 Market Restraints

- 4.3.1 High capital cost of all-flash and NVMe arrays

- 4.3.2 Data-sovereignty compliance fragmentation across EU

- 4.3.3 Legacy workload migration and vendor lock-in risks

- 4.3.4 Rare-earth and critical-metal supply constraints for NAND/SSD

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Storage System

- 5.1.1 Direct-Attached Storage (DAS)

- 5.1.2 Network-Attached Storage (NAS)

- 5.1.3 Storage Area Network (SAN)

- 5.1.4 Hyper-Converged Infrastructure (HCI)

- 5.1.5 Others

- 5.2 By Storage Architecture

- 5.2.1 File and Object-Based Storage

- 5.2.2 Block Storage

- 5.2.3 Software-Defined Storage (SDS)

- 5.3 By Memory and Media Type

- 5.3.1 Hard Disk Drive (HDD)

- 5.3.2 NAND Flash

- 5.3.3 NVMe

- 5.3.4 3D XPoint / Optane

- 5.3.5 Emerging NVM

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 Retail and e-Commerce

- 5.4.3 IT and Telecom

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Media and Entertainment

- 5.4.6 Government and Defence

- 5.4.7 Other End-User Industries

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Dell Technologies

- 6.4.2 Hewlett Packard Enterprise (HPE)

- 6.4.3 NetApp

- 6.4.4 Hitachi Vantara

- 6.4.5 IBM

- 6.4.6 Toshiba

- 6.4.7 Pure Storage

- 6.4.8 DataDirect Networks (DDN)

- 6.4.9 Scality

- 6.4.10 Fujitsu

- 6.4.11 Netgear

- 6.4.12 Huawei Technologies

- 6.4.13 Samsung Electronics

- 6.4.14 Western Digital

- 6.4.15 Seagate Technology

- 6.4.16 Micron Technology

- 6.4.17 Lenovo

- 6.4.18 Cisco Systems

- 6.4.19 Oracle

- 6.4.20 VAST Data

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment