PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849993

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849993

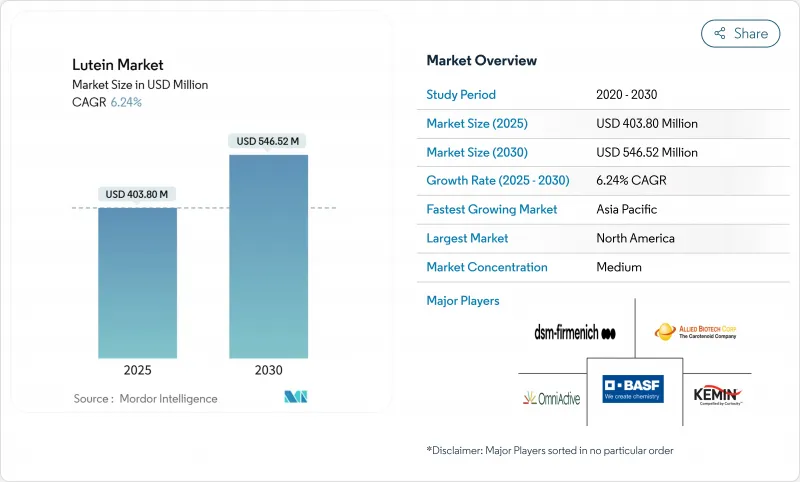

Lutein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global lutein market reached USD 403.80 million in 2025 and is projected to expand to USD 546.52 million by 2030, registering a CAGR of 6.24% during the forecast period.

Driven by its recognized benefits for eye health, cognitive function, and preventive wellness, the lutein market is on a steady rise. As consumers increasingly gravitate towards natural, functional ingredients, lutein's presence is expanding in dietary supplements, fortified foods, and beverages. Preference for clean labels has made naturally sourced lutein the dominant choice, while there's a notable uptick in demand for nutraceutical-grade products. While powdered and crystalline forms of lutein are widely used, oil-based formats are carving a niche, especially in emulsified applications. Dietary supplements lead in usage, but cosmetics and personal care are emerging as rapidly growing segments. North America stands out as a major revenue contributor, yet the Asia-Pacific region is witnessing the swiftest growth, spurred by innovation and heightened health awareness. Key players are bolstering market confidence and diversifying products through strategic collaborations and increasing clinical validations of lutein's benefits. Moreover, advancements in extraction technologies and the growth of marigold cultivation are streamlining the supply chain and enhancing scalability. In developing regions, regulatory backing for natural antioxidants in functional foods is further propelling market penetration.

Global Lutein Market Trends and Insights

Rising Demand for Eye Health Supplements and Products

The increased use of digital devices has led to higher demand for eye health supplements, particularly those containing lutein as a key ingredient. Research shows that lutein supplements improve macular pigment density and reduce eye strain in frequent screen users, with studies documenting better tear production and faster photo-stress recovery. The growing awareness of lutein's benefits has created a significant market opportunity in the eye health supplement sector. According to the Consumer Healthcare Products Association (CHPA), over-the-counter (OTC) eye care product sales in the United States reached 146 million units in 2024, indicating consistent consumer interest in eye health self-care . This substantial market performance reflects the increasing consumer focus on preventive eye care measures and self-directed health management solutions. Companies are seeking regulatory approvals and developing new products to strengthen their position in the eye health market. The FDA granted GRAS (Generally Recognized As Safe) status to OmniActive's Lutemax Free Lutein for infant formula use in 2025 . This approval extends lutein's applications from adult supplements to infant nutrition, confirming its safety for visual and cognitive development in infants. The growing body of scientific evidence supporting lutein's efficacy in eye health maintenance has strengthened its position as a crucial ingredient in the eye health supplement market.

Increasing Focus on Cognitive Health Solutions

Lutein exhibits neuroprotective properties that extend beyond its known benefits for eye health. Research indicates lutein supports cognitive performance and brain health across different age groups. Its capacity to cross the blood-brain barrier and concentrate in neural tissues makes it significant for addressing neurodegenerative conditions and preventing cognitive decline. Clinical studies show that lutein and zeaxanthin supplementation enhances dynamic visual and cognitive performance in children, including increased brain-derived neurotrophic factor (BDNF) levels. Research demonstrates improvements in attention, episodic memory, and visuospatial processing, indicating lutein's impact on brain structure and function. Moreover, lutein's ability to reduce neuroinflammation and oxidative stress in brain tissue. This evidence supports increased investment in cognitive health formulations that address the needs of aging and health-conscious populations. According to the Centers for Disease Control and Prevention (CDC), as of 2024, approximately 1 in 10 adults aged 45 and older report experiencing worsening memory loss or cognitive decline, while 1 in 4 report providing care for individuals with cognitive impairment . These statistics underscore the need for evidence-based interventions, positioning lutein as a key component in cognitive health applications.

Significant Fluctuations in Raw Material Prices

The lutein market faces a major constraint due to substantial fluctuations in raw material prices, primarily related to marigold flower cultivation. Marigold flowers, being the main natural source of lutein, are subject to agricultural output variations caused by climatic conditions, pest infestations, and seasonal supply-demand imbalances, which directly impact raw material availability and pricing. These price variations increase the overall costs of lutein extraction and production, reducing manufacturer margins and complicating price forecasting. Small-scale manufacturers are particularly vulnerable to these cost increases, which may result in market consolidation or diminished competitive positions. The pricing volatility is further intensified by geopolitical factors, trade restrictions, and changes in agricultural policies in key producing nations such as India and China. The unstable raw material prices also create difficulties in establishing long-term contracts and maintaining pricing stability for downstream applications across food, nutraceuticals, and pharmaceutical sectors. This instability can discourage substantial investments in new product development. Consequently, the fluctuating input costs continue to present a significant challenge for maintaining reliable supply chains and sustainable growth in the global lutein market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Adoption of Functional Foods and Beverages with Health-Promoting Ingredients

- Wide Availability of Raw Materials, Particularly Marigold Flowers

- Strong Competition from Alternative Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Natural lutein sources accounted for 71.25% of the market share in 2024, driven by consumer preference for clean-label products and regulatory support for marigold-derived ingredients. The natural segment is growing at 8.01% CAGR (2025-2030), supported by increased applications in infant formula and functional foods where natural ingredients command premium pricing. Synthetic lutein alternatives, despite their cost advantages, face resistance from consumers, particularly in developed markets with high clean-label awareness.

The natural segment benefits from established extraction technologies and regulatory approvals, with JECFA's acceptable daily intake levels supporting broad food applications. Microalgae-based production has emerged as a natural alternative to traditional marigold sources, with research showing lutein productivity rates 3-6 times higher than conventional cultivation methods. While the synthetic segment maintains its position in cost-sensitive applications and industrial uses, regulatory scrutiny and consumer preferences favor natural alternatives. Biotechnological production methods using engineered microorganisms are creating a middle ground between natural and synthetic categories, offering scalable production with natural positioning.

In 2024, food-grade lutein commands a 35.16% market share, buoyed by extensive regulatory endorsements and a robust safety profile spanning diverse food categories. This surge in market share is largely attributed to the escalating appetite for fortified foods and beverages, as consumers increasingly seek preventive health benefits, especially for vision and cognitive enhancement, from their daily consumables. The nutraceutical-grade segment is on a rapid ascent, with projections indicating a 7.85% CAGR growth from 2025 to 2030. This momentum is fueled by a rising demand for dietary supplements and strong clinical validation of lutein's health advantages. Meanwhile, pharmaceutical-grade lutein is carving out a niche, thanks to its stringent quality benchmarks and its promising roles in ophthalmology and neurology.

Cosmetic-grade lutein is also on the rise, driven by advanced delivery mechanisms and a growing consumer inclination towards natural anti-aging remedies. Innovations like microencapsulation technologies are enhancing the stability and bioavailability of specialized formulations across these grades. Leading the charge in crafting versatile lutein formulations, which adhere to regulatory standards across food, supplements, pharmaceuticals, and personal care, are industry giants such as DSM-Firmenich, Divi's Laboratories Ltd, and Flora Extracts Pvt. Ltd.

The Lutein Market Report Categorizes the Industry by Source (Natural, Synthetic), by Grade (Feed Grade, Food Grade, and More), by Form (Powder and Crystals, Beadlets, Oil Suspensions/Emulsions, Others), by Application (Dietary Supplements, Food and Beverage, Pharmaceuticals, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tonnes).

Geography Analysis

In 2024, North America commands a significant 35.95% share of the market, a position bolstered by its established regulatory framework. This framework not only includes FDA GRAS approvals for lutein in foods and infant formulas but also boasts extensive clinical validation from leading research institutions. The region's advanced dietary supplement industry thrives on a consumer base that prioritizes natural, scientifically validated ingredients like lutein. Retail infrastructures support premium product positioning, and consumers are increasingly willing to invest in clean-label and functional health products. Furthermore, with Health Canada recognizing lutein as a natural health product under Schedule 1, there's a boost in regulatory confidence, paving the way for cross-border product expansions.

Asia-Pacific is on a rapid ascent, forecasting a CAGR of 7.81% from 2025 to 2030. Rising disposable incomes, an aging populace, and a heightened urban focus on health fuel this growth. As Western dietary habits and wellness trends permeate, nations like China and India are experiencing a surge in the consumption of functional foods and dietary supplements. The region is also reaping the benefits of favorable regulatory endorsements, such as the European Union's nod to lutein esters (E 161b), which aids in regional adoption and aligns safety standards. Investments in domestic production and innovations in fortified food formats are propelling local manufacturing and boosting exports.

South America, along with the Middle East and Africa, holds significant untapped potential, especially in marigold-rich nations like Mexico and Peru. These areas are bolstering their extraction and processing capabilities, capitalizing on the availability of cost-effective raw materials and a surge in domestic demand. With regulatory harmonization and an influx of foreign investments in food processing, these regions are poised for accelerated market development in the coming years.

- Kemin Industries Inc.

- BASF SE

- Chenguang Biotech Group Co., Ltd. (CCGB)

- Allied Biotech Corp.

- OmniActive Health Technologies

- DSM-Firmenich N.V.

- Industrial Organica S.A. de C.V. (PIVEG)

- Lycored Corp.

- Divi's Laboratories Ltd

- Katra Group

- Zhejiang Medicine Co. Ltd

- Shaanxi Jiahe Phytochem Co., Ltd.

- Xi'an Healthful Biotechnology Co.,Ltd (HSF Biotech)

- Ingex Botanicals

- Chenguang Biotech Group Co., Ltd.

- NutriScience Innovations, LLC

- E.I.D. Parry

- Synthite Industries Pvt Ltd.

- Fenchem Biotek Ltd.

- Flora Extracts Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for eye health supplements and products

- 4.2.2 Increasing focus on cognitive health solutions

- 4.2.3 Growing adoption of functional foods and beverages with health-promoting ingredients

- 4.2.4 Wide availability of raw materials, particularly marigold flowers

- 4.2.5 Expanding market for anti-aging skincare products

- 4.2.6 Advancement in micro-algae fermentation reducing environmental impact

- 4.3 Market Restraints

- 4.3.1 Significant fluctuations in raw material prices

- 4.3.2 Strong competition from alternative ingredients

- 4.3.3 Consumer hesitation regarding synthetic lutein products

- 4.3.4 Intricate extraction and purification procedures

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Source

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.2 By Grade

- 5.2.1 Feed Grade

- 5.2.2 Food Grade

- 5.2.3 Pharmaceutical Grade

- 5.2.4 Cosmetic Grade

- 5.2.5 Nutraceutical Grade

- 5.3 By Form

- 5.3.1 Powder and Crystals

- 5.3.2 Beadlets

- 5.3.3 Oil Suspensions/Emulsions

- 5.3.4 Others

- 5.4 By Application

- 5.4.1 Dietary Supplements

- 5.4.2 Food and Beverage

- 5.4.3 Pharmaceuticals

- 5.4.4 Animal Feed

- 5.4.5 Cosmetics and Personal Care

- 5.4.6 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Kemin Industries Inc.

- 6.4.2 BASF SE

- 6.4.3 Chenguang Biotech Group Co., Ltd. (CCGB)

- 6.4.4 Allied Biotech Corp.

- 6.4.5 OmniActive Health Technologies

- 6.4.6 DSM-Firmenich N.V.

- 6.4.7 Industrial Organica S.A. de C.V. (PIVEG)

- 6.4.8 Lycored Corp.

- 6.4.9 Divi's Laboratories Ltd

- 6.4.10 Katra Group

- 6.4.11 Zhejiang Medicine Co. Ltd

- 6.4.12 Shaanxi Jiahe Phytochem Co., Ltd.

- 6.4.13 Xi'an Healthful Biotechnology Co.,Ltd (HSF Biotech)

- 6.4.14 Ingex Botanicals

- 6.4.15 Chenguang Biotech Group Co., Ltd.

- 6.4.16 NutriScience Innovations, LLC

- 6.4.17 E.I.D. Parry

- 6.4.18 Synthite Industries Pvt Ltd.

- 6.4.19 Fenchem Biotek Ltd.

- 6.4.20 Flora Extracts Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK