PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850005

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850005

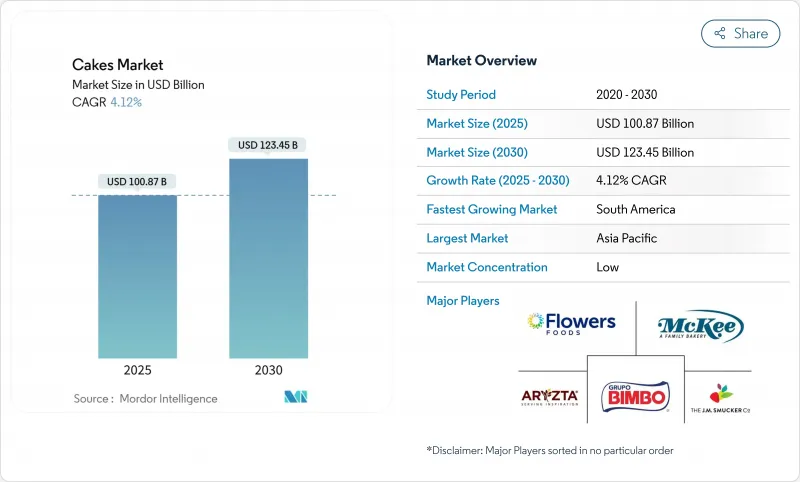

Cakes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cake market stands at USD 100.87 billion in 2025 and is forecast to reach USD 123.45 billion by 2030 on a 4.12% CAGR.

Rising premiumisation of artisanal lines, rapid acceptance of free-from recipes, and steady breakthroughs in long-shelf-life technology are steering growth, especially in developed economies where wellness and indulgence converge. Momentum is further supported by strong festive and gifting demand, while innovators amplify consumer excitement through new flavour combinations, functional enrichments, and experiential packaging. Regulatory headwinds tied to sugar-reduction and clean-label requirements temper expansion yet simultaneously spur product reformulation and portfolio diversification. Competitive intensity remains high because the cake market is fragmented; regional specialists continue to win local loyalties while global producers leverage scale, omnichannel reach, and sustainability credentials to widen portfolios and defend margins.

Global Cakes Market Trends and Insights

Premiumization of Artisanal Cakes in Duty-Free Retail Outlets

The placement of artisanal cakes in airports and cruise terminals as premium souvenirs has created a profitable market segment that exceeds the growth of the overall cake industry. Companies report revenue increases of more than 10% when introducing premium cakes in travel retail locations, as travelers are willing to pay higher prices for authentic local products with premium packaging. The controlled retail environment in these locations provides ideal conditions for maintaining product quality and presentation. The environment enables the sale of limited-edition flavors that may not be suitable for traditional retail distribution, creating a wider price range between standard and premium products. In October 2023, Mr. Kipling launched a range of artisan-inspired snack cakes in the United Kingdom. The products are available in different flavors.

Rapid Adoption of Free-From Cakes Among Consumers

Egg-free and vegan cakes flourish at a 12.6% CAGR, triple the overall cake market pace, as flexitarians and health-focused shoppers seek clean labels without sacrificing indulgence. Progress in plant-based emulsifiers, binding agents, and enzyme systems now replicates the moisture and crumb structure of traditional recipes. Manufacturers capture incremental share by highlighting ethical sourcing and allergen safety, while retailers expand dedicated bays that reinforce mainstream acceptance of free-from treats. The market players are launching new products in the market to cater to the rising demand. For instance, in May 2025, The Baker's Dozen (TBD), an artisanal bakery brand in India, launched its Zero Maida Donut Cake. The cake is baked, not fried.

High Sugar-Reduction Regulations Hampering Growth

Regulatory measures targeting sugar content in baked goods create compliance challenges that affect formulation costs and consumer acceptance. These measures aim to address public health concerns related to excessive sugar consumption and its associated health risks. Indonesia's 'Nutri-Level' labeling requirement for sugar, salt, and fat content, effective December 2024, requires warning labels on products with high sugar content, which may influence purchasing decisions.

The labeling system categorizes products based on their nutritional composition and mandates clear visual indicators for consumers. Manufacturers face technical challenges in maintaining taste and texture while reducing sugar, leading to increased research and development investments in alternative sweeteners and bulking agents. The complexity lies in finding substitutes that replicate sugar's multiple functional properties in baking, including moisture retention, browning reactions, and structural development.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Long-Shelf-Life Ambient Cakes in Convenience Chains

- Strong Festive and Gifting Demand

- Short Shelf Life of Fresh Cakes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The unpackaged/artisanal segment captured 54.78% of the cake market revenue in 2024. Consumers equate in-store freshness with authenticity, keeping foot traffic strong in bakeries and patisseries. Artisanal operators leverage local flavour twists and social media to attract younger demographics who equate craftsmanship with premium value. Faster turnaround, story-driven merchandising, and live preparation experiences reinforce loyalty despite higher tickets.

Packaged formats, although smaller, post a 4.78% CAGR. The uptake is propelled by enzyme-enabled freshness, tamper-evident film wraps, and portion-controlled tray packs that suit convenience stores and modern trade chains. Producers invest in visually transparent packs to retain the artisanal aura while ensuring the extended distribution reach that large-scale manufacturing affords. The market players are launching new products in the market to cater to the rising demand. For instance, in June 2025, the Karnataka Milk Federation (KMF) expanded its product portfolio by introducing 18 varieties of muffins, slice cakes, and bar cakes under the Nandini Goodlife brand.

Celebration cakes led turnover with a 36.04% share in 2024. They remain fixtures at birthdays, weddings, and festivals, giving brands predictable spikes and margin upside through elaborate decoration and custom themes. Heritage flavours and culturally resonant designs maintain emotional resonance across generations.

Center-filled cupcakes, expanding at 4.58% CAGR, offer novelty, portion control, and premium fillings that command elevated unit prices. Producers employ specialised depositor technology to maintain cream consistency and structural stability. Social media-friendly formats encourage impulse buying and giftability, extending reach to younger cohorts and export markets seeking differentiated indulgence.

The Cakes Market Report Segments the Industry Into by Form (Packaged, Unpackaged/Artisanal), by Product Type (Celebration Cakes, and More), by Ingredient Type (Conventional and Organic), by Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, and More), and by Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds a prominent market share of 33.59% in 2024. This leadership position stems from established artisanal traditions and consumer preferences for premium products. China's bakery aisles showcase Western formats infused with local flavours such as matcha and taro, addressing rising disposable incomes and a growing cafe culture.

Manufacturers are adapting their formulations to maintain taste while addressing health concerns, particularly in premium segments where consumers prioritize quality and authenticity. This growth results from increasing disposable incomes and urbanization, which drive demand for packaged and premium cake products. The market features unique combinations of Western cake formats with regional flavors and ingredients, attracting younger consumers seeking new taste experiences.

North America maintains consistent growth through developments in health-focused formulations and premium indulgence categories. Consumer spending on cakes and cupcakes increased by 26.4% in 2023, reaching USD 67 per household on average. According to the United States Bureau of Labor Statistics , showing a strong demand for celebration-related purchases despite economic challenges. Manufacturers focus on creating "better-for-you" options that balance taste with nutritional benefits.

South America offers growth potential through expanding middle-class populations and retail modernization, though market expansion faces limitations due to distribution challenges in developing areas. South America is expected to reach a CAGR of 9.27% during the forecast period.

- Grupo Bimbo S.A.B. de C.V.

- Flowers Foods Inc.

- McKee Foods Corporation

- Yamazaki Baking Co. Ltd.

- Hostess Brands Inc.

- Monginis Foods Pvt Ltd.

- Britannia Industries Ltd.

- Finsbury Food Group plc

- Valeo Foods Group

- Mondelez International Inc.

- Parle Products Pvt Ltd.

- Rich Products Corporation

- Aryzta AG

- BreadTalk Group Ltd.

- Dawn Food Products Inc.

- Dr. Oetker GmbH

- Dufflet Pastries

- General Mills (Betty Crocker)

- Grupo Vazquez (Cake Factory)

- YIldIz Holding A.S. (Ulker)

- Bonn Group of Industries

- DoFreeze LLC

- The J.M. Smucker Company

- Hosta Industrie- Vertriebsgesellschaft

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumization of Artisanal Cakes in Duty-free Retail Outlets

- 4.2.2 Rapid Adoption of Free-from Cakes among Consumers

- 4.2.3 Demand for Long-shelf-life Ambient Cakes in Convenience Chains

- 4.2.4 Innovation in Flavors and Health Variants Boosts Demand

- 4.2.5 Strong Festive and Gifting Demand

- 4.2.6 Influence of Social Media and Trends

- 4.3 Market Restraints

- 4.3.1 High sugar-reduction Regulations Hampering Growth

- 4.3.2 Short Shelf Life of Fresh Cakes

- 4.3.3 Regulatory Scrutiny on Ingredients like Color, Preservatives, etc.

- 4.3.4 Intense Competition from Alternative Snacks

- 4.4 Value-/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Packaged

- 5.1.2 Unpackaged/Artisanal

- 5.2 By Product Type

- 5.2.1 Celebration Cakes

- 5.2.2 Cupcakes

- 5.2.2.1 Center-filled

- 5.2.2.2 Plain

- 5.2.3 Sponge Cakes

- 5.2.3.1 Plain

- 5.2.3.2 Center-filled

- 5.2.3.3 Others

- 5.2.4 Other Cakes (cheesecake, pound cake, etc.)

- 5.3 By Ingredient Type

- 5.3.1 Conventional

- 5.3.2 Vegan

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets / Hypermarkets

- 5.4.2 Specialty Stores

- 5.4.3 Conveniece stores

- 5.4.4 Online Retail Stores

- 5.4.5 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Saudi Arabia

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Grupo Bimbo S.A.B. de C.V.

- 6.4.2 Flowers Foods Inc.

- 6.4.3 McKee Foods Corporation

- 6.4.4 Yamazaki Baking Co. Ltd.

- 6.4.5 Hostess Brands Inc.

- 6.4.6 Monginis Foods Pvt Ltd.

- 6.4.7 Britannia Industries Ltd.

- 6.4.8 Finsbury Food Group plc

- 6.4.9 Valeo Foods Group

- 6.4.10 Mondelez International Inc.

- 6.4.11 Parle Products Pvt Ltd.

- 6.4.12 Rich Products Corporation

- 6.4.13 Aryzta AG

- 6.4.14 BreadTalk Group Ltd.

- 6.4.15 Dawn Food Products Inc.

- 6.4.16 Dr. Oetker GmbH

- 6.4.17 Dufflet Pastries

- 6.4.18 General Mills (Betty Crocker)

- 6.4.19 Grupo Vazquez (Cake Factory)

- 6.4.20 YIldIz Holding A.S. (Ulker)

- 6.4.21 Bonn Group of Industries

- 6.4.22 DoFreeze LLC

- 6.4.23 The J.M. Smucker Company

- 6.4.24 Hosta Industrie- Vertriebsgesellschaft

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK