PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850007

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850007

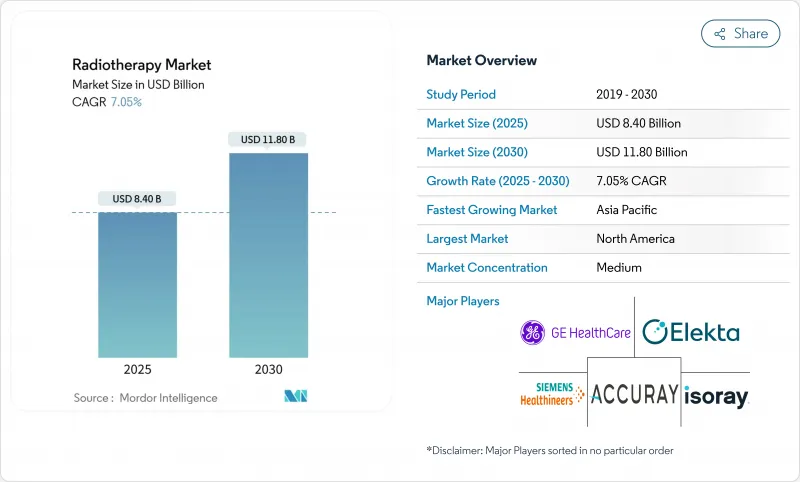

Radiotherapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Radiotherapy Market size is estimated at USD 8.40 billion in 2025, and is expected to reach USD 11.80 billion by 2030, at a CAGR of 7.05% during the forecast period (2025-2030).

Growth is underpinned by rising global cancer incidence, widening clinical acceptance of precision modalities such as ultrafast FLASH therapy, and the steady build-out of proton and carbon-ion facilities. Health-system demand is also buoyed by evidence that 50-60% of all oncology patients benefit from radiation at some stage of care. Providers in high-income countries are expanding MRI-guided linear accelerators that adapt treatment in real time, while middle-income systems prioritize single-room proton units to close access gaps. Vendor consolidation is reshaping competition; Siemens Healthineers' ownership of Varian positions the company to bundle imaging, planning, and treatment hardware into fully integrated cancer-care pathways. Meanwhile, cloud-based planning platforms and AI-driven workflow tools open new revenue pools for software specialists, and emerging biology-guided radiotherapy promises differentiated performance in oligometastatic disease.

Global Radiotherapy Market Trends and Insights

Growing Incidence of Hard-to-Treat Solid Tumors

Escalating early-onset cancer rates gastrointestinal malignancies rose at an annual percentage change of 2.16% over 10 years, stimulating demand for biologically potent modalities. Carbon-ion radiotherapy (CIRT) delivers clustered DNA damage that tumor cells struggle to repair, raising 5-year local control in chordoma to 70-80% compared with 50-60% for conventional photons. The multicentre ETOILE trial will provide level-III evidence comparing CIRT with standard care, and early institutional data already favor higher tumor-control probabilities, especially in hypoxic lesions. Health systems in Japan, Germany, and China are consequently prioritizing mixed-particle centers.

Rapid Installation of Hybrid MR-Linac Systems

Real-time MRI-guided systems, pioneered by Elekta and ViewRay, overcome conventional radiotherapy's inability to visualize anatomy during beam-on time. Adaptive workflows let clinicians re-optimize plans session-by-session, shrinking margins and sparing normal tissue. Academic centers in Europe and the United States report measurable toxicity reductions, though capital costs above USD 10 million restrict uptake to tertiary hospitals. Vendors now bundle AI-driven contouring and automated quality assurance to shorten cycle times and improve return-on-investment.

Lack of Skilled Personnel to Perform Radiotherapy

A qualitative survey of technicians in low-resource settings cited inflexible training frameworks and limited hands-on exposure as prime barriers to competency. U.S. Bureau of Labor Statistics data show median salaries of USD 101,990 but only 800 projected openings per year, well below demand. Workforce deficits risk underutilization of installed capacity and drive interest in automation, remote planning hubs, and immersive simulation for accelerated onboarding.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Number of Cancer Patients

- Huge Government and Non-Government Investments in R&D

- Capital Cost of Particle-Therapy Centers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Radiotherapy equipment generated 63.51% of 2024 revenue, reflecting sustained capital spending on linear accelerators, multileaf collimators, and imaging accessories. Treatment-planning and oncology-information software, although smaller in absolute terms, is forecast to expand at 9.34% CAGR through 2030 on the back of AI-enabled automation. The radiotherapy market size for software reached USD 2.6 billion in 2025 and is projected to double by the end of the decade. Platform vendors leverage deep-learning contouring and dose-prediction algorithms that can cut planning cycles from hours to minutes, easing clinician workloads and elevating throughput. Adaptive planning modules now recalculate dose in real time, integrating cone-beam CT or MRI feedback into session-specific plans. Hospitals pursuing value-based oncology care increasingly prefer vendor-neutral, cloud-hosted solutions that integrate imaging, chemotherapy, and surgery records for longitudinal decision-support.

In hardware, Siemens Healthineers focuses on premium-tier systems embedding spectral CT guidance, while mid-range entrants target cost-optimized accelerators for emerging markets. Downstream, independent software specialists such as RaySearch Laboratories exploit open-API ecosystems to insert new analytics tools alongside Varian's ARIA or Elekta's MOSAIQ, further segmenting the radiotherapy market.

Photon-based modalities retained 77.84% revenue leadership in 2024, upheld by widespread clinical familiarity and lower cost per fraction. Nonetheless, proton therapy's 13.66% CAGR positions it as the fastest-rising component of the radiotherapy market, propelled by escalating pediatric indications and tumors abutting critical structures. The pencil-beam nature of protons enables conformal dosing with minimal exit dose, cutting long-term cardiopulmonary toxicity. Eight new European centers launched in 2024 alone, and additional facilities are under construction in Belgium, Spain, the United Kingdom, and Norway. Meanwhile, carbon-ion investigations spurred by Japan's National Institute of Radiological Sciences focus on radioresistant lesions, with early data showing 10-20 percentage-point gains in 5-year local control versus photons.

Emergent FLASH regimens apply ultra-high dose rates that exploit differential normal-tissue sparing; preclinical work indicates the potential to collapse course length from six weeks to one day. Hybrid multi-ion gantries combining protons and carbon beams are under design, signaling a future where clinicians can select particle species tailored to individual tumor radiosensitivity.

The Radiotherapy Market Report Segments the Industry Into by Product (Radiotherapy Equipment, and More), Technology (Photon Beam Therapy, and More), Therapy Type (External Beam Radiation Therapy, and More), Application (Breast Cancer, and More), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands the largest radiotherapy market with 41.83% in 2024 owing to 42 operational proton centers, significant reimbursement coverage, and a robust clinical-research ecosystem. The United States accounts for more than half of global installations of MRI-guided linacs, although studies from the University of Chicago underscore lingering socioeconomic barriers to hypofractionated breast protocols that could reduce patient visits. Canada broadens capacity through provincial investments in dual-energy linacs and cross-training programs designed to mitigate workforce shortages.

Europe ranks second, distinguished by centralized cancer plans and public financing models that favor technology diffusion across member states. Eight proton centers opened in 2024, with additional capacity underway in Belgium, Spain, the United Kingdom, and Norway. Hypofractionation is widely embedded into national guidelines, allowing clinicians to deliver curative breast treatments in three weeks or fewer. The European Commission's regulatory clearance of the Siemens-Varian merger cements a vertically integrated supplier capable of bundling diagnostic imaging with therapy solutions.

Asia-Pacific is projected to deliver the fastest growth rate with 10.26% CAGR over 2025-2030, powered by significant unmet demand and escalating public health budgets. China's 14th Five-Year Plan designates heavy-ion therapy as a strategic priority, igniting construction of joint proton-carbon facilities in Guangzhou and Shanghai. South Korea subsidizes carbon-ion adoption under national insurance, while Japan maintains leadership through continuous operation at Gunma and QST. India, although improving, still operates only 779 teletherapy machinesbwell below needsbforcing 75% of treatment expenditure to be paid out-of-pocket. Southeast Asian nations pursue compact single-room designs to launch first-time services, with Vietnam and Thailand partnering with regional cancer institutes for skills transfer.

- Siemens Healthineers

- Elekta

- Accuray

- Ion Beam Applications SA

- Hitachi

- GE Healthcare Technologies Inc.

- Canon

- ViewRay Technologies Inc.

- Mevion Medical Systems Inc.

- Brain Lab

- RefleXion Medical Inc.

- IsoRay

- Neusoft Medical Systems Co. Ltd.

- Advanced Oncotherapy Plc

- ZAP Surgical Systems Inc.

- Panacea Medical Technologies

- Bionix Radiation Therapy LLC

- LAP GmbH Laser Applications

- RaySearch Laboratories

- Dosisoft SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Incidence of Hard-to-treat Solid Tumors boosting Demand for Ultra-Precise Radiotherapy

- 4.2.2 Rapid Installation of Hybrid MR-Linac Systems in High-Income Hospitals

- 4.2.3 Increasing Number of Cancer Patients Demanding Radiotherapy

- 4.2.4 Huge Government and Non-Government Investments in R&D of Cancer Treatment

- 4.2.5 AI-enabled Adaptive Planning Reducing Turnaround Times and Spurring Software Upgrade Cycles

- 4.2.6 National Reimbursement Revisions Raising Tariffs for Stereotactic Body Radiation Therapy

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Personnel to Perform Radiotherapy

- 4.3.2 Capital Cost of Particle-Therapy Centers

- 4.3.3 Limited Grid-Power Infrastructure Restricting Linac Deployment

- 4.3.4 Uptake of Immuno-Oncology Combinations Reducing Standalone Radiotherapy Fractions

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Radiotherapy Equipment

- 5.1.2 Brachytherapy Equipment

- 5.1.3 Radiotherapy Software

- 5.1.4 Services & Maintenance

- 5.2 By Technology

- 5.2.1 Photon Beam Therapy

- 5.2.2 Proton Beam Therapy

- 5.2.3 Carbon Ion Therapy

- 5.2.4 Brachytherapy

- 5.3 By Therapy Type

- 5.3.1 External Beam Radiation Therapy

- 5.3.1.1 Intensity-Modulated Radiation Therapy (IMRT)

- 5.3.1.2 Image-Guided Radiation Therapy (IGRT)

- 5.3.1.3 Tomotherapy

- 5.3.1.4 Stereotactic Radiosurgery (SRS)

- 5.3.1.5 Stereotactic Body Radiation Therapy (SBRT)

- 5.3.1.6 3D Conformal Radiotherapy

- 5.3.1.7 Proton Therapy

- 5.3.2 Internal Radiation Therapy

- 5.3.3 Systemic Radiation Therapy

- 5.3.1 External Beam Radiation Therapy

- 5.4 By Application

- 5.4.1 Breast Cancer

- 5.4.2 Lung Cancer

- 5.4.3 Prostate Cancer

- 5.4.4 Head and Neck Cancer

- 5.4.5 Cervical and Gynecological Cancers

- 5.4.6 Others

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Ambulatory & Radiotherapy Centers

- 5.5.3 Specialty Cancer Clinics

- 5.5.4 Academic and Research Institutes

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Siemens Healthineers

- 6.3.2 Elekta AB

- 6.3.3 Accuray Incorporated

- 6.3.4 Ion Beam Applications SA

- 6.3.5 Hitachi Ltd.

- 6.3.6 GE Healthcare Technologies Inc.

- 6.3.7 Canon Medical Systems Corp.

- 6.3.8 ViewRay Technologies Inc.

- 6.3.9 Mevion Medical Systems Inc.

- 6.3.10 Brainlab AG

- 6.3.11 RefleXion Medical Inc.

- 6.3.12 Isoray Inc.

- 6.3.13 Neusoft Medical Systems Co. Ltd.

- 6.3.14 Advanced Oncotherapy Plc

- 6.3.15 ZAP Surgical Systems Inc.

- 6.3.16 Panacea Medical Technologies Pvt. Ltd.

- 6.3.17 Bionix Radiation Therapy LLC

- 6.3.18 LAP GmbH Laser Applications

- 6.3.19 RaySearch Laboratories AB

- 6.3.20 Dosisoft SA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment