PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850011

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850011

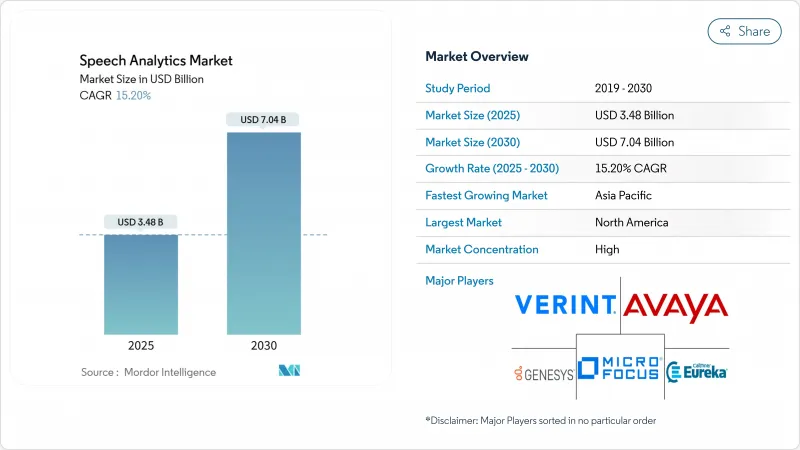

Speech Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The speech analytics market is valued at USD 3.48 billion in 2025 and is projected to reach USD 7.04 billion by 2030, advancing at a 15.20% CAGR.

Momentum is building around cloud-first customer-experience programs, AI transcription accuracy above 95%, and end-to-end compliance demands that now make voice data a board-level priority. Leading vendors continue to embed speech analytics in broader customer-experience suites, pushing adoption beyond quality-assurance teams into sales, compliance, and executive decision-making functions. Competitive intensity is rising as technology giants fold analytics into their cloud ecosystems, while specialist start-ups emphasise real-time agent assist and industry-ready language models. These shifts are accelerating cloud deployments, fuelling demand for implementation services, and widening the addressable base of small and mid-sized enterprises that previously lacked the resources to invest.

Global Speech Analytics Market Trends and Insights

Cloud-First CX Transformation Accelerates Analytics Adoption

Organisations migrating contact-centre workloads to the cloud are no longer analysing a token sample of calls; they now review every interaction, creating larger datasets for pattern recognition and proactive service improvements. Capital-expense barriers have receded, enabling mid-market firms to deploy advanced analytics without long procurement cycles. Vendors are bundling speech analytics into unified CX suites, smoothing workflow integration and cutting implementation timelines. This shift also promotes consumption-based pricing, opening the speech analytics market to smaller teams that prefer operational over capital budgets. As cloud ecosystems mature, integration with adjacent AI services such as intent prediction and sentiment scoring becomes turnkey, accelerating enterprise-wide adoption.

AI-Powered Transcription Accuracy Unlocks Enterprise-Wide Use Cases

Word-error rates below 4% have turned speech analytics from a quality-assurance tool into a strategic business system. Higher accuracy supports sentiment detection, real-time agent coaching, and automated compliance checks in heavily regulated industries. Deep-learning models now handle dialects, noisy environments, and domain-specific terminology with minimal human tuning, reducing operational costs. Enterprises extend speech analytics to sales enablement and executive-level communication analysis, broadening value capture. This technical leap positions speech analytics as a foundation for conversational intelligence platforms that fuse voice, text, and video data into a single analytic layer.

Implementation Costs Create Adoption Barriers

Licensing fees, language-model training, and integration services still strain mid-market budgets, delaying projects and limiting scope. Many firms underestimated the staff hours required for continuous optimisation as product vocabularies evolve. Cloud subscriptions ease capital commitments but do not eliminate the need for skilled analysts who translate insights into process changes. Despite falling infrastructure prices, professional-services demand remains high because speech analytics deployments touch multiple systems, including CRM, workforce management, and compliance archives. Vendors address the gap with packaged accelerators and automated configuration wizards, yet total cost of ownership remains a gating factor for first-time adopters.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Compliance Drives Comprehensive Call Recording

- Omnichannel Analytics Creates Unified Journey Insights

- Data-Privacy Regulations Complicate Implementation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The speech analytics market size for component solutions stood at USD 2.13 billion in 2024, reflecting a 61.20% share that underscores the centrality of core technology to adoption cycles. Services, however, are closing the gap as organisations recognise that accurate insights depend on specialised integration, custom model training, and workflow redesign. Between 2025 and 2030, service revenue is expected to log a 19.50% CAGR, outpacing product sales as enterprises prioritise actionable outcomes over feature checklists.

Consultancies and managed-service providers align analytics outputs with key performance indicators, reinforcing the speech analytics market's shift from tool-centric to value-centric selling. As cloud deployments accelerate, customers lean on partners to migrate historical audio archives, configure security controls, and provide change-management support. These factors collectively elevate services from an optional add-on to a decisive purchase driver, especially among firms lacking in-house data science talent.

On-premise architectures retained a 60.40% speech analytics market share in 2024, supported by legacy investments and stringent data-sovereignty rules in finance and healthcare. Yet cloud subscriptions are growing at a 21.00% CAGR, signalling a decisive pivot toward elasticity, frequent feature updates, and simplified integrations.

The speech analytics market size for cloud deployments is swelling as vendors bundle real-time analytics, storage, and AI model updates into pay-as-you-go tiers. Mid-market organisations with limited capital budgets welcome the shift, while global enterprises favour the ability to standardise across regions without duplicating infrastructure. Regulatory resistance is easing as hyperscale providers earn compliance certifications, further boosting migration momentum.

Speech Analytics Technology Market is Segmented by Component (Solutions, Services), Deployment (On-Premise, Cloud/SaaS), Organization Size (Small and Medium Enterprises, Large Enterprises), Application (Customer Experience Management, Call Monitoring and Quality Management and More), End-User Industry (BFSI, Telecommunications and IT, Healthcare and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America ranked first with 45.00% speech analytics market share in 2024, anchored by mature cloud ecosystems, high digital-service penetration, and strict compliance mandates in finance and healthcare. Ongoing investments focus on omnichannel journey analytics and real-time agent-assist tools, both of which rely on low-latency transcription and sentiment scoring. United States enterprises, in particular, allocate larger budgets to transform legacy contact centres into AI-enabled engagement hubs, extending the region's leadership position.

APAC is the fastest-growing territory with a projected 19.00% CAGR to 2030, led by China, Japan, and India. Government-backed AI programmes and rapid expansion of service-sector outsourcing create fertile ground for cloud-native deployments. Chinese banks embed voice analytics into super-apps, Japanese insurers use it to counter shrinking workforces, and Indian BPOs adopt it to monitor agent quality across multilingual queues F5. Local vendors collaborate with global partners to localise language models, accelerating adoption across high-growth industries.

Europe sits between the two, with substantial opportunity tempered by data-protection stringency. GDPR compliance drives demand for solutions that automate consent management, redaction, and regional data residency. The United Kingdom leads adoption, followed by Germany and France, each applying speech analytics to differentiate customer service in crowded retail and telecom markets. Spain's surge in voice-ad-spend underscores growing commercial interest in voice-channel intelligence, foreshadowing broader uptake across continental enterprises.

- NICE Ltd.

- Verint Systems Inc.

- Avaya Inc.

- Genesys Telecommunications Laboratories Inc.

- Micro Focus International PLC

- CallMiner Inc.

- Calabrio Inc.

- OpenText Corp.

- Talkdesk Inc.

- AWS (Amazon Transcribe / Contact Lens)

- Google Cloud (Contact Center AI and Speech-to-Text)

- IBM (Watson Speech Services)

- Uniphore

- Clarabridge (Qualtrics)

- Observe.AI

- LiveVox Holdings Inc.

- Cogito Corp.

- VoiceBase Inc. (LivePerson Inc.)

- Raytheon BBN Technologies

- CallRail Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first CX transformation in contact centers

- 4.2.2 AI-powered real-time transcription accuracy ?95 %

- 4.2.3 Regulatory demand for 100 % call?record compliance

- 4.2.4 Omnichannel analytics bundling (speech + text + video)

- 4.2.5 Surge in "agent assist" micro-apps sold via CCaaS marketplaces

- 4.2.6 Telco 5G network-exposed APIs enabling low-latency edge analytics

- 4.3 Market Restraints

- 4.3.1 High implementation and custom-tuning costs

- 4.3.2 Data-privacy concerns (GDPR, CPRA, PCI-DSS)

- 4.3.3 Scarcity of annotated domain-specific audio in low-resource languages

- 4.3.4 Model collapse risks when large LLMs retrain on synthetic speech

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE and GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Model

- 5.2.1 On-Premise

- 5.2.2 Cloud / SaaS

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Application

- 5.4.1 Customer Experience Management

- 5.4.2 Call Monitoring and Quality Management

- 5.4.3 Risk and Compliance Management

- 5.4.4 Sales and Marketing Intelligence

- 5.5 By End-User Industry

- 5.5.1 BFSI

- 5.5.2 Telecommunications and IT

- 5.5.3 Healthcare

- 5.5.4 Retail and E-commerce

- 5.5.5 Government and Public Sector

- 5.5.6 Travel and Hospitality

- 5.5.7 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Israel

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Turkey

- 5.6.5.5 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NICE Ltd.

- 6.4.2 Verint Systems Inc.

- 6.4.3 Avaya Inc.

- 6.4.4 Genesys Telecommunications Laboratories Inc.

- 6.4.5 Micro Focus International PLC

- 6.4.6 CallMiner Inc.

- 6.4.7 Calabrio Inc.

- 6.4.8 OpenText Corp.

- 6.4.9 Talkdesk Inc.

- 6.4.10 AWS (Amazon Transcribe / Contact Lens)

- 6.4.11 Google Cloud (Contact Center AI and Speech-to-Text)

- 6.4.12 IBM (Watson Speech Services)

- 6.4.13 Uniphore

- 6.4.14 Clarabridge (Qualtrics)

- 6.4.15 Observe.AI

- 6.4.16 LiveVox Holdings Inc.

- 6.4.17 Cogito Corp.

- 6.4.18 VoiceBase Inc. (LivePerson Inc.)

- 6.4.19 Raytheon BBN Technologies

- 6.4.20 CallRail Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment