PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850017

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850017

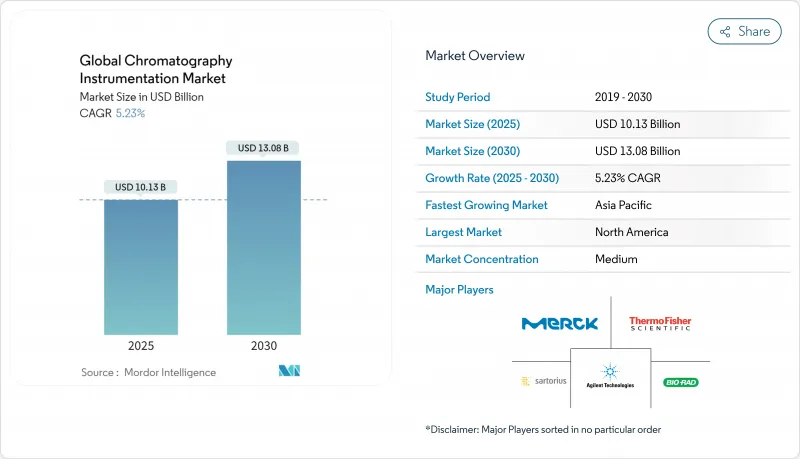

Global Chromatography Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The chromatography instrumentation market is valued at USD 10.13 billion in 2025 and is forecast to reach USD 13.08 billion by 2030, advancing at a 5.23% CAGR.

Rising regulatory scrutiny, expanding biologics pipelines, and rapid automation are reinforcing demand, while artificial-intelligence-enabled platforms are cutting laboratory cycle times by as much as 40%. Pharmaceutical and biopharmaceutical companies account for the most significant revenue contribution, driven by the US FDA's more rigorous analytical validation guidelines that favor ultra-high-performance systems. Parallel expansion of PFAS monitoring and food-safety testing is adding new application breadth, especially for ion and liquid chromatography platforms. Vendors are responding with greener solvent systems, smaller footprints, and cloud-connected software that supports predictive maintenance. Supply-chain localization for critical columns and resins further supports stable long-term growth as manufacturers mitigate geopolitical risk.

Global Chromatography Instrumentation Market Trends and Insights

Chromatography Integral to Accelerating Biologics & Small-Molecule Drug Approvals

Updated Q2(R2) and Q14 guidance from the US FDA now requires stronger evidence of method robustness, prompting widespread upgrades to ultra-high-performance LC-MS platforms. Waters' Empower software already supports roughly 80% of new drug dossiers worldwide, reflecting the technique's central role in quality-by-design programs. Demand is especially strong for biocompatible columns that eliminate metal contamination of antibody therapeutics. Continuous manufacturing lines rely on in-line chromatographic monitoring to keep critical process parameters within specification, reinforcing instrumentation sales to contract development and manufacturing organizations.

Rapid Technology Advances: Miniaturized & UHPLC/UPGC Platforms

Latest-generation systems deliver pressures beyond 1,300 bar while embedding self-diagnostic sensors that trigger automated maintenance routines. AI engines now tune gradient profiles in real time, improving peak capacity without operator intervention and reducing solvent use by up to 65%. Microfluidic sample preparation modules minimize reagent consumption and accelerate throughput, allowing smaller labs to handle complex matrices. Instrument footprints continue to shrink, enabling multiplexed installations even in space-constrained facilities. These gains directly address the global shortage of trained chromatographers by reducing manual workload.

High Upfront and Maintenance Cost of Advanced LC & MS-Coupled Systems

Next-generation LC-MS instruments often exceed USD 500,000, with service contracts adding another 12% annually, straining budgets in academia and diagnostic labs. Semiconductor tariffs risk pushing component costs higher, potentially delaying upgrades. Certified pre-owned programs from OEMs and resellers offer entry points as low as USD 14,000, yet limited warranty scope can raise lifecycle risk. Total analytical cost per complex bioanalytical sample frequently surpasses USD 100, forcing some facilities to outsource testing rather than invest internally.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Global Food-Safety and PFAS Regulations Upping Testing Volumes

- Expanding Bioprocessing & Continuous Manufacturing in Biopharma

- Shortage of Skilled Chromatographers & Data Analysts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquid chromatography systems captured 56.8% of 2024 revenue, reflecting broad applicability in pharma, environmental, and clinical arenas. The chromatography instrumentation market size for liquid platforms reached USD 5.75 billion in 2024 and is projected to advance at a 5.1% CAGR, buoyed by biocompatible hardware that minimizes metal adsorption of sensitive biomolecules. Supercritical fluid instruments, though smaller in absolute terms, will record the fastest 8.9% CAGR, riding pharmaceutical demand for greener chiral separations. Gas chromatography manufacturers are redesigning systems for hydrogen carriers to mitigate helium reliance, and ion chromatography gains relevance in drinking-water compliance. Consumables, especially columns engineered for PFAS and antibody analysis, drive recurring revenue and buffer suppliers from capital-spending cycles. Localization of agarose resin production in the US and Europe shields users from trans-Pacific logistics risk, improving lead times and pricing stability.

Technological differentiation now centers on embedded analytics. Instruments log every parameter change, creating traceable digital twins that feed laboratory information systems. Vendors integrate column health dashboards that predict failure, thereby protecting data integrity and reducing reruns. Compact autosamplers and solvent-saving gradient pumps align with green-chemistry mandates while preserving chromatographic resolution. These trends ensure sustained leadership for liquid systems, underpinning the overall trajectory of the chromatography instrumentation market.

The Chromatography Instruments Market is Segmented by Devices (Chromatography Systems {Gas, Liquid, and More}, Consumables {Columns, Syringes, and More}, Accessories {Column Accessories, Auto-Sampler Accessories, and More}), Application (Agriculture & Food Testing, Pharmaceutical Companies, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 38.7% of global revenue in 2024, anchored by intensive pharmaceutical R&D pipelines and strict FDA oversight that mandate high-end analytical validation. Domestic expansion projects such as Thermo Fisher's USD 2 billion capacity program improve access to instruments and consumables, supporting replacement cycles and new installations. Federal incentives for semiconductor onshoring also protect instrument component supply, enhancing ecosystem resilience.

Europe follows with a well-established base but faces tighter solvent and waste regulations that drive early adoption of greener technologies. Laboratories pivot toward low-flow UHPLC and hydrogen carrier gas solutions to comply with environmental directives. EU Horizon research funds continue to seed next-generation detection methods, sustaining regional innovation pipelines.

Asia-Pacific represents the principal growth engine, expanding at a 7.8% CAGR to 2030. China and India jointly account for over half of regional demand as contract research organizations, vaccine producers, and generics manufacturers scale operations. Government initiatives to upgrade food-safety testing and curb industrial pollution further stimulate orders. Japanese and South Korean firms remain at the forefront of platform engineering, exporting high-precision components worldwide and reinforcing the global standing of the chromatography instrumentation market.

- Agilent Technologies

- Waters Corporation

- Shimadzu

- Thermo Fisher Scientific

- PerkinElmer

- Merck

- Sartorius

- Bio-Rad Laboratories

- Restek

- Gilson

- Phenomenex Inc.

- Cytiva

- Bruker

- Hitachi

- LECO

- Danaher

- GE Healthcare Life Sciences

- Pall

- Knauer Wissenschaftliche Gerate

- Tosoh

- Trajan Scientific & Medical

- YMC Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Chromatography Integral To Accelerating Biologics & Small-Molecule Drug Approvals

- 4.2.2 Rapid Technology Advances: Miniaturized & UHPLC/UPGC Platforms

- 4.2.3 Stringent Global Food-Safety And PFAS Regulations Upping Testing Volumes

- 4.2.4 Expanding Bioprocessing & Continuous Manufacturing In Biopharma

- 4.2.5 Helium Shortage Spurring Alternative-Carrier-Gas GC System Upgrades

- 4.2.6 AI-Powered Workflow Automation Slashing Analytical Turnaround Time

- 4.3 Market Restraints

- 4.3.1 High Upfront And Maintenance Cost Of Advanced LC & MS-Coupled Systems

- 4.3.2 Shortage Of Skilled Chromatographers & Data Analysts

- 4.3.3 Volatility In Supply Of High-Purity Resins, Columns & Semiconductor Chips

- 4.3.4 Emerging Green-Solvent Mandates Raising Compliance And Redesign Costs

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Devices

- 5.1.1 Chromatography Systems

- 5.1.1.1 Gas Chromatography Systems

- 5.1.1.2 Liquid Chromatography Systems

- 5.1.1.3 Supercritical Fluid Chromatography Systems

- 5.1.1.4 Ion Chromatography Systems

- 5.1.1.5 Thin-Layer Chromatography Systems

- 5.1.2 Consumables

- 5.1.2.1 Columns

- 5.1.2.2 Solvents / Reagents / Adsorbents

- 5.1.2.3 Syringes / Needles

- 5.1.2.4 Membrane Filters

- 5.1.2.5 Others

- 5.1.3 Accessories

- 5.1.3.1 Column Accessories

- 5.1.3.2 Auto-Sampler Accessories

- 5.1.3.3 Pumps

- 5.1.3.4 Detectors

- 5.1.3.5 Other Accessories

- 5.1.1 Chromatography Systems

- 5.2 By Application

- 5.2.1 Agriculture & Food Testing

- 5.2.2 Pharmaceutical & Biopharmaceutical Companies

- 5.2.3 Clinical & Diagnostic Laboratories

- 5.2.4 Environmental Testing

- 5.2.5 Chemical & Petrochemical

- 5.2.6 Forensic & Toxicology

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Agilent Technologies

- 6.3.2 Waters Corporation

- 6.3.3 Shimadzu Corporation

- 6.3.4 Thermo Fisher Scientific

- 6.3.5 PerkinElmer Inc.

- 6.3.6 Merck KGaA

- 6.3.7 Sartorius AG

- 6.3.8 Bio-Rad Laboratories

- 6.3.9 Restek Corporation

- 6.3.10 Gilson Inc.

- 6.3.11 Phenomenex Inc.

- 6.3.12 Cytiva

- 6.3.13 Bruker Corporation

- 6.3.14 Hitachi High-Tech Corporation

- 6.3.15 LECO Corporation

- 6.3.16 Danaher (SCIEX)

- 6.3.17 GE Healthcare Life Sciences

- 6.3.18 Pall Corporation

- 6.3.19 Knauer Wissenschaftliche Gerate

- 6.3.20 Tosoh Bioscience

- 6.3.21 Trajan Scientific & Medical

- 6.3.22 YMC Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment