PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850026

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850026

Agricultural Adjuvants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

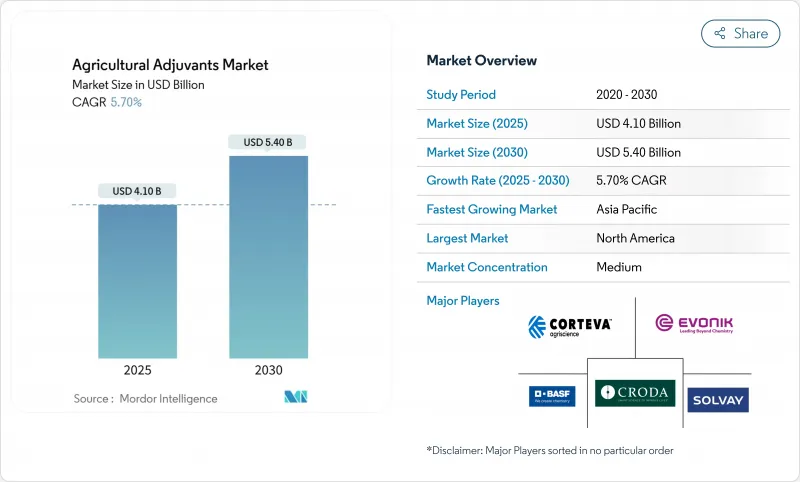

The agricultural adjuvants market is valued at USD 4.1 billion in 2025 and is forecast to expand to USD 5.4 billion by 2030, reflecting a 5.7% CAGR.

Steady growth stems from the escalating need to lift crop productivity while arable land continues to shrink, the rapid spread of precision-spraying technologies that need improved drift control, and the rising popularity of herbicide-tolerant seeds that depend on highly tailored adjuvant chemistry for optimal uptake. Rising investment in biological crop protection solutions also underpins demand because live microbes often require protective carriers and wetting agents to remain effective in the field. In addition, Asia-Pacific's modernization initiatives are redirecting global production footprints toward China and India, stimulating local output of specialty surfactants and oil-based carriers. At the same time, tightening toxicology regulations in Europe and North America push suppliers to design lower-hazard, bio-based ingredients, accelerating product renewal cycles across the agricultural adjuvants market.

Global Agricultural Adjuvants Market Trends and Insights

Growing Food Demand versus Declining Arable Land

Global population growth requires a 70% rise in food output by 2050 while arable land continues to contract 0.3% each year, compelling growers to lift yields per hectare through chemistry that maximizes pesticide performance. Adjuvants that combine wetter, penetrant, and sticker functions cut application frequency and lower labor costs. Adoption is highest in densely populated Asian countries where land scarcity is acute and rice yields already approach biological ceilings. Regional programs that subsidize low-toxicity additives are accelerating uptake among smallholders. Many governments also tie subsidy eligibility to proof of spray-quality training, indirectly boosting demand for premium adjuvants. Suppliers respond with packs that bundle water conditioners with drift agents to simplify choice at the farm gate. The commercial pull now extends to Africa, where rising cereal imports strain foreign exchange reserves, pushing policymakers to support input intensification. Public-private extension services are therefore adding adjuvant modules to farmer field schools to close the yield gap.

Precision-Farming Adoption Boosting Spray Accuracy

Variable-rate booms, drones, and robotic sprayers apply as little as 5 gallons per acre, creating a narrow margin for error in droplet formation. Specialty polymer drift agents enlarge median droplet size to 300-400 microns and improve leaf deposition under high-speed airflow from drones. United States growers now calibrate adjuvant doses with field-level weather feeds to prevent evaporation in low-humidity bands. Equipment makers preload software libraries that flag the correct additive when a nozzle size or active ingredient is selected, raising compliance. Asia-Pacific service companies bundle drone spraying with adjuvant-inclusive fee structures that guarantee coverage standards. Insurance programs in Canada have begun to require drift-control certification before indemnifying off-target damage, turning adjuvants into a risk-mitigation input. The move toward autonomous sprayers further elevates the need for consistent droplet behavior because human fine-tuning is limited. As digital agronomy models mature, data-validated performance metrics are anticipated to shift purchasing toward formulations with proven, repeatable results.

Tightening Toxicology Thresholds for Co-Formulants

European Green Deal targets call for a 50% cut in chemical pesticide risk by 2030, and regulators now scrutinize adjuvant toxicity independently of actives. Organosilicone surfactants linked to bee mortality face new data demands that lengthen approval queues. Companies accelerate reformulation programs to swap suspect silicones for biogenic ethers but must absorb higher raw-material costs. The United States Environmental Protection Agency is anticipated to release updated inert ingredient assessment protocols in 2026, potentially triggering parallel phase-outs. Smaller formulators with limited toxicology budgets risk product discontinuations. Certifications such as Eco-Label prefer adjuvants with established food-contact clearances, narrowing the candidate pool. As pipeline pressure rises, licensing deals for safer chemistry climb, inflating royalty costs for latecomers.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Herbicide-Tolerant Seeds Elevating Adjuvant Need

- Regulatory Pressure On Spray Drift And Higher Utility Adjuvant Demand

- Volatile Petrochemical Feedstock Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Activator adjuvants captured 62% of 2024 revenue, underscoring their central role in improving cuticular penetration and systemic movement. Demand climbs as herbicide-tolerant crops spread across soy, corn, and canola. Within the segment, methylated seed oil and non-ionic surfactant blends remain staples, yet bio-based oil derivatives post an 8.7% CAGR to 2030. That trajectory partly mirrors regulatory preference for low-toxicity options and grower interest in lower residue. As a result, the agricultural adjuvants market size tied to bio-oil activators is projected to reach USD 1.2 billion by 2030.

Utility adjuvants, including drift control agents, water conditioners, and antifoams, represent a smaller but increasingly strategic slice of the agricultural adjuvants market. Drone spraying, which relies on fine droplets, elevates the importance of high-shear-stable polymers that reduce drift yet preserve coverage. Water pH extremes in well-irrigated regions propel conditioner sales that sequester hardness ions and prevent precipitation. The segment's success relies on regulators enforcing drift guidelines and equipment makers integrating adjuvant dosing software.

The Agricultural Adjuvants Market Report is Segmented by Type (Activator Adjuvants and Utility Adjuvants), Application (Herbicide Adjuvants, Insecticide Adjuvants, and More), and by Geography (North America, South America, Europe, Asia-Pacific, Middle East, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific heads global expansion with a 6.4% CAGR to 2030. Government-led mechanization programs and digital extension services in India and China encourage precise pesticide use, opening space for advanced adjuvants. BASF's EUR 10 billion (USD 10.9 billion) Verbund complex in Zhanjiang signals a long-term bet on regional consumption and export potential. Local suppliers also scale to meet demand: Sharda Cropchem's 34% revenue growth in Q2 FY25 underscores appetite for performance-boosting additives across staple crops.

North America, while the most mature market, still contributes incremental volume at a 4.2% CAGR as precision-farming fleets continue to expand and account for 35% share in 2024. Regulatory emphasis on endangered species drives uptake of drift-control polymers. Growers also require water conditioners to cope with variable well-water alkalinity across the Corn Belt. The agricultural adjuvants market size for North America is forecast to add USD 330 million by 2030.

Europe posts steady 4% growth as the Farm to Fork strategy shifts chemistry toward renewable feedstocks. Suppliers that can certify biodegradability and low ecotoxicity gain pricing power. Bionema's biodegradable Soil-Jet BSP100 met EU performance and environmental criteria, setting a benchmark for new entrants. South America records a 5.6% CAGR; expedited pesticide registrations in Brazil shorten the time to market for adjuvants that fit new active ingredients. Africa advances 5% on commercial farm expansion and donor-backed crop insurance that encourages approved chemical use, though cost sensitivity tempers premium-grade adoption.

- BASF SE

- Corteva Agriscience

- Evonik Industries

- Solvay SA

- Croda International

- Nufarm Ltd

- Helena Agri-Enterprises

- AkzoNobel NV

- Brandt Consolidated

- Wilbur-Ellis Company

- Adjuvant Plus Inc.

- Huntsman Corporation

- Clariant AG

- Momentive Performance Materials

- Interagro Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing food demand versus declining arable land

- 4.2.2 Precision-farming adoption boosting spray accuracy

- 4.2.3 Shift to herbicide-tolerant seeds elevating adjuvant need

- 4.2.4 Expansion of biological crop-inputs requiring compatible adjuvants

- 4.2.5 Regulatory pressure on spray drift and higher utility adjuvant demand

- 4.2.6 Surge in bio-based surfactant innovation lowering toxicity

- 4.3 Market Restraints

- 4.3.1 Tightening toxicology thresholds for co-formulants

- 4.3.2 Volatility in petrochemical feedstock pricing

- 4.3.3 Farmer cost-sensitivity in low-margin crops

- 4.3.4 Compatibility issues with next-gen RNAi actives

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Activator Adjuvants

- 5.1.1.1 Surfactants

- 5.1.1.2 Oil Adjuvants

- 5.1.2 Utility Adjuvants

- 5.1.2.1 Drift Control Agents

- 5.1.2.2 Water Conditioners

- 5.1.2.3 Antifoaming Agents

- 5.1.2.4 Acidifiers and Buffers

- 5.1.1 Activator Adjuvants

- 5.2 By Application

- 5.2.1 Herbicide Adjuvants

- 5.2.2 Insecticide Adjuvants

- 5.2.3 Fungicide Adjuvants

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 India

- 5.3.4.3 Japan

- 5.3.4.4 Australia

- 5.3.4.5 Rest of Asia-Pacific

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Nigeria

- 5.3.6.3 Rest of Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Corteva Agriscience

- 6.4.3 Evonik Industries

- 6.4.4 Solvay SA

- 6.4.5 Croda International

- 6.4.6 Nufarm Ltd

- 6.4.7 Helena Agri-Enterprises

- 6.4.8 AkzoNobel NV

- 6.4.9 Brandt Consolidated

- 6.4.10 Wilbur-Ellis Company

- 6.4.11 Adjuvant Plus Inc.

- 6.4.12 Huntsman Corporation

- 6.4.13 Clariant AG

- 6.4.14 Momentive Performance Materials

- 6.4.15 Interagro Ltd

7 Market Opportunities and Future Outlook