PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850044

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850044

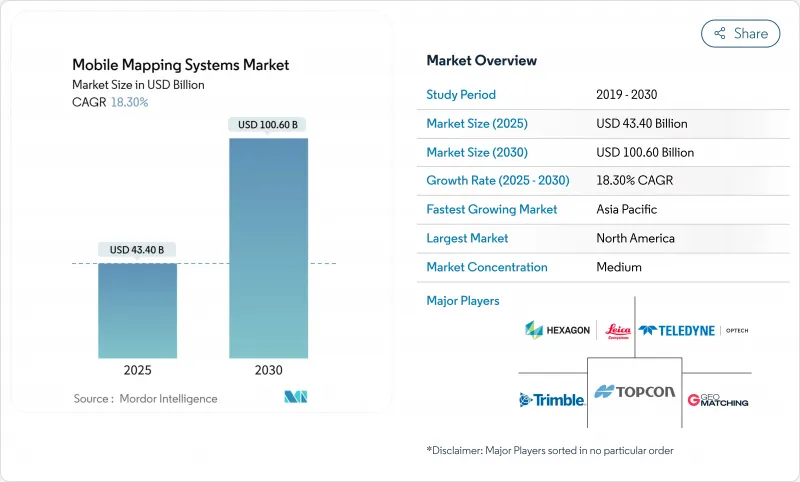

Mobile Mapping Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The mobile mapping systems market size is estimated at USD 43.4 billion in 2025 and is projected to reach USD 100.6 billion by 2030, reflecting an 18.30% CAGR.

Enterprise-grade feature extraction powered by artificial intelligence and steadily falling solid-state LiDAR prices continued to reshape acquisition economics, improving margins for service providers and end users. Government digital-twin mandates, the rise of vehicle-agnostic sensor payloads, and new subscription business models expanded adoption in infrastructure, mining, and emergency management. Meanwhile, vendors increased software integrations that shorten data-to-decision cycles, broadening the mobile mapping systems market addressable base and intensifying competition around value-added analytics.

Global Mobile Mapping Systems Market Trends and Insights

Integration with All Kinds of Vehicles

The ability to mount sensors on railcars, trucks, autonomous shuttles, and even boats widened the mobile mapping systems market scope. Deutsche Bahn certified Trimble's MX9 platform for 100 km/h rail surveys in 2022, validating non-stop asset capture for European rail corridors. Transportation agencies that previously scheduled weekend closures for manual LiDAR scans now deploy vehicle-independent payloads during regular service, accelerating inspection cycles and reducing safety risks. Similar integrations on autonomous road sweepers enabled night-time curb-level mapping for urban digital-twin programs in Germany and Canada, demonstrating how cross-platform compatibility has become a revenue driver for equipment makers.

Government Digital-Twin Mandates

National programs such as the United Kingdom's National Digital Twin initiative established compulsory data standards that require centimeter-grade 3D inputs. Municipalities responded by commissioning high-density mobile LiDAR of roadways, bridges, and public buildings to populate city-scale twins, spawning multi-year service contracts and stimulating procurement of modern sensor rigs. Uppsala's biodiversity corridor planning, which combined LiDAR with GIS analytics, showed how regulatory push translated into immediate demand for dynamic, update-ready spatial datasets. The mobile mapping systems market, therefore, benefited from predictable public-sector funding streams tied to long-range infrastructure resilience goals.

High Cost of System Acquisition and Deployment

Top-tier mobile mapping packages still commanded USD 250,000-750,000, a threshold that remained prohibitive for small civil-engineering firms. A Malaysian road-design study in 2022 highlighted cap-ex as the main reason LiDAR bidding was deferred despite clear technical gains. Financing hurdles were sharper in Latin America and Africa, where local banks rarely offered asset-backed leasing for specialized geospatial hardware. Vendors responded with "mapping-as-a-service" subscriptions, yet up-front investment persisted as the most significant drag on addressable demand within the mobile mapping systems market.

Other drivers and restraints analyzed in the detailed report include:

- Declining Solid-State LiDAR Costs

- AI-Powered Automatic Feature Extraction

- Skilled-Operator Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The hardware segment accounted for 51% of the mobile mapping systems market share in 2024, underscoring its past reliance on capital-intensive sensor suites. Premium vehicle rigs paired 3.6 MHz laser scanners with 72 MP panoramic cameras, while handheld units such as Leica's BLK2GO blended LiDAR with visual SLAM in one-kilogram packages. However, shrinking sensor footprints and solid-state innovations compressed unit costs, allowing more frequent refresh cycles and fostering modular upgrades.

The services segment achieved the fastest 20.70% CAGR through 2030 as organizations outsourced complex data processing. AI-enabled cloud platforms converted raw point clouds into CAD-ready deliverables, lowering internal overheads. This model shifted profit pools from hardware margins toward recurring analytics revenue, accelerating a structural transition in the mobile mapping systems market. The mobile mapping systems market size attached to services is projected to widen as pay-per-use offerings broaden access in emerging economies.

Vehicle-mounted platforms controlled 62% of the mobile mapping systems market in 2024, favored for highway and rail corridors where uninterrupted acquisition at posted speeds maximized productivity. Dual-head scanners on SUVs captured both pavement distress and roadside assets during a single pass, consolidating budgets across transportation agencies.

Drone-based payloads, expanding at 12.90% CAGR, opened vertical mines, cliff faces, and disaster zones to rapid LiDAR coverage. Lighter solid-state sensors extended flight endurance while onboard AI filtered vegetation in real time, reducing downstream workload. Railway-specific trolleys and backpack units addressed niche needs yet collectively contributed to a diversified equipment mix underpinning future mobile mapping systems market size momentum.

Mobile Mapping Market is Segmented by Component (Hardware, Software, Services), Mounting Type (Vehicle Mounted, Railway Mounted, and More), Application (Imaging Services, Aerial Mobile Mapping, and More), End-User Verticals (Government, Oil and Gas, Mining, Military, Others), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 38% of the mobile mapping systems market in 2024. Federal infrastructure funding and strong defense ISR budgets nurtured steady sensor demand. Pilot programs demonstrated a USD 2 return for every USD 1 invested in statewide mobile LiDAR, reinforcing budget allocations. Ecosystem maturity, abundant skilled labor, and aggressive R and D by domestic vendors sustained the region's leadership.

Asia-Pacific recorded the fastest 19.30% CAGR, driven by smart-city spending in China and India, Japan's resilience planning, and South Korea's autonomous-vehicle mapping corridors. Nearly half of global traffic on popular equipment-comparison portals originated from Asia-Pacific users in 2025, signaling high engagement that translated into orders for both drone and vehicle systems. Lower-cost sensors broadened entry-level uptake among provincial agencies, expanding the mobile mapping systems market footprint.

Europe, the Middle East, Africa, and South America presented mixed demand profiles. European mandates around sustainability spurred environmental monitoring projects such as truck-traffic lidar in German cities. The Middle East prioritized pipeline and megacity initiatives, while Brazilian and Chilean mines underpinned South American sales. Africa remained nascent but showed momentum in South African infrastructure surveys. Across all regions, integration of mobile mapping with cloud, IoT, and AI underpinned cross-vertical use cases, lifting the global mobile mapping systems market momentum.

- Leica Geosystems AG (Hexagon AB)

- Trimble Inc.

- Topcon Corporation

- Teledyne Optech Inc.

- RIEGL Laser Measurement Systems GmbH

- Zoller+Frohlich GmbH

- NavVis GmbH

- GeoSLAM Ltd.

- Kaarta Inc.

- Mandli Communications Inc.

- Applanix Corporation

- Siteco Informatica Srl

- YellowScan

- Fugro N.V.

- Cyclomedia Technology BV

- Imajing SAS

- Velodyne Lidar Inc.

- Ouster Inc.

- SureStar Technology Co., Ltd.

- Innoviz Technologies Ltd.

- Hesai Technology Co., Ltd.

- RoboSense (Suteng Innovation Technology Co., Ltd.)

- OxTS Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration with All Kinds of Vehicles

- 4.2.2 Government Digital-Twin Mandates

- 4.2.3 Declining Solid-State LiDAR Costs

- 4.2.4 AI-Powered Automatic Feature Extraction

- 4.2.5 Autonomous Robots and Drone Adoption

- 4.2.6 Defense ISR Modernization Budgets

- 4.3 Market Restraints

- 4.3.1 High Cost of System Acquisition and Deployment

- 4.3.2 Skilled-Operator Shortage

- 4.3.3 Data-Privacy and Surveillance Regulations

- 4.3.4 Construction-Sector Cap-ex Cyclicality

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Mounting Type

- 5.2.1 Vehicle Mounted

- 5.2.2 Railway Mounted

- 5.2.3 Drone Mounted

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Imaging Services

- 5.3.2 Aerial Mobile Mapping

- 5.3.3 Emergency Response Planning

- 5.3.4 Internet Applications

- 5.3.5 Facility Management

- 5.3.6 Satellite

- 5.4 By End-user Verticals

- 5.4.1 Government

- 5.4.2 Oil and Gas

- 5.4.3 Mining

- 5.4.4 Military

- 5.4.5 Other End-user Verticals

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Leica Geosystems AG (Hexagon AB)

- 6.4.2 Trimble Inc.

- 6.4.3 Topcon Corporation

- 6.4.4 Teledyne Optech Inc.

- 6.4.5 RIEGL Laser Measurement Systems GmbH

- 6.4.6 Zoller+Frohlich GmbH

- 6.4.7 NavVis GmbH

- 6.4.8 GeoSLAM Ltd.

- 6.4.9 Kaarta Inc.

- 6.4.10 Mandli Communications Inc.

- 6.4.11 Applanix Corporation

- 6.4.12 Siteco Informatica Srl

- 6.4.13 YellowScan

- 6.4.14 Fugro N.V.

- 6.4.15 Cyclomedia Technology BV

- 6.4.16 Imajing SAS

- 6.4.17 Velodyne Lidar Inc.

- 6.4.18 Ouster Inc.

- 6.4.19 SureStar Technology Co., Ltd.

- 6.4.20 Innoviz Technologies Ltd.

- 6.4.21 Hesai Technology Co., Ltd.

- 6.4.22 RoboSense (Suteng Innovation Technology Co., Ltd.)

- 6.4.23 OxTS Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment