PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850050

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850050

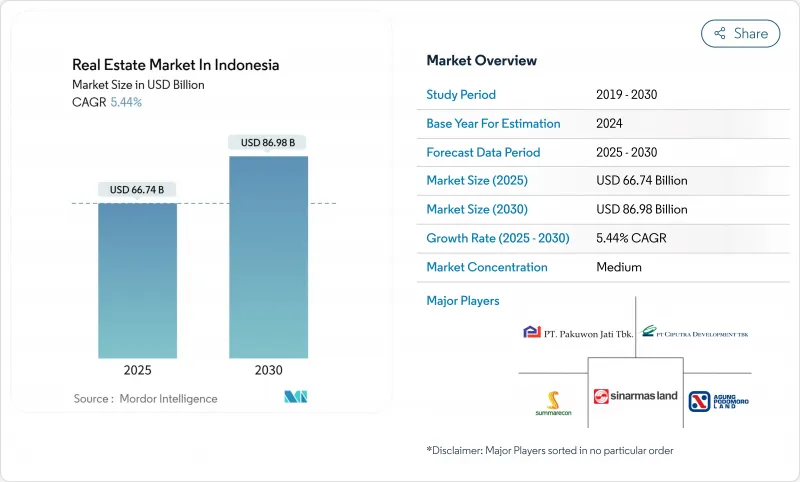

Real Estate In Indonesia - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Indonesia Real Estate Market size is estimated at USD 66.74 billion in 2025, and is expected to reach USD 86.98 billion by 2030, at a CAGR of 5.44% during the forecast period (2025-2030).

Continuous infrastructure spending, the presidential target of 8% annual GDP growth, and the ongoing 3 million houses program are the chief tailwinds behind this up-cycle. Progress on 153 National Strategic Projects worth USD 128.6 billion is strengthening logistics corridors and lifting demand for both residential and commercial assets. Cement offtake climbed to 28.542 million tons in 2024, confirming that construction momentum remains intact. At the same time, VAT exemptions on units priced up to IDR 5 billion and a recent 25 basis-point rate cut to 5.75% are assisting mid-income families in closing housing transactions.

Real Estate Market Trends and Insights

Growing Middle-Income Population Drives Urban Housing Demand

Household income growth and a projected 5.2% national GDP expansion in 2025 are enlarging the addressable buyer pool in core cities. The Indonesia real estate market is benefiting directly from the central bank's latest rate trim to 5.75%, which lowers mortgage servicing costs for first-time purchasers. VAT relief on homes priced at or below IDR 5 billion further narrows the affordability gap, effectively unlocking latent demand across Java's urban corridors. Analysts expect listed developers' equity valuations to firm as this purchasing power filters through pre-sales. Policy makers underscore housing's dual economic and social role, citing the sector's capacity both to lift construction-sector employment and to narrow poverty levels.

Urbanization Accelerates Vertical Development in Major Cities

Indonesia's urban population continues to climb, pushing developers toward high-rise formats on limited urban land. Cement demand in Kalimantan jumped 18.8% in 2024, mirroring the construction pace of Nusantara, the planned new capital. Government capex of USD 3 billion through 2029 underpins this transformation. Projects such as Mitsubishi Estate's Two Sudirman towers-set to reach 330 m and 270 m by 2028-illustrate how investors are responding to density pressures. These trends position vertical living as the default solution for future urban growth within the Indonesia real estate market.

Limited Affordability Constrains Lower-Income Housing Access

Low-income households face the brunt of an 11 million-unit housing backlog in Indonesia. Budget constraints are hampering project roll-outs, with allocations for 2025 set to dip below those of 2024. The widening income gap between Java and its outer islands exacerbates affordability challenges. This underscores the necessity of subsidies and innovative financing to tap into this demand. Absent these measures, Indonesia's real estate market may leave a significant demographic in the lurch, stunting its growth potential.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Development Enhances Real Estate Accessibility

- Affordable Housing Initiatives Stimulate Low-Mid Income Development

- Condominium Oversupply Pressures Urban Premium Segments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential assets captured 56.7% of the Indonesia real estate market in 2024, anchored by demographic growth, the 3 million houses initiative and still-strong cultural preferences for ownership. This dominance is evident in the Indonesia real estate market size for housing, and pre-sales remain concentrated in landed houses outside the Jakarta inner ring. Apartments and vertical condominiums are gaining share in Surabaya and Bandung as land becomes scarce, while villas attract lifestyle buyers in suburban corridors. Government backing via VAT relief and subsidised mortgages continues to secure front-loaded demand, ensuring that the Indonesia real estate market retains a solid residential backbone.

The Commercial category, though smaller, is set to expand at a 5.98% CAGR, the fastest among property types. Logistics warehouses lead this surge, propelled by e-commerce penetration and Indonesia's hub role within ASEAN supply chains. Office formats are migrating toward flexible workspaces, and data-centre footprints are widening as Telkom Indonesia courts new investors. Integrated tourism complexes such as the USD 2.58 billion PIK 2 project are also amplifying hospitality pipelines. These dynamics suggest that commercial stock will command an increasing slice of the Indonesia real estate market size through 2030.

The Indonesia Real Estate Market Report is Segmented by Property Type (Residential, and Commercial), by Business Model (Sales and Rental), by End User (Individuals/Households, Corporates & SMEs, and More), and by Region (DKI Jakarta, East Java, West Java, and the Rest of Indonesia). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- Sinar Mas Land

- PT Ciputra Development Tbk

- PT Pakuwon Jati Tbk

- AGUNG PODOMORO GROUP

- PT Summarecon Agung Tbk.

- PT Lippo Karawaci Tbk

- PT Intiland Development Tbk

- PT Agung Sedayu Group

- PT Kawasan Industri Jababeka Tbk

- PT PP Properti Tbk

- PT Alam Sutera Realty Tbk

- PT Waskita Karya Realty

- PT Puradelta Lestari Tbk (GIIC)

- PT Trans Property

- PT Modernland Realty Tbk

- PT HK Realtindo

- PT Adhi Commuter Properti Tbk

- PT Metropolitan Land Tbk

- PT Duta Anggada Realty Tbk

- PT Sentul City Tbk

- Paramount Enterprise International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Commercial Real Estate Buying Trends - Socio-economic & Demographic Insights

- 4.3 Rental Yield Analysis

- 4.4 Capital-Market Penetration & REIT Presence

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Insights into Real Estate Tech and Startups Active in the Real Estate Segment

- 4.8 Insights into Existing and Upcoming Projects

- 4.9 Market Drivers

- 4.9.1 Growing middle-income population is increasing demand for housing across urban centers.

- 4.9.2 Ongoing urbanization is fueling vertical development in major cities like Jakarta and Surabaya.

- 4.9.3 Infrastructure improvements such as MRT, toll roads, and airports are enhancing real estate accessibility.

- 4.9.4 Affordable housing initiatives are encouraging development in low- and mid-income segments.

- 4.9.5 Foreign investment interest is rising in commercial, logistics, and tourism-related real estate.

- 4.9.6 Expansion of e-commerce and retail networks is boosting demand for warehousing and retail spaces.

- 4.10 Market Restraints

- 4.10.1 Limited affordability among lower-income groups is constraining residential uptake.

- 4.10.2 Oversupply of condominiums in major urban areas is slowing price growth and absorption.

- 4.10.3 Lengthy permitting processes and regulatory complexity are delaying project execution.

- 4.10.4 High construction and financing costs are impacting developer margins and end-user pricing.

- 4.11 Value / Supply-Chain Analysis

- 4.11.1 Overview

- 4.11.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.11.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.11.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.11.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.11.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.11.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.12 Porter's Five Forces

- 4.12.1 Threat of New Entrants

- 4.12.2 Bargaining Power of Buyers/Occupiers

- 4.12.3 Bargaining Power of Suppliers (Developers/Builders)

- 4.12.4 Threat of Substitutes

- 4.12.5 Competitive Rivalry Intensity

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Property Type

- 5.1.1 Residential

- 5.1.1.1 Apartments & Condominiums

- 5.1.1.2 Villas & Landed Houses

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Logistics

- 5.1.2.4 Others (industrial real estate, hospitality real estate, etc.)

- 5.1.1 Residential

- 5.2 By Business Model

- 5.2.1 Sales

- 5.2.2 Rental

- 5.3 By End-user

- 5.3.1 Individuals / Households

- 5.3.2 Corporates & SMEs

- 5.3.3 Others

- 5.4 By Region

- 5.4.1 DKI Jakarta

- 5.4.2 West Java (Jawa Barat)

- 5.4.3 East Java (Jawa Timur)

- 5.4.4 Rest of Indonesia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)}

- 6.3.1 Sinar Mas Land

- 6.3.2 PT Ciputra Development Tbk

- 6.3.3 PT Pakuwon Jati Tbk

- 6.3.4 AGUNG PODOMORO GROUP

- 6.3.5 PT Summarecon Agung Tbk.

- 6.3.6 PT Lippo Karawaci Tbk

- 6.3.7 PT Intiland Development Tbk

- 6.3.8 PT Agung Sedayu Group

- 6.3.9 PT Kawasan Industri Jababeka Tbk

- 6.3.10 PT PP Properti Tbk

- 6.3.11 PT Alam Sutera Realty Tbk

- 6.3.12 PT Waskita Karya Realty

- 6.3.13 PT Puradelta Lestari Tbk (GIIC)

- 6.3.14 PT Trans Property

- 6.3.15 PT Modernland Realty Tbk

- 6.3.16 PT HK Realtindo

- 6.3.17 PT Adhi Commuter Properti Tbk

- 6.3.18 PT Metropolitan Land Tbk

- 6.3.19 PT Duta Anggada Realty Tbk

- 6.3.20 PT Sentul City Tbk

- 6.3.21 Paramount Enterprise International

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment