PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850055

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850055

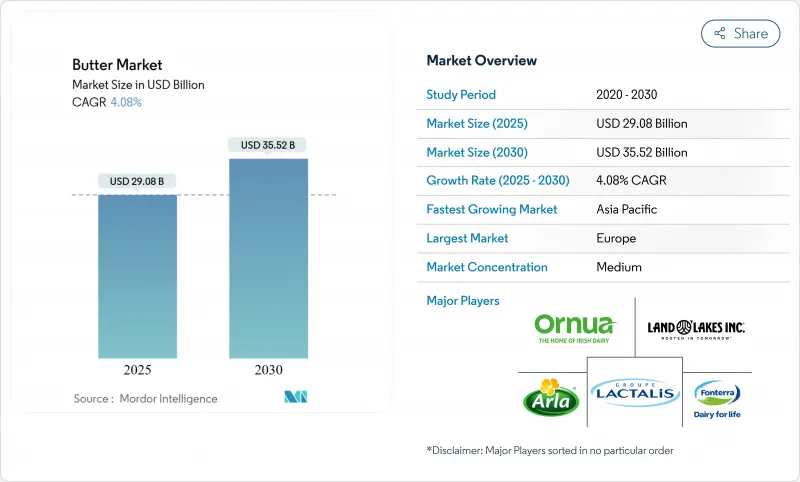

Butter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global butter market reached USD 29.08 billion in 2025 and is projected to climb to USD 35.52 billion by 2030, reflecting a steady 4.08% CAGR over the forecast period.

The butter market exhibits steady growth driven by traditional household demand and new premium product segments, enabling it to maintain stability compared to the price fluctuations seen in other dairy commodities. Also, major cooperatives continue to channel milk fat away from bulk cream and toward higher-margin butter SKUs, thereby strengthening processor pricing power and justifying fresh capacity investments. Besides, premiumisation further supports value creation, as origin-specific stories and small-batch claims move butter from an anonymous pantry staple to a product that signals craftsmanship at retail. Alongside these shifts, the butter market benefits from home-baking enthusiasm and long-term supply contracts between dairies and commercial bakeries, which collectively shield processors from short-term input volatility and encourage stable capital allocation.

Global Butter Market Trends and Insights

Premium Artisanal Butter Demand in the Bakery Channel

Artisanal butter products command substantial price premiums, often several multiples above mainstream offerings, yet bakery buyers continue to absorb the higher cost because flavor differentiation boosts product value downstream. Both independent and chain bakeries report that customers request information about the butter source used in pastries, demonstrating that butter origin has evolved into a key differentiator rather than an undisclosed ingredient. Manufacturers have responded by producing small-batch cultured variants, rolling out laminated formats optimised for croissant production, and highlighting single-breed or pasture-specific claims. The improved demand visibility for high-fat, low-moisture butter has enabled dairies to plan their production schedules more efficiently. The companies are offering new artisan butter products in the market to cater to the rising demand. For instance, Chef Nuno Bergonse and his wife Raquel established Manteiga Boua, an artisanal butter manufacturing operation, in Almancil. The product portfolio encompasses diverse flavor variants.

Rising Demand for Natural and Organic Food Products

The butter market is experiencing significant changes due to increasing consumer demand for clean-label products, with natural and organic varieties growing at double-digit rates compared to conventional products. This transformation aligns with broader food market trends where consumers actively seek products with clear ingredient transparency and minimal processing methods. Organic Valley's strategic expansion through the addition of more than 100 new family farms to its cooperative in 2024 directly addresses this increased market demand while emphasizing the fundamental relationship between sustainable farming practices and superior product quality. The continuous growth in the premium segment reflects consumers' increasing willingness to pay higher prices for products they perceive as healthier and environmentally sustainable. This consumer behavior trend is particularly prominent among younger demographic groups and higher-income households, creating substantial opportunities for product development and positioning that emphasize comprehensive health benefits and environmental sustainability credentials.

Climate-driven Milk-Supply Volatility

Weather-related disruptions in global milk production are significantly affecting butter availability and prices worldwide. The impact is particularly evident in butter prices across the European Union, which increased by 19% from October 2023 to October 2024. These substantial price fluctuations create operational challenges for food manufacturers and bakeries that depend on stable butter supplies and predictable prices for their production planning and cost management. The supply constraints are further intensified by reduced milk production in major exporting regions, creating additional market pressure. For instance, Australia has reached "peak milk," indicating a structural decline in production capacity, which has substantially increased its reliance on dairy imports to meet domestic demand. The persistent supply-demand imbalance in the global butter market presents strategic opportunities for producers with established milk supply chains and robust price management systems to maintain market stability.

Other drivers and restraints analyzed in the detailed report include:

- Menu-Innovation Push by QSRs

- Growing Popularity of Home Baking and Cooking

- Environmental and Sustainability Issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Uncultured butter holds a dominant market share of 81.23% in 2024, driven by consumer familiarity and its wide use across retail and foodservice sectors. Cultured butter is experiencing rapid growth with a projected CAGR of 5.91% (2025-2030). This premium segment's expansion stems from its distinct tangy flavor and traditional production methods, which appeal to culinary enthusiasts and health-conscious consumers in developed markets who are willing to pay higher prices. The growth of cultured butter aligns with increasing consumer interest in fermented foods and their potential probiotic properties.

Moreover, manufacturers emphasize traditional production processes and extended fermentation times to differentiate their products. Premium packaging that maintains product quality while emphasizing high-end positioning has become a key competitive factor. As cultured butter transitions from specialty to premium mainstream status, both established manufacturers and artisanal producers can benefit from enhanced profit margins.

Animal-based butter holds 92.31% market share in 2024, supported by established production infrastructure and widespread consumer acceptance across global markets. Plant-based butter alternatives represent the fastest-growing segment, with a projected CAGR of 9.52% during 2025-2030, significantly outpacing the overall market growth rate. This growth stems from increasing consumer focus on health, sustainability, and animal welfare, particularly among younger consumers and in environmentally conscious markets.

Moreover, the plant-based segment continues to evolve through technological advancement, as demonstrated by companies like Savor, which has developed methods to produce fats using carbon dioxide, hydrogen, and oxygen without animal or plant inputs. For instance, in May 2025, French luxury pastry brand Maison Linotte launched Purely, a plant-based butter alternative. This product, designed for professional chefs and home bakers, features organic ingredients and excludes palm oil, additives, and common allergens.

The Global Butter Market is Segmented by Product Type (Cultured Butter and Uncultured Butter), Source (Animal-Based and Plant-Based Butter Analogs), Salt Content (Salted and Unsalted), Packaging Type (Blocks/Cubes and More), Distribution Channel (Off-Trade and On-Trade), and Geography (North America, Europe, Asia-Pacific, South America, and More). Market Sizing is Presented in USD Value Terms for all the Abovementioned Segments.

Geography Analysis

Europe holds a 34.37% market share in 2024, supported by traditional butter consumption patterns and advanced dairy infrastructure. The region experiences supply challenges due to climate-related milk production fluctuations, resulting in increased butter prices. In response, European producers continue to expand capacity, as evidenced by Arla Foods' USD 300 million investment across five United Kingdom sites in May 2024. The investment includes upgrades to the Taw Valley site for export enhancement and improvements at Stourton, Aylesbury, and Westbury facilities.

Asia-Pacific shows the highest growth potential with a projected CAGR of 5.63% during 2025-2030, exceeding global market growth rates. This growth stems from increased disposable incomes, urbanization, and Western dietary influence. The expansion of modern retail and e-commerce platforms improves product availability in non-urban areas. Fonterra's expansion of foodservice operations in Asia, particularly in China, indicates the region's strategic importance.

North American butter consumption is increasing as consumers transition from margarine to natural, full-fat dairy products, influenced by taste preferences and health perceptions. According to the International Dairy Foods Association data from 2024, 6.5 pounds of butter were consumed per capita in the United States . Also, the region faces supply challenges as dairy producers prioritize cheese production, affecting milk fat availability. The impact of avian influenza on dairy herds has contributed to reduced milk output and higher butter prices. The market continues to develop in premium and specialty butter categories. Moreover, South America and the Middle East & Africa represent emerging markets, with Brazil's food sector benefiting from updated regulations aimed at improving efficiency and competitiveness.

- Fonterra Co-operative Group

- Arla Foods amba

- Ornua Co-operative Ltd

- Land O' Lakes Inc.

- Organic Valley (CROPP)

- Dairy Farmers of America

- Saputo Inc.

- Groupe Lactalis

- FrieslandCampina N.V.

- Kerry Group plc

- Valio Ltd

- Gujarat Co-operative Milk Marketing Federation (Amul)

- Upfield Group B.V.

- Almarai Company

- Westland Dairy Company

- Megmilk Snow Brand Co.

- CavinKare Pvt Ltd

- Berchtesgadener Land eG

- Emmi AG

- Ammerland eG

- Greenfields Ireland Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premium Artisanal Butter Demand in the Bakery Channel

- 4.2.2 Rising Clarified-butter Uptake Across Middle Class

- 4.2.3 Rising Demand for Natural and Organic Food Products

- 4.2.4 Menu-innovation Push by QSR's

- 4.2.5 Growing Popularity of Home Baking and Cooking

- 4.2.6 Growing Culinary Tourism and Globalization of Cuisines

- 4.3 Market Restraints

- 4.3.1 Competition from Other Alternatives

- 4.3.2 Climate-driven Milk-Supply Volatility

- 4.3.3 Saturated-fat Labeling Tightening Laws Hinder its Growth

- 4.3.4 Environmental and Sustainability Issues

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, VOLUME)

- 5.1 By Product Type

- 5.1.1 Cultured Butter

- 5.1.2 Uncultured Butter

- 5.2 By Source

- 5.2.1 Animal Based

- 5.2.1.1 Cow-milk

- 5.2.1.2 Buffalo-milk

- 5.2.1.3 Goat & Sheep-milk

- 5.2.1.4 Other Animal Based

- 5.2.2 Plant-based Butter Analogs

- 5.2.1 Animal Based

- 5.3 By Salt Content

- 5.3.1 Salted

- 5.3.2 Unsalted

- 5.4 By Packaging Type

- 5.4.1 Blocks/Cubes

- 5.4.2 Plastic Boxes

- 5.4.3 Others (Sheet/slabs, cartons, etc.)

- 5.5 By Distribution Channel

- 5.5.1 Off-Trade

- 5.5.1.1 Supermarkets / Hypermarkets

- 5.5.1.2 Convenience & Grocery Stores

- 5.5.1.3 Specialty Stores

- 5.5.1.4 Online Retail Stores

- 5.5.1.5 Other Distribution Channels

- 5.5.2 On-Trade

- 5.5.1 Off-Trade

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 United Kingdom

- 5.6.2.4 Netherlands

- 5.6.2.5 Italy

- 5.6.2.6 Sweden

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Spain

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Indonesia

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Colombia

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East & Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 South Africa

- 5.6.5.3 Nigeria

- 5.6.5.4 Saudi Arabia

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Fonterra Co-operative Group

- 6.4.2 Arla Foods amba

- 6.4.3 Ornua Co-operative Ltd

- 6.4.4 Land O' Lakes Inc.

- 6.4.5 Organic Valley (CROPP)

- 6.4.6 Dairy Farmers of America

- 6.4.7 Saputo Inc.

- 6.4.8 Groupe Lactalis

- 6.4.9 FrieslandCampina N.V.

- 6.4.10 Kerry Group plc

- 6.4.11 Valio Ltd

- 6.4.12 Gujarat Co-operative Milk Marketing Federation (Amul)

- 6.4.13 Upfield Group B.V.

- 6.4.14 Almarai Company

- 6.4.15 Westland Dairy Company

- 6.4.16 Megmilk Snow Brand Co.

- 6.4.17 CavinKare Pvt Ltd

- 6.4.18 Berchtesgadener Land eG

- 6.4.19 Emmi AG

- 6.4.20 Ammerland eG

- 6.4.21 Greenfields Ireland Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS