PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850065

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850065

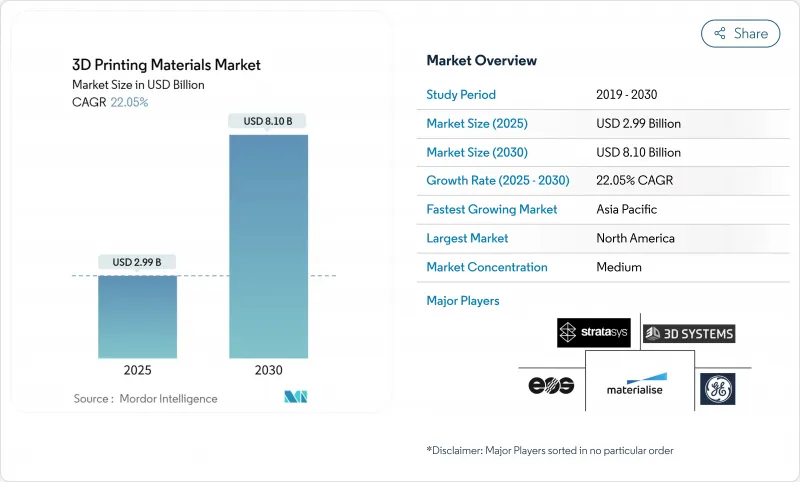

3D Printing Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The 3D printing materials market reached USD 2.99 billion in 2025 and is forecast to rise to USD 8.10 billion by 2030, advancing at a 22.05% CAGR.

This expansion reflects the migration of additive manufacturing from a prototyping resource to a validated production tool across aerospace, automotive, and healthcare supply chains. Aerospace primes continue to qualify titanium, nickel, and aluminum powders for serial production, while medical device makers secure regulatory clearances for patient-specific polymers and metals. Automotive OEMs accelerate adoption of lightweight electric-vehicle components and tooling efficiencies. Rapid material innovation lowers cycle times, improves part performance, and opens new revenue streams for chemical companies and printer vendors. Competitive strategies now center on tight integrating hardware, software, and consumables to lock in repeat material revenue.

Global 3D Printing Materials Market Trends and Insights

Surge in Metal Powder Usage for Serial Aerospace and Medical Production

Aerospace OEMs have moved beyond demonstration projects to certify titanium, nickel, and aluminum alloys for flight-critical components, with Ti-6Al-4V representing the major portion of the aerospace powder consumption thanks to its high strength-to-weight ratio and corrosion resistance. Medical device firms mirror this shift; biocompatible titanium and cobalt-chrome powders now support cranial plates, spinal cages, and joint replacements with internal lattices unachievable through subtractive routes. Honeywell's 2025 qualification of 6K Additive Nickel 718 illustrates how recycled feedstock can meet stringent turbine-engine requirements while reducing raw-material waste. Lengthy two-year qualification regimes create high entry barriers and shield incumbent powder suppliers from price-based disruption, reinforcing consolidation trends inside the 3D printing materials market.

Rapid Advances in High-Performance Polymers

Polyetheretherketone (PEEK), polyetherketoneketone (PEKK), and carbon-fiber-reinforced blends are replacing aluminum in satellite brackets, orthopedic trauma plates, and oil-and-gas flow restrictors. Stratasys introduced VICTREX AM 200 in 2025, enabling hundreds of parts per build and maintaining dimensional accuracy at 150 °C service temperatures. Dual-nozzle fused deposition systems now embed continuous carbon rovings that lift in-plane thermal conductivity to 4.54 W/(m*K), expanding use cases in heat sinks and EMI shielding. These advances compress production lead times below 36 hours and reduce post-machining by 50%, stimulating recurring polymer demand across the 3D printing materials market.

High Equipment and Material Cost

Industrial metal printers list between USD 100,000 and USD 1 million, while specialty powders and filaments account for 30-40% of total part cost, limiting penetration in small and medium manufacturers. Volatile nickel and rare-earth pricing add budgeting risk for service bureaus. Large integrators counter by signing multi-year feedstock contracts and developing in-house recycling, but capital intensity remains a gating factor for broader adoption across the 3D printing materials market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Demand from Automotive Applications

- Increase in the Adoption of Bio-Based/Biodegradable Feedstocks

- Stringent Certification for Aerospace and Medical Grades

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics led the 3D printing materials market with a 47.25% share in 2024, reflecting their cost advantage and compatibility with both consumer and industrial printers. The segment covers commodity grades such as ABS and PLA as well as engineering polymers capable of withstanding sterilization or high-temperature service. Demand scales in tandem with desktop printer shipments and professional fused-filament installations. The plastics segment benefits from continued improvements in color fidelity, flame retardancy, and mechanical performance, which keep desktop users engaged and industrial users satisfied with validated data sets.

Although holding a smaller base, metals are on track for a 23.24% CAGR to 2030, the fastest in the 3D printing materials market. Certified titanium, aluminum, and nickel super-alloy powders enable weight-critical aero-engine brackets, orthopaedic implants, and racing-car brake calipers. Ceramics and waxes occupy specialized niches such as investment casting shells and high-temperature electronics.

The 3D Printing Materials Market Report Segments the Industry by Material Type (Plastics, Metals, Ceramics, and Other Materials), Form (Powder, Filament, and Liquid/Resin), End-User Industry (Aerospace and Defense, Automotive, Medical, Consumer Electronics, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained leadership with 39.46% of the 3D printing materials market in 2024, supported by a robust aerospace supply chain, surgeon-led implant innovation, and federal funding channels such as the America Makes consortium. Material vendors leverage proximity to Tier-1 airframers and medical device clusters to co-develop application-specific powders and polymers. The region also hosts several powder recyclers that capture metal swarf and convert it into qualified additive feedstock, reducing dependence on virgin imports.

Asia-Pacific delivered the highest 26.25% CAGR and is projected to remain the growth engine through 2030. China dominates entry-level printer exports, providing cost advantages for bio-based polymers. Europe balances strong research and development capability with some of the strictest environmental regulations worldwide. The EU's circular-economy directives encourage recycled feedstock adoption, positioning bio-derived PLA and PA11 for accelerated volume gains.

- 3D Systems, Inc.

- Arkema

- BASF

- CRP TECHNOLOGY S.r.l.

- Custom Resin Solutions

- EnvisionTEC US LLC

- EOS GmbH

- Evonik Industries AG

- General Electric Company

- Henkel AG & Co. KGaA

- Hoganas AB

- HP Development Company, L.P.

- Materialise

- Renishaw plc

- Sandvik AB

- Solvay

- Stratasys

- voxeljet AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Metal Powder Usage for Serial Aerospace and Medical Production

- 4.2.2 Rapid Advances in High-performance Polymers

- 4.2.3 Surge in Demand from Automotive Application

- 4.2.4 Mass-customization Momentum in Healthcare and Consumer Goods

- 4.2.5 Increase in the Adoption of Bio-based/Biodegradable Feedstocks

- 4.3 Market Restraints

- 4.3.1 High Equipment and Material Cost

- 4.3.2 Stringent Certification for Aerospace and Medical Grades

- 4.3.3 Availability of Limited Types of Materials

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Plastics

- 5.1.1.1 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.1.2 Polylactic Acid (PLA)

- 5.1.1.3 Nylon

- 5.1.1.4 Polyamide

- 5.1.1.5 Polycarbonate

- 5.1.1.6 Other Plastics (Composites, Biodegradable Polymers, etc.)

- 5.1.2 Metals

- 5.1.3 Ceramics

- 5.1.4 Other Materials (Gases, Waxes)

- 5.1.1 Plastics

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Filament

- 5.2.3 Liquid/Resin

- 5.3 By End-user Industry

- 5.3.1 Aerospace and Defense

- 5.3.2 Automotive

- 5.3.3 Medical

- 5.3.4 Consumer Electronics

- 5.3.5 Others (Energy and Power, Industrial Machinery, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 South Korea

- 5.4.1.4 India

- 5.4.1.5 Singapore

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3D Systems, Inc.

- 6.4.2 Arkema

- 6.4.3 BASF

- 6.4.4 CRP TECHNOLOGY S.r.l.

- 6.4.5 Custom Resin Solutions

- 6.4.6 EnvisionTEC US LLC

- 6.4.7 EOS GmbH

- 6.4.8 Evonik Industries AG

- 6.4.9 General Electric Company

- 6.4.10 Henkel AG & Co. KGaA

- 6.4.11 Hoganas AB

- 6.4.12 HP Development Company, L.P.

- 6.4.13 Materialise

- 6.4.14 Renishaw plc

- 6.4.15 Sandvik AB

- 6.4.16 Solvay

- 6.4.17 Stratasys

- 6.4.18 voxeljet AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Introduction of New Materials, like Graphene Opens Up New Applications

- 7.3 Adoption of 3D Printing Technology in Home Printing