PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850066

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850066

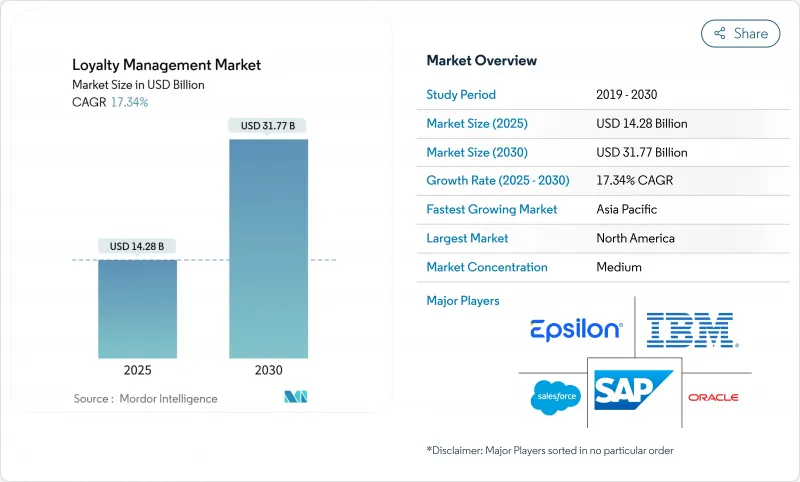

Loyalty Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The loyalty management market size is estimated at USD 14.28 billion in 2025 and is on course to reach USD 31.77 billion by 2030, reflecting a 17.34% CAGR during the forecast window.

Rising customer-acquisition costs in saturated digital channels, combined with inflation-driven margin pressure, are prompting brands to double down on retention economics. Cloud-native, AI-enabled platforms now integrate loyalty, CRM, and POS data to deliver unified experiences, making program orchestration faster and more scalable than in prior technology cycles. Demand for zero-party data is intensifying as privacy regulations tighten, and omnichannel engagement has become the minimum standard for competitive differentiation. Regional performance diverges: North America leads on spend, while Asia-Pacific supplies most of the incremental growth through 2030.

Global Loyalty Management Market Trends and Insights

Omnichannel Digital Transformation Elevates Retention Economics

Unified loyalty architectures now merge online, in-store, and partner touchpoints into a single engagement engine that maximizes lifetime value. Oracle's 2025 cloud revenue rose 21% to USD 5.6 billion, largely fueled by enterprises consolidating siloed loyalty data into cross-channel platforms. Retailers are pairing POS integrations with mobile wallets so members can earn and redeem in real time, and collaborations such as Starbucks-Marriott unlock cross-brand utility that single-player programs cannot replicate. Eighty-two percent of restaurant diners now prefer discounts delivered directly through loyalty apps rather than one-off coupons. Brands consequently require solutions that sit above legacy CRM stacks and orchestrate personalized experiences across functions, partners, and device types.

AI-Driven Personalization Engines Boost Program Stickiness and ROI

AI is recasting loyalty from a passive reward ledger into a live decision system that predicts intent and curates offers at the moment of need. Loyalty Juggernaut secured a third U.S. patent for its "mass individualization" engine in 2024, underscoring the race to automate relevance at scale. Salesforce's AgentForce amassed more than 3,000 paying customers within months, showing enterprise appetite for AI agents that autonomously manage campaign logic while honoring individual preferences. Early adopters report churn reductions near 25% and ARPU lifts topping 35%, signaling that algorithmic engagement is evolving from nice-to-have to baseline expectation.

Data-Privacy and Cross-Border Compliance Complexity

Varying rules across GDPR, CCPA, and emerging national statutes force brands to embed granular consent workflows, audit trails, and deletion triggers into loyalty databases. Compliance mandates elevate operating costs and constrain the kind of behavioral data that can be processed, dampening segmentation depth even as expectations for personalization climb. Vendors are responding with privacy-by-design frameworks, but the additional engineering reduces ROI for resource-constrained organizations.

Other drivers and restraints analyzed in the detailed report include:

- Escalating Customer-Acquisition Costs in Saturated E-Commerce

- Mobile-First Reward Apps Drive Frequency and Ticket Size

- Integration Burden with Legacy POS / CRM Stacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, B2C schemes controlled 54.5% of revenue, yet B2B initiatives are forecast to grow 18.3% annually through 2030. The loyalty management market size for B2B offerings is therefore expanding faster than any other solution set, propelled by higher average account values and entrenched switching barriers in business purchasing. HP's Planet Partners and American Express Partners Plus illustrate how non-transactional behaviors-recycling or referrals-earn rewards that reinforce multi-year contracts.

Channel-partner incentives are gaining traction in manufacturing and transport, with Peterbilt's dealer program rewarding parts purchases and service adherence. Meanwhile, consumer programs must innovate beyond simple points to offset fatigue, layering experiences such as app-based games or exclusive events. The dual-track growth suggests vendors will tailor modules for enterprise resource managers on the B2B side and experiential marketers on the B2C frontier.

Cloud platforms held 62.3% of loyalty management market share in 2024, and the model is growing at a 19.2% CAGR. The loyalty management market favors cloud because automatic updates, elastic compute, and API-first design reduce both implementation time and total cost of ownership. Oracle's cloud infrastructure revenue surge of 45% underscores enterprise migration patterns.

On-premise deployments persist in finance and government where data sovereignty dictates local hosting, yet they attract diminishing net-new spend. SMEs flock to subscription-based SaaS plans that bundle security, compliance, and analytics dashboards. Vendors able to demonstrate pre-built POS and e-commerce connectors gain competitive edge because integration friction remains the single biggest deterrent to platform switching

Loyalty Management Market is Segmented by Solution (B2C, B2B), Deployment (On-Premises, Cloud), Enterprise Size (SMEs, Large Enterprises), Industry Vertical (BFSI, Retail, and Consumer Goods, Travel and Hospitality, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 24.1% of 2024 revenue, leveraging mature cloud infrastructure and advanced analytics capabilities that make the region a blueprint for global best practice. Capillary's acquisition of Toronto-based Kognitiv added marquee retail clients and illustrates how solution providers are doubling down on North American scale. Regulatory fragmentation at the state level drives innovation in consent management technologies, positioning the region as both pathfinder and testbed.

Asia-Pacific is forecast to expand at 18.5% CAGR through 2030, the fastest in the loyalty management market. Mobile wallets dominate daily commerce, so app-centric engagement outpaces card-linked approaches. Japan's point-management overhaul and China's three-year consumer-experience plan are catalyzing public-private investment in loyalty infrastructure

- Oracle Corporation

- Salesforce Inc.

- IBM Corporation

- SAP SE

- Epsilon Data Management LLC (Publicis)

- Comarch SA

- Fidelity National Information Services (FIS)

- Capillary Technologies

- Kognitiv Corporation

- Kobie Marketing Inc.

- Bond Brand Loyalty

- TIBCO Software Inc.

- Maritz Motivation Inc.

- Session M (Mastercard)

- Cheetah Digital Inc.

- Tenerity Inc.

- Annex Cloud

- Antavo Ltd.

- Talon.One

- Merkle Inc.

- LoyaltyLion

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Omnichannel digital transformation elevates retention economics

- 4.2.2 AI-driven personalization engines boost program stickiness and ROI

- 4.2.3 Escalating customer-acquisition costs in saturated e-commerce

- 4.2.4 Mobile-first reward apps drive frequency and ticket size

- 4.2.5 Zero-party data collection via loyalty platforms

- 4.2.6 ESG-linked rewards influence Gen-Z brand choices

- 4.3 Market Restraints

- 4.3.1 Data-privacy and cross-border compliance complexity

- 4.3.2 Integration burden with legacy POS / CRM stacks

- 4.3.3 Loyalty-program fatigue among digital natives

- 4.3.4 Inflation-driven reward-fulfilment cost spikes

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Gen-AI, blockchain, wallets)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 B2C

- 5.1.2 B2B

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Organization Size

- 5.3.1 SMEs

- 5.3.2 Large Enterprises

- 5.4 By Industry Vertical

- 5.4.1 BFSI

- 5.4.2 Retail and Consumer Goods

- 5.4.3 Travel and Hospitality

- 5.4.4 IT and Telecom

- 5.4.5 Healthcare

- 5.4.6 Manufacturing

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Oracle Corporation

- 6.4.2 Salesforce Inc.

- 6.4.3 IBM Corporation

- 6.4.4 SAP SE

- 6.4.5 Epsilon Data Management LLC (Publicis)

- 6.4.6 Comarch SA

- 6.4.7 Fidelity National Information Services (FIS)

- 6.4.8 Capillary Technologies

- 6.4.9 Kognitiv Corporation

- 6.4.10 Kobie Marketing Inc.

- 6.4.11 Bond Brand Loyalty

- 6.4.12 TIBCO Software Inc.

- 6.4.13 Maritz Motivation Inc.

- 6.4.14 Session M (Mastercard)

- 6.4.15 Cheetah Digital Inc.

- 6.4.16 Tenerity Inc.

- 6.4.17 Annex Cloud

- 6.4.18 Antavo Ltd.

- 6.4.19 Talon.One

- 6.4.20 Merkle Inc.

- 6.4.21 LoyaltyLion

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment