PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850067

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850067

Automotive Suspension System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

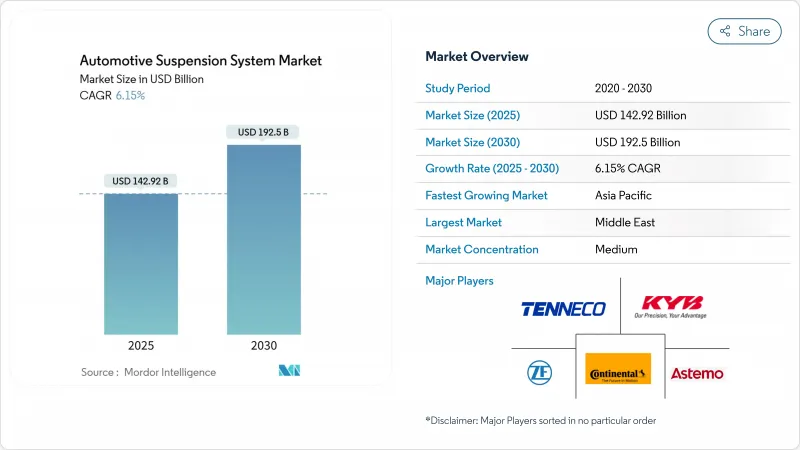

The Automotive Suspension Systems Market is valued at USD 142.92 billion in 2025 and is forecast to reach USD 192.50 billion by 2030, advancing at a 6.15% CAGR.

The expansion reflects how electrification, software-defined vehicle architectures, and tightening safety mandates reshape chassis components in every region. Automakers are switching from purely mechanical layouts to electronically controlled semi-active and active designs that balance ride comfort, energy recuperation, and packaging constraints in battery-electric platforms. Sensors, control units, and cloud connectivity now center suspension strategies, enabling continuous performance updates delivered over the air. At the same time, supply-chain uncertainty in rare-earth materials and semiconductors is forcing redesigns that lessen material intensity and diversify sourcing. Against this backdrop, the automotive suspension systems market continues to reward players capable of blending mechanical know-how with advanced electronics, software, and data analytics.

Global Automotive Suspension System Market Trends and Insights

Increasing Demand for Enhanced Ride Comfort and Handling

Rising consumer expectations for quiet, vibration-free cabins push automakers to embed real-time damping control across all price points. Magnetorheological dampers modulate fluid viscosity within milliseconds, a capability commercialized in systems such as MagneRide that first appeared in luxury models and now migrate into high-volume crossovers. Electric vehicles magnify this focus because the absence of engine noise exposes even slight suspension harshness to occupants. Shared-mobility fleets and autonomous prototypes add another layer of scrutiny, as passengers disengaged from driving become acutely aware of ride quality. Suppliers respond by integrating accelerometers, stroke sensors, and edge processors that adjust damping on a wheel-by-wheel basis while minimizing energy draw.

Electrification-Driven Chassis Redesign

Battery packs lower a vehicle's center of gravity but add hundreds of kilograms, prompting suspension engineers to adopt composite links and hollow stabilizer bars that counteract mass increases without compromising strength. Research on electro-hydrostatic regenerative dampers shows 45% peak energy recovery, equating to 5.25 g/km CO2 savings when integrated with vehicle energy-management logic.

High Upfront & Lifecycle Cost of Smart Suspension Architectures

Active systems combine motors, solenoid valves, acceleration sensors, and domain controllers, inflating the bill-of-materials by several hundred USD per vehicle compared with passive setups. OEMs hesitate to bundle such costs in mainstream segments with thin margins unless mandated or heavily subsidized. Total ownership expenses also rise, as specialized diagnostic tools and calibration rigs become necessary for service providers. These economics restrict penetration to premium trims, slowing mass-market adoption even when the underlying technology matures.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for ADAS-Linked Chassis Safety

- Rapid SUV & Premium-Vehicle Sales in Emerging Economies

- Rare-earth MR-fluid and Semiconductor Sensor Supply Bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 39.07% share held by shock absorbers in 2024 confirms their enduring role as the core energy-dissipation element. Yet, electronic control units and sensors are the fastest climbers at a 9.82% CAGR, supported by ADAS integration, edge-processing power gains, and the pivot toward cloud-linked updates. The automotive suspension systems market benefits from control modules that now host multiple safety functions, allowing OTA calibration and reducing the need for hardware revisions. As a result, the automotive suspension systems market size attributed to electronics is on track to double its 2024 baseline by 2030. Coil and leaf springs remain prevalent in commercial transport where durability outweighs finesse, while air springs gain share in luxury sedans and high-roof vans.

Software-defined vehicle roadmaps turn control units into modular compute nodes that meet ASIL-D safety levels while orchestrating data from wheel-travel sensors, load cells, and steering encoders. AI-assisted predictive algorithms feed cloud-derived road information into damping strategies, delivering proactive control and elevating occupant comfort even on unpredictable surfaces. This convergence between mechanical parts and digital intelligence reinforces the competitive moat of suppliers capable of manufacturing both domains at scale, propelling the automotive suspension systems market forward

Passive configurations retained a 65.28% share of the automotive suspension systems market size in 2024 due to simplicity and low running costs. Semi-active setups, however, are registering an 12.04% CAGR because they deliver meaningful ride gains without the energy draw and component count of fully active designs. Their adoption also underpins new steering innovations such as ZF's EasyTurn axle, which increases steering lock to 80 degrees, improving urban agility.

Magnetorheological and electromechanical valves allow millisecond-scale damping shifts that flatten body roll and pitch during high-speed maneuvers. Paired with predictive analytics drawn from cloud-sourced pothole maps, semi-active systems achieve near-active performance envelopes. Over the forecast horizon, active suspensions may gain greater visibility as battery energy density rises and regenerative dampers offset operational losses, but semi-active designs are expected to capture the bulk of incremental volume thanks to favorable cost-benefit ratios within the automotive suspension systems market.

The Automotive Suspension Systems Market Report is Segmented by Component Type (Coil Spring, Leaf Spring, and More), Suspension System Type (Passive Suspension and More), Geometry (MacPherson Strut, Double Wishbone, and More), Vehicle Type (Passenger Cars, LCV, and More), Sales Channel (OEM and Aftermarket), Propulsion (ICE and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific anchors the automotive suspension systems market with a 48.96% share in 2024, underpinned by China's scale and India's rapid capacity additions. Beijing's new-energy-vehicle subsidies and stringent ride-comfort benchmarks drive the adoption of semi-active damping in mass-market sedans. At the same time, Indian OEMs integrate lightweight composite springs to improve payload efficiency in small commercial trucks. Government schemes such as India's Automotive Mission Plan 2047 support local production of high-value chassis assemblies, reinforcing regional supply resilience. Japanese and South Korean suppliers contribute precision valves, smart bushings, and software stacks, lending depth to an ecosystem that now exports advanced suspension kits worldwide.

The Middle East and Africa, advancing at 7.65% CAGR, is emerging as a focal point for premium-SUV and commercial-vehicle demand that must withstand desert heat and rugged terrain. Gulf airlines' diversification into motorsport entertainment and Saudi Arabia's Grand Prix investments spur interest in high-performance damper technology capable of coping with severe thermal loads. Suppliers respond with specialized seals, long-stroke air bellows, and corrosion-resistant coatings designed for abrasive sand environments. Localization programs and free-trade zones lower import duties, enhancing the region's appeal for tier-1 manufacturing lines within the automotive suspension systems market.

North America and Europe maintain strong value shares through regulatory pull and premium-model concentration. The U.S. Inflation Reduction Act's domestic-battery incentives amplify demand for lightweight multi-link rear axles that protect floor-mounted packs in electric pickups. Europe's focus on Vision Zero and General Safety Regulation II embeds semi-active damping and ride-height control into homologation checklists, making intelligent suspensions a de facto requirement for OEM compliance. Mature supply chains, advanced simulation infrastructure, and robust test tracks ensure both regions continue to set performance and safety benchmarks that ripple across the global automotive suspension systems market.

- Continental AG

- ZF Friedrichshafen AG

- Tenneco Inc.

- KYB Corporation

- Hitachi Astemo Ltd.

- Thyssenkrupp AG

- Mando Corporation

- Marelli Corporation

- Hyundai Mobis Co. Ltd.

- BWI Group

- Sogefi SpA

- Parker LORD Corporation

- Benteler International AG

- Fox Factory Holding Corp.

- Hendrickson International

- Ohlins Racing AB

- Showa Corporation

- Multimatic Inc.

- SAF-HOLLAND SE

- WABCO (ZF CVS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for enhanced ride comfort & handling

- 4.2.2 Electrification-driven chassis redesign (lightweight adaptive suspensions)

- 4.2.3 Regulatory push for ADAS-linked chassis safety

- 4.2.4 Rapid SUV & premium-vehicle sales in emerging economies

- 4.2.5 Subscription-based OTA upgrades unlocking active-suspension features

- 4.2.6 3-D printed composite suspension parts reducing tooling cost

- 4.3 Market Restraints

- 4.3.1 High upfront & lifecycle cost of smart suspension architectures

- 4.3.2 Reliability & maintenance challenges in harsh conditions

- 4.3.3 Cyber-security & functional-safety compliance burden

- 4.3.4 Rare-earth MR-fluid & semiconductor sensor supply bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Component Type

- 5.1.1 Coil Springs

- 5.1.2 Leaf Springs

- 5.1.3 Air Springs

- 5.1.4 Shock Absorbers

- 5.1.5 Stabilizer / Anti-roll Bars

- 5.1.6 Suspension Arms & Links

- 5.1.7 Electronic Control Units & Sensors

- 5.1.8 Other Components

- 5.2 By Suspension System Type

- 5.2.1 Passive Suspension

- 5.2.2 Semi-Active Suspension

- 5.2.3 Active Suspension

- 5.3 By Geometry / Architecture

- 5.3.1 MacPherson Strut

- 5.3.2 Double Wishbone

- 5.3.3 Multi-Link

- 5.3.4 Torsion Beam / Twist Beam

- 5.3.5 Other Geometries

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Heavy Commercial Vehicles

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 By Propulsion

- 5.6.1 Internal-Combustion-Engine Vehicles

- 5.6.2 Electric & Hybrid Vehicles

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Aisa-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 South Africa

- 5.7.5.1.4 Egypt

- 5.7.5.1.5 Turkey

- 5.7.5.1.6 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 ZF Friedrichshafen AG

- 6.4.3 Tenneco Inc.

- 6.4.4 KYB Corporation

- 6.4.5 Hitachi Astemo Ltd.

- 6.4.6 Thyssenkrupp AG

- 6.4.7 Mando Corporation

- 6.4.8 Marelli Corporation

- 6.4.9 Hyundai Mobis Co. Ltd.

- 6.4.10 BWI Group

- 6.4.11 Sogefi SpA

- 6.4.12 Parker LORD Corporation

- 6.4.13 Benteler International AG

- 6.4.14 Fox Factory Holding Corp.

- 6.4.15 Hendrickson International

- 6.4.16 Ohlins Racing AB

- 6.4.17 Showa Corporation

- 6.4.18 Multimatic Inc.

- 6.4.19 SAF-HOLLAND SE

- 6.4.20 WABCO (ZF CVS)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment