PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850075

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850075

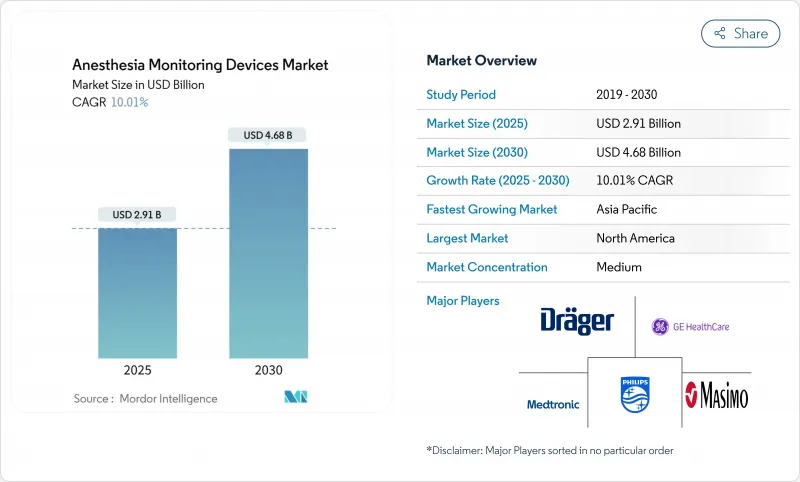

Anesthesia Monitoring Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The anesthesia monitoring devices market is valued at USD 2.91 billion in 2025 and is forecast to reach USD 4.68 billion by 2030, advancing at a 10.01% CAGR.

Growth rests on higher surgical volumes, artificial-intelligence-enabled predictive analytics, and an aging population that requires deeper perioperative vigilance. Integrated workstations remain the backbone of the anesthesia monitoring devices market because they blend ventilation, gas delivery, and multi-parameter tracking in one footprint, streamlining operating-room workflows. At the same time, AI-enhanced advanced monitors are pulling demand toward specialized applications such as brain activity and nociception tracking, signalling a shift from reactive to anticipatory care. Outpatient migration is another catalyst; portable systems that meet hospital-grade accuracy standards are critical as procedures move to ambulatory surgery centers (ASCs). Regionally, North America supplies stability through reimbursement and early technology uptake, but Asia-Pacific is the fastest-growing zone thanks to policy-backed localization drives that cut import dependency.

Global Anesthesia Monitoring Devices Market Trends and Insights

Development in Anesthesia Technology & Automated Record-keeping

Automated anesthesia information management systems (AIMS) slash manual charting errors by 40%, freeing clinicians to focus on patient care . Philips' IntelliSpace Critical Care and Anesthesia illustrates this trend with touch-optimized dashboards that feed real-time vitals directly into electronic health records . Closed-loop controllers already outmatch manual titration for hemodynamic stability, setting the stage for precision protocols driven by historical machine-learning feedback . Such gains meet a dual objective: higher safety margins and lower clinician burnout tied to administrative load. As a result, hospitals treat integrated AIMS as the core of a data-rich anesthesia monitoring devices market strategy.

Increasing Demand for Pain-free Surgeries

Patient expectations around rapid, opioid-sparing recovery are fueling multimodal techniques that hinge on objective nociception metrics. The NOL Index(R) finger probe converts four photoplethysmography channels into a 0-100 pain score, assisting anesthesiologists in tailoring analgesia . Validation studies confirm uniform accuracy across racial groups because infrared wavelengths and personalized algorithms normalize individual responses, answering equity concerns in perioperative care. In ASCs, where same-day discharge is the norm, NOL monitoring dovetails with ERAS pathways to curb respiratory depression and hasten mobilization. Consequently, pain-free protocols bolster the anesthesia monitoring devices market as facilities invest in sensors that align with patient-centric outcomes.

High Capital Cost & Preference for Conventional Techniques

Economic assessments show BIS monitoring costs USD 10,000-25,000 per avoided recall event, potentially adding USD 1 billion in annual spend if universally adopted. TIVA also presents higher variable expenses than low-flow inhalational strategies, leading resource-constrained systems to favor legacy monitors. Budget pressures, training overhead, and regulatory inertia slow advanced-device uptake, placing a drag on the anesthesia monitoring devices market where basic monitors suffice for routine cases.

Other drivers and restraints analyzed in the detailed report include:

- Rising Surgical Volumes from Aging Population

- AI-driven Predictive Analytics for Intra-operative Monitoring

- Shortage of Skilled Anesthesiologists in Developing Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Integrated workstations dominated with 41.34% share of the anesthesia monitoring devices market in 2024 as hospitals demanded single-console solutions that house gas delivery, ventilators, and monitors. Advanced monitors, though smaller in installed base, expand 10.78% CAGR by 2030, leveraging AI modules for brain and pain metrics that retrofit onto existing theaters. Basic monitors and consumables sustain the lower-cost layer, particularly in emerging markets and as redundancy backups. GE Healthcare's Aisys(TM) CS2 automates fresh-gas delivery, illustrating how workstation platforms integrate sustainability and cost savings, making them indispensable anchors within the anesthesia monitoring devices market.

Consumables show steady growth tied to procedure counts rather than capital cycles. Cyber-security is shaping purchase criteria; unified workstations reduce attack surfaces compared with disparate single-parameter devices. Consequently, procurement teams increasingly assess cyber-resilience alongside clinical performance, further buttressing integrated solutions' appeal in the anesthesia monitoring devices industry.

The Anesthesia Monitoring Devices Market Report Segments the Industry Into by Product (Basic Anesthesia Monitor, Integrated Anesthesia Workstation, and More), Parameter Monitored (Oxygenation, Ventilation, Circulation, and More), by End User (Hospitals, Ambulatory Surgery Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.68% revenue for the anesthesia monitoring devices market in 2024 on the back of early AI adoption, reimbursement coverage, and a consolidated supplier base. Regulatory clarity and cybersecurity guidance from agencies such as CISA speed procurement decisions, while major vendors leverage domestic manufacturing footprints to navigate supply-chain shocks.

Asia-Pacific leads with a 10.86% CAGR through 2030 as China and India escalate localization. China's device market is slated to climb from USD 36.35 billion in 2024 to USD 55.67 billion by 2029, supported by Made in China 2025 incentives that cut import reliance from 85% toward sub-50% thresholds. India restricts refurbished imports and aims for a USD 50 billion MedTech sector by 2030, opening avenues for indigenous anesthesia monitoring platforms. These moves enlarge the anesthesia monitoring devices market size across regional OEMs and global joint-venture partners.

Europe maintains mid-single-digit growth under the EU Medical Device Regulation, which nudges suppliers toward eco-design and post-market surveillance that strengthen buyer confidence. Middle East and Africa attract hospital-build projects tied to medical tourism corridors in the Gulf, spawning demand for integrated workstations with multilingual user interfaces. South America shows pockets of acceleration in Brazil and Argentina as public hospitals modernize, yet currency volatility keeps procurement cycles uneven. Altogether, geographic diversification cushions the anesthesia monitoring devices market against region-specific shocks and sustains double-digit global expansion.

- Medtronic

- GE HealthCare Technologies Inc.

- Koninklijke Philips

- Dragerwerk

- Masimo

- Nihon Kohden

- Mindray Bio-Medical Electronics Co., Ltd.

- Smiths Group plc (Smiths Medical)

- B. Braun

- Getinge

- Infinium Medical Inc.

- Schiller

- Fukuda Denshi Co., Ltd.

- Shenzhen Comen Medical Instruments Co., Ltd.

- Criticare Systems Inc.

- Spacelabs Healthcare

- EIZO Corporation

- Heyer Medical

- SternMed

- RWD Life Science Co., Ltd.

- Axcent Medical GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Development in Anesthesia Technology & Automated Record-keeping

- 4.2.2 Increasing Demand for Pain-free Surgeries

- 4.2.3 Rising Surgical Volumes from Aging Population

- 4.2.4 AI-driven Predictive Analytics for Intra-operative Monitoring

- 4.2.5 Opioid-sparing Protocols Driving Nociception Monitoring

- 4.2.6 Portable Monitors for Decentralized Ambulatory Settings

- 4.3 Market Restraints

- 4.3.1 High Capital Cost & Preference for Conventional Techniques

- 4.3.2 Shortage of Skilled Anesthesiologists in Developing Regions

- 4.3.3 Cyber-security Risks in Networked Anesthesia Workstations

- 4.3.4 Accuracy Limitations in Obese Patients Discouraging Adoption

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Basic Anesthesia Monitor

- 5.1.2 Integrated Anesthesia Workstation

- 5.1.3 Advanced Anesthesia Monitor

- 5.1.4 Consumables & Accessories

- 5.2 By Parameter Monitored

- 5.2.1 Oxygenation (SpO2)

- 5.2.2 Ventilation (EtCO2)

- 5.2.3 Circulation (BP/ECG)

- 5.2.4 Neuromuscular Transmission (EMG/TOF)

- 5.2.5 Brain Activity (EEG/BIS)

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgery Centers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Medtronic PLC

- 6.3.2 GE HealthCare Technologies Inc.

- 6.3.3 Koninklijke Philips NV

- 6.3.4 Dragerwerk AG & Co. KGaA

- 6.3.5 Masimo Corporation

- 6.3.6 Nihon Kohden Corporation

- 6.3.7 Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.8 Smiths Group plc (Smiths Medical)

- 6.3.9 B. Braun Melsungen AG

- 6.3.10 Getinge AB

- 6.3.11 Infinium Medical Inc.

- 6.3.12 Schiller AG

- 6.3.13 Fukuda Denshi Co., Ltd.

- 6.3.14 Shenzhen Comen Medical Instruments Co., Ltd.

- 6.3.15 Criticare Systems Inc.

- 6.3.16 Spacelabs Healthcare Inc.

- 6.3.17 EIZO Corporation

- 6.3.18 Heyer Medical AG

- 6.3.19 SternMed GmbH

- 6.3.20 RWD Life Science Co., Ltd.

- 6.3.21 Axcent Medical GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment