PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850079

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850079

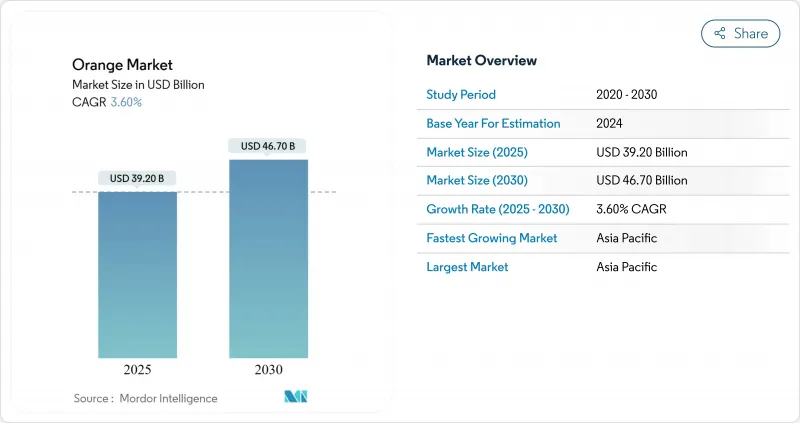

Orange - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global orange market reached USD 39.2 billion in 2025 and is projected to grow to USD 46.7 billion by 2030, at a CAGR of 3.6% during the forecast period.

The market maintains stability despite challenges from climate change, diseases, and logistics disruptions. Oranges serve as essential raw materials across multiple industries, including beverage processing, cosmetics, and textiles. The fruit's nutritional benefits have increased consumer demand and consumption. The market growth is supported by consistent processing demand, increased fresh fruit consumption in urban areas, and improved infrastructure. Production is expanding geographically, with Egypt investing in processing facilities, South Africa enhancing cold chain capabilities, and Asia-Pacific nations supporting orchard modernization. Market participants are gaining competitive advantages through disease-resistant cultivation methods, premium variety development, and digital supply chain integration. While price fluctuations and biosecurity concerns present ongoing challenges, the orange market remains an attractive investment in the fresh fruit segment.

Global Orange Market Trends and Insights

Rising Demand from Processing Industry

Egypt plans to commission six new processing plants by 2026, which will increase its capacity to convert export-grade fresh oranges into juice, concentrate, and puree products. Brazil processes 70% of its orange crop but faces limitations in agricultural land and weather volatility, enabling Egypt to establish a competitive cost advantage in bulk supply. International bottling companies implement diversified sourcing strategies through multi-country supply chains, which mitigate regional supply disruption risks in the orange market. The increased processing capacity generates additional revenue streams through by-products, including citrus oil and animal feed, facilitating comprehensive value-chain optimization.

Health-Driven Fresh Orange Intake

Orange juice consumption per capita in the United States decreased by 54% between 2005 and 2021, as consumers shifted toward whole oranges to increase fiber intake and reduce added sugar consumption. Oranges provide vitamin C, folate, and carotenoids, supporting immune system function as recommended by health organizations. While developed markets consume 147 g per person daily, least-developed countries average only 8 g per person. This consumption gap presents an opportunity that both international and local producers are addressing through accessible packaging options and consumer awareness programs.

Pests and Disease Infestation Reduce Yields

Huanglongbing (HLB) disease impacted 38% of Brazil's citrus trees by early 2025 and decreased Florida's production to 522,000 metric tons, its lowest level in 95 years. The disease has eliminated USD 4.6 billion in value since 2016. While gene-editing experiments, biological pest control, and thermal treatment methods at the orchard level indicate potential solutions, their commercial implementation remains distant. This production deficit constrains juice-grade citrus supply, requiring processors to increase sourcing from alternative regions and elevating production costs.

Other drivers and restraints analyzed in the detailed report include:

- Rising Cold Chain Expansion

- Government Support for Orange Production and Trade

- Global Orange Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Orange Market is Segmented by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Asia-Pacific holds 38.5% of the orange market and demonstrates a 4.5% CAGR. China's production reached 7.62 million metric tons, while India's exports have increased to 73,000 metric tons. Vietnam maintains regional leadership with 1.16 million metric tons of production in ASEAN. The region's infrastructure developments, including cold chain networks near ports and digital group purchasing platforms, improve supply chain efficiency and increase farmer income. Social media marketing by premium orange brands influences domestic pricing trends.

North America maintains significant consumption levels despite production challenges. Florida experiences historically low harvests due to citrus greening disease and increasing dependence on imports from Mexico and Chile. California and Texas implement water management technology to maintain production stability. Retail strategies shift from ambient juice promotion to fresh orange sales with vitamin C emphasis. Consumer preference for premium orange varieties continues to grow.

Europe increases imports to compensate for reduced Spanish production due to drought conditions. Germany leads European imports at USD 1.53 billion, with Egypt and Turkey serving as key suppliers during seasonal gaps. Suppliers adapt to stringent residue regulations through Global GAP and organic certifications. New rail-maritime infrastructure development in Valencia enhances distribution efficiency, supporting consistent supply to European supermarkets.

- Market Overview

- Market Drivers

- Market Restraints

- Value/Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand from Processing Industry

- 4.2.2 Health-Driven Fresh Orange Intake

- 4.2.3 Rising Cold Chain Expansion

- 4.2.4 Government Support for Orange Production and Trade

- 4.2.5 Premiumization of Export Oriented Orange Variety

- 4.2.6 Precision Farming Boosts Orchard Yields

- 4.3 Market Restraints

- 4.3.1 Pests and Disease Infestation Reduce Yields

- 4.3.2 Global Orange Price Volatility

- 4.3.3 Rising Water Scarcity in Orchards

- 4.3.4 Pesticide Residue Import Rejections

- 4.4 Value/Supply-Chain Analysis

- 4.4.1 Value Chain and Price Mark-ups

- 4.4.2 Stakeholder Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Value and Volume), Import Analysis (Value and Volume), Export Analysis (Value and Volume), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Mexico

- 5.1.1.4 Dominican Republic

- 5.1.2 Europe

- 5.1.2.1 Spain

- 5.1.2.2 Italy

- 5.1.2.3 Greece

- 5.1.2.4 Germany

- 5.1.2.5 France

- 5.1.2.6 United Kingdom

- 5.1.2.7 Netherlands

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 India

- 5.1.3.3 Vietnam

- 5.1.3.4 Thailand

- 5.1.3.5 Australia

- 5.1.3.6 Indonesia

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.4.3 Colombia

- 5.1.4.4 Peru

- 5.1.5 Middle East

- 5.1.5.1 Saudi Arabia

- 5.1.5.2 United Arab Emirates

- 5.1.5.3 Turkey

- 5.1.5.4 Iran

- 5.1.6 Africa

- 5.1.6.1 South Africa

- 5.1.6.2 Egypt

- 5.1.6.3 Morocco

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Stakeholders

7 Market Opportunities and Future Outlook