PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850088

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850088

Veterinary Parasiticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

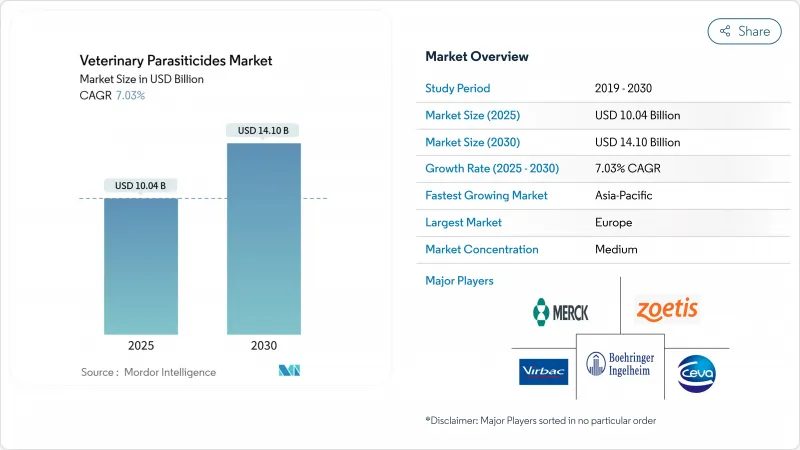

The veterinary parasiticides market size stood at USD 10.04 billion in 2025 and is forecast to reach USD 14.10 billion by 2030, reflecting a 7.03% CAGR.

Robust demand stems from rising pet ownership, climate-driven parasite range expansion, and steady livestock productivity investments. Regulatory approvals for broad-spectrum tablets and long-acting injectables, long-acting treatment protocols, and raise compliance. Digital diagnostics guide precise therapy selection, while emerging generic competition follows the macrocyclic-lactone patent's expiration. Resistance threats and stricter environmental evaluations temper growth but accelerate innovation in novel modes of action, delivery systems, and combination products across the veterinary parasiticides market.

Global Veterinary Parasiticides Market Trends and Insights

Rising Prevalence of Food-Borne & Zoonotic Infections

Zoonotic transmission elevates demand for preventive products as public health agencies integrate One Health priorities. Echinococcus multilocularis spread in North American canids raises human risk, driving mandatory treatment protocols. Climate change amplifies vector survivability, with Leishmania infantum transmission risk forecast to rise 71.6% in Iberia by 2060.Authorities respond with enhanced surveillance and compulsory deworming in high-risk herds. Preventive parasiticides prove more economical than outbreak management, securing long-term uptake in the veterinary parasiticides market.

Growing Companion-Animal Adoption & Humanization

Pet owner's view pets as family members and prioritize premium preventive care. An Elanco survey found 94% of dog owners favor proactive intestinal worm treatment. The trend boosts combination products that cover internal and external parasites in a single dose. Telemedicine supports tailored regimens, and palatable chewables meet user expectations. Manufacturers improve taste, packaging, and digital engagement, lifting average selling prices across the veterinary parasiticides market.

Stringent Multi-Jurisdictional Regulatory Approvals

Fragmented requirements delay launches by 18-24 months despite FDA-EMA parallel advice initiatives. Environmental risk assessments now examine dung-beetle and aquatic toxicity, raising data burdens. Proposed US labeling rules may increase compliance costs for legacy products. Smaller firms face disproportionate hurdles, which could consolidate power among large players in the veterinary parasiticides industry.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Animal-Health Expenditure in Emerging Economies

- Macrocyclic-Lactone Patent Expiries Unlocking Generics

- Escalating Resistance to Existing Active Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ectoparasiticides captured 42.5% of the veterinary parasiticides market share in 2024, thanks to their frontline role against ticks and fleas. Combination tablets are the fastest-growing segment at 11.2% CAGR because they merge internal and external parasite control in one dose. The veterinary parasiticides market benefits from the FDA approval of Credelio Quattro, which protects against six parasites in a single chewable. Endoparasiticides battle mounting resistance, especially in livestock. Endectocides hold a hybrid niche yet face competition from broader-spectrum newcomers. Environmental stewardship drives interest in botanical options, while nanotechnology improves solubility for hard-to-dissolve compounds, widening the innovation funnel for the veterinary parasiticides market.

The shift toward biologicals remains modest due to regulatory complexity and variable field efficacy. Still, formulations that spare dung fauna gain regulatory favor in Europe. Developers explore modes that maintain refugia populations to mitigate resistance escalation. Investment in novel actives rises as generic pressure bites into pricing for aging macrocyclic lactones. The overall trend positions combination therapies as a cornerstone for long-term growth within the veterinary parasiticides market.

Companion animals delivered 58.1% of 2024 revenue, reflecting the humanization wave and greater veterinary spend per pet. Within this cohort, dogs headline expansion with a 10.5% CAGR as owners seek simplified multi-parasitic coverage. Livestock customers focus on cost-efficient control but now adopt combination dewormers to combat resistance, especially in cattle herds. The veterinary parasiticides market size for canine applications is predicted to rise steadily, given premiumization and increasing adoption rates.

In poultry, FDA-approved SAFE-GUARD AQUASOL addresses backyard flock health and broadens the ruminant-heavy portfolio feedstuffs.com. Swine and sheep operations employ targeted, selective treatment to balance efficacy with stewardship. Cat health progresses at a measured pace due to species-specific safety hurdles, yet increased indoor pet numbers boost demand. Population and diet shifts in Asia Pacific keep food-producing animals a crucial revenue pillar, ensuring balanced growth across the veterinary parasiticides market.

The Veterinary Parasiticides Market is Segmented by Product Type (Ectoparasiticides, Endoparasiticides, and More), Animal Type (Food-Producing {Cattle, Poultry, and More} and Companion Animals {Dogs and Cats}, Mode of Administration (Topical, Oral, and More), End User (Veterinary Clinics & Hospitals, and More), and Geography (North America, Europe, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 34.9% of 2024 revenue owing to high pet ownership, premium care adoption, and supportive regulatory paths. Coordinated FDA-Health Canada reviews streamline new product launches, while climate change lengthens parasite seasons in northern states. E-commerce advances shift purchasing toward online pharmacies, but veterinary practices retain influence through prescription authority. Premium combination tablets and annual injectables anchor revenue resilience in the region's veterinary parasiticides market.

Asia Pacific is the fastest-growing territory with an 8.9% CAGR through 2030. China's expanding urban pet population, Japan's aging society preference for companion animals, and India's vast livestock base jointly drive demand. Governments emphasize food safety, prompting more rigorous parasite-control mandates. Distribution upgrades widen rural access, and pricing tiers broaden the customer base. Regulatory reforms in China shorten time-to-market, further raising momentum for the veterinary parasiticides market.

Europe exhibits steady mid-single-digit growth, shaped by strict environmental rules and welfare standards. Sustainability goals spur interest in biologicals and reduced-impact chemistries. Brexit reshapes supply chains, rewarding firms that adapt swiftly to new import checkpoints. Latin America and the Caribbean leverage large cattle populations and competitive beef exports to adopt combination dewormers that safeguard productivity. The Middle East and Africa show nascent but promising uptake as urbanization lifts companion-animal care, although infrastructure deficits temper premium product penetration. Together, these regional currents sustain the global expansion of the veterinary parasiticides market.

- Zoetis

- Elanco Animal Health Inc.

- Merck & Co., Inc. (Animal Health)

- Boehringer Ingelheim

- Virbac

- Ceva

- Vetoquinol

- Bayer AG (legacy brands)

- Dechra Pharmaceuticals

- Phibro Animal Health

- Norbrook Laboratories Ltd.

- Huvepharma EOOD

- PetIQ, Inc.

- Bimeda Animal Health Ltd.

- Heska

- Neogen

- KRKA d.d.

- Ourofino Saude Animal

- Kyoritsu Seiyaku

- Animalcare Group plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Food-Borne & Zoonotic Infections

- 4.2.2 Growing Companion-Animal Adoption & Humanization

- 4.2.3 Increasing Animal-Health Expenditure In Emerging Economies

- 4.2.4 Macrocyclic-Lactone Patent Expiries Unlocking Generics

- 4.2.5 Adoption Of Long-Acting Injectable & Combo Therapies

- 4.2.6 Climate-Change Driven Expansion Of Parasite Habitats

- 4.3 Market Restraints

- 4.3.1 Stringent Multi-Jurisdictional Regulatory Approvals

- 4.3.2 Escalating Resistance To Existing Active Ingredients

- 4.3.3 High R&D Cost Versus Price Ceilings In Livestock Sector

- 4.3.4 Channel Shift To E-Commerce Squeezing Veterinary Markup

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Patent-Expiry & Generic-Entry Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Ectoparasiticides

- 5.1.2 Endoparasiticides

- 5.1.3 Endectocides

- 5.1.4 Combination / Broad-spectrum Products

- 5.1.5 Biological & Botanical Parasiticides

- 5.2 By Animal Type

- 5.2.1 Food-Producing Animals

- 5.2.1.1 Cattle

- 5.2.1.2 Poultry

- 5.2.1.3 Swine

- 5.2.1.4 Sheep & Goats

- 5.2.2 Companion Animals

- 5.2.2.1 Dogs

- 5.2.2.2 Cats

- 5.2.1 Food-Producing Animals

- 5.3 By Mode of Administration

- 5.3.1 Topical

- 5.3.2 Oral

- 5.3.3 Injectable

- 5.3.4 Others

- 5.4 By End User

- 5.4.1 Veterinary Clinics & Hospitals

- 5.4.2 Animal Farms & Production Units

- 5.4.3 Retail & Online Pharmacies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Zoetis Inc.

- 6.3.2 Elanco Animal Health Inc.

- 6.3.3 Merck & Co., Inc. (Animal Health)

- 6.3.4 Boehringer Ingelheim International GmbH

- 6.3.5 Virbac SA

- 6.3.6 Ceva Sante Animale

- 6.3.7 Vetoquinol SA

- 6.3.8 Bayer AG (legacy brands)

- 6.3.9 Dechra Pharmaceuticals PLC

- 6.3.10 Phibro Animal Health Corp.

- 6.3.11 Norbrook Laboratories Ltd.

- 6.3.12 Huvepharma EOOD

- 6.3.13 PetIQ, Inc.

- 6.3.14 Bimeda Animal Health Ltd.

- 6.3.15 Heska Corporation

- 6.3.16 Neogen Corporation

- 6.3.17 KRKA d.d.

- 6.3.18 Ourofino Saude Animal

- 6.3.19 Kyoritsuseiyaku Corporation

- 6.3.20 Animalcare Group plc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment