PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850091

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850091

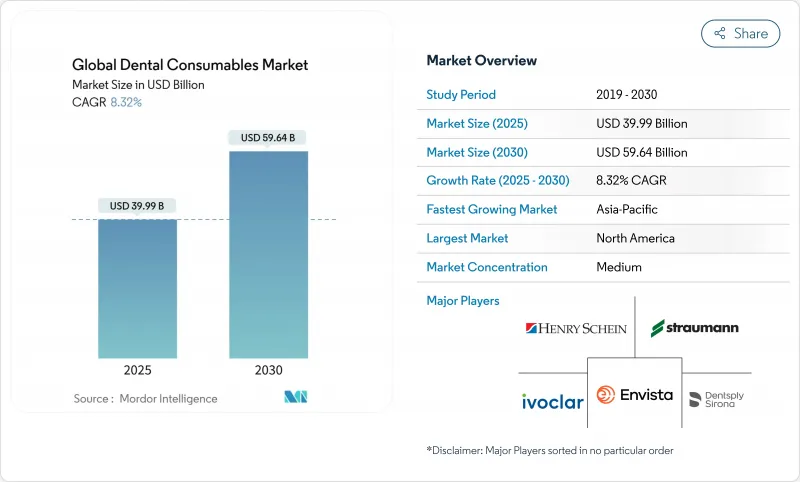

Global Dental Consumables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The dental consumables market size reached USD 39.99 billion in 2025 and is forecast to reach USD 59.64 billion by 2030, expanding at an 8.32% CAGR during the forecast period.

Steady gains stem from digital chairside workflows, bioactive implant materials, and bulk-procurement models that shift volumes toward premium product lines. DSOs are scaling rapidly, influencing procurement standards, while North America remains the revenue leader even as Asia-Pacific posts the fastest regional advance. Demand for same-day restorations, preventive sealants, and regenerative materials collectively elevate per-patient spending and favors suppliers with integrated digital ecosystems.

Global Dental Consumables Market Trends and Insights

Rising demand for same-day CAD/CAM prosthetics

More than half of U.S. dental practices already employ intraoral scanners, shortening treatment cycles and expanding indications for premium restorative materials. Chairside milling paired with cloud design services lowers laboratory overhead and lifts profitability. AI-enabled design modules automate complex margin and contact adjustments, further reducing chairtime. Adoption accelerated by 18% in 2024, and with scanner integration set to improve imaging precision in 2025, material throughput is expected to rise in tandem. Suppliers capable of bundling scanners, mills, and validated material blocks are securing long-term contracts with DSOs.

Elderly population expansion increasing prosthodontic procedures

Adults aged 65 plus represent the fastest-growing patient cohort. Japan already allocates specialized reimbursement pathways for implant-supported overdentures, and the EU's Silver Economy program earmarks funds for geriatric dental care. Digital denture workflows reduce appointment burden, improving acceptance among seniors with mobility constraints. Material suppliers are commercializing lightweight polymer bases and high-impact acrylics tailored to xerostomia-prone patients.

Limited insurance reimbursement for cosmetic dentistry

Aesthetic veneers, bleaching, and gingival contouring remain predominantly self-pay. While Medicare will extend coverage to certain medically-linked dental procedures in 2025, elective cosmetic benefits remain constrained. This bifurcates the market, sustaining luxury segments yet limiting total unit volumes. Manufacturers counteract by offering tiered composite lines that balance price and polish retention.

Other drivers and restraints analyzed in the detailed report include:

- Growth of dental service organizations (DSOs) driving bulk procurement

- Shift toward bioactive and regenerative implant materials

- Skills gap in chair-side CAD/CAM workflows

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dental implants accounted for 18.35% of the dental consumables market share in 2024. High-success bioactive coatings and digital surgical planning expand indications into softer bone situations. The dental consumables market size for personal protective wear is forecast to climb at 10.11% CAGR to 2030, notably buoyed by Asia Pacific's geriatric cohorts. The segment's sharp trajectory is further propelled by infection-control protocols that demand ASTM-certified respirators and autoclavable eye shields.

The prosthetics sub-segment benefits from CAD/CAM workflows that fabricate zirconia and lithium-disilicate crowns in under one hour. Universal bonding agents streamline inventory by covering multiple etching strategies. Regenerative materials such as calcium-phosphate granules grow in tandem with ridge-augmentation procedures. Meanwhile, sutures and burs, although mature, enjoy marginal gains from ergonomic handle redesigns that reduce operator fatigue.

Prosthodontic procedures accounted for 27.80% share of the dental consumables market in 2024 as full-arch rehabilitation moves chairside through guided surgery and immediate loading. Orthodontics, driven by clear aligners, records the highest modality growth of 9.78%; cloud-planning software and in-house 3-D printed aligners reduce cycle time and boost case starts.

Restorative dentistry embraces minimally invasive preps using bioactive composites that release fluoride and calcium ions, prolonging restoration life. Endodontics innovates with bioceramic sealers and reciprocation-motion files that cut procedure time. Periodontics integrates regenerative membranes and enamel-matrix derivatives that encourage new attachment. Cosmetic procedures, although self-funded, gain momentum via social media exposure and rising tele-consultation convenience.

The Dental Consumables Market Report is Segmented by Product Type (Aligners & Braces, Anesthetics, and More), Treatment Modality (Restorative, Prosthodontic, and More), Distribution Channel (Offline [B2B and B2C] and Online), End-User (Dental Clinics, Dental Hospitals and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 43.39% of global revenue in 2024. Implant therapy and clear-aligner cases command premium pricing, while insurers expand preventive benefits that lift sealant and fluoride varnish volumes. Regulatory clarity under FDA 510(k) accelerates product launches; however competition among a growing dentist workforce may intensify price sensitivity in commodity segments.

Asia Pacific is projected to grow at 9.54% CAGR through 2030, buoyed by urban middle-class expansion and inbound dental tourism. Governments in India and Thailand endorse public-private partnerships to equip rural clinics. Local manufacturers capitalize by offering cost-competitive scanners and implant systems while partnering with global majors for material validation, shortening supply chains and countering import tariffs.

Europe maintains steady 8.38% CAGR supported by robust reimbursement frameworks and rigorous product-quality standards. Germany's precision-engineering base nurtures high-strength ceramic production, while the United Kingdom accelerates digital dentistry adoption via NHS modernization funds. The Middle East & Africa and South America post 7.65% and 7.81% CAGRs respectively as private insurance penetration and public oral-health campaigns broaden access.

- Coltene Holding

- Dentsply Sirona

- Envista Holdings

- GC Corporation

- Henry Schein

- Hu-Friedy Mfg Co. LLC

- Ivoclar Vivadent

- Jeil Medical

- Kuraray Noritake Dental

- Nakanishi

- Osstem Implant

- Patterson Companies

- Septodont

- Shofu Inc.

- Solventum Corporation

- Straumann Group

- Thommen Medical

- Ultradent Products

- Young Innovations

- Ziacom Medical

- ZimVie

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for same-day CAD/CAM prosthetics

- 4.2.2 Elderly population expansion increasing prosthodontic procedures

- 4.2.3 Growth of dental service organisations (DSOs) driving bulk procurement

- 4.2.4 Rapid adoption of clear-aligner orthodontics

- 4.2.5 Shift toward bio-active and regenerative implant materials

- 4.2.6 Preventive-oral care campaigns boosting sealant consumption

- 4.3 Market Restraints

- 4.3.1 Limited insurance reimbursement for cosmetic dentistry

- 4.3.2 Skills gap in chair-side CAD/CAM workflows

- 4.3.3 Volatile resin and precious-metal prices

- 4.3.4 Regulatory delays for novel bio-ceramic approvals

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Aligners & Braces

- 5.1.2 Anesthetics

- 5.1.3 Bonding Agents & Adhesives

- 5.1.4 Dental Burs

- 5.1.5 Dental Implants

- 5.1.6 Dental Splints

- 5.1.7 Dental Sutures

- 5.1.8 Hemostats

- 5.1.9 Personal Protective Wear

- 5.1.10 Prosthetics

- 5.1.11 Regenerative Materials

- 5.1.12 Restorative Materials

- 5.1.13 Other Product Types

- 5.2 By Treatment Modality

- 5.2.1 Restorative

- 5.2.2 Prosthodontic

- 5.2.3 Endodontic

- 5.2.4 Periodontic

- 5.2.5 Orthodontic

- 5.2.6 Cosmetic / Aesthetic

- 5.2.7 Others

- 5.3 By Distribution Channel

- 5.3.1 Offline

- 5.3.1.1 B2B

- 5.3.1.2 B2C

- 5.3.2 Online

- 5.3.1 Offline

- 5.4 By End-User

- 5.4.1 Dental Clinics

- 5.4.2 Dental Hospitals

- 5.4.3 DSO / Group Practices

- 5.4.4 Other End-Users

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Product Portfolio Analysis

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Coltene Holding AG

- 6.4.2 Dentsply Sirona

- 6.4.3 Envista Holdings

- 6.4.4 GC Corporation

- 6.4.5 Henry Schein Inc.

- 6.4.6 Hu-Friedy Mfg Co. LLC

- 6.4.7 Ivoclar Vivadent AG

- 6.4.8 Jeil Medical Corporation

- 6.4.9 Kuraray Noritake Dental

- 6.4.10 Nakanishi Inc.

- 6.4.11 Osstem Implant Co. Ltd

- 6.4.12 Patterson Companies Inc.

- 6.4.13 Septodont Holding

- 6.4.14 Shofu Inc.

- 6.4.15 Solventum Corporation

- 6.4.16 Straumann Group

- 6.4.17 Thommen Medical AG

- 6.4.18 Ultradent Products Inc.

- 6.4.19 Young Innovations Inc.

- 6.4.20 Ziacom Medical

- 6.4.21 ZimVie Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment