PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850096

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850096

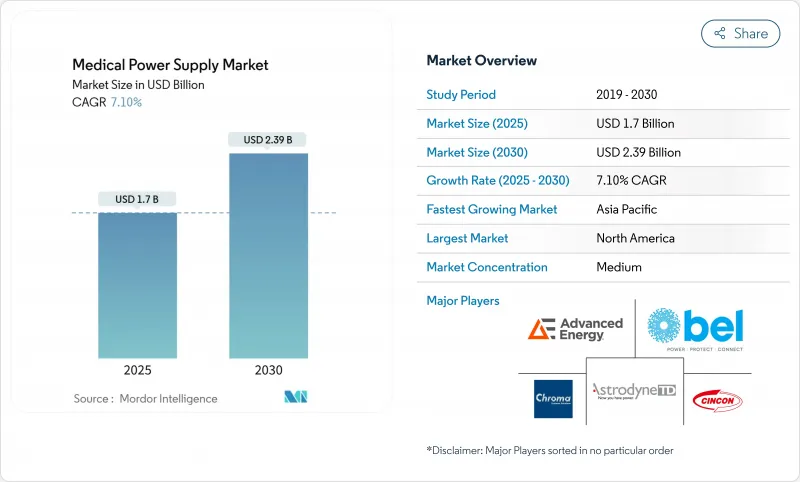

Medical Power Supply - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The medical power supply market size is at USD 1.70 billion in 2025 and is forecast to reach USD 2.39 billion by 2030, advancing at a 7.10% CAGR over the period.

Expansion reflects accelerated healthcare digitization, stricter safety codes, and the push for compact, high-efficiency architectures in portable and clinical equipment. Adoption of wide-bandgap semiconductors, notably GaN and SiC, enables conversion efficiencies above 95% and footprint reductions near 40%, giving suppliers measurable cost and performance advantages. Regulatory demands for >90% efficiency solutions, coupled with rising outpatient imaging fleets and home-based monitoring devices, sustain momentum across mature and emerging economies. North America retains leadership due to robust infrastructure and early technology adoption, while Asia-Pacific leads growth, powered by large-scale manufacturing incentives and policy support.

Global Medical Power Supply Market Trends and Insights

Rapid Miniaturisation via GaN and SiC Switching Devices

Wide-bandgap semiconductors raise switching frequencies beyond 1 MHz while sustaining better than 95% conversion efficiency, enabling smaller, lighter supplies for clinical and portable gear. Transitioning to 300 mm GaN wafers trims production cost 30%, encouraging uptake beyond premium platforms. Investor backing, such as the USD 32 million Series C secured by Cambridge GaN Devices, signals confidence in further 30% energy-saving potential. Medical device OEMs leverage these gains to shrink product footprints up to 40% and introduce compact CT and MRI systems suited to smaller clinics, broadening diagnostic access across underserved regions.

Expansion of Diagnostic-Imaging Fleets in Outpatient Centres

Migration of imaging services away from hospitals increases demand for power units designed for variable electrical environments. Vizient reports double-digit volume growth in CT and PET scans as ambulatory centres broaden capacity. Converting research scanners to clinical use, like recent actions at North Carolina Baptist Hospital, illustrates this decentralisation trend. Power supplies must deliver strong EMI suppression, flexible input ranges, and modular scalability to support phased equipment roll-outs and AI-enabled imaging workflows.

IEC 60601-1 "4th-Edition" EMC Upgrade Costs

Enhanced EMC rules and risk-management protocols impose significant compliance complexity. Test cycles of roughly three weeks and sparse notified-body capacity in Europe raise direct costs by 15-25% for smaller firms. Many OEMs prioritise the U.S. route to market while navigating EU MDR bottlenecks that slow product launches and dampen innovation. Investment in in-house regulatory teams and early design-for-compliance practices becomes essential to manage timelines and preserve margin.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Home-Based Patient Monitoring Equipment

- Decarbonisation Mandates Pushing >90% Conversion-Efficiency PSUs

- Semiconductor Supply-Chain Volatility for High-Voltage MOSFETs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

AC-DC devices accounted for 77.42% of medical power supply market share in 2024 thanks to their ubiquity in large imaging and surgical systems that tap direct facility mains. DC-DC supplies are forecast to post a 10.7% CAGR through 2030, riding the wave of modular electronics that demand multiple regulated rails with tight efficiency budgets. The medical power supply market continues to value AC-DC reliability, yet OEM roadmaps increasingly embed on-board DC-DC stages to distribute power and mitigate thermal hotspots. GaN-based DC-DC converters from Traco and Recom now achieve >95% efficiency and 500 kHz switching, unlocking 40% board-area savings. As portable infusion pumps, oxygen concentrators, and wearable diagnostics gain complexity, suppliers widen DC-DC portfolios to capture incremental revenue streams within the broader medical power supply market.

In hospital capital equipment, multi-kilowatt AC-DC blocks remain indispensable. Yet distributors report a steady shift in order mix toward smaller DC-DC modules for handheld ECG and endoscopy systems, reinforcing future demand for miniature high-frequency designs. By 2030, DC-DC units could exceed 30% revenue, reshaping competitive positioning within the medical power supply market. Continuous efficiency hikes, galvanic isolation techniques, and integration of digital tele-metrics drive differentiation between incumbents and specialist entrants.

Enclosed architectures captured 36.7% revenue in 2024, a reflection of stringent infection-control norms and EMI shielding needs inside operating rooms and intensive care. However, external adapters exhibit a robust 9.6% CAGR between 2025 and 2030 as care settings migrate to homes and community clinics. The medical power supply market rewards designs that isolate patients from high voltages, prompting OEMs to adopt Class II external bricks certified for Type BF applications. SL Power's ME series illustrates adapter evolution, meeting 2XMOPP insulation and <50 µA leakage thresholds for home devices.

Open-frame boards continue in cost-sensitive analyzers where airflow and chassis integration offset enclosure needs. Configurable platforms allow rapid SKU customisation, cutting design cycles for specialty imaging and lab automation systems. Environmental legislation encouraging repairability and recyclability further strengthens modular approaches across the medical power supply market. Suppliers accordingly expand digital telemetry options that feed maintenance dashboards, supporting power-as-a-service models rolled out in pilot schemes across North America and Europe.

Medical Power Supply Market is Segmented by Technology (AC-DC Power Supply and DC-DC Power Supply), Type (Open-Frame, Enclosed, and More), Power Range (0-50 W, 51-200 W, and More), Application (Diagnostic and Imaging Equipment, Patient Monitoring, Surgical and Life-Support, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.1% revenue in 2024, supported by USD 156 billion in domestic device spending and streamlined FDA pathways that shorten time to market. The FY 2025 Defense Health Program's USD 40.27 billion allocation for equipment modernisation further boosts demand. High focus on decarbonisation drives rapid uptake of >90% efficient GaN supplies across hospitals implementing ESG scorecards.

Asia-Pacific charts the quickest 9.8% CAGR to 2030 as India's devices market aims for USD 50 billion valuation under Production-Linked Incentive benefits. Regional OEMs expand GaN and SiC capacity, yet challenges persist: R&D outlay sits at only 0.5% of expenses and import reliance remains high for precision magnetics and capacitors. Trade-tension scenarios could subtract USD 23.6 billion from sector revenue yearly, emphasising the need for supply-chain resilience.

Europe's stringent MDR framework complicates conformity, with just 43 notified bodies covering roughly 500,000 devices, creating significant approval delays. Nevertheless, strong sustainability mandates and public-sector energy targets sustain interest in ultra-efficient medical power supply market solutions. MedTech Europe advocates regulatory reform to preserve innovation pipelines while supporting health-system investments in green infrastructure.

- Advanced Energy Industries Inc.

- Astrodyne TDI Corp.

- Bel Power Solutions (CUI Inc.)

- Chroma Systems Solutions Inc.

- Cincon Electronics Co. Ltd

- Cosel Co. Ltd

- Delta Electronics Inc.

- FRIWO AG

- GlobTek Inc.

- Inventus Power

- Mean Well Enterprises Co. Ltd

- Murata Power Solutions Inc.

- Powerbox International AB

- Power-One Inc. (Bel Fuse)

- Puls GmbH

- RECOM Power GmbH

- Shenzhen Huyssen Power Co. Ltd

- SL Power Electronics

- Spellman High Voltage Electronics Corp.

- SynQor Inc.

- TDK-Lambda Corporation

- Traco Power Group

- TT Electronics plc

- Vitec Power GmbH

- Wall Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid miniaturisation via GaN and SiC switching devices

- 4.2.2 Expansion of diagnostic-imaging fleets in outpatient centres

- 4.2.3 Surge in home-based patient monitoring equipment

- 4.2.4 Decarbonisation mandates pushing >90 % conversion-efficiency PSUs

- 4.2.5 Digitally-controlled, remotely-monitored supply units (power-as-a-service)

- 4.3 Market Restraints

- 4.3.1 IEC 60601-1 "4th-edition" EMC upgrade costs

- 4.3.2 Semiconductor supply-chain volatility for high-voltage MOSFETs

- 4.3.3 Tariff-driven cost spikes on Chinese magnetics and capacitors

- 4.3.4 Thermal management limits in sub-1-inch open-frame designs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Consumers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Technology

- 5.1.1 AC-DC Power Supply

- 5.1.2 DC-DC Power Supply

- 5.2 By Type

- 5.2.1 Open-Frame

- 5.2.2 Enclosed

- 5.2.3 External/Adapter

- 5.2.4 Configurable/Modular

- 5.3 By Power Range

- 5.3.1 0-50 W

- 5.3.2 51-200 W

- 5.3.3 201-1000 W

- 5.3.4 >1000 W

- 5.4 By Application

- 5.4.1 Diagnostic and Imaging Equipment

- 5.4.2 Patient Monitoring

- 5.4.3 Surgical and Life-support

- 5.4.4 Home-Healthcare Devices

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Singapore

- 5.5.4.6 Malaysia

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Advanced Energy Industries Inc.

- 6.4.2 Astrodyne TDI Corp.

- 6.4.3 Bel Power Solutions (CUI Inc.)

- 6.4.4 Chroma Systems Solutions Inc.

- 6.4.5 Cincon Electronics Co. Ltd

- 6.4.6 Cosel Co. Ltd

- 6.4.7 Delta Electronics Inc.

- 6.4.8 FRIWO AG

- 6.4.9 GlobTek Inc.

- 6.4.10 Inventus Power

- 6.4.11 Mean Well Enterprises Co. Ltd

- 6.4.12 Murata Power Solutions Inc.

- 6.4.13 Powerbox International AB

- 6.4.14 Power-One Inc. (Bel Fuse)

- 6.4.15 Puls GmbH

- 6.4.16 RECOM Power GmbH

- 6.4.17 Shenzhen Huyssen Power Co. Ltd

- 6.4.18 SL Power Electronics

- 6.4.19 Spellman High Voltage Electronics Corp.

- 6.4.20 SynQor Inc.

- 6.4.21 TDK-Lambda Corporation

- 6.4.22 Traco Power Group

- 6.4.23 TT Electronics plc

- 6.4.24 Vitec Power GmbH

- 6.4.25 Wall Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment