PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850111

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850111

Global Hospital Acquired Infection Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

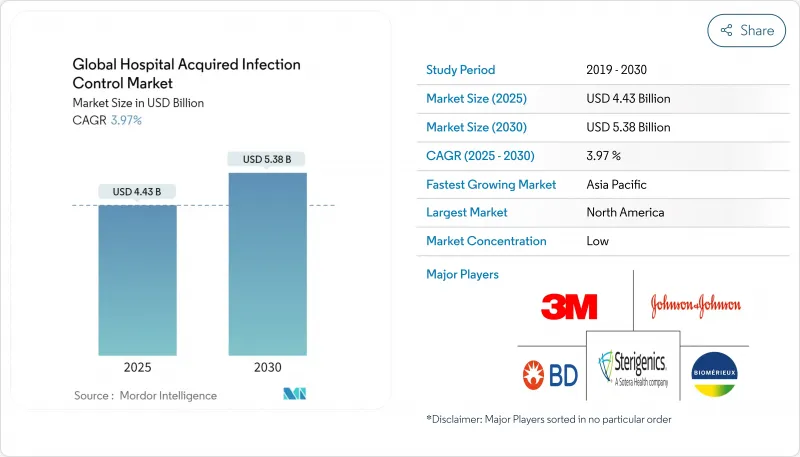

The Global Hospital Acquired Infection Control Market size is estimated at USD 4.43 billion in 2025, and is expected to reach USD 5.38 billion by 2030, at a CAGR of 3.97% during the forecast period (2025-2030).

Demand is being driven by mandatory infection-reporting rules, expanding surgical volumes, and the growing financial penalties tied to high infection rates. Hospitals are broadening prevention programs to cover the entire patient pathway, which is lifting purchases of both single-use supplies and outsourced service contracts. UV-C robots, hydrogen-peroxide sterilizers, and data-rich hand-hygiene trackers are moving from pilot projects to routine procurement, encouraged by evidence of double-digit reductions in infection incidence. Vendors are also responding to litigation risk in markets like Australia by supplying traceable, audit-ready processes that help facilities prove compliance.

Global Hospital Acquired Infection Control Market Trends and Insights

Rising Surgical Volumes and ICU Admissions Drive Prevention Needs

Surgical caseloads are climbing with aging populations and improved access to elective procedures. Roughly 1 in 31 inpatients acquires at least one infection each day, lengthening stays by 17 days and prompting a 42% readmission rate within 30 days. The financial impact is acute: surgical site infections alone cost USD 3 billion to USD 5 billion annually. These pressures reinforce continuous purchasing of disinfectants, sterile wraps, and barrier devices across the hospital-acquired infection control market.

Mandatory Reporting Requirements Reshape Compliance Landscape

The United States and several EU states tie Medicare, Medicaid, or national reimbursement to demonstrated infection-control performance, compelling hospitals to fund robust surveillance programs .Electronic dashboards that map hand-hygiene events or track central-line days help facilities defend payments and avoid penalties, stimulating demand for data-enabled solutions within the hospital-acquired infection control market.

Restraint Impact Analysis

Other drivers and restraints analyzed in the detailed report include:

- Rise in Incidences of Different Types of Hospital-Acquired Infections

- Innovative Technologies Transform Infection Control Landscape

- Lack of Awareness Regarding Hospital-Acquired Infection

- Stringent Regulatory Requirements Create Market Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Dentsply Sirono

- 3M

- STERIS

- Getinge

- Ecolab

- Advanced Sterilization Products

- STERIS

- Belimed

- Beckton Dickinson

- Olympus

- Matachana Group

- MMM Group

- Cardinal Health

- Halyard Health

- Ansell

- Metrex Research (Envista)

- HuFriedyGroup

- GAMA Healthcare

- Medline Industries

- Steelco

- Fedegari Autoclavi

- Tuttnauer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Surgical Volumes and ICU Admissions

- 4.2.2 Mandatory Reporting of HAIs in U.S. & Select EU Nations

- 4.2.3 Rise in the Incidences of Different Types of Hospital Acquired Infections

- 4.2.4 Innovative Technologies Implemented in Devices that Control Infection

- 4.2.5 Rapid Expansion of Ambulatory Surgery Centers in North America

- 4.2.6 Growing Adoption of Low-temperature H2O2 Sterilizers in Europe

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness Regarding Hospital Acquired Infection

- 4.3.2 Stringent Regulatory Requirement

- 4.3.3 High Capital Cost of UV/HPV Disinfection Systems for Tier-2 Hospitals

- 4.3.4 Workforce Skill Gaps in Endoscope Reprocessing

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product and Services

- 5.1.1 By Equipment

- 5.1.1.1 Sterilization

- 5.1.1.1.1 Steam Sterilizers

- 5.1.1.1.2 Low-temperature Ha,,Oa,, Sterilizers

- 5.1.1.1.3 Ethylene Oxide Sterilizers

- 5.1.1.1.4 Radiation Sterilization

- 5.1.1.1.5 Contract Sterilization Services

- 5.1.1.2 Disinfection

- 5.1.1.2.1 UV & Hydrogen-Peroxide-Vapor Devices

- 5.1.1.2.2 Endoscopic Reprocessor Systems

- 5.1.1.3 Others

- 5.1.2 Services

- 5.1.3 Consumables

- 5.1.1 By Equipment

- 5.2 By End-user

- 5.2.1 Hospitals & Intensive Care Units (ICUs)

- 5.2.2 Ambulatory Surgical Centers (ASCs)

- 5.2.3 Long-term Care Facilities

- 5.2.4 Specialty Clinics & Dialysis Centers

- 5.3 By Infection Type

- 5.3.1 Surgical Site Infections (SSI)

- 5.3.2 Catheter-associated Urinary Tract Infections (CAUTI)

- 5.3.3 Central-line Associated Bloodstream Infections (CLABSI)

- 5.3.4 Hospital-acquired & Ventilator-associated Pneumonia (HAP/VAP)

- 5.3.5 Gastro-intestinal Infections & Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Dentsply Sirono

- 6.3.2 3M Company

- 6.3.3 Steris PLC

- 6.3.4 Getinge AB

- 6.3.5 Ecolab Inc.

- 6.3.6 Advanced Sterilization Products

- 6.3.7 Steris

- 6.3.8 Belimed AG

- 6.3.9 Becton, Dickinson and Company

- 6.3.10 Olympus Corporation

- 6.3.11 Matachana Group

- 6.3.12 MMM Group

- 6.3.13 Cardinal Health Inc.

- 6.3.14 Halyard Health

- 6.3.15 Ansell Limited

- 6.3.16 Metrex Research (Envista)

- 6.3.17 HuFriedyGroup

- 6.3.18 GAMA Healthcare

- 6.3.19 Medline Industries

- 6.3.20 Steelco S.p.A.

- 6.3.21 Fedegari Autoclavi S.p.A.

- 6.3.22 Tuttnauer

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment