PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850120

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850120

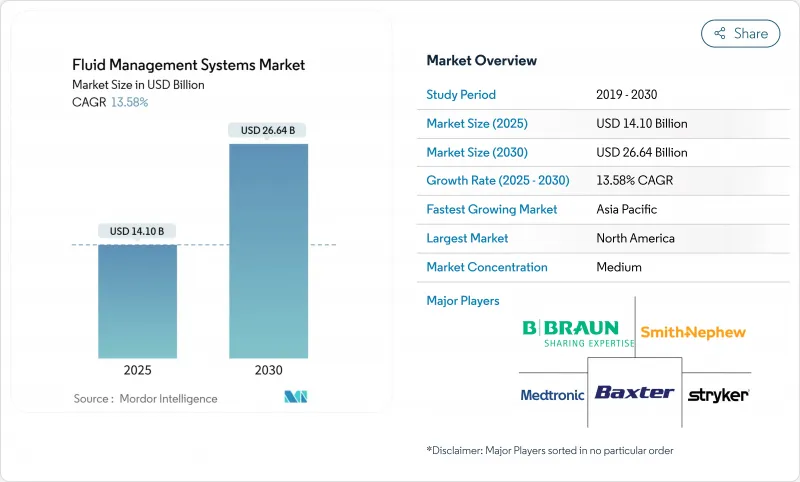

Fluid Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Fluid Management Systems Market size is estimated at USD 14.10 billion in 2025, and is expected to reach USD 26.64 billion by 2030, at a CAGR of 13.58% during the forecast period (2025-2030).

Rapid growth stems from rising minimally invasive surgery volumes, the increasing prevalence of chronic kidney disease, and accelerating adoption of AI-enabled closed-loop ultrafiltration platforms. Hospitals remain the primary purchasers, but home-care adoption is growing fast as portable dialysis devices enable in-home therapies. Competitive dynamics are intensifying as leading vendors bundle hardware, software, and analytics to deliver end-to-end solutions, yet shortages of surgeon talent and supply constraints on medical-grade polymers could temper near-term gains.

Global Fluid Management Systems Market Trends and Insights

Rise in Minimally-Invasive Surgery Volumes

Minimally invasive procedures now dominate many orthopedic and general surgery service lines, increasing demand for irrigation, suction, and insufflation technologies that can maintain clear visibility and stable cavity pressure. Ambulatory surgery centers are standardizing purchasing agreements with med-tech vendors to secure integrated fluid management platforms that streamline workflow and documentation. AI-enhanced devices are further optimizing flow parameters and reducing blood-loss variability. Together, these shifts are enlarging the installed base of high-specification systems in both hospitals and outpatient facilities.

Growing Prevalence of Chronic Kidney Disease & ESRD

Chronic kidney disease affects more than 850 million people worldwide, pushing dialysis procedure volumes higher and requiring new dialyzer membranes with needle-free connectors and bi-directional data feeds. Hemodiafiltration rollouts in the United States during 2025 promise better toxin clearance, while closed-loop feedback controls have lowered intradialytic hypotension events in 23 of 28 clinical trials. These advancements underpin sustained unit demand for dialysis-specific fluid management platforms across clinics and home settings.

Shortage of Endoscopy-Trained Surgeons

An 18% decline in surgical specialists projected by 2028 is delaying procedure backlogs in many regions. Rural hospitals find it hardest to recruit talent, limiting deployment of advanced endoscopic fluid systems and depressing utilization rates. Rural areas are disproportionately affected by surgeon shortages, limiting access to advanced fluid management technologies and creating geographic disparities in care delivery. The complexity of modern fluid management systems requires specialized training that may not be readily available in all healthcare settings, potentially limiting adoption rates despite technological advancement.

Other drivers and restraints analyzed in the detailed report include:

- AI-Enabled Closed-Loop Ultrafiltration Control Adoption

- Integrated Fluid-Waste & Disposable Insufflation Systems

- High Capital Cost of Integrated Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dialyzers generated 26.78% of 2024 revenue, reflecting the indispensable nature of renal replacement therapy within the broader fluid management systems market. Fresenius Medical Care posted EUR 21.5 billion in 2024 revenue, confirming the resilience of its dialyzer line. Fluid-waste management systems are set to rise at a 14.41% CAGR to 2030, propelled by stricter disposal mandates. Insufflators, suction units, and fluid warmers register steady gains as providers equip minimally invasive theaters with temperature-controlled, smoke-evacuation-ready kits that meet modern safety codes.

The long-tail "other products" bucket comprising AI sensors, cloud dashboards, and modular hubs could shift share toward software-centric vendors if predictive algorithms deliver measurable cost savings. Segment margins vary widely: dialyzer consumables enjoy high recurring revenue, whereas capital-intensive consoles face lengthier replacement cycles, underscoring distinct strategic imperatives within each sub-market.

Catheters accounted for 33.67% of 2024 revenues in this category, reflecting universal application in vascular access, irrigation, and drainage across settings. LSI materials, antimicrobial coatings, and kink-resistant geometries differentiate premium SKUs and support hospitals' infection-control targets. Valves headline future growth with a 17.04% CAGR, mirroring rising demand for automated shut-off and anti-reflux designs that pair seamlessly with smart pumps. Tubing sets and bloodlines represent high-volume staples, but value migration is underway toward integrated kits that bundle pressure sensors and RFID tracking.

Resin price spikes create margin volatility, prompting OEMs to dual-source polymers and redesign packaging to cut plastic weight. As EU legislation ratchets up recyclability thresholds, suppliers that calibrate formulations early could lock in multi-year supply contracts and solidify share positions within the fluid management systems market.

The Fluid Management Systems Market Report Segments the Industry Into by Product (Dialyzers, Insufflators, and More), Disposables and Accessories (Catheters, Bloodlines, and More), Application (Arthroscopy, Laparoscopy, and More), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America produced 41.56% of 2024 revenues, lifted by robust reimbursement and early adoption of AI monitors. Boston Scientific's USD 4.663 billion Q1 2025 sales underline the region's appetite for high-end cardiovascular solutions that rely on precise perfusion control. FDA rule harmonization is expected to streamline multi-site rollouts, though looming surgical workforce shortages could temper growth.

Asia-Pacific is the engine of expansion, advancing at a 14.98% CAGR. China is scaling tertiary hospitals, while India channels public funding into dialysis clinics. Regulatory diversity requires tailored market-access pathways, yet overall device approvals are accelerating as agencies modernize frameworks.

Europe balances maturity with sustainability imperatives. EU directives on post-market surveillance and recyclable packaging are reshaping component design, favoring manufacturers that can verify cradle-to-grave compliance. Meanwhile, decentralization policies in Germany and France bolster outpatient procedure volumes that depend on mobile fluid equipment.

Middle East & Africa and South America trail in absolute size but offer double-digit growth pockets where infrastructure projects align with rising non-communicable disease burdens. Currency fluctuations and import tariffs remain headwinds, pushing suppliers toward local assembly and strategic distributor alliances to penetrate these segments of the fluid management systems market.

- B. Braun

- Baxter

- Beckton Dickinson

- Cardinal Health

- Hologic

- Johnson & Johnson

- Medtronic

- Smiths Group

- Smiths Group

- Stryker

- Fresenius

- Olympus Corp.

- Zimmer Biomet

- Arthrex

- AngioDynamics

- Ecolab (Skytron)

- Teleflex

- Nipro Corp.

- Asahi Kasei Corp.

- ConMed Corp.

- Karl Storz

- Boston Scientific

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Minimally-Invasive Surgery Volumes

- 4.2.2 Growing Prevalence of Chronic Kidney Disease & ESRD

- 4.2.3 AI-Enabled Closed-Loop Ultrafiltration Control Adoption

- 4.2.4 Integrated Fluid-Waste & Disposable Insufflation Systems

- 4.2.5 Shift Toward Portable Home-Dialysis Fluid Platforms

- 4.2.6 Regulatory Push on OR Fluid-Waste Compliance

- 4.3 Market Restraints

- 4.3.1 Shortage of Endoscopy-Trained Surgeons

- 4.3.2 High Capital Cost of Integrated Platforms

- 4.3.3 Single-Use-Plastic Legislation Inflating Consumable Costs

- 4.3.4 Volatile Supply of Medical-Grade Polymers & Resins

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Dialyzers

- 5.1.2 Insufflators

- 5.1.3 Suction & Irrigation Systems

- 5.1.4 Fluid-Warming Devices

- 5.1.5 Fluid-Waste Management

- 5.1.6 Other Products

- 5.2 By Disposables & Accessories

- 5.2.1 Catheters

- 5.2.2 Bloodlines

- 5.2.3 Transducers

- 5.2.4 Valves

- 5.2.5 Tubing Sets

- 5.2.6 Other Disposables

- 5.3 By Application

- 5.3.1 Arthroscopy

- 5.3.2 Laparoscopy

- 5.3.3 Neurology

- 5.3.4 Cardiology

- 5.3.5 Urology

- 5.3.6 Dental

- 5.3.7 Gastroenterology

- 5.3.8 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Dialysis Centers

- 5.4.4 Specialty Clinics

- 5.4.5 Home-Care Settings

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 B. Braun Melsungen AG

- 6.3.2 Baxter International Inc.

- 6.3.3 Becton, Dickinson & Co.

- 6.3.4 Cardinal Health Inc.

- 6.3.5 Hologic Inc.

- 6.3.6 Johnson & Johnson

- 6.3.7 Medtronic plc

- 6.3.8 Smiths Medical (ICU Medical)

- 6.3.9 Smith & Nephew plc

- 6.3.10 Stryker Corp.

- 6.3.11 Fresenius Medical Care AG & Co. KGaA

- 6.3.12 Olympus Corp.

- 6.3.13 Zimmer Biomet Holdings Inc.

- 6.3.14 Arthrex Inc.

- 6.3.15 AngioDynamics Inc.

- 6.3.16 Ecolab (Skytron)

- 6.3.17 Teleflex Inc.

- 6.3.18 Nipro Corp.

- 6.3.19 Asahi Kasei Corp.

- 6.3.20 ConMed Corp.

- 6.3.21 Karl Storz SE & Co. KG

- 6.3.22 Boston Scientific Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment