PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850130

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850130

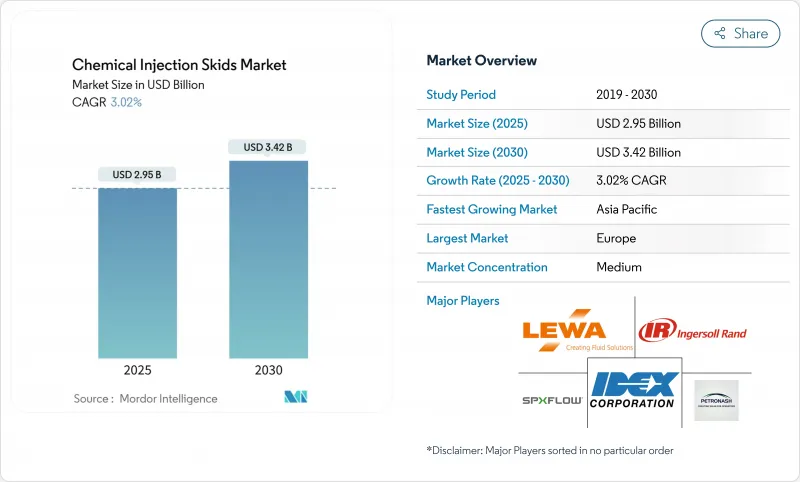

Chemical Injection Skids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The chemical injection skids market is valued at USD 2.95 billion in 2025 and is forecast to reach USD 3.42 billion by 2030, expanding at a 3.02% CAGR.

Steady growth is anchored in the expansion of downstream petrochemical complexes, tougher discharge regulations, and the need for reliable flow assurance across oil-and-gas operations. Operators view precision-dosing skids as insurance against unplanned shutdowns caused by scaling, corrosion, or microbial fouling. Investment momentum is reinforced as water-treatment plants adopt automation to meet nutrient-removal rules that carry financial penalties for non-compliance. Europe continues to purchase high-specification equipment to satisfy the EU's Fit-for-55 goals, while Asia-Pacific accelerates orders for large multi-feed packages alongside new ethylene, ammonia, and PTA capacity. Moderate consolidation among pump specialists and system integrators signals a maturity phase in which service reliability, materials engineering, and digital monitoring differentiate suppliers.

Global Chemical Injection Skids Market Trends and Insights

Rapid Growth in Downstream Petrochemical Capacity Additions

Mega-projects such as China's USD 20 billion Shandong complex require hundreds of dedicated dosing points for corrosion inhibition, antioxidant injection, and catalyst quenching. System suppliers respond by scaling fabrication lines: Advanced Precision Industrial Services lifted annual skid output 500% at its Saudi plant to meet Middle-East EPC backlogs. New crackers demand tighter flow-control tolerances than drilling or production operations, turning chemical injection skids from optional accessories into critical path equipment. Each additional ethylene train creates a multiplier effect because polymer, aromatics, and utilities islands all mandate separate dosing loops. The downstream build-out produces durable, project-linked demand that buffers the chemical injection skids market from oil price volatility.

Accelerating Demand from Water Treatment Applications

Municipalities now deploy multiple polymers, coagulants, and odor-control blends in a single process train; this complexity pushes operators toward fully automated, multi-chemical skids that integrate high-viscosity polymer pumps with gravimetric feeders. Accurate dosing trims chemical overuse penalties and reduces sludge-handling costs, bringing a two-year average payback in North American plants. Industrial users echo the trend as specialty-chemical producers face strict chloride, phosphate, and COD limits before discharging to sewers. Equipment vendors expand portfolios through M&A: Ingersoll Rand's purchase of SSI Aeration adds diffused-air expertise that complements its metering-pump line for complete water packages. Such shifts keep the chemical injection skids market vibrant even when traditional oil-and-gas orders soften.

High Initial Cost of Investment

Capital outlays for integrated chemical injection stations on an enhanced-oil-recovery test can top USD 15 million, a barrier that pushes independents toward manual drum-feed techniques during price downturns. The entry hurdle persists because sophisticated skids bundle explosion-proof motors, seal-less metering pumps, PLCs, and redundant instrumentation. Added spend on commissioning and training can double the invoice value, delaying payback for mid-tier operators. Vendors respond with rental fleets and performance-based leasing plans, yet adoption remains cautious in cash-constrained segments.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Environmental Discharge Norms

- Increasing Usage for Corrosion and Scale Inhibition Application

- Skilled-Labor Shortage for Skid Fabrication & Maintenance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The petrochemical sector held 35.16% of the chemical injection skids market share in 2024, underpinned by distributed dosing points across cracking, hydrogenation, and polymerization trains. Large complexes seldom tolerate unscheduled downtime, so operators favor duplex skid racks with hot-standby pumps that swap without disrupting flow. The segment anchors the chemical injection skids market size because each new ethylene unit demands conditions-specific acid inhibitors, antifoam, neutralizers, and biocide loops.

Water and wastewater facilities register the fastest 3.78% CAGR through 2030. Utilities seek nutrient-removal compliance, so multi-feed systems integrate polymer, alum, and PAC dosing on a single frame to conserve floor space. Adoption rises as municipalities shift from labor-intensive jar testing toward automated feedback loops that cut polymer overshoot by 15%. The chemical injection skids market size for water treatment is projected to rise, mirroring the build-out of tertiary treatment and sludge-dewatering lines.

The Chemical Injection Skids Market Report Segments the Industry by End-User Industry (Petrochemicals, Chemicals, Energy and Power, and More), Pump Type (Piston/Plunger Pumps, Diaphragm Pumps, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe accounted for 28.65% revenue in 2024, supported by Germany's EUR 160 billion chemical output and a compliance climate that rewards high-accuracy dosing equipment. German SMEs representing 96% of sector companies purchase compact skids for batch specialty production, whereas BASF-scale complexes procure fully enclosed ISO-container solutions with automated switchover. Energy prices have quadrupled versus 2010-2020 averages, so plants upgrade to variable-speed drives that cut pump power by 20%, stimulating retrofit activity across existing installations.

Asia-Pacific posts the fastest 3.36% CAGR through 2030. China's refinery-to-chemicals integration wave and India's pharmaceuticals build-out require synchronized additive streams that ensure feedstock purity and reactor protection. The USD 700 million SCG Chemicals ethane-enhancement project in Vietnam specifies triple-pump skids with gravimetric blending to accommodate variable ethane composition. Regional EPCs embrace modular packages shipped fully wired and tested, minimizing site labor where skilled welders remain scarce.

North America secures a stable share via shale-driven petrochemical investments and mature offshore fields that rotate skids on 7-year renewal cycles. Emphasis on predictive maintenance adds digital twins and vibration analytics, allowing operators to schedule hose or diaphragm replacement before failure. Mexico's maquiladora expansion adopts smaller capacity skids feeding paint, adhesive, and electronics finishing lines, broadening the customer base. South America, and Middle East and Africa trail in volume but gain traction as Brazil's Comperj project and Saudi Arabia's Vision 2030 downstream diversification roll out continuous-process units that integrate advanced chemical injection functionality.

- AES Arabia Ltd.

- Carotek, Inc

- Casainox FS Pty Ltd

- Euro Mechanical

- IDEX Corporation

- Ingersoll Rand

- INTECH

- Integrated Flow Solutions, Inc.

- ITC SL

- Lewa GmbH

- Petrak Industries, Inc.

- Petronash

- Proserv UK Ltd

- SEKO S.p.A.

- SLB

- SPX FLOW, Inc.

- TechnipFMC plc

- Watson-Marlow Fluid Technology Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth in downstream petrochemical capacity additions

- 4.2.2 Accelerating demand from water treatment applications

- 4.2.3 Stricter environmental discharge norms

- 4.2.4 Increasing usage for corrosion and scale inhibition application

- 4.2.5 Rising use of green chemicals requiring multi-feed skid designs

- 4.3 Market Restraints

- 4.3.1 High initial cost of investment

- 4.3.2 Skilled-labor shortage for skid fabrication & maintenance

- 4.3.3 Volatility in raw material prices

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By End-User Industry

- 5.1.1 Petrochemicals

- 5.1.2 Chemicals

- 5.1.3 Energy and Power

- 5.1.4 Oil and Gas

- 5.1.5 Water Treatment

- 5.2 By Pump Type

- 5.2.1 Piston/Plunger Pumps

- 5.2.2 Diaphragm Pumps

- 5.2.3 Peristaltic Pumps

- 5.2.4 Other Metering Pumps

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 United Kingdom

- 5.3.3.2 Germany

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%) / Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 AES Arabia Ltd.

- 6.4.2 Carotek, Inc

- 6.4.3 Casainox FS Pty Ltd

- 6.4.4 Euro Mechanical

- 6.4.5 IDEX Corporation

- 6.4.6 Ingersoll Rand

- 6.4.7 INTECH

- 6.4.8 Integrated Flow Solutions, Inc.

- 6.4.9 ITC SL

- 6.4.10 Lewa GmbH

- 6.4.11 Petrak Industries, Inc.

- 6.4.12 Petronash

- 6.4.13 Proserv UK Ltd

- 6.4.14 SEKO S.p.A.

- 6.4.15 SLB

- 6.4.16 SPX FLOW, Inc.

- 6.4.17 TechnipFMC plc

- 6.4.18 Watson-Marlow Fluid Technology Solutions

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Development of Technologically Advanced Chemical Injection System