PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850131

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850131

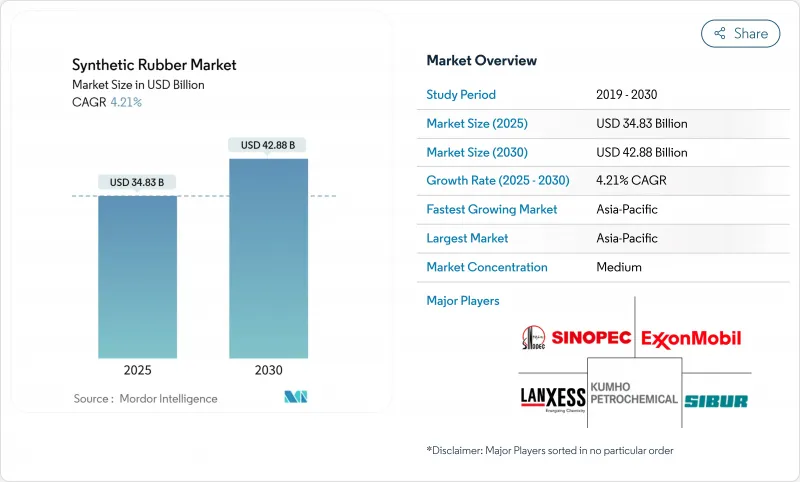

Synthetic Rubber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Synthetic Rubber Market size is estimated at USD 34.83 billion in 2025, and is expected to reach USD 42.88 billion by 2030, at a CAGR of 4.21% during the forecast period (2025-2030).

Resilient demand from tire producers, industrial manufacturers, and healthcare suppliers underpins this growth even as feedstock prices fluctuate and environmental standards tighten. Rising electric-vehicle (EV) adoption is reshaping product specifications, pushing suppliers toward solution-polymerized grades that deliver lower rolling resistance and extended wear life. Renewable-energy installations are creating new high-value channels for EPDM, while medical and consumer goods segments are broadening the customer base. At the same time, bio-based monomers are scaling rapidly as OEMs chase net-zero commitments, and this transition is compressing the margin window for legacy petroleum-based output.

Global Synthetic Rubber Market Trends and Insights

Surging Demand for High-Performance Tires from EV OEMs

EVs accelerate tire wear by 20-30% because of heavier battery packs and instant torque, prompting tire makers to specify solution-polymerized SBR that lowers rolling resistance and extends lifespan. Bridgestone's PeakLife polymer, introduced in late 2024, enhances silica interaction and meets EV durability targets. Continuous procurement from Chinese and European EV assemblers converts this technical requirement into a structural pull on the synthetic rubber market.

Growth of Industrial Rubber Goods in Renewable-Energy Installations

Wind-turbine cables, solar-panel gaskets, and hydroelectric seals rely on EPDM for weatherability and electrical insulation. Studies show UV exposure in marine wind farms can reduce EPDM mechanical properties by 27.67% after 480 hours, spurring compound innovation to preserve field durability. Capacity additions in offshore wind clusters around the North Sea and China's eastern seaboard drive incremental demand.

Volatility in Butadiene Feedstock Prices from Steam-Cracker Turnarounds

Steam-cracker shutdowns scheduled in France, the Netherlands, and Italy trim European crude C4 availability and lift butadiene prices, which represent roughly 50% of SBR raw-material cost. Margin squeeze prompts Asian producers to divert cargoes westward, yet logistics constraints and natural-gas price spikes keep volatility high.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in Medical and Healthcare Applications

- Shift Toward Bio-Based Monomers in North America Driven by Net-Zero Commitments

- Substitution by High-Performance Polyurethanes in Seals & Gaskets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Styrene-Butadiene Rubber (SBR) maintains its dominant position with 40% market share in 2024, primarily due to its extensive use in tire manufacturing, where it enhances traction and wear resistance. SBR remains indispensable for passenger-car treads because it balances grip and abrasion. EPDM, however, advances at 5.77% CAGR through 2030, the fastest among all types, as renewable-energy operators specify it for cable sheathing and sealing. EPDM's 30-50-year service life in roofing also appeals to construction contractors navigating harsher climate patterns.

Demand diversification intensifies. Polybutadiene Rubber blends with SBR to improve low-temperature flexibility in winter tires, while Isobutylene-Isoprene Rubber supports pharmaceutical stoppers where gas permeability must stay minimal. Polyisoprene attracts catheter and glove makers aiming to eliminate natural-latex allergens. Specialty grades such as NBR and CR find traction in oil-service hoses and flame-retardant cables. This expanding palette lets compounders tailor performance to discrete end-use conditions and retain pricing power.

Emulsion polymerization output accounted for 60% of synthetic rubber market share in 2024 as its reactors are established, cost efficient and highly automated. Yet the synthetic rubber market size attached to solution-polymerized grades will rise at 5.51% CAGR. Linear macro-molecules and narrow molecular-weight distributions produced in solution reactors improve elastic modulus to 18.7 MPa, a critical attribute for high-speed EV tires.

Advanced continuous polymerization uses real-time analytics to adjust monomer feeds, cutting VOC emissions, and enabling precise architecture control. Although its footprint is the smallest, it already underpins niche medical and aerospace demand where reproducibility trumps cost. Producers weigh capex trade-offs between process flexibility, energy intensity and carbon footprint before selecting site expansions.

The Synthetic Rubber Market Report Segments the Industry Into by Type (Styrene Butadiene Rubber (SBR), Polybutadiene Rubber (BR), and More), by Manufacturing Process (Emulsion Polymerization (E-SBR), Solution Polymerization (S-SBR), and More), by Raw Material (Butadiene, Isoprene, and More), by Application (Tire and Tire Components, Industrial Goods, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific commanded 57% of the synthetic rubber market in 2024 and is increasing volume at a 4.38% CAGR to 2030. China anchors this leadership with expansive tire and auto-parts exports, augmented by quickening EV penetration. India, Vietnam and Thailand add regional momentum through greenfield compounding plants. Hyosung's Vietnam project to derive BIO BDO from sugarcane will create the first integrated bio-based elastane center by 2026, initially rated at 50,000 tons per year.

North America combines advanced R&D with surging bio-content mandates. The National Renewable Energy Laboratory is prototyping reversible crosslinks for recyclable tires, and NC State University co-leads a National Science Foundation center to bolster domestic rubber supply resilience. Large fleet clients such as UPS and Amazon are piloting sustainable tires, creating a pull-through effect for bio-based feedstock producers.

Europe remains a premium hub despite steam-cracker closures tightening butadiene supply. Germany, France and Italy focus on high-performance specialty grades that meet stringent REACH and microplastic regulations. The European Commission's bio-manufacturing program finances alternative routes for both natural and synthetic rubber to cut import reliance and carbon intensity.

- Apcotex Industries

- Arlanxeo

- Asahi Kasei Corporation

- China Petrochemical Corporation

- Dow

- ENEOS Corporation

- Exxon Mobil Corporation

- Jiangsu Sailboat Petrochemical Co. Ltd.

- Kumho Petrochemical

- LANXESS

- LG Chem

- Mitsubishi Chemical Group Corporation

- Reliance Industries Limited

- SABIC

- Saudi Arabian Oil Co.

- SIBUR Holding PJSC

- Synthos

- The Goodyear Tire & Rubber Company

- Trinseo

- TSRC

- Versalis S.p.A.

- Zeon Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for High-Performance Tires from EV OEMs

- 4.2.2 Growth of Industrial Rubber Goods in Renewable-Energy Installations

- 4.2.3 Advancements in Medical and Healthcare Applications

- 4.2.4 Shift Toward Bio-Based Monomers in North America Driven by Net-Zero Commitments

- 4.2.5 Growth in Consumer Goods Sector

- 4.3 Market Restraints

- 4.3.1 Volatility in Butadiene Feedstock Prices from Steam-Cracker Turnarounds

- 4.3.2 Substitution by High-Performance Polyurethanes in Seals and Gaskets

- 4.3.3 Environmental and Regulatory Concerns

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Styrene-Butadiene Rubber (SBR)

- 5.1.2 Polybutadiene Rubber (BR)

- 5.1.3 Ethylene-Propylene-Diene Monomer (EPDM)

- 5.1.4 Isobutylene-Isoprene Rubber (IIR)

- 5.1.5 Polyisoprene Rubber (IR)

- 5.1.6 Others (NBR, CR, ACM, HNBR, etc.)

- 5.2 By Manufacturing Process

- 5.2.1 Emulsion Polymerization (E-SBR)

- 5.2.2 Solution Polymerization (S-SBR)

- 5.2.3 Advanced Continuous Polymerization

- 5.3 By Raw Material

- 5.3.1 Butadiene

- 5.3.2 Isoprene

- 5.3.3 Styrene

- 5.3.4 Ethylene and Propylene

- 5.3.5 Other Specialty Monomers (ACN, Chloroprene)

- 5.4 By Application

- 5.4.1 Tire and Tire Components

- 5.4.2 Non-Tire Automobile Applications

- 5.4.3 Industrial Goods

- 5.4.4 Footwear

- 5.4.5 Other Applications

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Malaysia

- 5.5.1.6 Thailand

- 5.5.1.7 Vietnam

- 5.5.1.8 Indonesia

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Nordics

- 5.5.3.8 Turkey

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Egypt

- 5.5.5.6 Nigeria

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Apcotex Industries

- 6.4.2 Arlanxeo

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 China Petrochemical Corporation

- 6.4.5 Dow

- 6.4.6 ENEOS Corporation

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 Jiangsu Sailboat Petrochemical Co. Ltd.

- 6.4.9 Kumho Petrochemical

- 6.4.10 LANXESS

- 6.4.11 LG Chem

- 6.4.12 Mitsubishi Chemical Group Corporation

- 6.4.13 Reliance Industries Limited

- 6.4.14 SABIC

- 6.4.15 Saudi Arabian Oil Co.

- 6.4.16 SIBUR Holding PJSC

- 6.4.17 Synthos

- 6.4.18 The Goodyear Tire & Rubber Company

- 6.4.19 Trinseo

- 6.4.20 TSRC

- 6.4.21 Versalis S.p.A.

- 6.4.22 Zeon Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Development of Bio-Based Synthetic Rubbers