PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850140

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850140

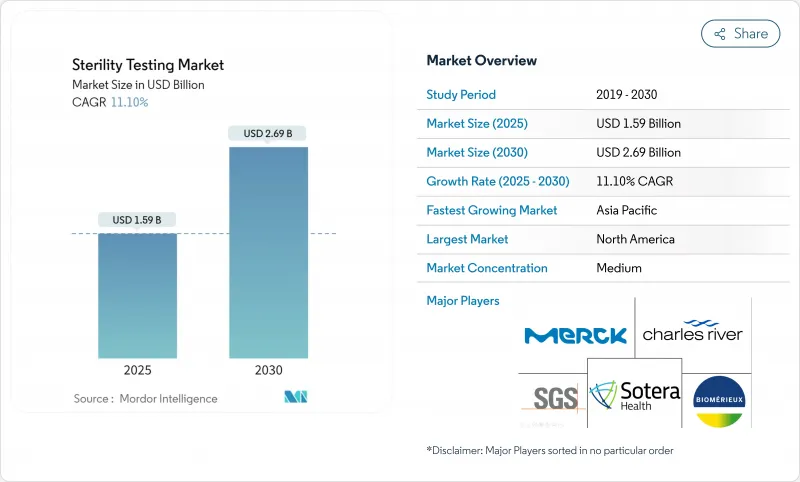

Sterility Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The sterility testing market is valued at USD 1.59 billion in 2025 and is forecast to attain USD 2.69 billion by 2030, reflecting an 11.1% CAGR over the period.

This trajectory mirrors the convergence of EU GMP Annex 1's zero-CFU requirement, the commercialization of complex biologics pipelines, and rapid-release methods that compress drug-to-patient cycles. Persistent venture capital inflows into cell and gene therapy, mounting public-sector vaccine procurement, and the migration of sterile fill-finish capacity to contract partners further energize demand. Membrane filtration maintains its long-established foothold, yet rapid microbial detection platforms are gaining regulatory favor, enabling batch disposition in hours rather than weeks. North America's sophisticated regulatory ecosystem underpins its leadership, while Asia Pacific's emerging mega-plants, preferential tax regimes, and harmonized pharmacopeial updates push it toward the highest regional CAGR.

Global Sterility Testing Market Trends and Insights

Stringent GMP Upgrades For Advanced Biologics Pipelines

The revision of EU GMP Annex 1 lengthened guidance from 16 to 59 pages and formalized the zero-CFU tolerance in Grade A environments, prompting a surge in capital expenditures on isolators, viable monitoring, and pre-use post-sterilization integrity testing. PUPSIT protocols, mandatory airflow diagrams, and digital data-integrity logs have become baseline requirements for marketing-authorization sponsors operating multi-site networks. Harmonization between the EMA and FDA narrows procedural divergence, letting multi-country manufacturers standardize validation master plans and accelerate lot-release decisions.

Surge In Cell & Gene-Therapy Commercial Batches Needing Rapid-Release Sterility Tests

More than 1,200 active US clinical studies and a wave of autologous approvals intensify the call for sterility confirmation within a 4-hour window to safeguard living-cell potency. bioMerieux's SCANRDI exploits solid-phase cytometry to detect single viable but non-culturable organisms, cutting time-to-result from 14 days to under 150 minutes while meeting USP <1223> acceptance criteria. FDA biologics license applications referencing rapid methods validate their commercial reliability and embolden smaller sponsors to replace legacy protocols.

High Capital Cost of Class B Isolator Infrastructure

Acquiring a dual-chamber isolator with automatic leak-test modules costs upward of USD 300,000, excluding validation and annual service contracts. Inspections citing data-integrity lapses at under-spec Chinese sterility labs underscore the risk of under-investment and force even start-ups to allocate disproportionate capex.

Other drivers and restraints analyzed in the detailed report include:

- Shift From In-House QC To Outsourced CDMO Sterility Services

- Adoption Of Modular Isolator Systems That Curb False Positives

- Limited Global Harmonization of Compendial Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services exhibit a 10.8% CAGR, reflecting industry eagerness to outsource sophisticated assays amid microbiologist scarcity. The sterility testing market benefits as leading CDMOs embed QC suites next to aseptic filling lines, enabling "test where you make" paradigms that slash logistic dwell. Kits and reagents, holding 50.7% revenue share, remain resilient by servicing decentralized quality-control points at small and midsize manufacturers. Single-use manifolds, color-change growth media, and off-the-shelf 0.45 µm hydrophilic PVDF membranes preserve relevance even as automation spreads. Instruments form the leanest revenue slice yet the highest innovation quotient. Growth Direct modules now incubate 126 cassettes simultaneously and integrate AI image analytics, delivering official sterility reads in 48 hours at high confidence thresholds.

Continued commoditization of agar plates pressures kit margins, motivating suppliers to bundle cloud-based analytics and traceability software. Services vendors capitalize on their consultative expertise, providing deviation investigations, contamination-source mapping, and right-first-time documentation for pre-approval inspections. Jabil's 360,000-sq-ft Pii campus in Maryland integrates sterile fill-finish with on-site microbiology labs, illustrating horizontal expansion that keeps samples on campus and reduces chain-of-custody risk. In parallel, regional labs in Ireland, Singapore, and Sao Paulo run 24-hour shifts to absorb accelerated release testing for parenterals destined for pandemic-preparedness stockpiles. As sponsors pivot from supplier-of-last-resort to strategic partnership mentality, service revenue streams gain multi-year visibility-bolstering the sterility testing market as a dependable annuity.

The Sterility Testing Market is Segmented by Product Type (Instruments, Kits & Reagents, and More), Test Type (Membrane Filtration, Direct Inoculation, and More), Application (Pharmaceutical & Biologics Manufacturing, and More), Mode (In-House Testing and Outsourced/Contract Testing), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 42.3% revenue share stems from its dense biologics licensure pipeline, aggressive venture funding, and the FDA's well-articulated sterility guidelines that incentivize early adoption of rapid methods. STERIS commissioned two new validation labs in Massachusetts and California during 2024 which provide same-day membrane filtration setup, shortening cross-country shipment lags. The region houses a mature CDMO cluster across the North-East corridor and the Texas-North Carolina biologics belt, generating network effects in consumables procurement and method harmonization. Workforce gaps persist; vacancy rates surpass 15% among QC analysts, pushing firms to create apprenticeship pathways with local colleges.

Asia Pacific exhibits a 9.7% CAGR, the fastest among all regions, driven by policy incentives, scaled vaccine campaigns, and private equity funding for multi-tenant bioparks. China's recent mandate aligning domestic test standards with PIC/S intensifies demand for Annex 1-grade isolators. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) actively pilots remote inspections aided by cloud-based environmental monitoring, spurring adoption of digital platforms. India's Hyderabad Genome Valley adds 1.8 million sq ft of sterile manufacturing space by 2026, widening downstream sterility testing workloads. However, inconsistent enforcement across ASEAN nations necessitates dual testing strategies, mildly eroding margin realization for service exporters. The sterility testing market benefits as global sponsors opt to replicate critical tests in US or EU labs before product launch.

Europe's outlook remains steady, buoyed by Annex 1's full enforcement in August 2023. Germany, the UK, and France lead in isolator retrofits, with small-batch biologics plants upgrading to fully integrated HEPA-filtered barrier systems. The EU's Fit-for-55 carbon targets spur suppliers to engineer low-energy vaporized hydrogen peroxide cycles, an emerging purchasing criterion. Smaller European economies such as Belgium and Denmark leverage national life-science clusters to court CDMO expansions, adding regional service capacity for Scandinavian and Benelux markets. Meanwhile, Central and Eastern Europe pitch cost-efficient labor pools, though slower regulatory turnaround times temper rapid testing adoption.

- bioMerieux

- Charles River

- Merck

- Sartorius

- SGS

- Sotera Health (Nelson Laboratories)

- STERIS Plc

- Thermo Fisher Scientific

- LabCorp

- WuXi App Tec

- Rapid Micro Biosystems

- Pace Analytical Services

- Eurofins

- Pacific BioLabs

- Lonza Group

- Boston Analytical

- Bio-Outsource (SGS)

- Toxikon Europe

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent GMP Upgrades For Advanced Biologics Pipelines

- 4.2.2 Surge In Cell & Gene-Therapy Commercial Batches Needing Rapid-Release Sterility Tests

- 4.2.3 Shift From In-House QC To Outsourced CDMO Sterility Services

- 4.2.4 Adoption Of Modular Isolator Systems Cutting False-Positive Rates

- 4.2.5 Regulatory Push For Validated Rapid Microbiological Methods

- 4.2.6 Rising Demand For Single-Use Technology Compatible Test Kits

- 4.3 Market Restraints

- 4.3.1 High Capital Cost Of Class B Isolator Infrastructure

- 4.3.2 Limited Global Harmonization Of Compendial Test Standards

- 4.3.3 Acute Shortage Of Skilled Microbiologists In Emerging Markets

- 4.3.4 False-Positive Risk In Direct-Inoculation Tests Delaying Releases

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Instruments

- 5.1.2 Kits & Reagents

- 5.1.3 Services

- 5.2 By Test Type

- 5.2.1 Membrane Filtration

- 5.2.2 Direct Inoculation

- 5.2.3 Rapid Sterility Tests

- 5.3 By Application

- 5.3.1 Pharmaceutical & Biologics Manufacturing

- 5.3.2 Medical Device Manufacturing

- 5.3.3 Others

- 5.4 By Mode

- 5.4.1 In-house Testing

- 5.4.2 Outsourced/Contract Testing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 bioMerieux SA

- 6.3.2 Charles River Laboratories

- 6.3.3 Merck KGaA

- 6.3.4 Sartorius AG

- 6.3.5 SGS SA

- 6.3.6 Sotera Health (Nelson Laboratories)

- 6.3.7 STERIS Plc

- 6.3.8 Thermo Fisher Scientific

- 6.3.9 Laboratory Corporation of America Holdings

- 6.3.10 WuXi AppTec

- 6.3.11 Rapid Micro Biosystems Inc.

- 6.3.12 Pace Analytical

- 6.3.13 Eurofins Scientific

- 6.3.14 Pacific BioLabs

- 6.3.15 Lonza Group

- 6.3.16 Boston Analytical

- 6.3.17 Bio-Outsource (SGS)

- 6.3.18 Toxikon Europe

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment