PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850143

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850143

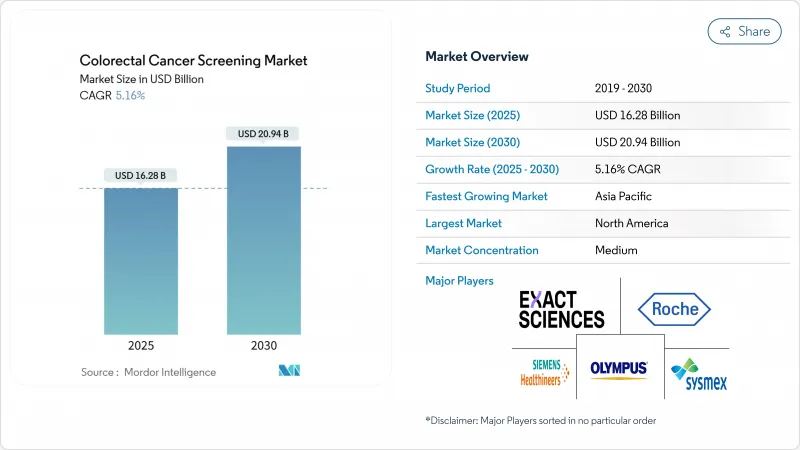

Colorectal Cancer Screening - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The colorectal cancer screening market size is USD 16.28 billion in 2025 and is forecast to reach USD 20.94 billion by 2030, advancing at a 5.16% CAGR.

Uptake accelerates as clinical guidelines now recommend starting routine tests at age 45, enlarging the eligible cohort by 19 million people in the United States alone. Adoption of less-invasive modalities, especially stool DNA and blood-based assays, is rising as these options lower procedural anxiety and require no facility visits. Artificial-intelligence (AI) add-ons that raise adenoma detection rates are reshaping competitive positioning, while value-based reimbursement frameworks push payers to reward preventive care that reduces downstream treatment spending. Vendors that bundle digital navigation, at-home sample collection, and AI-augmented analytics are capturing early mover advantage across the colorectal cancer screening market.

Global Colorectal Cancer Screening Market Trends and Insights

Escalating Global Incidence and Earlier Age-of-Onset of Colorectal Cancer

The demographic composition of colorectal cancer (CRC) is tilting toward younger age brackets, and that shift is quietly rewriting the market's total addressable population. With clinical evidence confirming that early-onset tumors often display accelerated progression, health-system executives increasingly frame screening as a lifetime customer-relationship program rather than a late-career intervention. The implication for manufacturers is a longer monetization runway per individual, provided that product portfolios integrate digital engagement features familiar to working-age consumers. In parallel, payers are recalculating actuarial assumptions because a younger entrant pool extends the period over which preventive savings accrue; this is driving reimbursement models that reward longitudinal adherence rather than one-off test completion.

China's sizable burden of new CRC cases underscores how incidence is decoupling from historical age curves, and regional oncology societies now caution that traditional screening start ages risk missing a clinically meaningful subset of patients. A corollary insight for hospital administrators is that existing endoscopy capacity, once tuned to Medicare-age demand, must be reallocated across a wider spectrum of risk profiles. Consequently, several integrated delivery networks are negotiating wholesale purchases of at-home kits to funnel low-risk cohorts into non-invasive pathways, preserving colonoscopy slots for advanced or symptomatic cases. The downstream effect is a subtle shift in revenue mix: margins once tied predominately to procedural throughput are migrating toward hybrid packages that bundle remote sample collection, algorithmic triage, and rapid escalation for positive results.

Government-Mandated Lowering of Screening Start Age Across Major Economies

Mandatory guideline changes have become the most powerful catalyst for volume growth. When the Centers for Medicare & Medicaid Services (CMS) began reimbursing average-risk beneficiaries at age forty-five in January 2023, private insurers moved quickly to align benefits, ensuring network adequacy in employer segments that demand parity. Vendors accustomed to targeting retirees must now craft messaging for human-resources managers and younger policyholders who weigh discretionary health purchases against out-of-pocket costs.

Modeling commissioned by CMS demonstrated that earlier detection curtails future chemotherapy and hospitalization outlays, allowing payers to justify expanded front-end spending. Commercial carriers are importing the same logic into shared-savings agreements with provider groups, stipulating that any technology selected must produce verifiable adherence data. This validation requirement elevates the strategic value of longitudinal evidence reservoirs; companies that can mine millions of historical test records to display five-year avoided-treatment curves negotiate preferred status on payer formularies. For investors, the lesson is clear: clinical sensitivity remains essential, yet the durability of market share increasingly depends on proprietary outcomes analytics that simplify budget-impact forecasting for actuaries.

Persistent Cost and Reimbursement Gaps in Low- and Middle-Income Countries

Resource-constrained markets present a markedly different commercial calculus. Ministries of health often juggle infectious-disease priorities alongside non-communicable burdens, delaying broad CRC program deployment. The resulting two-tier landscape forces suppliers to engineer price-study variants, typically by reducing reagent volumes per kit and localizing assembly to sidestep import tariffs. While such adaptations protect gross margin, they also necessitate rigorous supply-chain audits to retain regulatory approvals across multiple jurisdictions.

An increasingly relevant access channel in Asia and the Middle East is the employer-sponsored voucher. Multinational corporations fund screening for their urban workforce to curb absenteeism linked to late-stage diagnoses. Manufacturers that supply this niche build brand familiarity among insured employees, who subsequently act as informal ambassadors when national reimbursement eventually materializes. A related insight for strategic planners is that corporate programs generate early epidemiological datasets-often the first of their kind in those countries-which can later underpin dossier submissions to health-technology assessment bodies.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Technology Convergence Toward Minimally-Invasive Biomarker Platforms

- Payer Shift to Value-Based Care Models Increasing Reimbursement for Preventive Screening

- Patient Non-Compliance Due to Cultural Stigma and Procedure-Related Anxiety

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, colonoscopy generated the most significant proportion of test revenues, retaining 46.4% of colorectal cancer screening market share. Yet stool DNA assays posted the quickest revenue rise and are predicted to grow 11.2% annually through 2030. At-home kits resonate with busy younger adults who value convenience and privacy. The colorectal cancer screening market size attributed to stool DNA platforms stood at USD 3.5 billion in 2025 and is projected to double by 2030 alongside guideline-driven uptake. Rising accuracy, evidenced by analytical sensitivity above 90% for advanced lesions, keeps clinicians confident in recommending follow-up colonoscopy only when warranted.

Capital deployment pivots toward scalable laboratory infrastructure that accelerates turnaround time for millions of mailed-in samples. Public-private partnerships are emerging to co-finance regional processing hubs, adding redundancy and trimming logistics expenses. Marketing campaigns target primary-care networks that previously defaulted to colonoscopy referrals, stressing equal effectiveness for average-risk adults. Overall, competitive differentiation within this segment now hinges on kit price, logistics efficiency, and digital result delivery-factors that collectively expand coverage in the colorectal cancer screening market.

Diagnostic hardware, reagents, and kits accounted for 53.3% of market share in 2024, whereas AI-driven software modules are projected to post a 12.8% CAGR through 2030 as clinical evidence mounts. Systems that flag subtle polyps in real time or classify histology on-screen reduce miss rates and downstream pathology costs. The colorectal cancer screening market size attached to software modules is expected to surpass USD 2 billion by 2030, reflecting hospital procurement of AI licences embedded in endoscopy towers.

Software developers bundle cloud analytics and remote quality dashboards, enabling health-system leaders to benchmark adenoma detection across sites. This data transparency fuels pay-for-performance contracts under value-based care, reinforcing enterprise shifts toward software-centric solutions. Partnerships between endoscope makers and algorithm startups shorten integration timelines, making AI-enhanced workflows an expectation rather than a premium feature in the colorectal cancer screening market.

The Colorectal Cancer Screening Market is Segmented by Screening Test (Stool-Based Tests, and More), Product Type (Test Kits & Reagents, Analyzers & Imaging Systems, and More), Mode of Offering (Physician-Led Screening and Direct-To-Consumer Home Testing), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds a 38.6% market share in the market in 2024 due to expanded Medicare eligibility at age 45 and proactive outreach programs lifted national adherence rates, yet 30.3% of adults still miss recommended testing. That shortfall directs innovation toward digital reminders, community health partnerships, and culturally tailored messaging, all intended to convert non-compliant groups. Canada mirrors US trends, with provincial payers now funding stool DNA as a population-level option to expand coverage across rural territories. The scale of North American reimbursement propels supplier investment in AI-enabled colonoscopy towers and high-throughput laboratory automation for the colorectal cancer screening market.

Europe presents a patchwork landscape. Countries such as the Netherlands and the UK operate mature national programs, achieving 70-75% participation, whereas parts of Eastern Europe remain below 10% due to fiscal limitations. The European Society of Gastrointestinal Endoscopy's endorsement of optical diagnosis accelerates the adoption of Narrow Band Imaging systems that can decrease polyp miss rates by 29%. Economic austerity in several member states directs procurement toward cost-effective FIT and DNA kits with minimal capital outlay. Vendors demonstrating comparative cost-utility in multicountry trials gain formulary precedence, reinforcing gradual convergence on AI-supported, quality-monitored solutions across the colorectal cancer screening market.

Asia-Pacific is the fastest-expanding region by patient volume. China's 517,100 incident cases in 2024 spotlight both need and opportunity, although absence of a national screening program restrains uptake. Regional pilots in Shanghai and Shenzhen that subsidize stool-based tests are showing double-digit participation gains, prompting policy debate on broader rollout. Elsewhere, Japan's aging population and high gastric screening penetration provide a template for integrating colorectal kits into existing check-up pathways. In the Middle East, Saudi Arabia's 62% non-screened population underscores cultural and logistical hurdles; emerging home-based tests combined with teleconsultations in Arabic aim to bridge the gap. These developments reinforce Asia-Pacific's pivotal role in shaping long-term expansion of the colorectal cancer screening market.

- Exact Sciences

- Roche

- Siemens Healthineers

- Sysmex

- Olympus

- Eiken Chemical Co., Ltd.

- Epigenomics

- Polymedco Inc.

- Hemosure

- QuidelOrtho

- Abbott Laboratories

- Guardant Health, Inc.

- Illumina

- Natera, Inc.

- Danaher Corp. (Beckman Coulter)

- FUJIFILM

- Clinical Genomics

- Geneoscopy Inc.

- Lucid Diagnostics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Global Incidence and Earlier Age-of-Onset of Colorectal Cancer

- 4.2.2 Government-Mandated Lowering of Screening Start Age Across Major Economies

- 4.2.3 Rapid Technology Convergence Toward Minimally-Invasive Biomarker Platforms

- 4.2.4 Payer Shift to Value-Based Care Models Increasing Reimbursement for Preventive Screening

- 4.2.5 Rapid Uptake of Direct-to-Consumer Home Collection Kits

- 4.2.6 National Adoption of FIT-Based Population Screening and Expanded Reimbursement for Fecal Immunochemical Testing

- 4.3 Market Restraints

- 4.3.1 Persistent Cost and Reimbursement Gaps in Low- and Middle-Income Countries

- 4.3.2 Patient Non-Compliance Due to Cultural Stigma and Procedure-Related Anxiety

- 4.3.3 Limited Access to CT Colonography Infrastructure in Emerging Economies

- 4.3.4 FIT Reagent Supply-Chain Bottlenecks Post-COVID

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Screening Test

- 5.1.1 Stool-Based Tests

- 5.1.1.1 Fecal Immunochemical Test (FIT)

- 5.1.1.2 Guaiac-based Fecal Occult Blood Test (gFOBT)

- 5.1.1.3 Stool DNA Test (sDNA)

- 5.1.2 Visual Tests

- 5.1.2.1 Colonoscopy

- 5.1.2.2 CT Colonography (Virtual Colonoscopy)

- 5.1.2.3 Flexible Sigmoidoscopy

- 5.1.3 Serology & Liquid Biopsy Tests

- 5.1.3.1 Septin9 Blood Test

- 5.1.3.2 microRNA Panels

- 5.1.4 Other Screening Tests (Capsule Endoscopy, etc.)

- 5.1.1 Stool-Based Tests

- 5.2 By Product Type

- 5.2.1 Test Kits & Reagents

- 5.2.2 Analyzers & Imaging Systems

- 5.2.3 Software & AI Algorithms

- 5.2.4 Services

- 5.3 By Mode of Offering

- 5.3.1 Physician-Led Screening

- 5.3.2 Direct-to-Consumer Home Testing

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Independent Diagnostic Laboratories

- 5.4.4 Home Care Settings

- 5.4.5 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Exact Sciences Corporation

- 6.3.2 F. Hoffmann-La Roche AG

- 6.3.3 Siemens Healthineers AG

- 6.3.4 Sysmex Corporation

- 6.3.5 Olympus Corporation

- 6.3.6 Eiken Chemical Co., Ltd.

- 6.3.7 Epigenomics AG

- 6.3.8 Polymedco Inc.

- 6.3.9 Hemosure Inc.

- 6.3.10 QuidelOrtho Corporation

- 6.3.11 Abbott Laboratories

- 6.3.12 Guardant Health, Inc.

- 6.3.13 Illumina, Inc.

- 6.3.14 Natera, Inc.

- 6.3.15 Danaher Corp. (Beckman Coulter)

- 6.3.16 Fujifilm Holdings Corporation

- 6.3.17 Clinical Genomics Technologies Pty Ltd.

- 6.3.18 Geneoscopy Inc.

- 6.3.19 Lucid Diagnostics Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment