PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850148

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850148

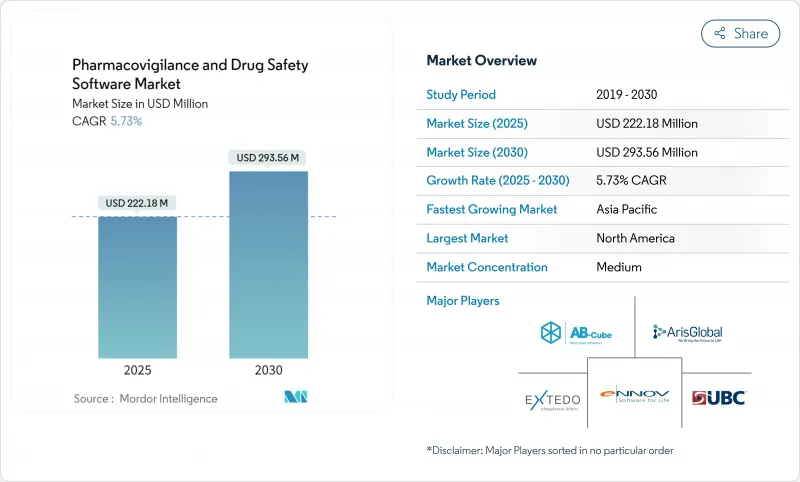

Pharmacovigilance And Drug Safety Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The pharmacovigilance software market is valued at USD 222.18 million in 2025 and is forecast to reach USD 293.56 million by 2030, advancing at a steady 5.73% CAGR.

Growth pivots on the transition from basic compliance systems to AI-enabled safety intelligence platforms that help sponsors evaluate real-world evidence in near-real time. Intensifying harmonization of global reporting rules, spearheaded by the FDA's E2B(R3) mandate and the European Health Data Space Regulation, converts regulatory deadlines into non-discretionary IT spending.Cloud adoption crosses 80% penetration among life-science firms, creating a preferred deployment backbone for modern safety databases. Meanwhile, explainable-AI modules that automate case triage lower processing costs by as much as 50%, giving early adopters an economic edge. Geopolitical stability in Asia Pacific, coupled with streamlined ethics approvals, is relocating a rising share of clinical trials eastward and lifting regional demand for advanced surveillance tools.

Global Pharmacovigilance And Drug Safety Software Market Trends and Insights

Rising Incidence of Adverse Drug Reactions (ADRs)

Escalating ADR prevalence reshapes demand for advanced monitoring as new molecular entities enter wider use. Cureus Journal data show the 21-40 age group now reports the highest ADR frequencies, reflecting greater polypharmacy and increased hospital interactions. With the FDA approving 50 new molecular entities in 2024, sponsors must surveil diverse patient sub-populations for previously unseen safety signals. Biologics and gene therapies add complexity because reactions can vary across genetic backgrounds. Accordingly, the pharmacovigilance software market shifts from static report repositories toward real-world evidence engines capable of analyzing heterogeneous longitudinal datasets. Vendors that embed AI-powered pattern recognition into reporting workflows gain relevance because manual methods cannot keep pace with volume and complexity.

Stringent Global E2B(R3)/IDMP Compliance Deadlines

April 2026 marks the FDA's cut-off for E2B(R3) submissions, forcing sponsors to abandon legacy R2 formats and invest in upgraded platforms. Simultaneously, the European Medicines Agency's IDMP roll-out tightens medicinal-product data requirements, compelling software to manage both event and product identifiers in one schema. Dual-system maintenance inflates risk and overhead, so firms accelerate migration ahead of statute. This regulatory synchrony turns spending on compliance upgrades into a certainty rather than a discretionary budget item, underpinning predictable growth for the pharmacovigilance software market.

Data-Sovereignty & Cross-Border-Transfer Restrictions

The European Health Data Space Regulation, effective May 2025, sets new standards for secondary health-data use and introduces consent layers that software must honor. GDPR already limits external processing, and similar frameworks are emerging in Asia and Latin America. Vendors must therefore design federated models that keep data in the country while sharing de-identified signals globally. This architecture raises costs and elongates deployment cycles, damping part of the pharmacovigilance software market's expansion.

Other drivers and restraints analyzed in the detailed report include:

- Cloud-First Migration of Safety Databases

- Explainable-AI Modules Slash Case-Processing Costs

- Shortage of PV Data-Science Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Adverse events reporting software retained a commanding 40.7% share of the pharmacovigilance software market in 2024, underscoring its status as a non-negotiable compliance pillar. Yet signal detection and risk-management modules are forecast to grow at an 18.4% CAGR, demonstrating the pivot toward preventive analytics that flag anomalies before regulators intervene. Many sponsors now favor unified platforms that merge intake, triage, analytics, and submission into one workflow. Oracle added AI-powered conditional touchless processing to Argus in 2024, illustrating how embedded intelligence elevates legacy solutions. Continuous rise in biological approvals coupled with diverse real-world data feeds widens the opportunity for platforms that draw correlations across ethnic, genomic, and social determinants of health datasets.

Integrated suites also reduce validation overhead because a single quality-management system covers multiple modules. As a result, vendors capable of harmonizing point solutions into end-to-end architecture are expanding their installed bases faster than niche competitors. Signal detection units may ultimately outpace event-reporting revenue, yet both modules remain symbiotic because regulatory filings still stem from source case data. The pharmacovigilance software market size attributable to advanced analytics is therefore set to climb more rapidly than the aggregate market, even as reporting retains foundational relevance.

The Pharmacovigilance and Drug Safety Software Market is Segmented by Functionality (Adverse Event Reporting, Drug Safety Audit Software, and More), Mode of Delivery (On-Premise, Cloud/SaaS, and More), End User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 35.9% revenue share in 2024, anchored by stringent FDA oversight and a dense concentration of top 20 pharmaceutical companies. Many regional sponsors pioneered cloud-based safety systems before 2020; Pfizer's COVAES platform processed more than 1.5 million COVID-19 vaccine cases using automated triage and de-duplication. The FDA's 2025 creation of a chief AI officer underscores the regulator's readiness to evaluate algorithmic submissions, reinforcing regional appetite for AI-rich upgrades. Talent shortages remain a hurdle, inflating salaries for data-science specialists and pressuring smaller firms to outsource.

Asia Pacific records the fastest 14.3% CAGR on the back of clinical-trial migration to South Korea, Taiwan and Singapore, where shorter ethics-committee timelines accelerate recruitment. China's expanding contract research landscape, led by Wuxi AppTec, pulls in global clients that need local PV capacity aligned with National Medical Products Administration rules. Government investment programs, such as Japan's AMED grants for AI drug-safety research, further stimulate domestic software adoption. Despite diverse legal frameworks, many Asia-Pacific regulators now accept ICH E2B(R3) XML, reducing localization barriers.

Europe maintains significant scale because mature pharmacovigilance obligations and GDPR heightens the need for configurable, audit-ready platforms. The European Health Data Space Regulation formalizes secondary health-data use, prompting sponsors to adopt software capable of granular consent management. Germany's new Digital Act unlocks de-identified claims datasets for research, enabling safety algorithms to mine national repositories once off-limits. However, strict data-sovereignty clauses require EU-based hosting, spurring demand for region-specific cloud zones. Collectively, these dynamics keep Europe a premium market for feature-rich platforms even though growth trails Asia Pacific.

- Oracle

- Aris Global

- Veeva Systems

- Sparta Systems

- IQVIA

- Ennov Solutions

- Extedo

- AB Cube

- Anju Software

- Sarjen Systems

- United BioSource Corp.

- Accenture

- Cognizant

- Tata Consultancy Services (TCS ADD)

- Parexel International

- Medidata Solutions

- Saama Technologies

- Intellimed (Vigilance 360)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence Of Adverse Drug Reactions (ADRs)

- 4.2.2 Stringent Global E2B(R3)/IDMP Compliance Deadlines

- 4.2.3 Cloud-First Migration Of Safety Databases

- 4.2.4 Explainable-AI Modules Slash Case-Processing Costs

- 4.2.5 Real-World-Evidence (RWE) Integration For Early Signals

- 4.2.6 Low-Code Localisation For Emerging-Market Forms

- 4.3 Market Restraints

- 4.3.1 Data-Sovereignty & Cross-Border-Transfer Restrictions

- 4.3.2 Shortage Of PV Data-Science Talent

- 4.3.3 Algorithmic-Bias Scrutiny Delaying AI Approvals

- 4.3.4 Escalating API Pricing From Dominant DB Vendors

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Functionality

- 5.1.1 Adverse Event Reporting Software

- 5.1.2 Drug Safety Audit Software

- 5.1.3 Issue Tracking Software

- 5.1.4 Fully Integrated Safety Suites

- 5.1.5 Signal Detection & Risk-Management Tools

- 5.2 By Mode of Delivery

- 5.2.1 On-premise

- 5.2.2 Cloud / SaaS

- 5.2.3 Hybrid Deployment

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biotechnology Companies

- 5.3.2 Contract Research Organizations (CROs)

- 5.3.3 Business-Process-Outsourcing (BPO) Firms

- 5.3.4 Medical-Device Manufacturers

- 5.3.5 Other PV Service Providers

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Oracle Corporation

- 6.3.2 ArisGlobal

- 6.3.3 Veeva Systems

- 6.3.4 Sparta Systems

- 6.3.5 IQVIA

- 6.3.6 Ennov Solutions

- 6.3.7 Extedo GmbH

- 6.3.8 AB Cube

- 6.3.9 Anju Software

- 6.3.10 Sarjen Systems

- 6.3.11 United BioSource Corp.

- 6.3.12 Accenture

- 6.3.13 Cognizant

- 6.3.14 Tata Consultancy Services (TCS ADD)

- 6.3.15 Parexel International

- 6.3.16 Medidata Solutions

- 6.3.17 Saama Technologies

- 6.3.18 Intellimed (Vigilance 360)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment