PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850154

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850154

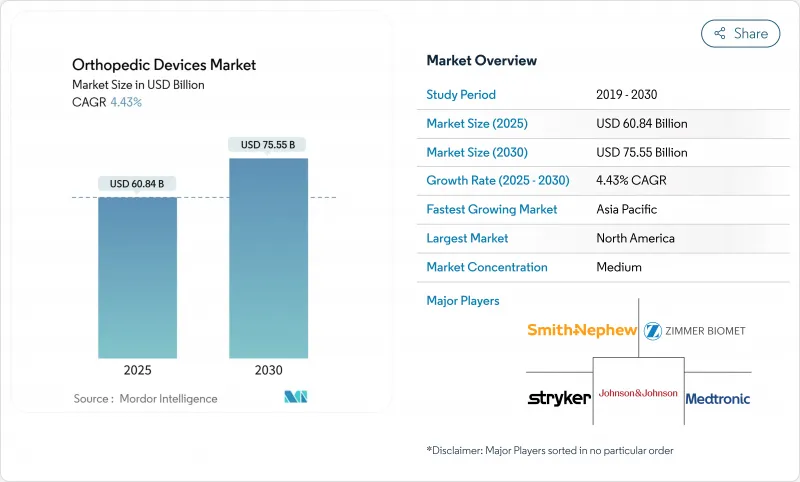

Orthopedic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The orthopedic devices market is valued at USD 60.84 billion in 2025 and is forecast to reach USD 75.55 billion by 2030, advancing at a 4.43% CAGR.

The growth curve is steady rather than rapid, reflecting maturing demand, stricter reimbursement policies, and a pivot toward value-based purchasing. Joint reconstruction volumes continue to expand on the back of population aging, while AI-assisted surgical planning and robotic guidance improve clinical precision and shorten recovery windows. Manufacturers are also investing in 3-D printed and bioabsorbable implants to overcome limitations of traditional metals, supporting a pipeline of patient-specific solutions. At the same time, the orthopedic devices market feels pressure from complex approval pathways and surgeon reimbursement cuts, factors that temper acceleration despite favorable demographics.

Global Orthopedic Devices Market Trends and Insights

Aging Population Driving Degenerative-Joint Procedures

Hip replacements in the United States are projected to reach 635,000 cases and knee replacements 1.28 million by 2030, illustrating how longevity shifts demand toward large-joint implants. Similar trajectories appear worldwide; Colombia expects 39,270 lower limb arthroplasties by 2050 and Germany projects a 55% rise in total knee arthroplasty by 2040. Younger, active individuals are also opting for surgery earlier, extending implant duty cycles and fueling premium material uptake. Health systems must therefore expand surgical capacity, reinforce rehabilitation networks, and standardize outcome tracking to manage procedure surges efficiently.

Technological Advances in 3-D Printed & Bioabsorbable Implants

Additive manufacturing now delivers patient-matched geometries that speed osseointegration and cut operating time. FDA clearance for the first PEEK cranial implant in 2024 demonstrated regulatory acceptance of 3-D printed polymers in load-bearing indications. Industrial-scale printers in Alabama can already fabricate spine cages with minimal waste, signaling cost competitiveness. Bioabsorbable devices address sports and trauma cases where permanent hardware is unnecessary, a capability strengthened by recent FDA authorizations of platelet-rich plasma systems that encourage biologic healing. These innovations differentiate suppliers and open regenerative pathways that may reduce revision burdens long term.

Stringent Multi-Region Regulatory Approvals

Europe's Medical Device Regulation, enforced fully in 2024, raised evidence thresholds and extended review cycles, delaying product launches and inflating development budgets. Parallel changes at the FDA, including new coating guidance and change-control plans, add additional documentation layers, particularly for antimicrobial or surface-modified implants. Firms must now conduct multi-center clinical studies and maintain post-market surveillance systems that stretch smaller innovators' resources and may slow technology diffusion.

Other drivers and restraints analyzed in the detailed report include:

- AI-Driven Surgical Planning & Robotics Improve Outcomes

- Rising Orthopedic Trauma & Accident Incidence

- Unfavorable Reimbursement & Shortage of Skilled Surgeons

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Joint reconstruction implants held 37.16% of orthopedic devices market share in 2024, anchored by hip and knee replacement volumes that will keep rising well into the next decade. Manufacturers focus on long-wearing polyethylene liners, porous titanium scaffolds, and smart sensors that relay load data to clinicians. Orthobiologics, though smaller, is the fastest-growing group at a 5.86% CAGR, propelled by cartilage repair matrices and growth-factor-enriched grafts. The orthopedic devices market continues to shift toward combination products that blend mechanics with biology, a trend underscored by CARTIHEAL AGILI-C's 87% reduction in conversion to total knee arthroplasty at four years.

Sports-medicine instrumentation and arthroscopes benefit from younger cohorts seeking preventive repairs, while spine devices absorb gains from minimally invasive techniques that shorten recovery. Trauma sets remain resilient thanks to steady accident rates. Vendors therefore manage a broad development slate, balancing high-volume reconstructive workhorse implants with specialized biologics to hedge against reimbursement squeezes in commoditized segments of the orthopedic devices market.

Titanium and its alloys accounted for 42.84% of the orthopedic devices market size in 2024, thanks to strength-to-weight advantages and proven biocompatibility. Supply-chain volatility, however, drives exploration of alternatives as titanium costs range from USD 6 to USD 30 per pound depending on refinement grade. Bioabsorbable polymers and composites grow fastest at 6.58% CAGR, offering temporary fixation that dissolves once healing completes, a property prized in sports injuries and pediatric fractures.

PEEK maintains a foothold in spine cages because it yields artifact-free imaging and modulus compatibility with bone; more than 15 million PEEK devices are implanted worldwide. Advanced beta-titanium alloys with niobium and zirconium reduce modulus mismatch to limit stress shielding, while magnesium-based resorbables advance through trials. These shifts indicate a gradual transition away from permanent metallic hardware, positioning the orthopedic devices market for more regenerative, life-cycle-oriented therapies.

The Orthopedic Devices Market is Segmented by Device Type (Joint Reconstruction Implants, Trauma Fixation Devices, and More), by Material (Titanium and Titanium Alloys, Stainless Steel, and More), by Application (Hip Orthopedic Procedures, Knee Orthopedic Procedures, and More), by End User (Hospitals, Orthopedic and Specialty Clinics, and More), by Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America controlled 44.62% of orthopedic devices market revenue in 2024 as robust insurance coverage and early adoption of robotics accelerated premium implant uptake. CMS has introduced new patient-reported outcome measures for joint arthroplasty in 2025, linking reimbursement to functional improvement and nudging suppliers toward evidence-based pricing. Meanwhile, the region's ASC build-out is slated to lift outpatient orthopedic volumes by 21% over the next decade, pressuring vendors to sharpen cost-to-value propositions.

Asia-Pacific, growing at 7.23% CAGR, gains from rising middle-class incomes, government investment in surgical robotics, and soaring incidence of degenerative spinal disease. China alone targets a medical-device market of USD 210 billion by 2025, and regional production hubs supply titanium and PEEK, shortening lead times and reducing import tariffs. Local companies co-develop products with multinationals, hastening technology transfer and customizing features for smaller stature patients.

Europe posts steady expansion despite Medical Device Regulation hurdles that extend approval cycles. Germany projects total knee arthroplasty incidence will climb 55% by 2040, creating durable baseline demand even as hospitals consolidate implant vendors. Middle East-Africa and South America remain nascent but attractive; orthopedic tourism in the Gulf boosts high-acuity procedure volumes, while macro-economic recovery in Brazil unlocks capital budgets for trauma and sports-medicine inventory.

- Johnson & Johnson

- Zimmer Biomet

- Stryker

- Smiths Group

- Medtronic

- Enovis Corporation (DJO)

- B. Braun

- Arthrex

- Globus Medical

- NuVasive

- ATEC Spine Inc.

- Ossur hf. (Embla Medical hf.)

- CTL Amedica

- Conmed

- MicroPort Orthopedics

- SeaSpine Orthopedics Corporation (Orthofix Medical Inc.)

- Integra LifeSciences

- Exactech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging population driving degenerative-joint procedures

- 4.2.2 Increasing number of large-joint reconstruction surgeries

- 4.2.3 Technological advances in 3-D printed & bioabsorbable implants

- 4.2.4 Rising orthopedic trauma & accident incidence

- 4.2.5 AI-driven surgical planning & robotics improve outcomes

- 4.2.6 Value-based care boosting modular cost-efficient implants

- 4.3 Market Restraints

- 4.3.1 Stringent multi-region regulatory approvals

- 4.3.2 Unfavorable reimbursement & shortage of skilled surgeons

- 4.3.3 Supply-chain volatility in titanium & PEEK materials

- 4.3.4 Outpatient migration eroding inpatient implant margins

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 Joint Reconstruction Implants

- 5.1.2 Trauma Fixation Devices

- 5.1.3 Spine Surgery Devices

- 5.1.4 Craniomaxillofacial Devices

- 5.1.5 Sports Medicine & Arthroscopy Devices

- 5.1.6 Orthobiologics

- 5.1.7 Other Orthopedic Devices

- 5.2 By Material

- 5.2.1 Titanium & Titanium Alloys

- 5.2.2 Stainless Steel

- 5.2.3 Polymeric Biomaterials

- 5.2.4 Bioabsorbable & Composite Materials

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Hip Orthopedic Procedures

- 5.3.2 Knee Orthopedic Procedures

- 5.3.3 Spine Orthopedic Procedures

- 5.3.4 Trauma Fixation

- 5.3.5 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Orthopedic & Specialty Clinics

- 5.4.3 Ambulatory Surgical Centers (ASCs)

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 DePuy Synthes (Johnson & Johnson)

- 6.3.2 Zimmer Biomet Holdings Inc.

- 6.3.3 Stryker Corporation

- 6.3.4 Smith & Nephew plc

- 6.3.5 Medtronic plc

- 6.3.6 Enovis Corporation (DJO)

- 6.3.7 B. Braun SE

- 6.3.8 Arthrex Inc.

- 6.3.9 Globus Medical Inc.

- 6.3.10 NuVasive Inc.

- 6.3.11 ATEC Spine Inc.

- 6.3.12 Ossur hf. (Embla Medical hf.)

- 6.3.13 CTL Amedica

- 6.3.14 CONMED Corporation

- 6.3.15 MicroPort Orthopedics

- 6.3.16 SeaSpine Orthopedics Corporation (Orthofix Medical Inc.)

- 6.3.17 Integra LifeSciences

- 6.3.18 Exactech Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment