PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850157

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850157

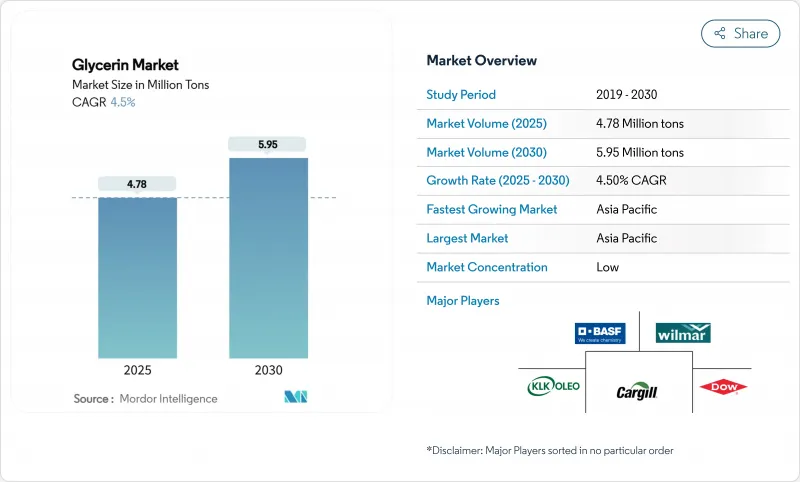

Glycerin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Glycerin Market size is estimated at 4.78 Million tons in 2025, and is expected to reach 5.95 Million tons by 2030, at a CAGR of 4.5% during the forecast period (2025-2030).

Demand is lifted by pharmaceutical grade adoption, robust personal-care formulation pipelines, and tighter European rules that encourage bio-based chemistries. Vertical integration among biodiesel producers and oleochemical majors is helping stabilize feedstock availability, while advances in purification technology enable smaller firms to upgrade crude streams to refined specifications. Asia-Pacific retains pricing power thanks to its sizable manufacturing base, and sustained biodiesel investments in the United States create regional surpluses that flow into export channels. However, the Glycerin market remains vulnerable to sharp swings in crude glycerin prices that track biodiesel feedstock costs, compelling refiners to sign long-term offtake contracts that protect margins.

Global Glycerin Market Trends and Insights

Surging Demand for USP-grade Glycerin in Pharmaceutical Industry

Tightening quality rules from regulators are boosting demand for USP-grade glycerin that consistently tests above 99.5% purity. The United States FDA now requires manufacturers to verify diethylene glycol and ethylene glycol levels below 0.10%, forcing buyers to prioritize fully traceable supply chains. European and Asian drug makers are locking in multi-year supply deals with integrated refiners that can furnish batch-level certificates, and this premium segment is capturing higher margins. Production lines are being upgraded with advanced gas chromatography systems to guarantee contaminant control, cementing refined glycerin's position as an indispensable excipient. For the Glycerin market, pharmaceutical uptake is adding a defensible demand pillar that is largely insulated from biodiesel price noise.

Increasing Use in the Personal Care and Cosmetics Industries

Formulators are leveraging glycerin's humectant capability to deliver durable skin hydration in clean-label products. Beyond simple moisturization, research laboratories are pairing glycerin with ceramides and niacinamide to build barrier-repair systems that heighten consumer appeal. The trend is strongest in Asia, but global brands are reformulating legacy lines to raise natural-origin content, lifting average inclusion rates above 3% by weight. Because refined grades carry fewer odor compounds, they integrate seamlessly into fragrance-forward cosmetics. This steady pull from beauty applications is expected to offset any cyclical slowdown in industrial end-uses, reinforcing volume stability for the overall Glycerin market.

Volatile Crude Glycerin Prices Linked to Biodiesel Feedstock Swings

Crude glycerin prices fluctuate with soybean, canola, and waste-oil costs, destabilizing refiner margins and complicating budget forecasts. Feedstock shifts toward animal fats introduce higher impurity loads, forcing additional purification steps that erode profitability. To manage the risk, large buyers are migrating to index-linked contracts and installing polishing columns that flex with variable input quality. While volatility is expected to persist, firms that lock in multi-year offtake deals and diversify feedstock sourcing can shield themselves, preserving confidence in long-term Glycerin market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Biodiesel Production

- Regulatory Push for Low-VOC Alkyd Resins

- Availability of Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refined grades commanded 68% of the Glycerin market in 2024, and segment volume is forecast to grow 4.9% annually to 2030. The upswing reflects regulatory emphasis on contaminant control and the surge in personal-care and pharmaceutical launches that require USP-compliant excipients. Higher purity enables consistent sensory profiles, making refined glycerin indispensable in serum, lotion, and injectable formulations.

At the same time, crude glycerin is attracting interest as a biogas substrate and as a carbon feed in algae cultivation, diversifying downstream revenue. Purification costs are gradually falling as membrane filtration and ion-exchange technologies mature, narrowing the price gap between grades and inviting mid-tier producers to enter the refined arena.

The Glycerin Market Report Segments the Industry by Grade (Crude Glycerin and Refined Glycerin), Source (Biodiesel, Fatty Acids, Fatty Alcohols, and Other Sources), Application (Personal Care and Cosmetics, Pharmaceuticals, Food and Beverage, Polyether Polyols, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific led the Glycerin market with a 48% share in 2024 and is projected to register the fastest 5% CAGR to 2030. Thanks to extensive biodiesel build-outs and its sizable personal-care manufacturing hub, China anchors supply and demand. India's oleochemical investments and Malaysia's palm-based biodiesel capacity reinforce regional self-sufficiency.

North America contributes significantly, backed by its mature biofuel policy framework and sophisticated pharmaceutical sector. The United States plans to boost biofuel output to 1.3 million boepd by 2035, ensuring abundant crude glycerin flow.

Europe emphasizes sustainability leadership, with Germany, the United Kingdom, Italy, and France consuming refined glycerin in pharmaceuticals, coatings, and packaging. EU legislation limiting VOC emissions is spurring substitution of petro-resins by glycerin-based alkyds, and trials in volumetric additive manufacturing are expanding niche demand.

- ADM

- Aemetis, Inc.

- BASF

- Biodex-SA

- Cargill, Incorporated

- Dow

- Emery Oleochemicals

- Godrej Industries Group

- IOI Corporation Berhad

- Kao Corporation

- KLK OLEO

- Louis Dreyfus Company

- Munzer Bioindustrie GmbH

- Musim Mas Group

- Oleon NV

- Procter & Gamble

- Renewable Biofuels

- Thai Glycerine Co.

- Vance Group Ltd.

- Vantage Specialty Chemicals, Inc.

- Wilmar International Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for USP-grade Glycerin in Pharmaceutical industry in Asia and EU

- 4.2.2 Increasing Use in the Personal Care and Cosmetics Industries

- 4.2.3 Expansion of Biodiesel Production

- 4.2.4 Regulatory Push for Low-VOC Alkyd Resins Boosting Glycerin Usage (EU)

- 4.2.5 Rising Adoption of Vegetable-sourced Glycerin in Halal and Vegan Foods in MENA, ASEAN Region

- 4.3 Market Restraints

- 4.3.1 Volatile Crude Glycerin Prices Linked to Biodiesel Feedstock Swings

- 4.3.2 Availability Of substitutes

- 4.3.3 Stringent Pharmaceutical Monographs Limiting Technical-grade Uptake

- 4.4 Value Chain Analysis

- 4.5 Feedstock Analysis

- 4.6 Pricing Analysis (Historical and Forecast)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Grade

- 5.1.1 Crude Glycerin

- 5.1.2 Refined Glycerin

- 5.2 By Source

- 5.2.1 Biodiesel

- 5.2.2 Fatty Acids

- 5.2.3 Fatty Alcohols

- 5.2.4 Other Sources

- 5.3 By Application

- 5.3.1 Personal Care and Cosmetics

- 5.3.2 Pharmaceuticals

- 5.3.3 Food and Beverage

- 5.3.4 Polyether Polyols

- 5.3.5 Alkyd Resins and Surface Coatings

- 5.3.6 Tobacco Humectants

- 5.3.7 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Caribbeans

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Turkey

- 5.4.5.4 South Africa

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JVs, Partnerships)

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global overview, Market overview, Core segments, Financials, Strategic info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ADM

- 6.4.2 Aemetis, Inc.

- 6.4.3 BASF

- 6.4.4 Biodex-SA

- 6.4.5 Cargill, Incorporated

- 6.4.6 Dow

- 6.4.7 Emery Oleochemicals

- 6.4.8 Godrej Industries Group

- 6.4.9 IOI Corporation Berhad

- 6.4.10 Kao Corporation

- 6.4.11 KLK OLEO

- 6.4.12 Louis Dreyfus Company

- 6.4.13 Munzer Bioindustrie GmbH

- 6.4.14 Musim Mas Group

- 6.4.15 Oleon NV

- 6.4.16 Procter & Gamble

- 6.4.17 Renewable Biofuels

- 6.4.18 Thai Glycerine Co.

- 6.4.19 Vance Group Ltd.

- 6.4.20 Vantage Specialty Chemicals, Inc.

- 6.4.21 Wilmar International Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Rapid Uptake of Glycerin in E-cigarette Liquids in Asia and Middle-East