PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850159

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850159

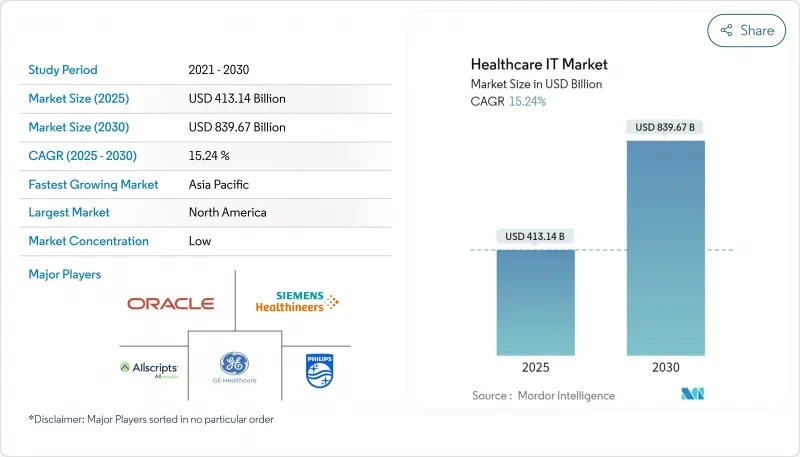

Healthcare IT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Healthcare IT Market size is estimated at USD 413.14 billion in 2025, and is expected to reach USD 839.67 billion by 2030, at a CAGR of 15.24% during the forecast period (2025-2030).

Sustained momentum confirms that the industry is now central to healthcare cost-containment and quality-improvement agendas. Transaction disclosures show that buyers consistently channel the highest capital into cloud-ready analytics platforms, while simultaneously paring budgets for stand-alone on-premise software. The Healthcare Information Technology industry benefits from payers' expanded reimbursement codes for remote services, a policy move that is nudging even conservative providers toward digital front doors. Implementation partners that can bundle workflow redesign with cybersecurity assurances are shortening time-to-value, a pattern that explains the services component's out-sized Healthcare Information Technology market share. Investor calls reveal that boards are weighing supply-chain fragility less heavily than clinician burnout when green-lighting IT spend, indirectly elevating AI-based automation to the top of strategic roadmaps.

Global Healthcare IT Market Trends and Insights

AI-Driven Clinical Decision Support: Redefining Diagnostic Precision

Hospitals are moving decisively into algorithm-enabled care: by end-2025, roughly nine in ten institutions plan to operationalize AI for early diagnosis and remote monitoring. Automated documentation already cuts paperwork time by close to two-thirds, freeing clinicians for direct patient engagement. Radiology is at the vanguard; AI-assisted detection tools are catching subtle lesions that once required second reads, leading to measurable improvements in treatment pathways. Yet only 53 % of U.S. health systems have dedicated governance teams overseeing these models, an oversight gap that raises the risk of unmonitored performance drift. Vendors that include real-time bias dashboards in their offerings are seeing higher renewal rates, suggesting that transparency is emerging as a key buying criterion. Clinicians who receive model-explainability cues at the point of care report greater confidence in AI-generated recommendations, encouraging deeper workflow embedding.

Rapid Telehealth Uptake: Rural Access Revolution

Telehealth is closing distance-based care gaps for an estimated two billion people in under-served geographies, a critical advancement as rural doctor numbers are projected to fall another 23 % by 2030. Collaborative tele-ICU networks show up to 40 % reductions in mortality after virtually enabled coverage extends specialist oversight to low-acuity hospitals. Broadband consortia funded under infrastructure bills have lowered connectivity costs, enabling primary-care clinics to pilot video triage that shaves minutes off emergency-department boarding times. Provider CFOs increasingly cite telehealth revenue as an offset to declining elective-procedure margins, signalling that virtual visits have matured into a durable line of business. An emerging behavior is that physicians seasoned in remote consults become change champions for adjacent innovations such as digital wound care, organically accelerating broader transformation.

Complexity of Regulations: Compliance Burden Intensifies

More than 630 active healthcare rules-and over twenty recent updates-force organizations to pour roughly USD 39 billion a year into non-clinical compliance. Smaller hospitals allocate a disproportionate share of overhead to documentation teams, crowding out funds for patient-facing technologies. Providers that invested in centralized rule-mapping engines now receive real-time workflow alerts, enabling faster remediation and reducing audit penalties. Nevertheless, looming AI-specific legislation is prompting developers to publish model-card disclosures, extending product cycles but enhancing buyer trust. Compliance consultants report that integrating privacy-by-design principles at early coding stages trims future re-engineering costs, a lesson gradually reflected in procurement scorecards.

Other drivers and restraints analyzed in the detailed report include:

- Rise in Demand for Paper-less Technology: Data-Driven Care Transformation

- Increased Government Funding: Policy-Driven Market Acceleration

- Shortage of Skilled Health-IT Workforce: Implementation Bottleneck

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Epic Systems Corp.

- Oracle Health (Cerner)

- McKesson Corp.

- Koninklijke Philips

- GE Healthcare

- Siemens Healthineers

- Allscripts (Altera Digital Health)

- athenahealth

- IBM

- Optum

- Teladoc Health

- Amwell

- InterSystems Corp.

- Meditech

- Change Healthcare

- R1 RCM

- Accenture Health

- Cognizant Digital Health

- Tata Consultancy Services (TCS)

- Wipro HealthEdge

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-Driven Clinical Decision Support Adoption

- 4.2.2 Rapid Telehealth Uptake in Rural Areas

- 4.2.3 Rise in the Demand for Paper-less Technology

- 4.2.4 Increased Government Funding on Healthcare Services and Infrastructure

- 4.2.5 Aging Population Driving Remote Patient-Monitoring Deployment

- 4.3 Market Restraints

- 4.3.1 Complexity of Regulations

- 4.3.2 Shortage of Skilled Health-IT Workforce

- 4.3.3 Capital-Budget Constaint in Small and Medium sized Healthcare facilities

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Application

- 5.1.1 Electronic Health Records (EHR)

- 5.1.2 Picture Archiving & Communication Systems (PACS)

- 5.1.3 Medical Imaging Information Systems (RIS)

- 5.1.4 Laboratory Information Systems (LIS)

- 5.1.5 Computerized Physician Order Entry (CPOE)

- 5.1.6 Clinical Decision Support Systems (CDSS)

- 5.1.7 Telehealth Solutions

- 5.1.8 Remote Patient Monitoring

- 5.1.9 Revenue Cycle Management (RCM)

- 5.1.10 Pharmacy Information Systems (PIS)

- 5.1.11 Clinical Information systems

- 5.1.12 Digital Healthcare Supply chain management systems

- 5.1.13 Customer Relationship Management (CRM)

- 5.1.14 Healthcare Payer Solutions

- 5.1.15 Fraud Detection & Payment Integrity

- 5.1.16 Others

- 5.2 By Component

- 5.2.1 Software

- 5.2.2 Hardware

- 5.2.3 Services

- 5.3 By Delivery Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud-Based

- 5.4 By End-User

- 5.4.1 Hospitals & Health Systems

- 5.4.2 Diagnostic & Imaging Centers

- 5.4.3 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Epic Systems Corp.

- 6.3.2 Oracle Health (Cerner)

- 6.3.3 McKesson Corp.

- 6.3.4 Philips Healthcare

- 6.3.5 GE HealthCare

- 6.3.6 Siemens Healthineers

- 6.3.7 Allscripts (Altera Digital Health)

- 6.3.8 athenahealth

- 6.3.9 IBM Watson Health

- 6.3.10 Optum Inc.

- 6.3.11 Teladoc Health

- 6.3.12 Amwell

- 6.3.13 InterSystems Corp.

- 6.3.14 MEDITECH

- 6.3.15 Change Healthcare

- 6.3.16 R1 RCM Inc.

- 6.3.17 Accenture Health

- 6.3.18 Cognizant Digital Health

- 6.3.19 Tata Consultancy Services (TCS)

- 6.3.20 Wipro HealthEdge

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment