PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850160

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850160

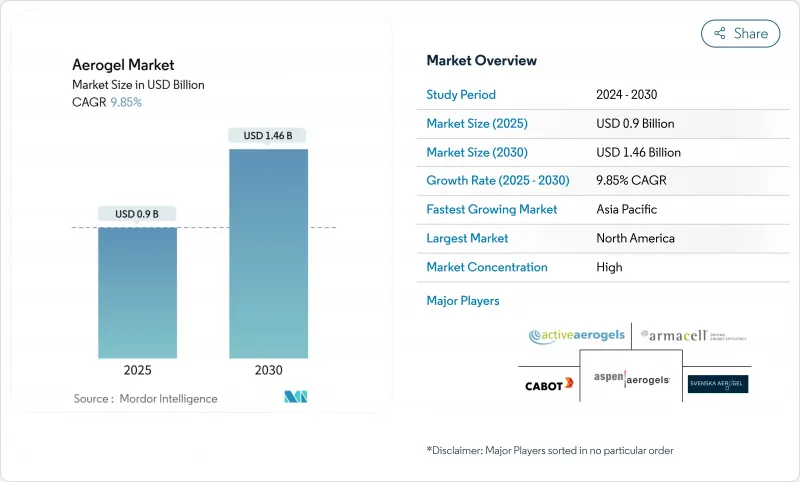

Aerogel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aerogel market is valued at USD 0.90 billion in 2025 and is projected to grow to USD 1.46 billion by 2030, advancing at a 9.85% CAGR in the 2025-2030 period.

Sustained demand for high-performance thermal insulation, coupled with accelerating electrification and carbon-reduction mandates, is placing the aerogel market on a strong growth trajectory. North America leads today with a 40% share, supported by strict energy-efficiency codes and an active oil-and-gas retrofit cycle. High market consolidation prevails; Aspen Aerogels and Cabot Corporation anchor global revenue, yet a host of regional specialists compete aggressively in formulation niches.

Global Aerogel Market Trends and Insights

Rise in Adoption of Aerogel Due to Reusability and Recyclability

Manufacturers are prioritizing production routes that maximize re-use potential and minimize waste generation. New silica aerogels now preserve 95% porosity at a low 75 kg/m3 density, allowing multiple service cycles without thermal loss. ENERSENS scaled a computer-controlled evaporation microwave process that lifts output 60% while enabling material recovery, lowering total cost of ownership for end users. Life-cycle analysis confirms industrial-scale aerogel synthesis slashes environmental burdens versus conventional insulants, making the material attractive in net-zero pathways. As brands quantify CO2 savings for green-building labels, reusable aerogel insulation is gaining specification priority, particularly in facade retrofits seeking long service life.

Rapidly Growing Construction Demand for High-performance Insulation

Building codes tightened under the 2021 International Energy Conservation Code and similar EU standards mandate lower envelope U-values. Aerogel panels deliver R-values 2-4 times times higher than mineral wool while occupying thinner cavities, critical for urban refurbishments where space is limited. Record heatwaves in 2024 accelerated interest in aerogel-filled glazing systems that limit solar gain without sacrificing daylight. Novel wildfire-resistant "morphing" aerogels now protect structures in fire-prone regions, highlighting broader resilience benefits beyond energy savings.

High Production Cost

Super-critical drying remains the dominant manufacturing route and demands specialized vessels operating at high pressure and temperature. Capital intensity keeps unit prices above mainstream insulation, discouraging uptake in cost-sensitive residential segments. Research into ambient pressure drying shows promise, but it is not yet commercial at scale. Short-term mitigation focuses on throughput gains and solvent recovery to lower variable costs. Until those techniques mature, premium positioning will constrain aerogel penetration to projects with stringent performance needs or carbon-reduction incentives that justify a higher upfront outlay.

Other drivers and restraints analyzed in the detailed report include:

- Energy-Efficiency Regulations Boosting EU and North American Demand

- Expansion of LNG Infrastructure Across Asia

- Limited Availability of Raw Materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Silica grades commanded a 72% share of the aerogel market in 2024 and are expected to widen their lead by posting a robust 10.11% CAGR through 2030, a rare scenario where the largest slice also grows fastest. This leadership stems from broad applicability in oil-and-gas pipelines, facade insulation, and EV battery modules. Significant research and development produced silica/polyimide "pomegranate" composites that yield 12-fold higher compressive strength without sacrificing thermal values, removing a historic barrier to mechanical handling.

Second-generation silica systems are also targeting moisture resistance and easier finishing. Tailored hydrophobic coatings now sustain contact angles above 120°, allowing exterior facade usage in humid climates. Meanwhile, formulators are exploring low-alkoxide sol-gel routes that cut solvent consumption, reducing cost and CO2 footprint. Given this multi-pronged innovation, silica's hold on the aerogel market appears secure, and its technological progress will likely dictate overall performance benchmarks the sector must meet.

Blankets secured 64% of the aerogel market revenue in 2024, owing to installation ease and compatibility with pipe-insulation jacketing used in energy infrastructure. Recent iterations achieve thermal conductivity as low as 0.0143 W/mK and reach thermal equilibrium in 10 minutes, shortening construction schedules.

Particle form is the breakout category, forecast to log a 10.34% CAGR through 2030 as formulators incorporate aerogel powders into coatings, lithium-ion separators, and polymer composites. ENTERA particles from Cabot serve as drop-in thermal modifiers in EV battery cathodes, mitigating runaway events without thick barriers.

The Aerogel Market Report Segments the Industry by Type (Silica, Carbon, Alumina, and Other Types), Form (Blanket, Particle, Block, and Panel), Application (Thermal Insulation, Acoustic Insulation, Catalyst and Adsorbent, and More), End-User Industry (Oil and Gas, Construction, Automotive, Marine, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the aerogel market with a 40% revenue share in 2024. Federal and state efficiency mandates, alongside robust oil-and-gas capital expenditure, underpin solid demand. Cabot Corporation's USD 50 million Department of Energy award to localize battery-grade conductive additives affirms policy-driven investment in thermal-management materials with direct aerogel synergies. National Science Foundation grants are also seeding next-generation building insulation research, keeping North America at the forefront of performance breakthroughs.

Asia-Pacific is projected to register a 10.25% CAGR to 2030, making it the fastest-growing region. Rapid LNG infrastructure deployment, booming residential construction, and accelerating EV production converge to raise regional consumption sharply. Chinese institutes have introduced carbon-aerogel composites that withstand extreme temperatures while bearing structural loads, supporting domestic high-temperature industries.

Europe remains strong in regulatory leadership, leveraging EPBD revisions to encourage deep-energy retrofits that favor thin, high-R material systems. Pilot programs in social housing blocks showcase facade aerogel panels achieving 40% space-heating cuts while preserving exterior aesthetics. The Middle East and Africa continue to adopt aerogel in refining and petrochemical upgrades, while South America's growth is tied to LNG imports and rising green-building certification momentum.

- Acoustiblok, Inc.

- Active Aerogels

- Aerogel Technologies, LLC

- aerogel-it

- Armacell

- Aspen Aerogels, Inc.

- BASF

- Blueshift Materials Inc.

- Cabot Corporation

- ENERSENS

- Guangdong Alison Technology Co., Ltd.

- Knauf Insulation

- Nano Tech Co., Ltd.

- Ningbo Surnano Aerogel Co., Ltd

- Porex

- Sino Aerogel

- Svenska Aerogel AB

- TAASI Corporation

- Thermablok Aerogels Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Adoption of Aerogel Due to Reusability and Recyclability

- 4.2.2 Rapidly Growing Construction Demand for High-performance Insulation

- 4.2.3 Energy-Efficiency Regulations Boosting EU and North-American Demand

- 4.2.4 Expansion of LNG Infrastructure Across Asia

- 4.2.5 Oil and Gas Industry Dominating the Aerogel Demand

- 4.3 Market Restraints

- 4.3.1 High Production Cost

- 4.3.2 Limited Availability of Raw Materials

- 4.3.3 Competition from High-performance Polymer Foams in Buildings

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Silica

- 5.1.2 Carbon

- 5.1.3 Alumina

- 5.1.4 Other Types

- 5.2 By Form

- 5.2.1 Blanket

- 5.2.2 Particle

- 5.2.3 Block

- 5.2.4 Panel

- 5.3 By Application

- 5.3.1 Thermal Insulation

- 5.3.2 Acoustic Insulation

- 5.3.3 Catalyst and Adsorbent

- 5.3.4 Battery and Energy Storage

- 5.3.5 Day-lighting and Translucent Panels

- 5.3.6 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Oil and Gas

- 5.4.2 Construction

- 5.4.3 Automotive

- 5.4.4 Marine

- 5.4.5 Aerospace

- 5.4.6 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Acoustiblok, Inc.

- 6.4.2 Active Aerogels

- 6.4.3 Aerogel Technologies, LLC

- 6.4.4 aerogel-it

- 6.4.5 Armacell

- 6.4.6 Aspen Aerogels, Inc.

- 6.4.7 BASF

- 6.4.8 Blueshift Materials Inc.

- 6.4.9 Cabot Corporation

- 6.4.10 ENERSENS

- 6.4.11 Guangdong Alison Technology Co., Ltd.

- 6.4.12 Knauf Insulation

- 6.4.13 Nano Tech Co., Ltd.

- 6.4.14 Ningbo Surnano Aerogel Co., Ltd

- 6.4.15 Porex

- 6.4.16 Sino Aerogel

- 6.4.17 Svenska Aerogel AB

- 6.4.18 TAASI Corporation

- 6.4.19 Thermablok Aerogels Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment