PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850161

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850161

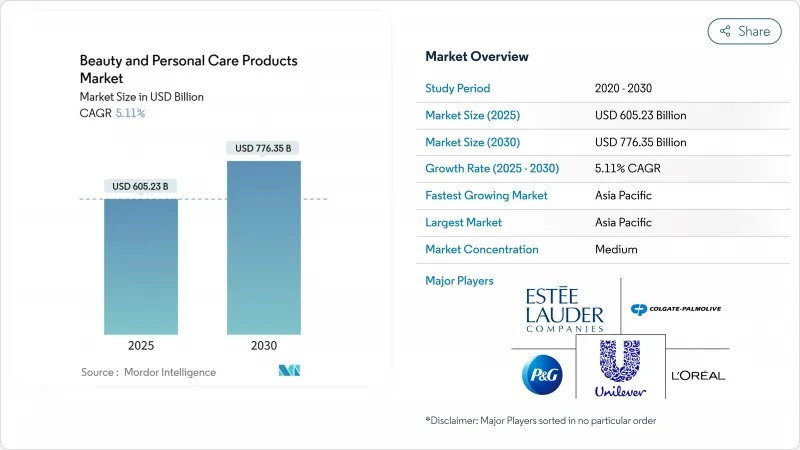

Beauty And Personal Care Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The beauty and personal care market size is estimated to be USD 605.23 billion in 2025 to USD 776.35 billion by 2030, at a CAGR of 5.11%.

This growth is driven by shifting consumer preferences, particularly among Generation Z consumers who prioritize product efficacy and sustainability over brand loyalty. The increasing awareness of chemical-based products' side effects, such as skin irritation and allergies, has heightened demand for natural and organic skincare products. Market players are responding to these trends by expanding their product portfolios through strategic launches and incorporating technological innovations, such as AI-powered virtual makeup try-ons, to enhance the digital shopping experience. The industry's resilience is further demonstrated by its ability to adapt to economic uncertainties while maintaining steady growth. Additionally, the market continues to benefit from economies of scale, allowing companies to invest in research and development while maintaining competitive pricing strategies. As the beauty and personal care industry continues to evolve, companies that successfully balance innovation, sustainability, and consumer demands will likely emerge as market leaders in the coming years.

Global Beauty And Personal Care Products Market Trends and Insights

Consumer Preference for Natural and Organic Beauty and Personal Care Products

Growing concerns about the adverse effects of chemical ingredients in beauty and personal care products, including skin irritation, allergies, and hormonal imbalances, have led to increased demand for natural and organic skincare alternatives. Unlike synthetic cosmetics, organic products derived from plant extracts and natural oils offer gentle skincare and beauty solutions while providing additional benefits such as hydration and nourishment. Consumer awareness about ingredient transparency has become a significant factor in purchasing decisions, with buyers actively seeking products that list recognizable, plant-based components. In response to this market shift, manufacturers have expanded their product portfolios to include items labeled as organic, vegan, natural, chemical-free, and cruelty-free, addressing both health concerns and ethical considerations in the skincare industry. According to NSF, a leading global public health and safety organization, a study published in March 2025, 74% of consumers consider organic ingredients important in personal care products, indicating a clear shift toward clean beauty products . However, the prevalence of greenwashing and lack of consumer trust in voluntary organic labels emphasize the importance of third-party testing and certification.

Influence of Social Media and Impact of Digital Technology on the Market

The emergence of evolving technologies, including smartphones, personal computers, the internet, e-commerce, social media, communication strategies, and marketing campaigns, has transformed the global beauty and personal care products market landscape. Social media platforms have become essential for brands to showcase their products, reach potential customers, and generate market interest. Leading companies like L'Oreal, Unilever, and Estee Lauder utilize Facebook, Instagram, and YouTube to promote product launches, engage consumers through tutorials, and execute promotional campaigns. The market players implement influencer marketing strategies on social media platforms to influence customers and shift brand conversations to the digital space. Moreover, a 2024 University of Portsmouth survey indicated that 60% of consumers trusted influencer recommendations, while nearly half of all purchasing decisions were influenced by these endorsements . Influencer content on these platforms increased brand visibility and consumer engagement, particularly among younger demographics who were frequent social media users.

Availability of Counterfeit Products Impacts Market Development

Counterfeit goods pose a significant threat to the beauty and personal care sector, with digital channels emerging as the primary platform for their distribution. These fake products predominantly appear in small beauty supply outlets and e-commerce platforms, where oversight is typically less stringent than in larger retail chains. The prevalence of discounted options online makes it challenging for consumers to differentiate between authentic and counterfeit products, potentially leading to dissatisfaction and damaged brand reputation for legitimate companies. The scale of this issue is evident in recent enforcement actions - in July 2023, the US Customs and Border Protection (CBP) seized pharmaceutical and personal care products worth USD 102.30 million in intellectual property rights violations. This unchecked distribution of counterfeits not only undermines consumer trust but also disrupts market dynamics, creating an uneven playing field for legitimate brands. Addressing this challenge requires coordinated efforts between regulatory bodies, e-commerce platforms, and legitimate manufacturers to protect consumers and maintain market integrity.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Men's Personal Care Products

- Increased Awareness About Oral Hygiene Among Consumers

- High Manufacturing Costs and Raw Material Expenses Limit Market Growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Personal care products dominate the market with an 88.45% share in 2024 and are projected to grow at a 5.88% CAGR through 2030. This growth is driven by several key segments, including oral care, which is evolving beyond traditional hygiene through the incorporation of advanced ingredients like peptides and hydroxyapatite. Moreover, the cosmetics segment is experiencing a shift as Generation Z demonstrates a clear preference for skincare, with 60% identifying it as their primary beauty purchase. Additionally, men's grooming products are expanding beyond conventional offerings to include skincare and color cosmetics. This diversification of product categories reflects the industry's response to changing consumer demographics and preferences.

The market's evolution is characterized by the increasing integration of wellness concepts into personal care formulations, resulting in hybrid products that transcend traditional category boundaries. This trend is particularly evident in the skincare segment, where consumer focus has shifted toward preventative health measures rather than corrective treatments. This transformation reflects a broader change in consumer behavior, emphasizing holistic health awareness and comprehensive personal care routines. The convergence of beauty and wellness has created new opportunities for product innovation and market expansion.

Mass Products maintains a commanding 72.34% market share in 2024, driven by wide availability across supermarkets, drugstores, convenience stores, and online platforms. This dominance stems from their accessibility, competitive pricing, and consumer acceptance across demographic segments. While mass products lead the market, premium products demonstrate stronger growth potential with a 6.45% CAGR (2025-2030). The market shows resilience during economic uncertainty, with 94% of prestige buyers also purchasing mass products, indicating value-conscious consumer behavior across price segments.

Major companies, including Unilever, Procter & Gamble Co., and private-label brands, are adapting to consumer demand through ethical and eco-friendly product development. The convergence of mass and premium categories has intensified competition while expanding access to high-quality formulations. Mass Products maintains its position through product innovation and competitive pricing, while the premium segment grows through natural/organic skincare launches and beauty influencer marketing. This market dynamic enables broader consumer access to premium-quality formulations while maintaining practical solutions for everyday beauty and personal care needs.

The Beauty and Personal Care Products Market is Segmented by Product Type (Personal Care Products, Cosmetics/Makeup Products), Category (Premium Products and Mass Products), Ingredient Type (Natural/Organic, and Conventional/Synthetic), Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Online Retail Channels and Other Channels), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- L'Oreal SA

- Unilever PLC

- Procter & Gamble Company

- Beiersdorf AG

- Colgate-Palmolive Company

- The Estee Lauder Companies Inc.

- Shiseido Company, Ltd.

- ITC Limited

- Kenvue Inc.

- Kao Corporation

- Henkel AG & Co. KGaA

- LVMH Moet Hennessy Louis Vuitton SE

- AmorePacific Corporation

- Natura & Co Holding SA

- Revlon Inc.

- Coty Inc.

- Edgewell Personal Care Company

- Mary Kay Inc.

- L'Occitane International SA

- Godrej Consumer Products Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Consumer Preference for Natural and Organic Beauty and Personal Care Products

- 4.2.2 Growing Demand for Anti-Aging and Age Management Products

- 4.2.3 Influence of Social Media and Impact of Digital Technology on the Market

- 4.2.4 Rising Demand for Men's Personal Care Products

- 4.2.5 Digital Transformation and Virtual Try-on

- 4.2.6 Increased Awareness About Oral Hygiene Among Consumers

- 4.3 Market Restraints

- 4.3.1 Availability of Counterfeit Products Impacts Market Development

- 4.3.2 Growing Concerns Over Product Safety and Ingredients

- 4.3.3 Intense Market Competition Leading to Price Pressure and Reduced Profit Margins

- 4.3.4 High Manufacturing Costs and Raw Material Expenses Limit Market Growth

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Personal Care Products

- 5.1.1.1 Hair Care

- 5.1.1.1.1 Shampoo

- 5.1.1.1.2 Conditioner

- 5.1.1.1.3 Hair Colorant

- 5.1.1.1.4 Hair Styling Products

- 5.1.1.1.5 Others

- 5.1.1.2 Skin Care

- 5.1.1.2.1 Facial Care Products

- 5.1.1.2.2 Body Care Products

- 5.1.1.2.3 Lip and Nail Care Products

- 5.1.1.3 Bath and Shower

- 5.1.1.3.1 Shower Gels

- 5.1.1.3.2 Soaps

- 5.1.1.3.3 Others

- 5.1.1.4 Oral Care

- 5.1.1.4.1 Toothbrush

- 5.1.1.4.2 Toothpaste

- 5.1.1.4.3 Mouthwashes and Rinses

- 5.1.1.4.4 Others

- 5.1.1.5 Men's Grooming Products

- 5.1.1.6 Deodorants and Antiperspirants

- 5.1.1.7 Perfumes and Fragrances

- 5.1.2 Cosmetics/Makeup Products

- 5.1.2.1 Facial Cosmetics

- 5.1.2.2 Eye Cosmetics

- 5.1.2.3 Lip and Nail Makeup Products

- 5.1.1 Personal Care Products

- 5.2 By Category

- 5.2.1 Premium Products

- 5.2.2 Mass Products

- 5.3 By Ingredient Type

- 5.3.1 Natural and Organic

- 5.3.2 Conventional/Synthetic

- 5.4 By Distribution Channel

- 5.4.1 Specialty Stores

- 5.4.2 Supermarkets/Hypermarkets

- 5.4.3 Online Retail Stores

- 5.4.4 Other Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Columbia

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Saudi Arabia

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 L'Oreal SA

- 6.4.2 Unilever PLC

- 6.4.3 Procter & Gamble Company

- 6.4.4 Beiersdorf AG

- 6.4.5 Colgate-Palmolive Company

- 6.4.6 The Estee Lauder Companies Inc.

- 6.4.7 Shiseido Company, Ltd.

- 6.4.8 ITC Limited

- 6.4.9 Kenvue Inc.

- 6.4.10 Kao Corporation

- 6.4.11 Henkel AG & Co. KGaA

- 6.4.12 LVMH Moet Hennessy Louis Vuitton SE

- 6.4.13 AmorePacific Corporation

- 6.4.14 Natura & Co Holding SA

- 6.4.15 Revlon Inc.

- 6.4.16 Coty Inc.

- 6.4.17 Edgewell Personal Care Company

- 6.4.18 Mary Kay Inc.

- 6.4.19 L'Occitane International SA

- 6.4.20 Godrej Consumer Products Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK