PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850162

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850162

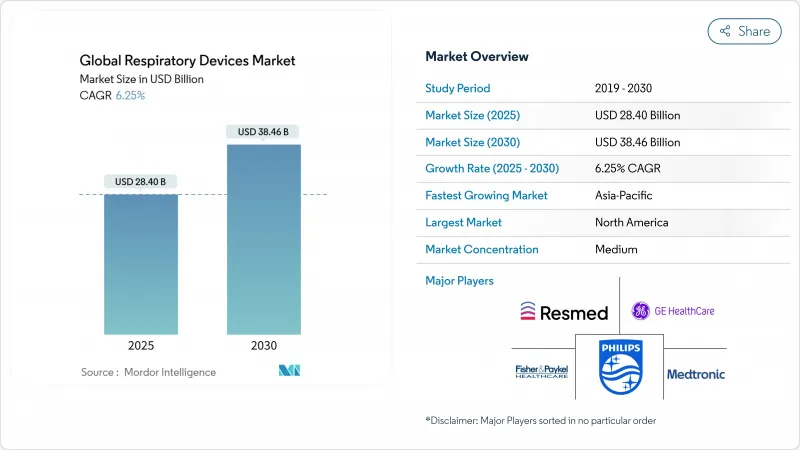

Respiratory Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global respiratory devices market size is estimated at USD 28.40 billion in 2025, and is expected to reach USD 38.46 billion by 2030, at a CAGR of 6.25% during the forecast period (2025-2030).

Accelerating diagnoses of asthma and COPD, rapid uptake of portable oxygen solutions and continuous-positive-airway-pressure (CPAP) systems, and widening health-insurance coverage are reinforcing demand. Momentum is further amplified by artificial-intelligence algorithms that personalize airflow settings, stronger policy attention to clean air, and multi-vendor collaborations that integrate sensors, software, and consumables into unified therapy ecosystems. Competitive focus has shifted from product breadth to data-enabled adherence platforms, while emerging-market tender activity is unlocking price-sensitive volumes for low-maintenance concentrators and hybrid ventilator-concentrator units. As a result, the respiratory devices market is evolving around home-health use cases that complement hospital capacity rather than replace it.

Global Respiratory Devices Market Trends and Insights

Surge in Prevalence of Respiratory Disorders

Continuing growth in COPD and asthma cases is underpinning sustained equipment demand. The American Lung Association reported that 44.2 million U.S. residents had asthma diagnoses in 2023, with adults aged 18-55 recording the highest lifetime incidence at 16.8%. Females faced higher asthma prevalence than males, widening the addressable user base for inhalers, spirometers, and smart peak-flow meters. Meanwhile, World Health Organization data frames COPD as a silent killer concentrated in low- and middle-income economies. This pattern spurs donor-funded purchases of affordable concentrators and mobile diagnostic vans.

Technological Advancements

Manufacturers now embed adaptive pressure algorithms into CPAP units, cutting mask-leak discomfort and elevating therapy adherence. NovaResp clinched USD 3 million to refine such AI engines in 2024. University of Cincinnati engineers introduced VortexPAP, which uses vortex airflow to supply the required airway pressure without a tight facial seal, promising greater patient convenience. Lightweight humidifiers, cloud-linked oximeters, and Bluetooth-enabled nebulizers illustrate a pipeline oriented toward seamless data capture and clinician dashboards.

High Cost of Devices

Premium ventilators, CPAP platforms, and lab-grade diagnostic gear carry five-figure price tags and recurring service contracts, limiting penetration in resource-constrained settings. The World Health Organization underscores that more than 90% of COPD fatalities occur in low-income regions lacking sufficient device access, magnifying the affordability gap. Researchers have responded with modular systems combining oxygen generation and ventilation at lower cost, exemplified by a cross-over trial validating such a portable solution for acute-lung-injury care in 2025.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Penetration of Respiratory Devices in Home-Healthcare

- Rising Adoption of Non-Invasive Ventilation (NIV)

- Stringent Regulatory Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutic platforms held 45.33% of 2024 sales, reflecting entrenched use of ventilators, CPAPs, and oxygen concentrators for acute and chronic care. The respiratory devices market size for therapeutic systems is forecast to advance at a mid-single-digit rate, supported by rising elective-surgery volumes and chronic-disease surveillance programs. Intensive-care wards increasingly prefer turbine-based ventilators that reduce compressed-air requirements, curbing utility costs and broadening deployment in field hospitals. Parallel progress in humidifier miniaturization and closed-loop oxygen control enhances patient comfort, reinforcing demand.

Diagnostic and monitoring equipment, including spirometers, capnographs, and wireless pulse oximeters, is the fastest-growing branch, charting an 8.53% CAGR through 2030. Population-screening campaigns for occupational lung disease and at-home sleep-test kits are key catalysts. Artificial-intelligence analysis of flow-volume loops now flags early obstruction with greater specificity, encouraging pre-symptomatic intervention. As these tools converge with telemedicine portals, payers recognize their preventive value, boosting reimbursement adoption and widening the respiratory devices market.

COPD accounted for 42.25% of revenue in 2024, reflecting its chronicity and frequent exacerbations that necessitate nebulizers, long-term oxygen therapy, and NIV. An aging smoker population and prolonged exposure to biomass smoke in emerging markets sustain device demand. Programs integrating spirometry into primary care are widening diagnostic catchment, and digital inhalers that confirm dose delivery are resetting adherence metrics.

Sleep-apnea therapies are projected to record the strongest momentum, with an 8.93% CAGR over 2025-2030. Rising obesity prevalence, heightened cardiovascular-risk recognition, and extensive marketing of home sleep-apnea tests underpin growth. The FDA-cleared NightOwl HSAT, introduced in April 2025, underscores a self-administered diagnostic shift. CPAP designs now incorporate fabric masks and quiet turbine housings to elevate patient comfort, a critical variable in long-term adherence, thereby expanding the respiratory devices market.

The Respiratory Devices Market Report is Segmented by Device Type (Diagnostic and Monitoring Devices, Therapeutic Devices, and Consumables and Disposables), Indication (COPD, Asthma, and More), Patient Age Group (Adult and Pediatric/Neonatal), End User (Hospitals, Respiratory and Sleep Clinics and More), and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America contributed 39.35% of 2024 revenue, anchored by high device penetration, structured reimbursement, and robust research funding. The National Institutes of Health earmarked USD 148 million for COPD research in 2024 and USD 149 million for 2025, supporting translational programs that spawn next-generation ventilator algorithms. Market dynamics are also influenced by recall cycles, such as Philips' 2023-2024 CPAP foam-degradation event, which spurred replacement demand and intensified regulatory scrutiny. Evolving FDA expectations regarding cybersecurity and software updates further shape supplier strategies within the respiratory devices market.

Asia-Pacific is projected to log an 8.47% CAGR through 2030. Rapid urbanization, growing middle-class incomes, and policy measures that subsidize oxygenic devices elevate demand. WHO data indicate that over 90% of global COPD deaths occur in low- and middle-income economies, many situated in this region. Undiagnosed COPD remains widespread, exemplified by Japan's 8.4% diagnostic rate despite regular pulmonary tests. This diagnostic gap, once addressed through awareness campaigns and affordable spirometry drives, can unlock substantial volumes for the respiratory devices market.

Europe sustains a sizeable share through strong public-health infrastructure and stringent clinical protocols. The United Kingdom reported 2.4 million asthma patients in fiscal year 2023-2024, reinforcing recurring demand for inhalers, spacers, and emergency nebulizers. Budget pressures are prompting procurement frameworks that balance upfront cost with life-cycle value, favoring devices offering predictive-maintenance analytics. Growing focus on eco-design, such as reusable water chambers and recyclable mask components, is gradually shaping product-development pipelines.

- Koninklijke Philips

- Resmed

- Fisher & Paykel Healthcare

- Medtronic

- GE Healthcare

- Dragerwerk AG

- Getinge

- Baxter

- Vyaire Medical

- Hamilton Medical

- Beijing Aeonmed Co. Ltd.

- Mindray

- React Health

- Medical Depot, Inc.

- Asahi Kasei

- AirLife

- Flexicare (Group) Limited (Allied Medical LLC)

- Teleflex

- OMRON Healthcare, Inc

- ICU Medical

- Medikro Oy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Prevalence of Respiratory Disorders

- 4.2.2 Technological Advancements

- 4.2.3 Rapid Penetration of Respiratory Devices in Home-Healthcare

- 4.2.4 Rising Adoption of Non-Invasive Ventilation (NIV)

- 4.2.5 Government Initiatives & Reimbursement Expansion

- 4.2.6 Inegration of Digital Health Technologies

- 4.3 Market Restraints

- 4.3.1 High Cost of Devices

- 4.3.2 Stringent Regulatory Requirements

- 4.3.3 Shortage of Skilled Healthcare Professionals

- 4.3.4 Supply Chain Disruptions

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value/Volume)

- 5.1 By Device Type

- 5.1.1 Diagnostic and Monitoring Devices

- 5.1.1.1 Spirometers

- 5.1.1.2 Sleep Test Devices

- 5.1.1.3 Peak Flow Meters

- 5.1.1.4 Pulse Oximeters

- 5.1.1.5 Capnographs

- 5.1.1.6 Other Diagnostic and Monitoring Devices

- 5.1.2 Therapeutic Devices

- 5.1.2.1 CPAP Devices

- 5.1.2.2 BiPAP Devices

- 5.1.2.3 Humidifiers

- 5.1.2.4 Nebulizers

- 5.1.2.5 Oxygen Concentrators

- 5.1.2.6 Ventilators

- 5.1.2.7 Inhalers

- 5.1.2.8 Other Therapeutic Devices

- 5.1.3 Consumables and Disposables

- 5.1.3.1 Masks (Nasal, Full-Face, Pediatric)

- 5.1.3.2 Breathing Circuits and Tubing

- 5.1.3.3 Filters, Valves and Other Disposables

- 5.1.1 Diagnostic and Monitoring Devices

- 5.2 By Indication

- 5.2.1 COPD

- 5.2.2 Asthma

- 5.2.3 Sleep Apnea

- 5.2.4 Infectious Diseases

- 5.2.5 Other Respiratory Disorders

- 5.3 By Patient Age Group

- 5.3.1 Adult

- 5.3.2 Pediatric / Neonatal

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Respiratory and Sleep Clinics

- 5.4.3 Other End Users (Ambulatory Surgical and Emergency Centers, Home Settings)

- 5.5 Geographic Segmentation

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Koninklijke Philips N.V.

- 6.3.2 ResMed

- 6.3.3 Fisher & Paykel Healthcare Limited.

- 6.3.4 Medtronic plc

- 6.3.5 GE HealthCare

- 6.3.6 Dragerwerk AG

- 6.3.7 Getinge

- 6.3.8 Baxter

- 6.3.9 VYAIRE

- 6.3.10 Hamilton Medical

- 6.3.11 Beijing Aeonmed Co. Ltd.

- 6.3.12 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.13 React Health

- 6.3.14 Medical Depot, Inc.

- 6.3.15 Asahi Kasei Corporation (ZOLL Medical Corporation)

- 6.3.16 AirLife

- 6.3.17 Flexicare (Group) Limited (Allied Medical LLC)

- 6.3.18 Teleflex Incorporated

- 6.3.19 OMRON Healthcare, Inc

- 6.3.20 ICU Medical, Inc.

- 6.3.21 Medikro Oy

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment