PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850165

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850165

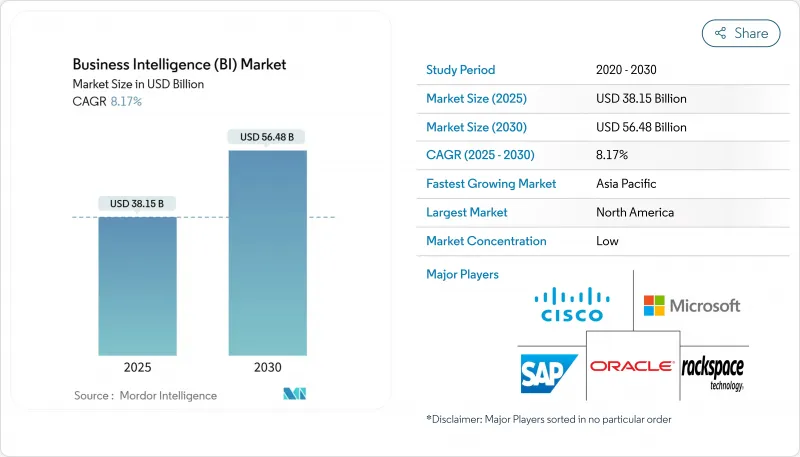

Business Intelligence (BI) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The business intelligence market stands at USD 38.15 billion in 2025 and will reach USD 56.28 billion by 2030 on an 8.17% CAGR.

Cloud-native architectures, AI-enhanced analytics, and growing data-driven cultures keep demand high across enterprises of all sizes. Real-time ingestion of semi-structured data, GPU-accelerated query execution, and rising adoption of embedded analytics move the conversation beyond historical dashboards toward predictive and prescriptive models. Subscription pricing and managed services lower entry barriers, while multi-cloud strategies mitigate vendor lock-in and support compliance in regulated sectors. Intensifying competition comes from hyperscalers that bundle analytics with infrastructure and from AI-native start-ups focused on no-code automation. Skills shortages, cross-border data-sovereignty rules, and cloud egress fees remain the main speed bumps for the business intelligence market.

Global Business Intelligence (BI) Market Trends and Insights

Cloud-first analytics adoption

Enterprises move BI workloads to cloud platforms that deliver elastic compute and native AI services, replacing on-premises stacks that struggle with real-time model execution. Oracle's cloud revenue reached USD 6.2 billion in Q3 2025 with a 25% gain, and management linked the surge to AI projects that demand scalable GPU instances. Multicloud architectures become popular for best-of-breed analytics but raise issues around data movement costs and governance consistency. Regulated industries now treat cloud compliance automation as a competitive advantage rather than a risk, accelerating migration projects across healthcare and financial services. Vendors respond with regionally partitioned data controls, enabling compliant analytics while preserving performance.

Explosion of semi-structured IoT data

Factories, logistics hubs, and smart-city programs deploy billions of sensors that generate nested JSON and time-series streams. Classical relational warehouses cannot parse the scale or format, prompting uptake of streaming platforms that analyse data in motion. Edge appliances handle first-pass analytics to cut latency, then push summarized data to cloud AI models for fleet-wide insights. Nutanix found 85% of firms have a generative-AI deployment plan, and more than half are funding infrastructure upgrades to support high-volume analytics. This driver sustains double-digit growth for GPU-accelerated engines and in-memory column stores across the business intelligence market.

Shortage of data-literate workforce

Delivering AI outputs is only half the job; turning them into operational decisions requires staff fluent in statistics and domain context. Healthcare systems report 41% skill gaps for AI projects, and public agencies cite similar shortages. Talent scarcity inflates salaries, extends project timelines, and forces vendors to invest in automated insight generation and natural-language interfaces to bridge capability gaps. The constraint slows rollouts in emerging economies and rural regions, tempering the trajectory of the business intelligence market.

Other drivers and restraints analyzed in the detailed report include:

- Embedded BI in SaaS business apps

- Restraint % Impact on CAGR Forecast Geographic Relevance Impact Timeline

- Up-front integration cost for legacy core systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Growing enterprise demand for AI-fuelled insights keeps software platforms at the forefront, representing 67% revenue in 2024. This dominance ensures the business intelligence market size for platforms will climb alongside an 8% CAGR for services that customize and optimize deployments. Microsoft's Productivity and Business Processes division logged USD 29.4 billion in Q2 2025, with Dynamics 365 up 19% year-on-year, underscoring appetite for integrated business apps with built-in BI.

Platform vendors embed automated data modelling, natural-language search, and proactive notifications to distinguish themselves from visualization-only rivals. Salesforce's Tableau Next introduced AI agents that surface anomalies inside workflows, shrinking time from data to action. Services teams profit from the added complexity, guiding regulated industries through model validation, audit-ready lineage, and domain-specific tuning. As a result, consulting revenues tied to the business intelligence market rise faster than legacy maintenance streams.

Cloud held 66% of revenue in 2024 and is on pace for a 9.5% CAGR through 2030, reflecting its role as the default setting for new analytics. Hybrid adoption endures in defence and public sectors, but even these groups push non-sensitive workloads to regional cloud zones. SAP recorded EUR 4.9 billion (USD 5.3 billion) in cloud sales during Q1 2025, up 27%, showing legacy ERP clients migrating analytics modules first.

Elastic compute, global presence, and packaged AI services make cloud indispensable for real-time dashboards and model training. Edge nodes process local telemetry in manufacturing and retail, then sync summaries to cloud repositories, forming a distributed architecture that enlarges the business intelligence market footprint. On-premises solutions survive mainly where data-residency rules forbid external hosting, though containerized deployments now emulate cloud patterns inside private data centers.

Business Intelligence (BI) Market Segmented by Component (Software and Platform, Services), Deployment (On-Premise and Cloud), Business Model (Subscription / SaaS License, Perpetual License and More), End-User Industry (BFSI, IT and Telecommunication and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.3% revenue in 2024, anchored by a dense ecosystem of hyperscalers and ISVs that iterate quickly and cross-sell analytics into existing software estates. Investments now center on augmenting established deployments with generative AI and conversational BI to deepen usage. Stringent privacy and AI-ethics guidelines influence global product roadmaps, further elevating North America's sway over the business intelligence market.

Asia-Pacific delivers the highest growth at 12.7% CAGR to 2030, a function of leapfrogging legacy constraints and state-backed digital programs. Forty-three percent of APAC firms plan to raise AI spend by more than 20% in the upcoming year. China accelerates around banking modernization and hospital analytics, while India and Southeast Asia benefit from rapidly expanding data-center capacity that reached 12.2 GW operational in 2024.

Europe grows steadily as GDPR and the forthcoming EU AI Act shape procurement. Vendors emphasize privacy-by-design, federated learning, and localized hosting to satisfy 144 national data-privacy laws that mirror GDPR principles. Latin America and Africa emerge as nascent hotspots, propelled by government cloud mandates and improving connectivity, yet limited by talent shortages and patchwork regulations that temper near-term contributions to the business intelligence market.

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- International Business Machines Corp. (IBM)

- SAS Institute Inc.

- Salesforce Inc. (Tableau and Einstein Analytics)

- Amazon Web Services Inc. (QuickSight)

- Google LLC (Looker Studio)

- QlikTech International AB

- MicroStrategy Inc.

- Domo Inc.

- TIBCO Software

- Infor Inc.

- Zoho Corporation (Zoho Analytics)

- Teradata Corp.

- Alteryx Inc.

- Sisense Inc.

- ThoughtSpot Inc.

- Yellowfin International

- GoodData Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Key Performance Indicators (KPIs)

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream Cloud-first analytics adoption

- 4.2.2 Mainstream Explosion of semi-structured IoT data

- 4.2.3 Mainstream Embedded BI in SaaS business apps

- 4.2.4 Under-the-radar Data clean-room partnerships in privacy-first advertising

- 4.2.5 Under-the-radar GPU-accelerated query engines lowering TCO

- 4.2.6 Under-the-radar Rise of Analytics-as-Code and GitOps practices

- 4.3 Market Restraints

- 4.3.1 Mainstream Shortage of data-literate workforce

- 4.3.2 Mainstream Up-front integration cost for legacy core systems

- 4.3.3 Under-the-radar Escalating egress fees in multi-cloud BI architectures

- 4.3.4 Under-the-radar Data-sovereignty clampdowns in emerging digital-trade rules

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software and Platform

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Industry

- 5.3.1 BFSI

- 5.3.2 IT and Telecommunication

- 5.3.3 Retail and e-Commerce

- 5.3.4 Healthcare

- 5.3.5 Manufacturing

- 5.3.6 Government and Public Sector

- 5.4 By Business Model

- 5.4.1 Subscription / SaaS License

- 5.4.2 Perpetual License

- 5.4.3 Freemium / Usage-based

- 5.4.4 Managed Service / BI-as-a-Service

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Microsoft Corporation

- 6.4.2 SAP SE

- 6.4.3 Oracle Corporation

- 6.4.4 International Business Machines Corp. (IBM)

- 6.4.5 SAS Institute Inc.

- 6.4.6 Salesforce Inc. (Tableau and Einstein Analytics)

- 6.4.7 Amazon Web Services Inc. (QuickSight)

- 6.4.8 Google LLC (Looker Studio)

- 6.4.9 QlikTech International AB

- 6.4.10 MicroStrategy Inc.

- 6.4.11 Domo Inc.

- 6.4.12 TIBCO Software

- 6.4.13 Infor Inc.

- 6.4.14 Zoho Corporation (Zoho Analytics)

- 6.4.15 Teradata Corp.

- 6.4.16 Alteryx Inc.

- 6.4.17 Sisense Inc.

- 6.4.18 ThoughtSpot Inc.

- 6.4.19 Yellowfin International

- 6.4.20 GoodData Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Assessment