PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850177

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850177

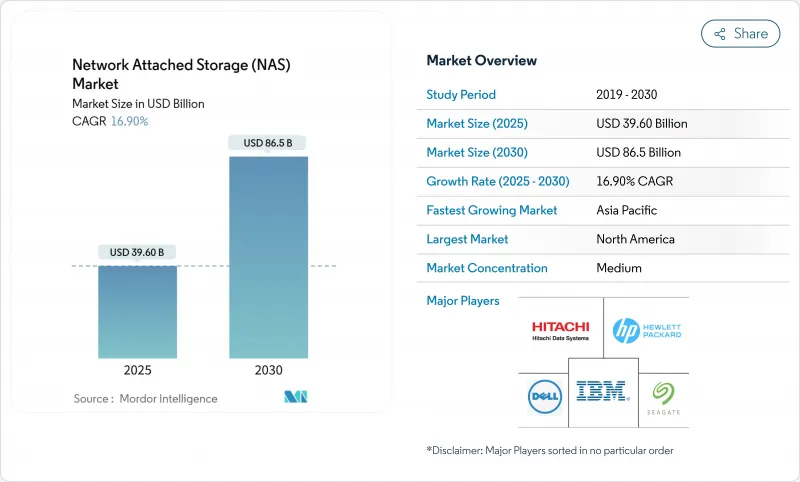

Network Attached Storage (NAS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Network Attached Storage Market size is estimated at USD 39.60 billion in 2025, and is expected to reach USD 86.5 billion by 2030, at a CAGR of 16.90% during the forecast period (2025-2030).

Demand has been buoyed by enterprises racing to contain unstructured-data growth, the push for hybrid work, and the capture of AI/ML workloads that need high-throughput file services. Vendors also benefited from renewed interest in on-premises solutions near 5G edge sites, where latency-sensitive applications run close to users. North America remained the revenue leader as of 2024, yet Asia-Pacific is setting the growth pace on the back of sizeable data-center build-outs and accelerated digital transformation. Competitive dynamics are tilting toward software-defined, AI-optimized, and hybrid-cloud offerings that blend local performance with cloud economics.

Global Network Attached Storage (NAS) Market Trends and Insights

Explosion of Unstructured Data

Annual enterprise data volume expanded at rates that routinely exceeded 20%, forcing IT teams to rethink storage elasticity. Many migrated toward scale-out NAS that scales node-by-node without downtime, while applying automated tiering to balance cost and performance. Healthcare providers typified this shift, archiving ever-larger imaging files while relying on policy-driven placement to curb spending.

Remote and Hybrid-Work Data Surge

Hybrid work turned edge offices and home networks into primary data creators. Enterprises responded by rolling out NAS appliances that expose a global namespace and accelerate traffic with WAN caching. Many teams placed cold data in cloud tiers while keeping active project files on-prem devices that synchronize automatically, reducing branch infrastructure cost without impacting user experience.

Cloud-Storage Substitution

Consumption-based cloud storage kept eroding demand for purely on-prem NAS, attracting organizations that preferred opex models and elastic scaling. Vendors mitigated the risk by embedding cloud tiering, snapshot replication to object buckets, and subscription pricing that blurs traditional capex boundaries, preserving appliance relevance while acknowledging the cloud's pull.

Other drivers and restraints analyzed in the detailed report include:

- Data-Center Virtualization and SD-NAS

- 5G Edge Build-Out Boosts On-Prem NAS

- Performance Bottlenecks at Petabyte Scale

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Scale-out arrays held 52% of the network-attached storage market share in 2024. The architecture allowed administrators to add performance and capacity linearly, removing forklift upgrades and supporting data sets that were doubling in months. As a result, the segment is forecast to log an 18% CAGR from 2025-2030. In contrast, scale-up appliances stayed popular with smaller teams that favored simplicity over elastic scaling. IBM SONAS demonstrated scale-out efficiency by managing billions of files under a single namespace while driving ownership costs down by up to 40% through automated tiering.

Scale-up products continued to ship into departmental and SMB settings, helped by lower initial list prices and straightforward administration. Yet once workloads required high concurrent throughput, typical in media post-production or genomic analysis enterprises, gravitated to clustered designs. Over the forecast period, incremental hardware advances such as NVMe-oF and 400 GbE networking are expected to add momentum to the scale-out segment, reinforcing its position at the heart of the broader network-attached storage market.

On-premise configurations still commanded 52% of 2024 revenue, yet enterprises increasingly blended local arrays with on-demand cloud capacity. The hybrid tier is projected to notch a 21.1% CAGR, the fastest within the network-attached storage market. Organizations retained compliance-sensitive datasets onsite while redirecting inactive files to cloud buckets, a model supported by Dell's unstructured-data services that move snapshots seamlessly between environments.

Pure-cloud NAS grew too, propelled by corporate mandates to shrink data-center footprints and adopt cloud-first strategies. Vendors accordingly prioritized single dashboards for policy management across endpoints, default encryption at rest, and API hooks for DevOps automation. Over time, multi-cloud file services that span regions and providers are expected to flatten cost differentials and strengthen the overall pull toward hybrid architectures, cementing their role in the network-attached storage market size dialogue.

Network Attached Storage (NAS) Market Report is Segmented by Type (Scale-Up, Scale-Out), End-User Industry (BFSI, IT and Telecom, and More), Deployment (On-Premise, Cloud, and Hybrid), Product Tier (High-end/Enterprise, Mid-Market, Low-end/SOHO), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 39% of 2024 revenue owing to deep cloud connectivity, a concentration of hyperscale buyers, and a mature channel ecosystem. United States enterprises continued to refresh file platforms to support AI inference as well as to satisfy rising cyber-insurance requirements. Canada and Mexico made progress in finance, government, and manufacturing upgrades, reinforcing the region's heavyweight status within the network attached storage market.

Asia-Pacific registered the quickest trajectory, clocking an expected 18% CAGR for 2025-2030. China's stimulus for digital infrastructure, India's 5G rollout, and Japan's investment in edge manufacturing robotics amplified capacity deployments. Local ODMs offered price-competitive all-flash gear, giving domestic firms alternatives to foreign incumbents. The combination of rising digital maturity and ambitious data-center construction positions Asia-Pacific to lift its slice of future network attached storage market share.

Europe remained significant, helped by GDPR-driven compliance spending and edge computing in automotive and pharmaceutical corridors. The Middle East and Africa saw early adoption in smart-city and oil-field telemetry projects, while Latin America trended upward more gradually as broadband quality and data-sovereignty frameworks matured. Across all regions, the common denominator was heightened scrutiny of data residency, further validating hybrid and edge-heavy deployment strategies sewn into the network attached storage market.

- Dell Technologies

- NetApp Inc.

- Synology Inc.

- QNAP Systems Inc.

- Hewlett Packard Enterprise

- Western Digital Corp.

- Seagate Technology PLC

- IBM Corporation

- Hitachi Vantara

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- Lenovo Group Ltd.

- Supermicro Computer Inc.

- Buffalo Inc.

- Zyxel Communications Corp.

- Asustor Inc.

- TerraMaster

- Thecus Technology Corp.

- Drobo Inc.

- Promise Technology

- Infortrend Technology Inc.

- Netgear Inc.

- HGST (WD subsidiary)

- TrueNAS (iXsystems)

- Fujitsu Ltd.

- NEC Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of unstructured data

- 4.2.2 Remote and hybrid-work data surge

- 4.2.3 Data-center virtualization and SD-NAS

- 4.2.4 5G edge build-out boosts on-prem NAS

- 4.2.5 AI/ML training workloads need parallel file access

- 4.2.6 Tariff-driven reshoring of NAS production

- 4.3 Market Restraints

- 4.3.1 Cloud-storage substitution

- 4.3.2 Performance bottlenecks at petabyte scale

- 4.3.3 High TCO with explosive data growth

- 4.3.4 Rising cyber-insurance premiums for on-prem file systems

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Scale-up

- 5.1.2 Scale-out

- 5.2 By End-user Industry

- 5.2.1 BFSI

- 5.2.2 IT and Telecom

- 5.2.3 Healthcare

- 5.2.4 Retail and E-commerce

- 5.2.5 Media and Entertainment

- 5.2.6 Government and Public Sector

- 5.2.7 Others (Education, Manufacturing)

- 5.3 By Deployment

- 5.3.1 On-premise

- 5.3.2 Cloud

- 5.3.3 Hybrid

- 5.4 By Product Tier

- 5.4.1 High-end / Enterprise

- 5.4.2 Mid-market

- 5.4.3 Low-end / SOHO

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Dell Technologies

- 6.4.2 NetApp Inc.

- 6.4.3 Synology Inc.

- 6.4.4 QNAP Systems Inc.

- 6.4.5 Hewlett Packard Enterprise

- 6.4.6 Western Digital Corp.

- 6.4.7 Seagate Technology PLC

- 6.4.8 IBM Corporation

- 6.4.9 Hitachi Vantara

- 6.4.10 Cisco Systems Inc.

- 6.4.11 Huawei Technologies Co. Ltd.

- 6.4.12 Lenovo Group Ltd.

- 6.4.13 Supermicro Computer Inc.

- 6.4.14 Buffalo Inc.

- 6.4.15 Zyxel Communications Corp.

- 6.4.16 Asustor Inc.

- 6.4.17 TerraMaster

- 6.4.18 Thecus Technology Corp.

- 6.4.19 Drobo Inc.

- 6.4.20 Promise Technology

- 6.4.21 Infortrend Technology Inc.

- 6.4.22 Netgear Inc.

- 6.4.23 HGST (WD subsidiary)

- 6.4.24 TrueNAS (iXsystems)

- 6.4.25 Fujitsu Ltd.

- 6.4.26 NEC Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment