PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850178

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850178

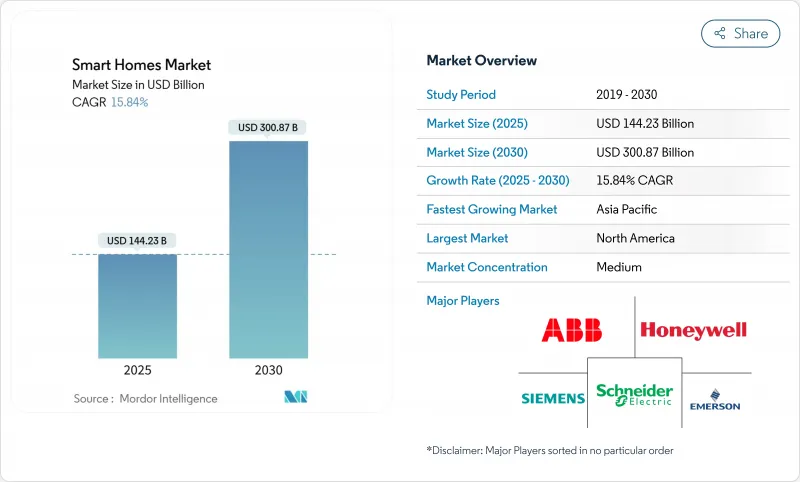

Smart Homes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart homes market size is valued at USD 144.23 billion in 2025 and is projected to reach USD 300.87 billion by 2030, advancing at a 15.8% CAGR.

The up-swing stems from energy-cost inflation, decarbonization policies, and technology convergence that shift connected living from premium novelty to baseline residential infrastructure. Sizeable federal incentives anchor North America's leadership, while Asia-Pacific delivers the fastest expansion on the back of urbanization and smart-city programs. The convergence of 5G, artificial intelligence, and the Matter interoperability protocol is eroding cost and complexity barriers, broadening adoption beyond affluent early users. Device ecosystems remain fragmented, yet platform integration is accelerating as builders include connected infrastructure in new construction and multi-family operators adopt smart solutions to differentiate properties.

Global Smart Homes Market Trends and Insights

Increasing demand for energy-efficient smart appliances

Rising electricity tariffs and climate targets are propelling consumers toward connected devices that optimize consumption and qualify for generous tax credits. Under the Inflation Reduction Act, U.S. households recoup 30% of purchase costs for qualifying heat pumps, water heaters, and energy-savvy controls, sharply lowering payback periods. GE Appliances' EcoBalance platform integrates rooftop solar, storage, and EV chargers, enabling whole-home orchestration that can trim electricity use 20-35% and earn homeowners rebates up to USD 4,000 through federal efficiency programs. Utilities, facing grid volatility, increasingly pay connected-appliance owners for participating in demand-response events, turning kitchens and HVAC systems into distributed energy assets. The resulting revenue stream motivates manufacturers to embed AI that predicts load-shaving opportunities and boosts lifetime appliance value.

Growing broadband and 5G penetration

High-speed connectivity underpins reliable device performance. 5G Fixed Wireless Access already serves more than 4 million U.S. households and delivers fiber-class speeds that sustain real-time security feeds and voice assistants. Edge processing over 5G cuts latency for safety-critical functions and allows inexpensive IoT sensors to proliferate. Rural communities benefit most, bypassing costly last-mile fiber and unlocking the smart homes market for demographics traditionally left behind. As spectrum auctions accelerate in India and Brazil, comparable infrastructure gains are expected to broaden smart-home accessibility across emerging markets.

High upfront installation and retrofit costs

Total-home systems typically range from USD 15,000-40,000, a hurdle for middle-income adopters despite lifetime energy savings. Older dwellings require panel upgrades and rewiring that inflate project budgets. Skilled-labor shortages in electrical and HVAC trades compound costs. Although rebates can offset as much as 80% for low-income households, paperwork complexity and delayed reimbursements limit efficacy. Financing innovations such as on-bill repayment and green mortgages are emerging to soften initial spend and accelerate penetration of the smart homes market.

Other drivers and restraints analyzed in the detailed report include:

- Incentives for residential decarbonization and energy-management

- Aging-in-place and home-health integration surge

- Cyber-security and data-privacy concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Access Control, Safety, and Security retained 22.1% of 2024 revenue, underpinning the smart homes market as homeowners prioritize burglary deterrence and insurance savings. Smart locks now integrate biometric credentials and generate audit trails for delivery personnel. The smart homes market size for healthcare components is forecast to expand fastest, climbing at 16.2% CAGR as chronic-disease management shifts into residences. Voice-controlled hubs double as medication coaches, and connected stethoscopes stream real-time vitals to clinicians. Utilities catalyze Energy-Management systems by offering bill credits for automated demand response, while Smart HVAC gains traction through AI-optimized heat pumps that communicate grid conditions. Controllers and hubs face commoditization as Matter certification allows multi-vendor pairing; differentiation is pivoting toward embedded analytics that predict maintenance and refine comfort algorithms.

Emergent categories include smart kitchens where AI recommends recipes aligned with dietary goals and inventory. GE Appliances' Flavorly service links grocery ordering to appliance settings, illustrating convergence between food retail and residential IoT. Lighting is shifting beyond illumination to circadian-friendly spectrums and energy harvesting switches that operate without batteries, lowering maintenance costs for large residences.

Single-family properties controlled 64.5% revenue in 2024 as individual homeowners freely select device ecosystems and implement whole-home packages. Smart meters, rooftop solar, and battery storage sync with EV chargers to form self-contained energy nodes. Multi-family adoption is closing the gap at a 16.9% CAGR, propelled by asset managers seeking higher occupancy and operating efficiency. Smart locks simplify unit turnover, and energy dashboards expose sub-meter data that improve tenant billing transparency. Rent premiums in tech-equipped apartments range between 5-25%, motivating continued investment. Privacy safeguards, including resident-controlled access logs, are central to tenant acceptance. Central management dashboards give operators visibility across portfolios, enabling predictive maintenance that restrains operational expenditure.

The Smart Homes Market Report is Segmented by Components (Consumer Electronics, Access Control, Safety, and Security, Lighting, Energy Management, Smart HVAC / Climate Control, Controllers / Hubs, Smart-Home Healthcare, and Smart Kitchen), Housing Type (Single-Family and Multi-Family), Installation Type (New Construction and Retrofit), Sales Channel (Online and Offline), and Geography.

Geography Analysis

North America commanded 36.4% of 2024 revenue, buoyed by policy incentives and broad broadband coverage. Up to USD 14,000 per household is now recoverable for energy-efficient retrofits that include connected controls, driving mainstream uptake. Provincial programs in Canada mirror federal support, issuing CAD 10,000 grants and zero-interest loans that prioritize connected heat pumps and monitoring dashboards. Ecosystem alliances, such as Samsung's SmartThings Energy linking electric vehicles to home-grid balancing, showcase regional leadership in whole-ecosystem integration.

Asia-Pacific is the fastest-growing arena at 16.5% CAGR, steered by rapid urbanization and government-sponsored smart-city blueprints. China's domestic brands like Xiaomi deliver affordable whole-home bundles, catalyzing mass-market adoption. India's fiber and 5G rollouts expand addressable households, while Singapore pilots senior-care apartments equipped with ambient sensing that alerts caregivers to abnormalities. Manufacturing concentration in the region compresses bill-of-materials costs, making entry-level solutions attainable for emerging middle classes and widening the smart homes market footprint.

Europe exhibits stable uptake, bolstered by stringent energy directives and privacy-centric regulations. Household penetration surpassed 112 million smart homes by 2022, and trajectories point to 47% adoption by 2027. Schneider Electric's Wiser Home platform applies AI forecasting to shave consumption during tariff peaks, reflecting continental emphasis on grid stability. GDPR prompts local data processing, pushing vendors to design edge-intelligent devices. Incentives under the Fit-for-55 package reward homeowners for grid-interactive equipment, integrating solar surplus into demand response markets. The Middle East and Africa, though nascent, benefit from flagship smart-city builds such as Saudi Arabia's NEOM. Latin America progresses as connectivity infrastructure matures and Brazil's nationwide smart-meter rollout accelerates consumer familiarity with connected living.

- ABB Ltd

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric Co.

- Siemens AG

- LG Electronics Inc.

- Cisco Systems Inc.

- Google LLC

- Microsoft Corporation

- General Electric Company

- IBM Corporation

- Legrand SA

- Lutron Electronics Co. Inc.

- Samsung Electronics Co., Ltd.

- Control4 Corporation

- Assa Abloy AB

- Amazon.com, Inc.

- Apple Inc.

- Bosch Smart Home GmbH

- Sony Group Corporation

- Faststream Technologies

- Simplisafe Inc.

- Ecobee Inc.

- Signify N.V.

- ADT Inc.

- Arlo Technologies, Inc.

- Vivint Smart Home, Inc.

- Ring LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for energy-efficient smart appliances

- 4.2.2 Growing broadband and 5G penetration

- 4.2.3 Incentives for residential decarbonisation and energy-management

- 4.2.4 Aging-in-place and home-health integration surge

- 4.2.5 Interoperability standard (Matter) accelerating ecosystem

- 4.2.6 Gen-Z home-ownership driving automation spend

- 4.3 Market Restraints

- 4.3.1 High upfront installation and retrofit costs

- 4.3.2 Cyber-security and data-privacy concerns

- 4.3.3 Fragmented device ecosystems hinder adoption

- 4.3.4 Semiconductor supply-chain volatility

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Components

- 5.1.1 Consumer Electronics

- 5.1.1.1 Smart Speaker

- 5.1.1.2 Smart Home Theater

- 5.1.1.3 Smart Purifier

- 5.1.1.4 Other Appliances

- 5.1.2 Access Control, Safety and Security

- 5.1.2.1 Smart Alarm

- 5.1.2.2 Smart Locks

- 5.1.2.3 Smart Sensors

- 5.1.2.4 Smoke/ Hazard Detectors

- 5.1.2.5 Smart Cameras and Monitoring

- 5.1.2.6 Garage-Door Operators and Others

- 5.1.3 Lighting

- 5.1.3.1 Smart Lighting

- 5.1.3.2 Smart Lamps and Luminaires

- 5.1.3.3 Ambient Lighting

- 5.1.3.4 Other Lighting Products

- 5.1.4 Energy Management

- 5.1.4.1 Lighting Energy Controllers

- 5.1.4.2 Central Control Systems

- 5.1.4.3 HVAC Energy Controls

- 5.1.5 Smart HVAC / Climate Control

- 5.1.5.1 Fans

- 5.1.5.2 Radiators

- 5.1.5.3 Thermostats

- 5.1.5.4 Air-Conditioners

- 5.1.6 Controllers / Hubs

- 5.1.6.1 DIY Hubs and Panels

- 5.1.6.2 Professional Hubs and Panels

- 5.1.7 Smart-Home Healthcare

- 5.1.7.1 Medical-alert Systems

- 5.1.7.2 Smart Glucose Monitors

- 5.1.7.3 Smart Cardiac Monitors

- 5.1.8 Smart Kitchen

- 5.1.8.1 Smart Refrigerators

- 5.1.8.2 Smart Cookware and Cooktops

- 5.1.8.3 Smart Dishwashers

- 5.1.8.4 Smart Ovens

- 5.1.8.5 Others

- 5.1.1 Consumer Electronics

- 5.2 By Housing Type

- 5.2.1 Single-family

- 5.2.2 Multi-family

- 5.3 By Installation Type

- 5.3.1 New Construction

- 5.3.2 Retrofit

- 5.4 By Sales Channel

- 5.4.1 Online

- 5.4.2 Offline

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN

- 5.5.3.6 Australia and New Zealand

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Schneider Electric SE

- 6.4.3 Honeywell International Inc.

- 6.4.4 Emerson Electric Co.

- 6.4.5 Siemens AG

- 6.4.6 LG Electronics Inc.

- 6.4.7 Cisco Systems Inc.

- 6.4.8 Google LLC

- 6.4.9 Microsoft Corporation

- 6.4.10 General Electric Company

- 6.4.11 IBM Corporation

- 6.4.12 Legrand SA

- 6.4.13 Lutron Electronics Co. Inc.

- 6.4.14 Samsung Electronics Co., Ltd.

- 6.4.15 Control4 Corporation

- 6.4.16 Assa Abloy AB

- 6.4.17 Amazon.com, Inc.

- 6.4.18 Apple Inc.

- 6.4.19 Bosch Smart Home GmbH

- 6.4.20 Sony Group Corporation

- 6.4.21 Faststream Technologies

- 6.4.22 Simplisafe Inc.

- 6.4.23 Ecobee Inc.

- 6.4.24 Signify N.V.

- 6.4.25 ADT Inc.

- 6.4.26 Arlo Technologies, Inc.

- 6.4.27 Vivint Smart Home, Inc.

- 6.4.28 Ring LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment