PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850184

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850184

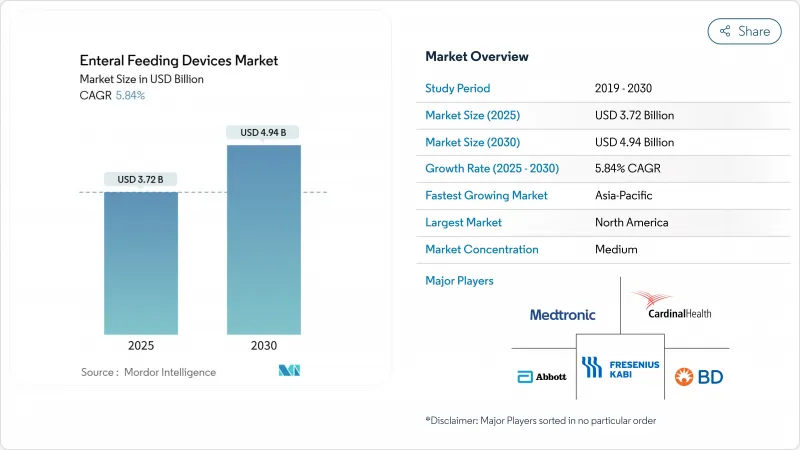

Enteral Feeding Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The enteral feeding devices market stands at USD 3.72 billion in 2025 and is on track to reach USD 4.94 billion by 2030, advancing at a 5.84% CAGR.

The expansion reflects a steady switch from legacy feeding methods toward systems built around safety, digital connectivity, and ENFit-compliant fittings. Demographic pressures, especially longer lifespans and rising chronic illness prevalence, shore up baseline demand. Early compliance with ISO 80369-3 standards has become a clear competitive lever, rewarding manufacturers able to re-engineer product lines for the new connector format while accelerating consolidation among firms lacking the resources to adapt. Device makers that combine rigorous safety design with smart pumps, remote monitoring, and intuitive interfaces are now best placed to capture growth as care shifts into patient homes and outpatient centers.

Global Enteral Feeding Devices Market Trends and Insights

Shift Toward Home & Outpatient Enteral Nutrition

More care is moving from hospital wards to living rooms. Portable pumps with wireless modules now allow nurses to supervise feeds remotely, trimming inpatient costs while improving comfort. Insurers in the United States and parts of Europe reimburse these regimens, reinforcing take-home adoption. Device interfaces have been simplified so caregivers can operate pumps safely with minimal training. However, reimbursement gaps across many Asia Pacific and Latin American health systems delay uptake, resulting in a two-speed enteral feeding devices market.

Rising Premature Births Worldwide

The neonatal sub-segment is buoyed by global increases in preterm deliveries and better intensive-care survival. Clinical trials show donor milk diets help very-low-birth-weight infants reach full feeds four days sooner than formula diets, spurring demand for precise pumps and small-bore ENFit syringes. Algorithms from Stanford Medicine now calibrate nutrient mixes automatically, improving prescription accuracy in fragile infants. These technology layers raise the bar for safety and push prices higher, yet shortages of syringe pumps in low-resource hospitals highlight on-going supply fragility.

Reimbursement Gaps in Low-Income Countries

Only 40% of surveyed Asia Pacific nations provide structured funding for home enteral feeds, forcing hospitals to rely on blenderized diets that undermine device penetration. Such financing vacuums split the enteral feeding devices industry along income lines, with premium pumps entering wealthy hospitals and bare-bones tubes predominating elsewhere.

Other drivers and restraints analyzed in the detailed report include:

- Growing Geriatric Population & Chronic Disease Burden

- Rapid Adoption of ENFit-Compliant Connectors

- Tube-Related Complications & Aspiration Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, feeding pumps generated 39.67% of revenue, asserting dominance through dose accuracy and safety alarms. Volumetric units remain central to critical-care routines, but lightweight ambulatory models are rising fast as care decentralizes. The enteral feeding devices market size for tubes is climbing at a 6.87% CAGR, fueled by integrated cameras that guide bedside placement and cut X-ray exposure. Manufacturers bundle ENFit sets with both pumps and tubes, ensuring connector compliance across the care pathway. A short-cycle replacement pattern for disposable giving sets further strengthens recurring revenues, drawing new capital into this portion of the enteral feeding devices market.

Regulatory scrutiny over syringes, categorized as Class II in the United States, has nudged vendors toward tamper-evident caps and color cues that prevent wrong-route errors. Bags and administration sets show slower but dependable uptake because every feed regimen needs consumables. Raw-material shortages in East Asia medical-grade plastics, however, expose the supply chain to volatility and may spur reshoring projects in North America and Europe.

Adults accounted for 72.45% of 2024 sales as chronic disorders and post-stroke care dominate procedure counts. Conversely, the pediatric & neonatal bracket is advancing at 7.12% CAGR on the back of expanding neonatal intensive-care capacity in emerging economies. Exclusive donor-milk protocols and AI-driven nutrient calculators shorten time to full feeds, reinforcing demand for calibrated syringes and low-volume pumps.

The enteral feeding devices market share for neonatal-specific devices remains modest but premium, reflecting strict safety criteria and limited vendor competition. Supply gaps, notably syringe pump shortages that forced clinicians in some low-resource settings to adapt adult gear for infants, spotlight the need for resilient manufacturing footprints. Adult-focused design is now borrowing pediatric ergonomics to simplify use in the home, demonstrating cross-pollination benefits across the enteral feeding devices market.

The Enteral Feeding Devices Market Report is Segmented by Product Type (Feeding Pumps [Volumetric Pumps and More], Feeding Tubes [Nasogastric Tubes and More], and More), Age Group (Adults and More), Distribution Channel (Offline and Online), Application (Oncology and More), End-User (Hospitals and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 36.64% of 2024 global spend, underpinned by wide reimbursement and early ENFit adoption. Growth, although slower at 5.14% CAGR, remains supported by home-based care models and federal incentives for telemonitoring devices. The FDA's spotlight on pediatric device shortages has pushed suppliers to expand domestic molding and assembly, improving lead times and mitigating raw-material risks.

Europe posts a 5.57% CAGR through 2030, aided by the Medical Device Regulation that standardizes approval requirements across member states. Harmonized rules lower administrative costs for multi-country launches and let manufacturers focus on differentiating features like app-enabled dose logging. Aging-in-place policies across Germany, France, and the Nordics encourage wider home feed adoption, especially via national nursing programs. Food for special medical purposes rules add complexity yet favor experienced firms that can document compliance. The enteral feeding devices market size tied to European home programs is set to climb steadily as municipalities integrate remote nutrition checks into routine elder care.

Asia Pacific marks the fastest regional pace at 6.68% CAGR owing to hospital building booms and expanding universal-health schemes in China and India. Yet access remains uneven; fewer than half of APAC nations reimburse home enteral formulas, so blenderized diets persist in lower-middle-income areas. Indian distributor Entero Healthcare registered 22% annual revenue growth in 2024, evidencing strong device appetite once funding barriers fall. To penetrate price-sensitive zones, global firms ally with local assemblers and offer tiered portfolios that pair low-cost tubes with optional smart features. These steps aim to convert nascent interest into durable gains for the enteral feeding devices market.

- Abbott Laboratories

- ALCOR Scientific

- Amsino International

- Applied Medical Resources

- Avanos Medical

- B. Braun

- Beckton Dickinson

- Boston Scientific

- Cardinal Health

- Conmed

- Cook Group

- Danone

- Fidmi Medical

- Fisher & Paykel Healthcare

- Fresenius

- Mead Johnson Nutrition

- Medtronic

- Micrel Medical Devices S.A.

- Moog

- Nestle S.A.

- Owens & Minor (Halyard Health)

- Vygon S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward home & outpatient enteral nutrition

- 4.2.2 Growing geriatric population & chronic disease burden

- 4.2.3 Rapid adoption of ENFit-compliant connectors

- 4.2.4 Rising premature births worldwide

- 4.2.5 Growth of ambulatory cancer care requiring mobile pumps

- 4.2.6 Value-based care incentives for early discharge with enteral kits

- 4.3 Market Restraints

- 4.3.1 Reimbursement gaps in low-income countries

- 4.3.2 Regulatory uncertainty during ISO-80369-3 transition

- 4.3.3 Tube-related complications & aspiration risks

- 4.3.4 Medical-grade plastic supply chain constraints

- 4.4 Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Feeding Pumps

- 5.1.1.1 Volumetric Pumps

- 5.1.1.2 Ambulatory Pumps

- 5.1.1.3 Syringe Pumps

- 5.1.2 Feeding Tubes

- 5.1.2.1 Nasogastric Tubes

- 5.1.2.2 Gastrostomy Tubes

- 5.1.2.3 Others

- 5.1.3 Enteral Feeding Bags

- 5.1.4 Administration Sets & Accessories

- 5.1.5 Enteral Syringes

- 5.1.1 Feeding Pumps

- 5.2 By Age Group

- 5.2.1 Adults

- 5.2.2 Pediatric & Neonatal

- 5.3 By Distribution Channel

- 5.3.1 Offline

- 5.3.2 Online

- 5.4 By Application

- 5.4.1 Oncology

- 5.4.2 Gastroenterology

- 5.4.3 Critical Care & Trauma

- 5.4.4 Other Applications

- 5.5 By End-User

- 5.5.1 Hospitals

- 5.5.2 Ambulatory Surgical Centers

- 5.5.3 Home Care Settings

- 5.5.4 Other End-Users

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Abbott Laboratories

- 6.4.2 ALCOR Scientific Inc.

- 6.4.3 Amsino International Inc.

- 6.4.4 Applied Medical Technology Inc.

- 6.4.5 Avanos Medical Inc.

- 6.4.6 B. Braun Melsungen AG

- 6.4.7 Becton, Dickinson and Company

- 6.4.8 Boston Scientific Corp.

- 6.4.9 Cardinal Health Inc.

- 6.4.10 ConMed Corporation

- 6.4.11 Cook Medical Inc.

- 6.4.12 Danone S.A.

- 6.4.13 Fidmi Medical

- 6.4.14 Fisher & Paykel Healthcare

- 6.4.15 Fresenius Kabi

- 6.4.16 Mead Johnson Nutrition

- 6.4.17 Medtronic plc

- 6.4.18 Micrel Medical Devices S.A.

- 6.4.19 Moog Inc.

- 6.4.20 Nestle S.A.

- 6.4.21 Owens & Minor (Halyard Health)

- 6.4.22 Vygon S.A.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet Need Assessment