PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850185

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850185

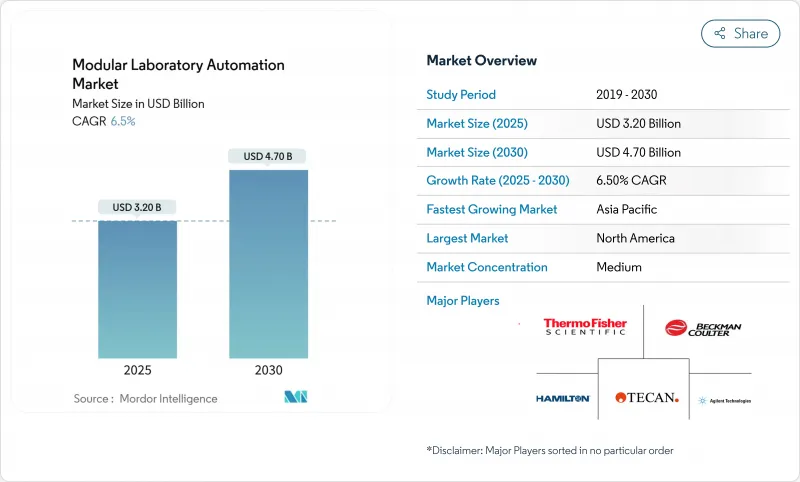

Modular Laboratory Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The modular laboratory automation market size is estimated at USD 3.2 billion in 2025 and is set to advance to USD 4.7 billion by 2030, translating to a 6.50% CAGR throughout the forecast window.

Heightened regulatory scrutiny, a shrinking laboratory workforce, and the growing need for reproducible data position automated, network-ready work cells as critical infrastructure for life-science innovation. Suppliers now bundle artificial-intelligence software with robotics, allowing laboratories to standardize protocols, capture complete audit trails, and shorten testing cycles. Pharmaceutical manufacturers are accelerating adoption to satisfy the EU GMP Annex 1 contamination-control requirements, while hospital networks favour modular deployments that scale distributed testing without lengthy construction projects. In parallel, federal support such as the NIH MATChS program signals that laboratory automation is no longer discretionary but a strategic enabler for biomedical research.

Global Modular Laboratory Automation Market Trends and Insights

Rising Need for Reproducibility & Data Integrity

Automated platforms impose strict process control, cutting variability that manual techniques often introduce. The Mayo Clinic's sorting system moves 6,000 tubes per hour without mis-sorts, demonstrating zero-defect data capture. Such results are indispensable as regulators demand granular audit trails for every assay. Multi-site consortia use standardized robotic workflows to compare results confidently, boosting collaborative studies. Vendors increasingly embed blockchain-ready logs to safeguard raw data. These capabilities elevate laboratory credibility when submitting evidence to regulatory agencies.

Chronic Skilled-Labor Shortages in Life-Science Labs

Vacancies nearing 25,000 positions across North America have pushed labs toward automation that reassigns repetitive tasks to machines while scientists focus on interpretation. Clarapath's robotic microtomy lets one technician oversee multiple slide-prep stations, tripling output capacity. Such labour-multiplying benefits shorten testing backlogs and support 24/7 operations without overtime premiums. Automation also institutionalizes tacit knowledge by encoding protocols into software, reducing onboarding time for new hires. With retirement rates climbing, the economic rationale for modular laboratory automation market investments strengthens further.

High Upfront Capex & Long ROI Cycles

Entry-level robotic benches cost USD 100,000-300,000, while full lines exceed USD 1 million, straining academic and midsize budgets. Payback often stretches past three years because benefits like error-free data or staff redeployment resist simple monetization. Leasing schemes and usage-based pricing partially lower the barrier, yet maintenance contracts, validation, and operator training still elevate total cost of ownership. Finance committees therefore stage investments in phases, favouring the modular laboratory automation market approach that lets sites bolt on capacity incrementally.

Other drivers and restraints analyzed in the detailed report include:

- High-Throughput Genomics & Cell-Therapy Pipelines

- EU GMP Annex 1 Contamination-Control Mandates

- Integration Complexity with Legacy Instruments & LIMS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automated liquid handlers generated 26.41% of the modular laboratory automation market size in 2024, cementing their role as the backbone of assay preparation. Laboratories favour these platforms because precision pipetting ensures downstream data quality while freeing staff for analytical tasks. Demand for integrated software that optimizes deck layouts and predicts tip consumption is growing, reducing consumable waste and unplanned downtime. Automated storage & retrieval systems, projected to grow at 7.21% CAGR, solve the chronic challenge of sample archiving by delivering samples to work cells just-in-time. Vendors now combine low-temperature warehouses with AI route planning, minimizing freeze-thaw events and safeguarding biomolecule integrity.

Software innovation shapes competitive differentiation as vendors embed machine-learning algorithms that flag anomalies before assay failures propagate. Thermo Fisher's Vulcan platform illustrates how combining robotic arms with self-tuning workflows elevates throughput. Analysers capable of inline mass spectrometry or fluorescence detection compress total turnaround time, letting labs condense multi-day protocols into single shifts. The net effect is a structural rise in demand for cohesive ecosystems rather than single-purpose boxes, reinforcing supplier emphasis on modular laboratory automation market ecosystems that orchestrate hardware and data in one pane of glass.

Clinical diagnostics contributed 28.50% revenue in 2024, underpinned by high-volume chemistries and strict accreditation criteria that reward reproducible automation. Hospital laboratories integrate conveyor-linked work cells with middleware that posts verified results directly to electronic health records, shortening patient care cycles. Cell & gene therapy workflows, forecast for 9.66% CAGR, need closed-system robots that minimize contamination risk during lengthy culture periods. Robots equipped with environmental sensors and AI classifiers maintain sub-micron cleanliness, preventing batch failures that could cost millions of USD.

Drug-discovery groups continue to deploy high-throughput screens on 1,536-well plates, while genomics consortia automate library prep for population cohorts. Proteomics is emerging as laboratories automate sample digestion and LC-MS loading. Cross-disciplinary platforms that support reagent-agnostic protocols are gaining traction, as they let sites pivot capacity between diagnostic, discovery, and manufacturing workloads. This versatility reinforces investment in the modular laboratory automation market because a single capital outlay serves many revenue streams.

Modular Laboratory Automation Market is Segmented by Equipment and Software (Automated Liquid Handlers, Automated Plate Handlers and More), Field of Application (Drug Discovery, Genomics and More), End User (Pharmaceutical and Biotech Companies, and More), Automation Type (Standalone Instrument Automation, Modular Workcells and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America sustained a 41.70% revenue share in 2024, reflecting the concentration of biopharmaceutical headquarters, generous NIH funding, and a mature regulatory environment that favours technology investments. Recent federal grants, such as the USD 2.15 million MATChS award, confirm public-sector endorsement of intelligent automation. Tier-1 hospitals are integrating decentralized work cells, pushing specimen processing closer to patient intake to reduce logistics delays. Canada's life-science clusters leverage provincial tax credits to upgrade research infrastructure, though staffing shortages remain acute; automation therefore offers a pragmatic path to maintain throughput despite limited headcount. Mexico, seeking export accreditation for sterile injectables, is piloting robotic isolators to meet Annex 1 requirements and secure contract manufacturing deals.

Asia-Pacific registers the highest growth trajectory as governments subsidize biotech infrastructure and encourage local manufacturing of advanced therapies. China invests in national sequencing hubs that adopt fully automated, closed-loop pipelines, reducing per-genome costs and accelerating precision-medicine pilot programs. Japan's aging population elevates demand for diagnostic automation capable of handling chronic-disease panels. India's contract-manufacturing sector implements modular isolators that comply with global sterility standards, positioning domestic plants for regulated-market exports. South Korea focuses on cell-therapy centers of excellence that combine dual-arm robots with AI analytics, bringing complex biologics to market more swiftly. Collectively, these initiatives underpin sustained demand across the modular laboratory automation market throughout the region.

Europe remains a pivotal market because Annex 1 lifts technical barriers in favour of robotics, driving upgrades across legacy fill-finish lines. Germany's engineering base integrates high-precision mechatronics with cloud-native MES platforms, while the United Kingdom channels research funding into university-hospital partnerships that validate AI-directed work cells. France modernizes public-sector laboratories through stimulus packages that offset upfront capex. Italy and Spain prioritize total laboratory automation in blood-bank operations to curb transfusion errors. The regulatory commonality across the European Economic Area encourages cross-border standardization, letting suppliers offer uniform validation packages and thereby expedite procurement across multiple sites within the modular laboratory automation market.

- Thermo Fisher Scientific

- Danaher Corporation (Beckman Coulter)

- Tecan Group AG

- Agilent Technologies

- PerkinElmer Inc.

- Siemens Healthineers

- Becton Dickinson (BD)

- Hudson Robotics Inc.

- Honeywell International Inc.

- Hamilton Company

- HighRes Biosolutions

- Biosero Inc.

- QIAGEN N.V.

- Copan Diagnostics

- Retisoft Inc.

- Bruker (Chemspeed)

- Roche Diagnostics

- ABB Ltd.

- LabVantage Solutions

- Festo AG and Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising need for reproducibility and data integrity

- 4.2.2 Chronic skilled-labor shortages in life-science labs

- 4.2.3 High-throughput genomics and cell-therapy pipelines

- 4.2.4 EU GMP Annex 1 contamination-control mandates accelerating robotics (under-reported)

- 4.3 Market Restraints

- 4.3.1 High upfront capex and long ROI cycles

- 4.3.2 Integration complexity with legacy instruments and LIMS

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Equipment and Software

- 5.1.1 Automated Liquid Handlers

- 5.1.2 Automated Plate Handlers

- 5.1.3 Robotic Arms

- 5.1.4 Automated Storage and Retrieval Systems (ASRS)

- 5.1.5 Analyzers

- 5.1.6 Software

- 5.2 By Field of Application

- 5.2.1 Drug Discovery

- 5.2.2 Genomics

- 5.2.3 Proteomics

- 5.2.4 Clinical Diagnostics

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Pharmaceutical and Biotech Companies

- 5.3.2 Academic and Research Institutes

- 5.3.3 Clinical and Diagnostic Laboratories

- 5.3.4 Contract Research Organisations

- 5.3.5 Food and Environmental Testing Labs

- 5.4 By Automation Type

- 5.4.1 Standalone Instrument Automation

- 5.4.2 Modular Workcells

- 5.4.3 Integrated Workcells

- 5.4.4 Total Laboratory Automation (TLA) Lines

- 5.4.5 Mobile/Cloud-connected Robots

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Israel

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Thermo Fisher Scientific

- 6.4.2 Danaher Corporation (Beckman Coulter)

- 6.4.3 Tecan Group AG

- 6.4.4 Agilent Technologies

- 6.4.5 PerkinElmer Inc.

- 6.4.6 Siemens Healthineers

- 6.4.7 Becton Dickinson (BD)

- 6.4.8 Hudson Robotics Inc.

- 6.4.9 Honeywell International Inc.

- 6.4.10 Hamilton Company

- 6.4.11 HighRes Biosolutions

- 6.4.12 Biosero Inc.

- 6.4.13 QIAGEN N.V.

- 6.4.14 Copan Diagnostics

- 6.4.15 Retisoft Inc.

- 6.4.16 Bruker (Chemspeed)

- 6.4.17 Roche Diagnostics

- 6.4.18 ABB Ltd.

- 6.4.19 LabVantage Solutions

- 6.4.20 Festo AG and Co. KG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment