PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850190

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850190

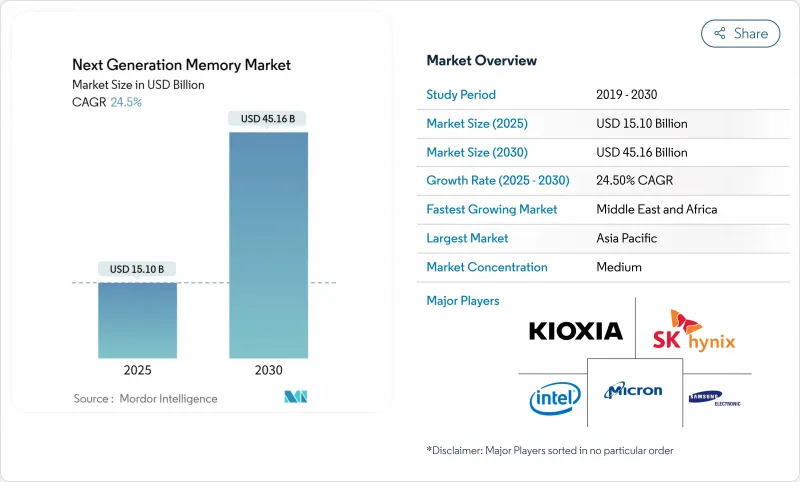

Next Generation Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Next Generation Memory market size was valued at USD 15.10 billion in 2025 and is forecast to reach USD 45.16 billion by 2030, reflecting a vigorous 24.5% CAGR.

Demand accelerated as AI training clusters, edge servers, and autonomous vehicles all confronted the latency wall of conventional DRAM-NAND hierarchies. Vendors prioritized high-bandwidth architectures, persistent storage class devices, and advanced packaging to close the widening compute-to-memory gap. Asia-Pacific remained the production powerhouse, while North American fab incentives fostered parallel capacity. Interface innovations such as Compute Express Link (CXL) and Universal Chiplet Interconnect Express (UCIe) have begun to redraw system design philosophies, encouraging disaggregated memory pools that scale almost linearly with accelerator count. Supply constraints for premium nodes and wafers, however, continued to shape pricing and allocation strategies across the Next Generation Memory market.

Global Next Generation Memory Market Trends and Insights

AI-driven demand for HBM in hyperscale data centres

Surging transformer model sizes forced cloud operators to double server-level DRAM and solid-state budgets, making bandwidth rather than capacity the primary bottleneck. High Bandwidth Memory multiplied link throughput beyond 1.5 TB/s and delivered dramatic energy savings per bit moved. Global allocation tightened when SK Hynix reported its entire 2025 HBM output sold in advance, which prompted long-term volume reservations for 2026. Micron observed that an AI server deploys nearly twice the DRAM of a classic x86 node. The Next Generation Memory market, therefore, pivoted from bit-cost leadership toward bandwidth leadership, creating premium pricing tiers and margin expansion opportunities.

Automotive L4 ADAS needs instant-on persistent memory

Level 4 autonomy demands deterministic recovery after power events and harsh operating temperatures beyond 150 °C. Ferroelectric RAM devices withstand 1014 cycles while retaining data without standby power, ensuring cold-start availability for sensor fusion stacks that generate up to 100 GB/s. Automakers now evaluate asymmetric persistent-volatile hybrids combining FRAM with LPDDR5X scratch pads. These architectures protect mission logs, facilitate over-the-air updates, and support functional safety goals under ISO 26262, reinforcing growth in the Next Generation Memory market across the mobility value chain.

Thermal stability failures of automotive-grade PCM

Phase-change alloys struggled to retain data above 150 °C, jeopardizing event recorder integrity in desert and under-hood deployments. Material engineering explored Ge-rich GeSbTe and serial PCM cell pairs that push endurance windows to 153 °C but add lithography steps and cost. OEM qualification cycles, therefore, slowed PCM adoption, shifting near-term design wins to FRAM and ReRAM until reliability goals are met. The constraint compressed overall growth, particularly within the automotive subset of the Next Generation Memory market.

Other drivers and restraints analyzed in the detailed report include:

- Smartphone migration to LPDDR5X and embedded ReRAM

- National memory localization programs

- Foundry concentration for sub-28 nm STT-MRAM

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Volatile devices delivered 85.6% of 2024 revenue, anchored by HBM's steep capacity premiums. That dominance has persisted because AI accelerators saturate anything below 1 TB/s, ensuring HBM purchase commitments stretch multiple fiscal years. The Next Generation Memory market size for volatile solutions is projected to keep expanding in absolute terms even while share slips, as ReRAM, PCM, and MRAM gain credibility in edge and instrumentation workloads. ReRAM leads non-volatile momentum, growing at 38.3% CAGR thanks to simple metal-oxide stacks that co-fabricate on 28 nm nodes without extra masks. PCM's gradual thermal-stability gains are expected to unlock automotive attach once the 10-year, 150 °C retention benchmark is certified. MRAM advances remain tied to future EUV capacity and to process simplification that narrows the per-bit premium versus NAND.

Structurally, volatile makers now explore stacked chiplet topologies, trimming die area, and spreading yield risk. Non-volatile challengers respond with cross-point arrays and selector-less designs that eliminate area-consuming transistors. Over the outlook period, supply acceleration for ReRAM and PCM is expected to erode volatile share by roughly 10 percentage points, although absolute volatile revenue still rises because the AI server TAM doubles. Designers will continue to co-package volatile and non-volatile dies, cultivating hybrid stacks that trade endurance for persistence. Those dynamics ensure a multi-node roadmap, widening solution diversity within the Next Generation Memory market.

Interfaces adapted to bandwidth-hungry accelerators long before monolithic silicon could keep pace. In 2024, DDR and LPDDR channels retained a 38.3% share, but adoption ceilings emerged at four channels per socket. CXL's cache-coherent attach over PCIe 5.0 eased that limit, pooling terabytes of memory behind shared switches and slashing stranded capacity. The arrival of the UCIe 2.0 spec in August 2024 delivered 3D-stacked chiplets with 75 X the prior inter-die bandwidth, empowering hyperscalers to tile dozens of compute dies against a single HBM stack.

Looking ahead, 50% of new HPC tape-outs in 2025 will embed 2.5D or 3D die-to-die links, elevating CXL or UCIe from optional to mandatory design elements. Retiming hubs and retimers emerge as ancillary profit pools. Synchronous to these shifts, PCIe/NVMe continues incremental generational moves, but SATA fades toward archival niches. Collectively, novel interfaces propel modular deployments that decouple capacity planning from CPU upgrade cycles, enlarging diversification options within the Next Generation Memory market.

Next Generation Memory Market is Segmented by Technology (Volatile, and Non-Volatile), by Memory Interface (DDR/LPDDR, PCIe/NVMe, SATA, and Others (CXL, Ucie)), by End-Use Device (Consumer Electronics, Enterprise Storage and Data Centers, Automotive Electronics and ADAS, and More), by Wafer Size (<= 200 Mm, 300 Mm, and 450 Mm), and by Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa).

Geography Analysis

Asia-Pacific maintained its leadership with 47.3% revenue in 2024, sustained by Samsung, SK Hynix, and TSMC, whose combined capital plans exceeded USD 85 billion for next-generation nodes. China advanced its indigenous DRAM capacity to a 5% global share and targeted 10% by 2025, guided by state grants and preferential loan terms. Japan's renewed subsidies preserved local NAND output and specialty equipment clusters. India launched fabrication incentive programs that attracted joint ventures geared toward assembly, test, and eventually 3D NAND slicing. This regional depth anchored supply security and fostered volume leverage for the Next Generation Memory market.

North America's CHIPS incentive catalysed Micron's Idaho HBM fab and Texas memory assembly centres, ensuring domestic capacity for defense and hyperscale procurement. Mexico captured backend assembly flows, complementing the United States front-end wafer starts. Canadian institutes contributed materials science breakthroughs aimed at ultra-low-power non-volatiles, expanding the research and development halo of the continent.

Europe pursued strategic autonomy under its semiconductor act, targeting a 20% global share by 2030. Germany funnelled grants toward automotive-grade memory consortia, while France invested in ReRAM pilot lines. The United Kingdom prioritized foundry-agnostic IP for chiplet die-to-die fabrics. Collectively, the bloc sought tighter integration between automotive OEMs and local memory houses, reinforcing regional demand in the Next Generation Memory market.

The Middle East and Africa exhibited the fastest trajectory, with a 31.2% CAGR outlook underpinned by sovereign wealth-fund backed fabs in Saudi Arabia and the UAE. Turkey marketed itself as a Eurasian packaging hub, and South Africa leveraged telecom densification to spur consumer memory uptake. While the base is modest, aggressive capital allocations and labour-force upskilling suggest durable upside for the region's share of the Next Generation Memory market.

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- Micron Technology, Inc.

- Kioxia Holdings Corporation

- Intel Corporation

- Western Digital Corporation

- Everspin Technologies, Inc.

- Crossbar Inc.

- Avalanche Technology Inc.

- Spin Memory, Inc.

- Nantero Inc.

- Weebit Nano Ltd.

- Renesas Electronics Corporation

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Changxin Memory Technologies (CXMT)

- Taiwan Semiconductor Manufacturing Co. Ltd.

- GlobalFoundries Inc.

- Winbond Electronics Corporation

- Macronix International Co., Ltd.

- Nanya Technology Corporation

- Advanced Semiconductor Engineering (ASE) Inc.

- Powerchip Semiconductor Manufacturing Corp.

- Yangtze Memory Technologies Co. (YMTC)

- Microchip Technology Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-Driven Demand for HBM in Hyperscale Data Centers

- 4.2.2 Automotive L4 ADAS Need for Instant-On Persistent Memory

- 4.2.3 Smartphone Migration to LPDDR5X and Embedded ReRAM

- 4.2.4 National Memory Localization Programs

- 4.2.5 Industrial Edge-IoT Requiring Ultra-Low-Power FRAM

- 4.2.6 Data-Privacy-Driven Persistent In-Memory Databases Using 3D XPoint

- 4.3 Market Restraints

- 4.3.1 450 mm Wafer Delay Constraining ReRAM Scale-up

- 4.3.2 High Per-Bit MRAM Cost versus NAND

- 4.3.3 Thermal Stability Failures of Automotive-Grade PCM

- 4.3.4 Foundry Concentration for Sub-28 nm STT-MRAM

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Emerging Memory Technology Roadmap Analysis

- 4.8 Impact of Macroeconomic factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Non-Volatile

- 5.1.1.1 Phase-Change Memory (PCM)

- 5.1.1.2 Spin-Transfer MRAM (STT-MRAM)

- 5.1.1.3 Toggle MRAM

- 5.1.1.4 Resistive RAM (ReRAM)

- 5.1.1.5 3D XPoint / Optane

- 5.1.1.6 Ferroelectric RAM (FeRAM)

- 5.1.1.7 NanoRAM

- 5.1.2 Volatile

- 5.1.2.1 High-Bandwidth Memory (HBM)

- 5.1.2.2 Hybrid Memory Cube (HMC)

- 5.1.2.3 Low-Power DDR5 / LPDDR5X

- 5.1.1 Non-Volatile

- 5.2 By Memory Interface

- 5.2.1 DDR / LPDDR

- 5.2.2 PCIe / NVMe

- 5.2.3 SATA

- 5.2.4 Others (CXL, UCIe)

- 5.3 By End-Use Device

- 5.3.1 Consumer Electronics

- 5.3.2 Enterprise Storage and Data Centers

- 5.3.3 Automotive Electronics and ADAS

- 5.3.4 Industrial IoT and Manufacturing Automation

- 5.3.5 Aerospace and Defense

- 5.3.6 Healthcare and Medical Devices

- 5.3.7 Others (Smart Cards, Wearables)

- 5.4 By Wafer Size

- 5.4.1 <= 200 mm

- 5.4.2 300 mm

- 5.4.3 450 mm

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Samsung Electronics Co., Ltd.

- 6.4.2 SK Hynix Inc.

- 6.4.3 Micron Technology, Inc.

- 6.4.4 Kioxia Holdings Corporation

- 6.4.5 Intel Corporation

- 6.4.6 Western Digital Corporation

- 6.4.7 Everspin Technologies, Inc.

- 6.4.8 Crossbar Inc.

- 6.4.9 Avalanche Technology Inc.

- 6.4.10 Spin Memory, Inc.

- 6.4.11 Nantero Inc.

- 6.4.12 Weebit Nano Ltd.

- 6.4.13 Renesas Electronics Corporation

- 6.4.14 Infineon Technologies AG

- 6.4.15 NXP Semiconductors N.V.

- 6.4.16 Changxin Memory Technologies (CXMT)

- 6.4.17 Taiwan Semiconductor Manufacturing Co. Ltd.

- 6.4.18 GlobalFoundries Inc.

- 6.4.19 Winbond Electronics Corporation

- 6.4.20 Macronix International Co., Ltd.

- 6.4.21 Nanya Technology Corporation

- 6.4.22 Advanced Semiconductor Engineering (ASE) Inc.

- 6.4.23 Powerchip Semiconductor Manufacturing Corp.

- 6.4.24 Yangtze Memory Technologies Co. (YMTC)

- 6.4.25 Microchip Technology Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment