PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850196

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850196

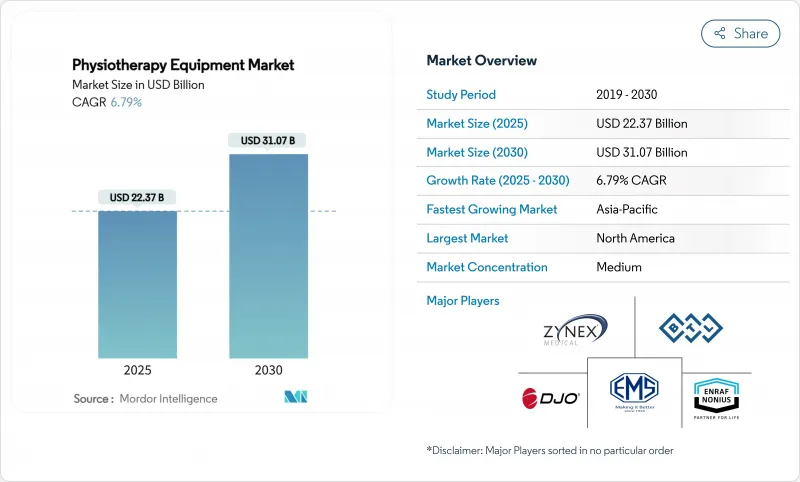

Physiotherapy Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The physiotherapy equipment market reached USD 22.37 billion in 2025 and is forecast to attain USD 31.07 billion by 2030, registering a 6.79% CAGR over the period.

Demand is advancing as the global population ages, chronic musculoskeletal and neurological conditions climb, and connected devices enable therapists to monitor progress beyond clinic walls. Clinicians are integrating portable systems into mainstream practice because they shorten treatment cycles and support home-based care. Hospital purchasing departments remain the primary buyers, yet specialty centers and sports-medicine clinics are ordering newer modalities to address precise rehabilitation goals. Established suppliers now embed artificial intelligence into devices to personalize protocols, while start-ups court early adopters with subscription-based analytics.

Global Physiotherapy Equipment Market Trends and Insights

Rising Geriatric Population & Chronic Disease Burden

The global population aged 65 and above is expanding quickly, raising long-term demand for rehabilitation that mitigates mobility loss and co-morbidities. Health systems position physiotherapy as a cost-effective alternative to surgery for degenerative joint disease, propelling procurement of electrotherapy, ultrasound and robotic gait systems. The World Health Organization's healthy-aging agenda encourages exoskeleton use that augments functional capacity in older adults, influencing purchasing criteria in developed markets.Suppliers adapt by integrating fall-prevention analytics and softer, lighter exosuits into standard offerings. These developments sustain steady replacement cycles for clinics seeking to treat larger elderly cohorts.

Expanding Post-Surgical & Oncology Rehabilitation Demand

Minimally invasive surgery accelerates discharge, shifting recovery to outpatient settings that require compact, multi-modality workstations. Ambulatory surgical centers purchase portable electrical stimulation and continuous-passive-motion units to support same-day joint procedures. Cancer survival rates continue to improve, and oncology guidelines now recommend physiotherapy to counter fatigue and neuropathy, igniting orders for low-intensity ultrasound and pneumatic compression. Fifty-one dedicated rehabilitation hospitals opened or broke ground in 2024 and many include oncology suites, underscoring facility-level capital spending devoted to specialised equipment.Vendors respond by bundling devices with remote-monitoring dashboards that track post-operative milestones.

Shortage of Skilled Physiotherapists Worldwide

Many nations lack sufficient training programs, and only half include geriatric modules in entry-level education, limiting adoption of sophisticated electro-mechanical systems. Clinics compensate by automating data collection and incorporating AI that guides patients through standard protocols, yet complex cases still require human oversight. Workforce gaps intensify in rural hospitals and low-income regions where recruitment is difficult, constraining equipment utilisation. As a result, vendors bundle on-site training and virtual tutorials to accelerate staff proficiency, but the overall capacity shortfall suppresses the addressable base in key emerging economies.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Connected & Portable Physiotherapy Devices

- Growing Investments in Outpatient & Sports Medicine Facilities

- Unfavorable or Patchy Reimbursement in Developing Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electrotherapy accounted for 35.72% of physiotherapy equipment market share in 2024 thanks to its established role in pain and neuromuscular management. Hospitals continue bulk purchases of multi-channel stimulators because reimbursement codes are well defined and opioid-reduction programs favour non-pharmacological pain relief. Low-frequency variants now feature Bluetooth connectivity, giving therapists remote control and usage logging. Ultrasound systems post the fastest 7.18% CAGR to 2030 as research validates low-intensity applications for cartilage regeneration. The physiotherapy equipment market size for ultrasound devices is therefore projected to swell steadily, supported by FDA-cleared sustained acoustic medicine units deployed in sports clinics. Laser and light devices nibble at niche segments such as chronic wounds, while shockwave and PEMF remain specialist options.

The competitive field for electrotherapy tightens because consumer-grade TENS gadgets sell online at attractive prices, forcing premium brands to differentiate with evidence-backed waveforms and integrated outcome dashboards. In contrast, ultrasound suppliers focus on expanding indications beyond thermal effects, marketing non-contact devices that allow continuous use at home without gel. Combined therapy stations that house stimulation, ultrasound and vacuum massage within a single console appeal to space-constrained outpatient centers. These hybrid offerings reinforce vendor relationships because facility managers prefer unified service contracts and software updates.

Musculoskeletal disorders delivered 52.58% of physiotherapy equipment market size in 2024, underpinned by the prevalence of osteoarthritis and lower-back pain. High-volume procedures such as knee replacements generate predictable demand for continuous-passive-motion machines and neuromuscular electrical stimulators. Sports and orthopedic injuries, however, outpace all other indications with a 7.44% CAGR through 2030. Teams and recreational athletes invest in wearable motion sensors that flag asymmetries before they escalate into overuse injuries. That momentum shifts procurement toward dynamic loading platforms and anti-gravity treadmills capable of high-intensity conditioning without joint strain.

Neurorehabilitation gains visibility because robotic exosuits shorten intensive gait-training sessions and document progress objectively. Cardio-pulmonary protocols expand to include post-COVID exercise tolerance programs, spurring sales of cycle ergometers fitted with respiratory feedback modules. Pediatric suites require scaled-down robotics and colorful virtual-reality games that encourage adherence. Women's-health physiotherapy, addressing pregnancy-related pelvic pain and post-partum recovery, broadens the client base yet calls for gentler modalities such as low-level laser therapy. Across indications, AI-powered assessment apps guide therapists toward evidence-based parameter settings.

The Physiotherapy Equipment Market is Segmented by Equipment Type (Electrotherapy, Ultrasound Therapy, and More), by Application (Musculoskeletal, Neurology, and More), by End User (Hospitals, Rehabilitation Centers / Specialty Clinics, Home-Care Settings, and More), by Distribution Channel (Direct Institutional Sales, E-Commerce and Retail), by Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America controlled 39.52% of the physiotherapy equipment market in 2024, reflecting mature reimbursement and high adoption of connected modalities. United States Medicare extended telehealth flexibilities to 2025, legitimising remote patient-monitoring bundles that include electrical stimulation kits for home use. The U.S. physical-therapy services sector, worth USD 61 billion in 2025, channels stable purchasing power toward equipment refresh cycles. Canada's provincial health systems fund advanced robotics in academic centers, while Mexico upgrades public hospitals through procurement programs that specify digital-reporting capabilities. Competitive bids increasingly weight cybersecurity certifications to safeguard patient data.

Asia-Pacific posts the fastest 8.52% CAGR through 2030 as China, Japan and India scale rehabilitation capacity. Government grants subsidise smart-hospital pilots outfitted with sensor-laden treadmills and AI analytics engines. Although regional venture funding for med-tech declined by 22% in recent years, domestic device makers find opportunities in mid-tier clinics requiring affordable but connected solutions. Demographic shifts accelerate demand: Japan's silver economy drives sales of lower-limb exoskeletons, while India invests in physiotherapy laboratories within new medical colleges. Variations in reimbursement persist, but growing middle-class households increasingly pay out of pocket for home-use ultrasound.

Europe maintains steady growth owing to universal healthcare and strict regulatory oversight that guarantees safety. German sickness funds reimburse evidence-based electrotherapy sessions and encourage digital-health applications. United Kingdom outpatient departments deploy shockwave therapy for plantar fasciitis, and Scandinavian countries pioneer telerehabilitation for rural residents. Eastern Europe narrows the gap by modernising county hospitals with EU structural funds earmarked for rehabilitation upgrades. The Middle East and Africa show emerging momentum: Bahrain's Amana Healthcare facility opening in 2025 includes hydrotherapy pools, signalling government commitment under Vision 2030. South America remains price sensitive, yet private insurers in Brazil start covering neuromuscular electrical stimulation for post-operative cases, gradually broadening equipment import volumes.

- Enovis Corporation (DJO Global Inc.)

- BTL

- Zimmer MedizinSysteme (Enraf-Nonius BV)

- EMS Physio

- Patterson Medical (Performance Health)

- Dynatronics

- Zynex Medical

- HMS Medical system

- SEERS Medical

- Mectronic Medicale

- Guangzhou Longest Science&Technology Co.,Ltd.

- ITO Co. Ltd.

- Lifeward, Inc.

- Restorative Therapies

- Hocoma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising geriatric population & chronic disease burden

- 4.2.2 Expanding post-surgical & oncology rehabilitation demand

- 4.2.3 Rapid adoption of connected & portable physiotherapy devices

- 4.2.4 Growing investments in outpatient & sports medicine facilities

- 4.2.5 AI-driven tele-rehabilitation platforms gaining reimbursement (under-radar)

- 4.2.6 Exoskeleton & robotics integration in physiotherapy suites (under-radar)

- 4.3 Market Restraints

- 4.3.1 Shortage of skilled physiotherapists worldwide

- 4.3.2 Unfavorable or patchy reimbursement in developing markets

- 4.3.3 High upfront cost of advanced electro-mechanical systems

- 4.3.4 Cyber-security & data-compliance risk in connected devices (under-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Equipment Type

- 5.1.1 Electrotherapy

- 5.1.2 Ultrasound Therapy

- 5.1.3 Laser & Light Therapy

- 5.1.4 Shockwave Therapy

- 5.1.5 Magnetic & PEMF Therapy

- 5.1.6 Heat & Cryotherapy Systems

- 5.1.7 Hydrotherapy Systems

- 5.1.8 Multi-exercise & Rehabilitation Stations

- 5.1.9 Others

- 5.2 By Application

- 5.2.1 Musculoskeletal

- 5.2.2 Neurology

- 5.2.3 Cardiovascular and Pulmonary

- 5.2.4 Sports and Orthopedic Injuries

- 5.2.5 Pediatrics

- 5.2.6 Women's Health & OB/GYN

- 5.2.7 Others

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Rehabilitation Centers / Specialty Clinics

- 5.3.3 Home-care Settings

- 5.3.4 Ambulatory Surgical Centers

- 5.3.5 Others

- 5.4 By Distribution Channel

- 5.4.1 Direct Institutional Sales

- 5.4.2 E-commerce and Retail

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Enovis Corporation (DJO Global Inc.)

- 6.3.2 BTL Industries

- 6.3.3 Zimmer MedizinSysteme (Enraf-Nonius BV)

- 6.3.4 EMS Physio

- 6.3.5 Patterson Medical (Performance Health)

- 6.3.6 Dynatronics

- 6.3.7 Zynex Medical Inc.

- 6.3.8 HMS Medical Systems

- 6.3.9 SEERS Medical

- 6.3.10 Mectronic Medicale

- 6.3.11 Guangzhou Longest Science&Technology Co.,Ltd.

- 6.3.12 ITO Co. Ltd.

- 6.3.13 Lifeward, Inc.

- 6.3.14 Restorative Therapies

- 6.3.15 Hocoma

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment