PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850208

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850208

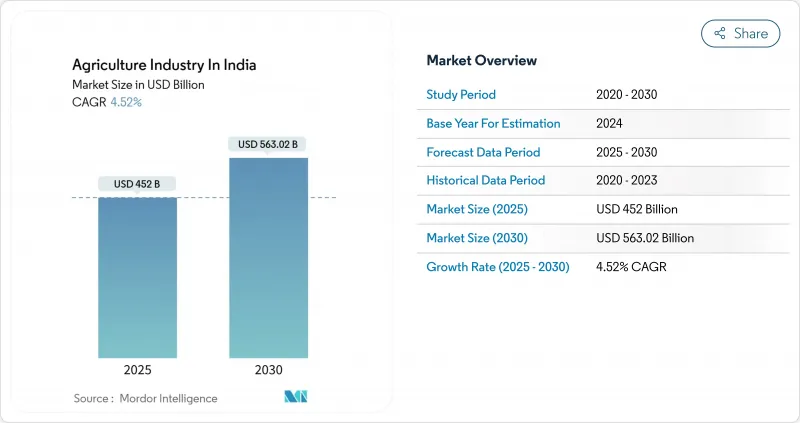

Agriculture Industry In India - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India agriculture market size reached USD 452 billion in 2025 and is forecast to rise to USD 563.02 billion by 2030, translating into a 4.52% CAGR over the period.

Strong government spending, broadened credit access, and rapidly growing digital infrastructure are combined to lift productivity and earnings across commodity segments. Digital platforms that link 11 crore farmers to formal finance, subsidies, and advisory services are already cutting transaction costs and improving price discovery. Robust foodgrain output of 354 million tons in 2024-25 reflects favorable monsoon conditions, higher minimum support prices, and wider use of improved seed cultivars. Trade reforms that streamline export certification and expand e-commerce hubs are widening access to premium overseas buyers, even as import substitution missions target edible oils and pulses deficits.

Agriculture Industry In India Market Trends and Insights

Government Support Through Subsidies and Policies

The Union Budget 2025-26 increased the Kisan Credit Card limit to Rs 5 lakh, unlocking larger working capital lines for smallholders and easing input purchases at critical crop stages. Prime Minister Dhan-Dhaanya Krishi Yojana channels resources to 100 low-productivity districts, bundling irrigation, precision farming training, and risk-mitigation tools. Minimum support price adjustments for 2024-25 favor oilseeds such as nigerseed and sesamum, encouraging diversification into high-value crops. Input subsidies, which account for 73% of the agriculture budget, reduce fertilizer and energy costs, creating a positive cycle of investment, productivity, and rural consumption.

Rising Adoption of Agri-tech and Mechanization

A Rs 6,000 crore allocation for digital agriculture infrastructure is funding AI-based crop surveys, drone-enabled nutrient mapping, and app-based credit scoring, helping farmers access formal loans within 24 hours. National mechanization now stands at 47%; Punjab and Haryana exceed 40-45%, while northeastern states remain largely manual, revealing significant headroom for expansion. The farm machinery market is forecast to grow from USD 16.73 billion in 2024 to USD 25.15 billion by 2029, driven by labor scarcity and better cash flows. Precision tools can boost yields by 30% and cut water and fertilizer use by 15-20%, improving profitability and resource efficiency.

Fragmented Landholdings and Declining Soil Fertility

Small and marginal farms now cover 85% of holdings, with average size falling below 2 hectares, making mechanization and scale efficiencies difficult without shared-service models. Fertility imbalances persist, with excess nitrogen and insufficient phosphorus-potassium inputs weakening soil structure and raising greenhouse-gas emissions. The Soil Health Card Scheme has expanded sampling, yet state-level adoption of balanced nutrient application remains uneven. Custom Hiring Centers that rent tractors and harvesters mitigate fragmentation constraints, though coverage gaps underline the need for expanded service networks.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Organic and Sustainable Farming

- Expanding Export Demand via New Trade Agreements

- Inadequate Cold-Chain and Storage Infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cereals and grains controlled 49.50% of the India agriculture market in 2024. The India agriculture market size for cereals is projected to advance steadily at the sector's average CAGR, helped by expanded irrigation and mechanized harvesting. Pulses and oilseeds remain vulnerable to yield fluctuations, prompting a Mission for Aatmanirbharta in Pulses to foster self-sufficiency. Targeted subsidies, climate-resilient varieties, and integrated pest-management programmes are projected to stabilize these sub-segments over the forecast horizon.

Fruits and vegetables form the fastest-growing slice of the India agriculture market, projected to clock a 7.80% CAGR through 2030 as urban diets diversify and export orders climb. Horticulture output rose to 355.2 million tons in 2023-24, including 112.62 million tons of fruit and 204.96 million tons of vegetables. Targeted subsidies, climate-resilient varieties, and integrated pest-management programmes are projected to stabilize these sub-segments over the forecast horizon.

The Agriculture Industry in India Report is Segmented by Commodity Type (Cereals and Grains, Pulses and Oilseed, and More). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government support through subsidies and policies

- 4.2.2 Rising adoption of agri-tech and mechanization

- 4.2.3 Growing demand for organic and sustainable farming

- 4.2.4 Expanding export demand via new trade agreements

- 4.2.5 Carbon-credit monetization from regenerative farming

- 4.2.6 Climate-resilient seed cultivars boosting yields

- 4.3 Market Restraints

- 4.3.1 Fragmented landholdings and declining soil fertility

- 4.3.2 Vulnerability to climate change and extreme weather

- 4.3.3 Inadequate cold-chain and storage infrastructure

- 4.3.4 Labor shortages from rural-to-urban migration

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Production Analysis by Volume, Consumption Analysis by Volume and Value, Import Analysis by Volume and Value, Export Analysis by Volume and Value, and Price Trend Analysis)

- 5.1 By Commodity Type

- 5.1.1 Cereals and Grains

- 5.1.1.1 Production Analysis

- 5.1.1.2 Consumption Analysis

- 5.1.1.3 Export Analysis

- 5.1.1.4 Import Analysis

- 5.1.1.5 Price Trend Analysis

- 5.1.2 Pulses and Oilseed

- 5.1.2.1 Production Analysis

- 5.1.2.2 Consumption Analysis

- 5.1.2.3 Export Analysis

- 5.1.2.4 Import Analysis

- 5.1.2.5 Price Trend Analysis

- 5.1.3 Fruits and Vegetables

- 5.1.3.1 Production Analysis

- 5.1.3.2 Consumption Analysis

- 5.1.3.3 Export Analysis

- 5.1.3.4 Import Analysis

- 5.1.3.5 Price Trend Analysis

- 5.1.4 Cash Crops

- 5.1.4.1 Production Analysis

- 5.1.4.2 Consumption Analysis

- 5.1.4.3 Export Analysis

- 5.1.4.4 Import Analysis

- 5.1.4.5 Price Trend Analysis

- 5.1.1 Cereals and Grains

6 Competitive Landscape

- 6.1 List of Stakeholders

7 Market Opportunities and Future Outlook