PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850209

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850209

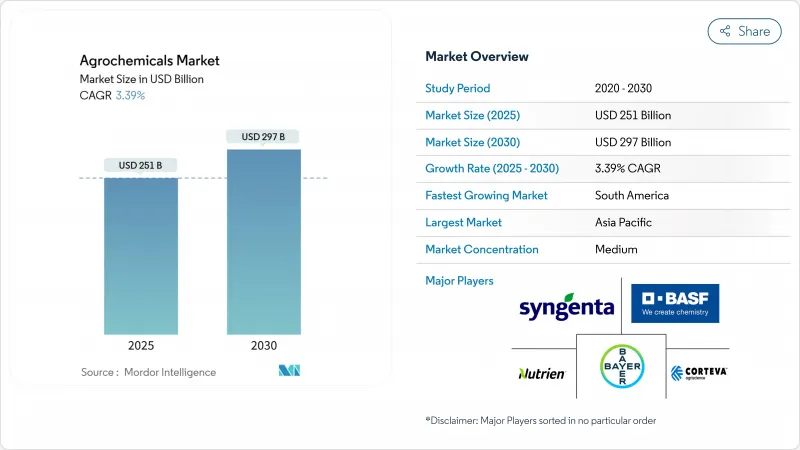

Agrochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The agrochemicals market reached USD 251 billion in 2025 and is forecast to rise to USD 297 billion by 2030, translating into a steady 3.39% CAGR.

Growth is supported by sustained fertilizer demand in large grain economies, rapid penetration of biological crop-protection products, and wider deployment of precision-agriculture tools that lift input-use efficiency. At the same time, the European Union's Farm to Fork mandate to halve chemical pesticide use by 2030, China's periodic fertilizer export curbs, and increasingly stringent residue limits in major import markets are forcing producers to accelerate portfolio shifts toward low-toxicity chemistries and digital advisory services. Biologicals are scaling quickly on the back of pesticide-tax regimes now active in 30 countries and streamlined Brazilian and Indian registration pathways, while premium herbicides with novel modes of action address the costly rise of resistant weeds. Competitive intensity is growing as generics erode margins on mature molecules and new "input-as-a-service" models reward outcome-based pricing over product volume, setting the stage for a decade defined by technology integration and sustainability credentials within the agrochemicals market.

Global Agrochemicals Market Trends and Insights

Escalating Herbicide-Resistant Weeds Spur Premium Herbicide Demand

Herbicide-resistant weeds now infest more than 270 million acres worldwide, pushing growers toward premium actives that deliver novel modes of action. FMC's Dodhylex active, the first new herbicide mode in three decades, secured its inaugural registration in Peru and targets resistant grass weeds in rice, with a commercial launch slated for August 2025. The United States Environmental Protection Agency's 2024 resistance-management framework reinforces integrated weed-management protocols, giving regulatory support to innovative formulations. Sumitomo Chemical's Rapidicil registration in Argentina underpins the competitive race to serve no-till systems, aiming for JPY 100 billion (USD 0.65 billion) in annual sales from conservation-tillage herbicides. Growers' willingness to pay remains strong because resistant weeds impose yearly global yield losses above USD 15 billion.

Convergence of AI-Enabled Input-as-a-Service Business Models

Digital farming platforms are displacing traditional product-only distribution by bundling agronomic advice, variable-rate prescriptions, and outcome-based guarantees. Bayer's CROPWISE platform now integrates field sensors, weather data, and satellite imagery to fine-tune spraying and fertilizing schedules. BASF and Agmatix apply machine-learning diagnostics to detect soybean cyst nematode stress before visual symptoms appear, protecting yields while cutting chemical load. Syngenta's tie-up with Taranis equips retailers with AI-powered scouting to drive precise input placement, converting one-time sales into subscription revenue. These services reduce chemical intensity per acre by up to 20%, aligning profitability with sustainability imperatives in the agrochemicals market.

Accelerating Phase-Outs of High-Toxicity Actives in EU, Brazil, and China

Regulators are shortening grace periods for active ingredients flagged for toxicity, forcing manufacturers to write off inventory and accelerate reformulation pipelines. The European Union's latest proposal eliminates certain organophosphates from sensitive habitats, while Brazil aligns approval criteria with the EU, removing nearly 200 legacy molecules by 2026. BASF shuttered its glufosinate plant in 2024, booking impairment charges linked to the tighter regulatory outlook. Chinese policies prioritize low-toxicity fungicides and biopesticides, expecting commercial volumes of 90,000 metric tons by 2025.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Biologicals Pushed by Pesticide-Tax Regimes

- Carbon-Credit Monetization of Nitrogen-Efficiency Products

- Volatile Glyphosate Pricing Squeezes Formulator Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fertilizers accounted for 46.0% of 2024 revenue inside the agrochemicals market, reflecting their indispensable role in macronutrient delivery to grains and oilseeds. Yet volatile natural gas prices inflated ammonia costs, squeezing margins for nitrogen producers and signaling a pivot toward efficiency technologies such as urease inhibitors and controlled-release coatings that reduce application rates by 15-25% without yield loss. The agrochemicals market size for fertilizers is forecast to expand at just 2.3% CAGR, slower than the overall market because of plateauing application rates in developed economies. Producers, therefore, emphasize premium polymer-coated lines and carbon-credit-linked offerings that capture value beyond volume.

The biological segment, encompassing microbials, botanicals, pheromones, and biochemicals, grew 14.7% in 2024 and is projected to reach USD 25 billion by 2030. Within that total, the agrochemicals market size for bio-insecticides is on track to advance at 15.2% CAGR, buoyed by European residue-limit tightening and Brazilian fast-track registrations. As a result, integrated pest-management programs now mix chemical and biological tools in single-season rotations, enabling suppliers to cross-sell proprietary strains and adjuvants. Major players such as Syngenta Biologicals and FMC pivot aggressively toward this space, accelerating mergers and acquisitions to fill portfolio gaps. Herbicides, fungicides, adjuvants, and plant growth regulators remain critical; and their combined share of the agrochemicals market is projected to decline slightly as biologicals cannibalize volume while fetching higher margins.

The Agrochemicals Market Report is Segmented by Product Type (Fertilizers, Pesticides, Adjuvants, and Plant Growth Regulators), by Application (Crop-Based and Non-Crop-Based), and by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained the highest regional revenue in 2024, accounting for 48.5% within the agrochemicals market, supported by intensive cultivation across China and India. China manufactures 50% of the worldwide active-ingredient output, yet domestic environmental rules now favor low-toxicity lines, stimulating investment in biopesticide capacity. India's contract development and manufacturing organizations secure multiyear deals that fill Western pipeline gaps, driving double-digit revenue growth. Japan accelerates the adoption of controlled-release fertilizers to meet emission targets, the Australia balances fertilizer demand with climate-induced drought adjustments. Government subsidy programs promoting digital soil testing and balanced nutrition enhance baseline consumption patterns.

South America is the fastest-growing territory, expanding by 4.4% CAGR through 2030. Brazil's biological market hit BRL 5 billion (USD 1 billion) in 2024, with uptake concentrated in soybean and cotton. Logistics bottlenecks persist; 62% of Brazilian agricultural roads are below optimal quality, raising costs and encouraging localized formulation plants. Argentina's no-till acreage exceeds 90%, underpinning demand for residue-compatible herbicides such as Rapidicil. Climate volatility, especially drought, boosts micronutrient and water-efficiency product sales, shaping a resilient business case for adaptive technologies within the agrochemicals market.

North America and Europe, though mature, remain innovation hubs. The United States contends with tariff proposals on Canadian potash that could raise farmer costs by USD 100 per ton, prompting interest in biological nitrogen replacement and potassium-solubilizing microbes. Canada promotes 4R nutrient-stewardship certification, linking lender incentives to fertilizer best practices. Europe's Farm to Fork strategy mandates 50% pesticide cuts by 2030, triggering accelerated biological approvals and digital traceability systems. The Middle East and Africa grew 3.4% and 4.1%, respectively, propelled by sovereign food-security investments, hydroponic adoption, and reclaimed desert farming, albeit from smaller bases. Collectively, these dynamics keep the agrochemicals market on a path of gradual volume growth complemented by higher-value product substitution.

- Syngenta Group

- Bayer Crop Science AG

- BASF Agricultural Solutions

- Corteva Agriscience

- Nutrien Ltd

- Yara International ASA

- Mosaic Company

- CF Industries Holdings

- UPL Ltd

- FMC Corporation

- Sumitomo Chemical AgroSolutions

- Nufarm Ltd

- K+S AG

- ICL Group

- OCP Group

- Albaugh LLC

- OCI Global

- RovensaNext

- Bharat Rasayan Ltd

- Helm AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating herbicide-resistant weeds spur premium herbicide demand

- 4.2.2 Convergence of AI-enabled Input-as-a-service business models

- 4.2.3 Surge in biologicals pushed by pesticide-tax regimes

- 4.2.4 Carbon-credit monetization of nitrogen-efficiency products

- 4.2.5 Mainstream expansion of controlled-release fertilizers

- 4.2.6 Crop diversification in vertical and indoor farms

- 4.3 Market Restraints

- 4.3.1 Accelerating phase-outs of high-toxicity actives in EU, Brazil and China

- 4.3.2 Volatile glyphosate pricing squeezes formulator margins

- 4.3.3 Rising Regulatory data-package costs

- 4.3.4 Chronic activist litigation risk in North America

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Fertilizers

- 5.1.1.1 Nitrogenous

- 5.1.1.2 Phosphatic

- 5.1.1.3 Potassic

- 5.1.2 Pesticides

- 5.1.2.1 Herbicides

- 5.1.2.2 Insecticides

- 5.1.2.3 Fungicides

- 5.1.2.4 Bio-pesticides

- 5.1.3 Adjuvants

- 5.1.4 Plant Growth Regulators

- 5.1.1 Fertilizers

- 5.2 By Application

- 5.2.1 Crop-based

- 5.2.1.1 Grains and Cereals

- 5.2.1.2 Pulses and Oilseeds

- 5.2.1.3 Fruits and Vegetables

- 5.2.2 Non-crop-based

- 5.2.2.1 Turf and Ornamental Grass

- 5.2.2.2 Other Non-crop-based

- 5.2.1 Crop-based

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Egypt

- 5.3.6.3 Rest of Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Syngenta Group

- 6.4.2 Bayer Crop Science AG

- 6.4.3 BASF Agricultural Solutions

- 6.4.4 Corteva Agriscience

- 6.4.5 Nutrien Ltd

- 6.4.6 Yara International ASA

- 6.4.7 Mosaic Company

- 6.4.8 CF Industries Holdings

- 6.4.9 UPL Ltd

- 6.4.10 FMC Corporation

- 6.4.11 Sumitomo Chemical AgroSolutions

- 6.4.12 Nufarm Ltd

- 6.4.13 K+S AG

- 6.4.14 ICL Group

- 6.4.15 OCP Group

- 6.4.16 Albaugh LLC

- 6.4.17 OCI Global

- 6.4.18 RovensaNext

- 6.4.19 Bharat Rasayan Ltd

- 6.4.20 Helm AG

7 Market Opportunities and Future Outlook