PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850218

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850218

Bulletproof Vest - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

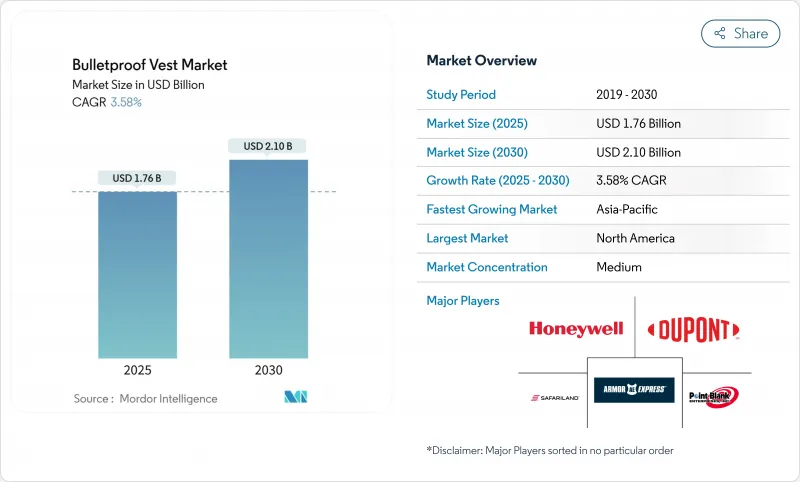

The bulletproof vest market stood at USD 1.76 billion in 2025 and is forecast to rise to USD 2.10 billion by 2030, reflecting a 3.58% CAGR that signals measured expansion as procurement programs mature and new threat profiles emerge.

Growth hinged on defense modernization in Europe and Asia-Pacific, rapid adoption of lightweight soft armor by law enforcement agencies, material innovations that balanced protection with mobility, and tighter certification standards that raised replacement demand. Rising executive protection spending, particularly in North America and Western Europe, broadened the customer base beyond traditional military buyers. Meanwhile, the Ukraine conflict reshaped European procurement priorities, prompting local manufacturers to scale capacity and accelerating the adoption of Level IV plates for multi-hit scenarios. Ongoing raw-material price swings and counterfeit equipment scandals tempered near-term growth yet spurred demand for authenticated, NIJ-certified gear.

Global Bulletproof Vest Market Trends and Insights

Escalating Defense Modernization Programs

European, Asian, and North American armies pursued large-scale re-capitalization programs prioritizing survivability, driving orders for next-generation plates and carriers. France adopted the modular G3P system with boron-carbide inserts and real-time damage sensors, while Germany delivered 100,000 MOBAST vests to its troops, underscoring demand for scalable, technology-enabled solutions. Canada's USD 19.7 million contract for 3,000 advanced sets further exemplified the modernization wave. These programs emphasized modularity, integration with soldier-worn sensors, and ergonomic adjustments for diverse body types, including female personnel, indicating a systemic shift toward user-centric armor design. Long-run funding commitments sheltered suppliers from short-term budget volatility.

Rising Procurement of Lightweight Soft Armor by Law Enforcement

Police departments in the United States and Europe increased orders for soft vests that cut officer fatigue without sacrificing NIJ compliance. DuPont's Kevlar EXO and Dyneema's SB301 reduced weight by up to 30% compared with prior fabrics, widening daily-wear adoption. Updated NIJ Standard 0101.07 introduced gender-specific fit testing that aligned procurement specifications with a more diverse workforce. Department of Justice field trials found negligible core-temperature increases among 504 officers wearing modern armor, dispelling heat-stress concerns and strengthening compliance rates. These factors collectively lifted replacement cycles and spurred backlog orders across municipal agencies.

Volatile Aramid and UHMWPE Raw Material Prices

Aramid and UHMWPE costs swung sharply with petrochemical inputs and capacity additions, compressing margins for armor assemblers that lacked long-term supply pacts. DuPont's USD 768 million goodwill impairment in Q1 2025 highlighted profitability headwinds inside legacy aramid lines. Chinese UHMWPE makers undercut Western rivals on price, forcing brand-name suppliers to justify premiums through tighter quality control and PFAS-free chemistries. Research confirmed that resin-parameter variance directly affected fiber modulus, elevating scrap risk and raising processing costs during quality re-work. The resulting cost pass-through squeezed procurement budgets and elongated purchasing cycles

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Female-Fit Ballistic Vests

- Adoption of Multi-Hit Ceramic-UHMWPE Hybrid Plates

- Proliferation of Counterfeit/Uncertified Body-Armor Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard configurations captured 84.21% of 2024 sales, confirming operational priorities that favored armored plate carriers able to withstand rifle fire. The bulletproof vest market size for hard vests was expected to increase by 3.66% CAGR to 2030, fueled by battlefield reports emphasizing multi-hit survivability against armor-piercing rounds. Military buyers demanded modular carriers that integrated communications routing, trauma packs, and identification panels, compressing legacy soft-armor share.

Material advances trimmed weight penalties, allowing infantry to add side plates or deltoid protection without breaching load thresholds. Soft vests remained essential for undercover police and VIP details that required concealment, yet their unit share contracted as weight savings in hard plates narrowed the mobility gap. 3D-knit fabrics and spacer meshes improved thermal regulation inside soft carriers, hinting at future crossover products that merge plate pockets with concealable textiles.

Aramid preserved 53.56% of 2024 revenues, but UHMWPE climbed fastest at a 4.12% CAGR on the strength of higher specific energy absorption and buoyancy for maritime missions. PPTA/UHMWPE laminates outperformed single-fiber layups, demonstrating that hybrid stacks supplied optimal back-face deformation control during NIJ RF1 trials. Dyneema's PFAS-free grades attracted buyers in Europe, where chemical-safety rules tightened.

Price volatility remained a drag on UHMWPE adoption because refinery outages and freight instability jolted feedstock costs. Still, suppliers secured long-term offtake agreements with plate assemblers, locking in volume discounts and shielding programs from spot-market spikes. Research into chainmail-like 2D polymers signaled the next leap, promising 47-fold stiffness gains and weights below contemporary UHMWPE sheets.

The Bulletproof Vest Market Report is Segmented by Type (Soft Vest and Hard Vest), Material (Aramid Fibers, UHMWPE Fibers, Ceramic and Composite Inserts, and More), Protection Level (Level II, Level IIIA, and More), End User (Military and Civilian, and Law Enforcement ), and Geography (North America, Europe, South America, Asia-Pacific, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 42.29% of global sales in 2024 as sustained federal grants and proximity to major prime contractors anchored purchase volumes. Point Blank and Safariland exploited vertical integration to compress lead times. At the same time, US reshoring initiatives heightened site-security spending across new defense-industrial facilities, and some faced 75-point differences in security risk scores within a single metro area. Canada's 2025 contract award confirmed a regional pipeline of modular plate carriers with delivery slated for 2026.

Asia-Pacific charted a 3.90% CAGR to 2030, propelled by 6.2% year-on-year growth in East-Asian defense budgets and indigenous production scale-ups in India, China, and South Korea. MKU's Kavro Doma 360 helmet order illustrated the region's preference for localized supply chains that met fast-track delivery targets for frontline units. Chinese UHMWPE exporters drove price competition, enhancing affordability for emerging Southeast-Asian buyers who balanced capability with budget caps.

Europe underwent structural realignment after the Ukraine war sparked ammunition and armor shortages, prompting EU funding worth EUR 500 million to boost defense manufacturing, including body armor fabrication lines. Germany's 100,000-unit MOBAST delivery and France's roll-out of the G3P vest indicated continental commitment to home-grown solutions that met NATO STANAG specifications. Bulgaria's new 150,000 m2 plant broadened European supplier diversity and signaled investor confidence in long-run volume. Ongoing recalls in the United Kingdom highlighted compliance gaps that encouraged agencies to centralize testing at NATO-accredited labs.

- Point Blank Enterprises, Inc.

- Safariland, LLC

- Central Lake Armor Express, Inc.

- MKU Limited

- EnGarde B.V.

- ELMON S.A.

- U.S. Armor Corporation

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- Hardshell Ltd.

- Indian Armour Systems Pvt. Ltd.

- ARGUN s.r.o.

- Seyntex N.V.

- MARS Armor

- Zhejiang Hua An Safety Equipment Co. Ltd.

- Survival Armor

- GARED s.r.o.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating defense modernization programs

- 4.2.2 Rising procurement of lightweight soft armor by law-enforcement

- 4.2.3 Growing demand for female-fit ballistic vests

- 4.2.4 Adoption of multi-hit ceramic-UHMWPE hybrid plates

- 4.2.5 Intensifying geopolitical conflicts and territorial disputes

- 4.2.6 Expansion of private security and VIP protection industry

- 4.3 Market Restraints

- 4.3.1 Volatile aramid and UHMWPE raw-material prices

- 4.3.2 Stringent export licensing for ballistic products

- 4.3.3 Heat-stress and back-face deformation concerns in tropical climates

- 4.3.4 Proliferation of counterfeit / uncertified body-armor products

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Soft Vest

- 5.1.2 Hard Vest

- 5.2 By Material

- 5.2.1 Aramid Fibers

- 5.2.2 UHMWPE Fibers

- 5.2.3 Ceramic and Composite Inserts

- 5.2.4 Steel and Other Materials

- 5.3 By Protection Level

- 5.3.1 Level II

- 5.3.2 Level IIIA

- 5.3.3 Level III

- 5.3.4 Level IV

- 5.4 By End User

- 5.4.1 Military

- 5.4.2 Civilian and Law Enforcement

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Point Blank Enterprises, Inc.

- 6.4.2 Safariland, LLC

- 6.4.3 Central Lake Armor Express, Inc.

- 6.4.4 MKU Limited

- 6.4.5 EnGarde B.V.

- 6.4.6 ELMON S.A.

- 6.4.7 U.S. Armor Corporation

- 6.4.8 DuPont de Nemours, Inc.

- 6.4.9 Honeywell International Inc.

- 6.4.10 Hardshell Ltd.

- 6.4.11 Indian Armour Systems Pvt. Ltd.

- 6.4.12 ARGUN s.r.o.

- 6.4.13 Seyntex N.V.

- 6.4.14 MARS Armor

- 6.4.15 Zhejiang Hua An Safety Equipment Co. Ltd.

- 6.4.16 Survival Armor

- 6.4.17 GARED s.r.o.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment