PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850223

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850223

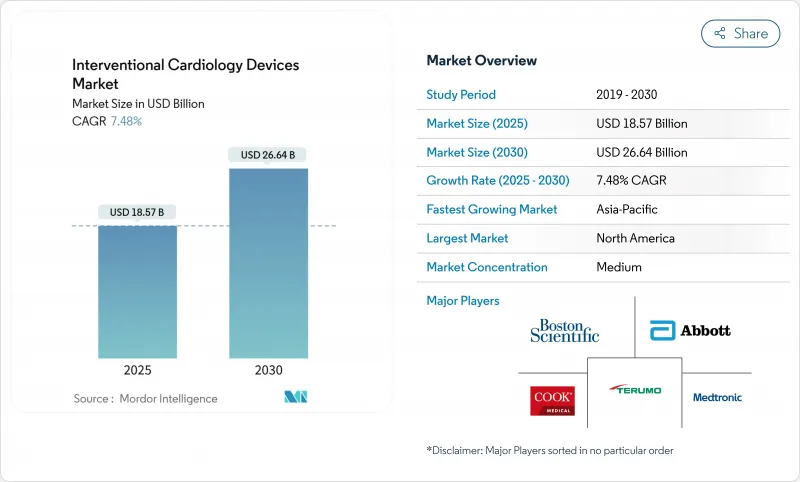

Interventional Cardiology Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The interventional cardiology devices market generated USD 18.57 billion in 2025 and is forecast to reach USD 26.64 billion by 2030, registering a 7.48% CAGR.

Current growth is anchored by brisk uptake of minimally invasive procedures that rely on drug-eluting stents, intravascular lithotripsy (IVL) systems and AI-enhanced imaging. The expanding global burden of coronary artery disease (CAD), together with same-day discharge pathways and ambulatory surgical center (ASC) adoption, continues to enlarge the addressable patient pool. Product pipelines are shifting toward thinner-strut, bio-resorbable platforms as regulators and providers place greater emphasis on long-term safety and sustainability. Competitive intensity is rising as large manufacturers pursue acquisitions that add differentiated technologies and shore up supply chains. Escalating regulatory scrutiny, workforce shortages and material legislation present headwinds but have not derailed the market's upward trajectory.

Global Interventional Cardiology Devices Market Trends and Insights

Growing Prevalence of CAD & PCI Procedures

CAD remains the leading global cause of mortality, affecting more than 20 million adults in the United States alone. Aging populations, obesity and sedentary lifestyles are increasing procedural demand, particularly for multivessel disease and complex calcified lesions that benefit from IVL therapy. Asia-Pacific markets show the steepest rise as urbanization alters dietary and activity patterns. Re-interventions now constitute a larger portion of procedural volume because CAD is managed as a chronic condition, sustaining device utilization beyond single-episode care.

Accelerating Shift to Minimally Invasive Therapies

Hospitals and payers favor percutaneous approaches that shorten admissions and reduce complications. The COVID-19 pandemic reinforced this preference and catalyzed adoption of drug-eluting balloons and bio-resorbable scaffolds. AI-assisted imaging enhances precision, lowers contrast load and expands eligibility for elderly or comorbid patients once deemed high risk for open surgery.

Stringent Multi-Region Regulatory Pathways

EU Medical Device Regulation demands more rigorous clinical data and post-market surveillance, increasing time-to-market and compliance costs. Concurrently, the United States has heightened recall oversight after several Class I events. Divergent regional requirements force manufacturers to run parallel approval programs, straining smaller innovators.

Other drivers and restraints analyzed in the detailed report include:

- Continuous DES Price Erosion Expanding Addressable Pool

- AI-Augmented Pre-PCI Imaging & Decision Support Adoption

- Global Shortage of Cath-Lab Personnel & Interventional Cardiologists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Coronary stents generated the largest revenue, holding 41.35% of the interventional cardiology devices market in 2024, supported by durable demand for percutaneous interventions. IVL platforms, although nascent, are forecast to advance at 11.25% CAGR through 2030. The interventional cardiology devices market size for IVL technology is expected to expand markedly as heavily calcified lesions become more frequently treated percutaneously. Ultra-thin-strut drug-eluting stents and next-generation bio-absorbable scaffolds reduce restenosis and facilitate physiologic vessel healing. Bare-metal stents are now reserved for patients requiring abbreviated dual antiplatelet therapy. PTCA balloons and guidewires maintain steady volume growth, with drug-coated balloons gaining attention for in-stent restenosis management following FDA approval of the Agent platform in 2024.

Procedural adjuncts such as IVUS and OCT catheters benefit from AI overlays that refine lesion assessment and optimize device sizing. Hemostasis devices that enable immediate ambulation are integral to same-day discharge protocols. Collectively, these innovations bolster procedural efficiency and extend the clinical reach of PCI.

The Interventional Cardiology Devices Market Report is Segmented by Product Type (Coronary Stents [Bare-Metal Stents, and More], Catheters [Angiography Catheters, and More], PTCA Balloons, Guide Wires, and More), End-User (Hospitals, Ambulatory Surgical Centers, and More), Material (Cobalt-Chromium Alloy, Nitinol, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the interventional cardiology devices market with 41.82% revenue in 2024 on the back of broad insurance coverage, robust clinical research networks and rapid uptake of AI-guided imaging. The region is also pioneering ASC adoption and same-day discharge for complex PCI, although FDA recall vigilance and cath-lab staffing gaps temper growth. Europe follows as a mature yet innovation-friendly arena where sustainability initiatives encourage bio-resorbable scaffolds and lower-carbon supply chains. MDR compliance costs weigh on small manufacturers, but Germany and France continue to pilot early human use of next-generation devices.

Asia-Pacific is the standout growth engine with a 12.61% forecast CAGR. China's public insurance expansion and hospital construction boom are scaling PCI volumes, while India's price-capped environment favors cost-effective DES platforms anchored by local production. Japan's stringent approval process slows rollouts but commands premium pricing once clearance is secured. South Korea and Australia showcase high procedural quality and early AI integration, positioning them as secondary innovation hubs. Together these trends are set to re-shape regional competitive dynamics and redistribute future revenue pools within the interventional cardiology devices market.

- Abbott Laboratories

- Medtronic

- Boston Scientific

- B. Braun

- Terumo Corp.

- Biosensors International

- BIOTRONIK

- Cardinal Health

- Cook Group

- Koninklijke Philips

- Edwards Lifesciences Corp.

- Nano Therapeutics Pvt. Ltd.

- Shockwave Medical Inc.

- Merit Medical Systems

- Siemens Healthineers

- AngioDynamics

- C. R. Bard (BD)

- MicroPort Scientific Corp.

- Alvimedica

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of CAD & PCI Procedures

- 4.2.2 Accelerating Shift To Minimally-Invasive Therapies

- 4.2.3 Continuous DES Price Erosion Expanding Addressable Pool

- 4.2.4 AI-Augmented Pre-PCI Imaging & Decision Support Adoption

- 4.2.5 Hospital Migration To Same-Day Discharge & ASC Settings

- 4.2.6 Sustainability Push For Fully Bio-Resorbable Platforms

- 4.3 Market Restraints

- 4.3.1 Stringent Multi-Region Regulatory Pathways

- 4.3.2 Availability Of Potent First-Line Pharmacotherapy

- 4.3.3 Global Shortage Of Cath-Lab Personnel & Interventional Cardiologists

- 4.3.4 Anti-Plastic Legislation Challenging Polymer-Based DES Supply Chain

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Coronary Stents

- 5.1.1.1 Bare-metal Stents

- 5.1.1.2 Drug-eluting Stents

- 5.1.1.3 Bio-absorbable Scaffolds

- 5.1.2 Catheters

- 5.1.2.1 Angiography Catheters

- 5.1.2.2 IVUS/OCT Catheters

- 5.1.2.3 PTCA Guiding Catheters

- 5.1.3 PTCA Balloons

- 5.1.4 Guidewires

- 5.1.5 Hemostasis & Vascular Closure Devices

- 5.1.6 Intravascular Lithotripsy (IVL) Systems

- 5.1.1 Coronary Stents

- 5.2 By End-user

- 5.2.1 Hospitals

- 5.2.2 Ambulatory Surgical Centers

- 5.2.3 Cardiac Catheterization Labs

- 5.3 By Material

- 5.3.1 Cobalt-Chromium Alloy

- 5.3.2 Platinum-Chromium Alloy

- 5.3.3 Nitinol

- 5.3.4 Polymer/Bio-resorbable

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Medtronic PLC

- 6.3.3 Boston Scientific Corp.

- 6.3.4 B. Braun Melsungen AG

- 6.3.5 Terumo Corp.

- 6.3.6 Biosensors International

- 6.3.7 Biotronik SE & Co. KG

- 6.3.8 Cardinal Health Inc.

- 6.3.9 Cook Medical Inc.

- 6.3.10 Koninklijke Philips N.V.

- 6.3.11 Edwards Lifesciences Corp.

- 6.3.12 Nano Therapeutics Pvt. Ltd.

- 6.3.13 Shockwave Medical Inc.

- 6.3.14 Merit Medical Systems

- 6.3.15 Siemens Healthineers AG

- 6.3.16 AngioDynamics Inc.

- 6.3.17 C. R. Bard (BD)

- 6.3.18 MicroPort Scientific Corp.

- 6.3.19 Alvimedica

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment