PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850234

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850234

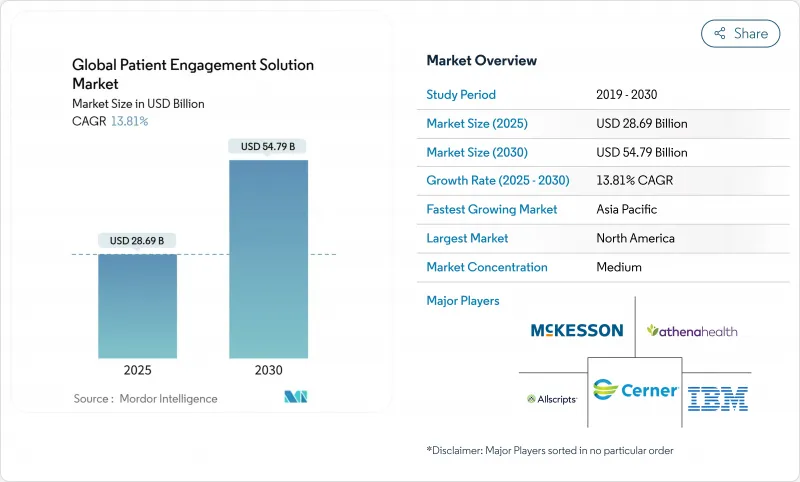

Patient Engagement Solution - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Patient Engagement Solution Market size is estimated at USD 28.69 billion in 2025, and is expected to reach USD 54.79 billion by 2030, at a CAGR of 13.81% during the forecast period (2025-2030).

Growth is propelled by the healthcare sector's pivot toward value-based care, the rapid maturation of AI-enabled engagement platforms, and mounting evidence that connected patients are more adherent to treatment plans. North America continues to set the pace, but Asia-Pacific's digital-health momentum, broad smartphone access, and favorable policy shifts position the region for outsized gains. Cloud deployment, omni-channel engagement, and tighter EHR interoperability are solidifying competitive advantages for vendors that can offer turnkey, enterprise-grade solutions. Despite strong demand signals, data-security compliance and persistent talent shortages present headwinds that could temper adoption in the near term.

Global Patient Engagement Solution Market Trends and Insights

Rapid Adoption of AI-Driven Engagement Platforms in Hospitals

Hospitals are embedding conversational AI, predictive analytics, and automated triage into front-office and clinical workflows. Eighty-two percent of health systems surveyed plan to implement AI-enabled engagement tools within two years. Early adopters report shorter wait times, smoother care transitions, and higher clinician satisfaction, largely because virtual assistants pre-populate charts and handle routine queries. Philips found that 85% of executives now allocate specific budgets for generative-AI engagement projects.As algorithms mature, hospitals see improved appointment adherence and a decline in no-shows, producing measurable revenue uplift while strengthening patient loyalty.

Rising Trend of Mobile Health Applications

Smartphone-centric care pathways give patients real-time access to their medical data, chatbots, and behavioral nudges, which has helped lift portal log-in rates across large health systems. Asia-Pacific leads mobile-health downloads, yet North American providers record the highest per-user session length. Health organizations are layering video visits, secure messaging, and remote vitals capture into single apps, building an omni-channel presence that mirrors consumer-tech experiences. The approach reduces inbound call-center volume and accelerates follow-up scheduling, delivering cost savings and better care continuity.

Protection of Patient Information

Data security concerns represent a significant restraint on market growth, as healthcare organizations must balance enhanced patient engagement with stringent data protection requirements. With over 5,000 reported healthcare data breaches from 2009 to 2022, the industry faces mounting pressure to implement robust security frameworks while maintaining user-friendly engagement solutions. The implementation of regulations like HIPAA in the US and GDPR in Europe creates compliance challenges that can slow adoption, particularly for smaller healthcare providers with limited IT resources. Healthcare organizations are increasingly turning to frameworks like the HITRUST Common Security Framework (CSF) to address these challenges, but implementation requires significant investment in both technology and expertise. The need for secure authentication mechanisms that don't compromise user experience presents a particular challenge, as cumbersome security measures can reduce patient engagement rates and limit the effectiveness of otherwise valuable solutions.

Other drivers and restraints analyzed in the detailed report include:

- Growing Popularity Among the Aging Population

- Rising Investments and Technological Advancements

- Lack of Skilled IT Professionals in the Healthcare Industry

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software commands the largest share of the Patient Engagement Solution Market at 56.31% in 2024, serving as the cornerstone of digital transformation initiatives across healthcare organizations. This dominance stems from software's ability to integrate seamlessly with existing healthcare IT infrastructure while providing the functionality necessary for meaningful patient interactions. Patient portals, mobile applications, and telehealth platforms represent the most widely adopted software solutions, with features ranging from appointment scheduling to secure messaging and access to medical records. The services segment, while currently smaller, is experiencing the fastest growth at a CAGR of 16.09% for 2025-2030, as healthcare organizations increasingly recognize the importance of implementation support, training, and ongoing maintenance to maximize their technology investments. Hardware components, including kiosks, tablets, and wearable devices, play a supporting but essential role in the overall ecosystem, particularly in clinical settings where direct patient interaction is required.

The software landscape is evolving rapidly with AI integration emerging as a defining trend, as 85% of healthcare leaders invest in generative AI to enhance clinician productivity and patient engagement. Interoperability has become a critical focus area, with healthcare organizations prioritizing solutions that can exchange data seamlessly across disparate systems to create a unified patient experience. The shift toward cloud-based software delivery models is accelerating, driven by advantages in scalability, accessibility, and reduced IT overhead. Services providers are expanding their offerings beyond basic implementation to include strategic consulting, workflow optimization, and continuous improvement programs that help healthcare organizations maximize the value of their patient engagement investments. The component ecosystem continues to evolve in response to changing healthcare delivery models, with an increasing emphasis on solutions that support care delivery outside traditional clinical settings.

Web and cloud-based solutions collectively dominate the market with a 70.31% share in 2024, reflecting healthcare's decisive shift away from legacy on-premise systems. Cloud-based solutions specifically are experiencing explosive growth at a CAGR of 18.94% for 2025-2030, as healthcare organizations recognize the advantages in scalability, accessibility, and reduced IT burden. The economic case for cloud adoption is compelling, with cloud deployments being 77% cheaper than on-premises systems and offering significant reductions in maintenance costs. On-premise solutions retain relevance primarily in settings with specific security requirements or connectivity limitations, but their market share continues to decline as cloud security capabilities mature and connectivity infrastructure improves.

The transition to cloud-based delivery models is enabling new capabilities that were previously impractical, including real-time data analytics, seamless multi-device experiences, and rapid feature updates that keep pace with evolving healthcare needs. Healthcare organizations are increasingly adopting hybrid approaches that combine cloud and on-premise elements to balance security, compliance, and accessibility requirements. The cost structure of cloud solutions, typically following a 'per user per month' model, is proving particularly attractive for smaller healthcare organizations that lack the capital for large upfront investments. Security concerns that previously limited cloud adoption are being addressed through advanced encryption, multi-factor authentication, and compliance certifications, with many cloud providers now exceeding the security capabilities of traditional on-premise deployments. The flexibility of cloud-based solutions is proving especially valuable during healthcare disruptions, enabling rapid deployment of new engagement capabilities in response to changing patient needs and care delivery models.

The Patient Engagement Solution Market Report Segments the Industry Into by Component (Hardware, Software, Services), Delivery Mode (Web-Based and Cloud-Based, On-Premise), Application (Social and Behavioral Management, and More), End User (Providers, Payers, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains its dominant position in the Patient Engagement Solution Market with a 42.15% share in 2024, driven by advanced healthcare infrastructure, favorable reimbursement policies, and early adoption of digital health technologies. The region's leadership is reinforced by strong regulatory support for patient engagement initiatives, including Meaningful Use requirements and value-based care programs that incentivize provider investments in engagement technologies. A comprehensive survey by the Healthcare Information and Management Systems Society (HIMSS) indicates that 61% of U.S. healthcare organizations have prioritized patient experience and engagement initiatives in their strategic plans, with 72% planning to increase investments in digital patient engagement technologies by 2026. The integration of AI-powered engagement solutions is particularly advanced in this region, with applications ranging from automated appointment scheduling to personalized health recommendations and virtual health assistants. Canada and Mexico are following similar adoption trajectories, though at a somewhat slower pace due to differences in healthcare system structures and funding mechanisms.

Asia-Pacific represents the fastest-growing regional market with a projected CAGR of 17.77% for 2025-2030, fueled by rapidly expanding healthcare infrastructure, increasing smartphone penetration, and growing middle-class populations with higher healthcare expectations. China leads regional growth with substantial investments in digital health infrastructure and patient-centered care initiatives, while India is experiencing accelerated adoption driven by government digital health programs and a burgeoning telehealth sector. Japan's aging population is creating unique engagement challenges and opportunities, with solutions increasingly focused on remote monitoring and chronic disease management for elderly patients. Australia and South Korea are at the forefront of integrating advanced technologies like AI and IoT into patient engagement platforms, creating more personalized and proactive care experiences. The region's growth is further supported by increasing healthcare expenditure and a strong focus on improving healthcare accessibility in both urban and rural areas.

Europe holds a significant market share, with countries like Germany, the United Kingdom, and France leading adoption of patient engagement solutions. The region's strict data protection regulations, particularly GDPR, have shaped the development of engagement platforms with enhanced privacy features and transparent data governance practices. The Middle East and Africa region, while currently representing a smaller market share, is experiencing growing adoption particularly in Gulf Cooperation Council (GCC) countries where healthcare modernization initiatives are driving investments in patient engagement technologies. South America shows promising growth potential, with Brazil leading regional adoption as healthcare providers seek to address access challenges through digital engagement solutions. The global nature of the patient engagement market is increasingly evident, with solutions being adapted to address region-specific healthcare challenges while maintaining core functionality that transcends geographic boundaries.

- Oracle Cerner Corporation

- Epic Systems

- Allscripts

- Athenahealth

- Mckesson

- IBM

- GetWellNetwork

- Lincor Solutions

- Medecision

- Medhost

- Orion Health Ltd.

- WelVU

- YourCareUniverse Inc.

- AdvancedMD

- Kareo

- Meditech

- CureMD Healthcare

- NextGen Healthcare

- Tebra Technologies

- TeleVox (Odeza)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption of AI-Driven Engagement Platforms in Hospitals

- 4.2.2 Rising Trend of Mobile Health Applications

- 4.2.3 Growing Popularity of Patient Engagement Solutions Among the Aging Population

- 4.2.4 Rising Investments and Technological Advancements

- 4.2.5 Shift from Fee-for-Service to Risk-Sharing Contracts Fuelling Payer Demand

- 4.2.6 Integration of Remote Patient Monitoring with Value-Based Care Reimbursement

- 4.3 Market Restraints

- 4.3.1 Protection of Patient Information

- 4.3.2 Lack of Skilled IT Professionals in the Healthcare Industry

- 4.3.3 Persistent Interoperability Gaps Between EHR and Third-Party Engagement Apps

- 4.3.4 Sub-Optimal Reimbursement Codes for Home-Health Engagement

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Delivery Mode

- 5.2.1 Web-Based and Cloud-Based

- 5.2.2 On-Premise

- 5.3 By Application

- 5.3.1 Social and Behavioral Management

- 5.3.2 Fitness and Health Management

- 5.3.3 Home Healthcare Management

- 5.3.4 Financial Management

- 5.3.5 Population Health Management

- 5.4 By End User

- 5.4.1 Providers (Hospitals, Clinics, ACOs)

- 5.4.2 Payers (Public and Private Insurers)

- 5.4.3 Patients & Caregivers

- 5.4.4 Pharmaceutical Companies

- 5.4.5 Pharmacies and Retail Health Chains

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Oracle Cerner Corporation

- 6.3.2 Epic Systems Corporation

- 6.3.3 Allscripts Healthcare Solutions Inc.

- 6.3.4 Athenahealth Inc.

- 6.3.5 McKesson Corporation

- 6.3.6 IBM Corporation

- 6.3.7 GetWellNetwork Inc.

- 6.3.8 Lincor Solutions

- 6.3.9 Medecision Inc.

- 6.3.10 MEDHOST

- 6.3.11 Orion Health Ltd.

- 6.3.12 WelVU

- 6.3.13 YourCareUniverse Inc.

- 6.3.14 AdvancedMD

- 6.3.15 Kareo

- 6.3.16 MEDITECH

- 6.3.17 CureMD Healthcare

- 6.3.18 NextGen Healthcare

- 6.3.19 Tebra Technologies

- 6.3.20 TeleVox (Odeza)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment