PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850235

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850235

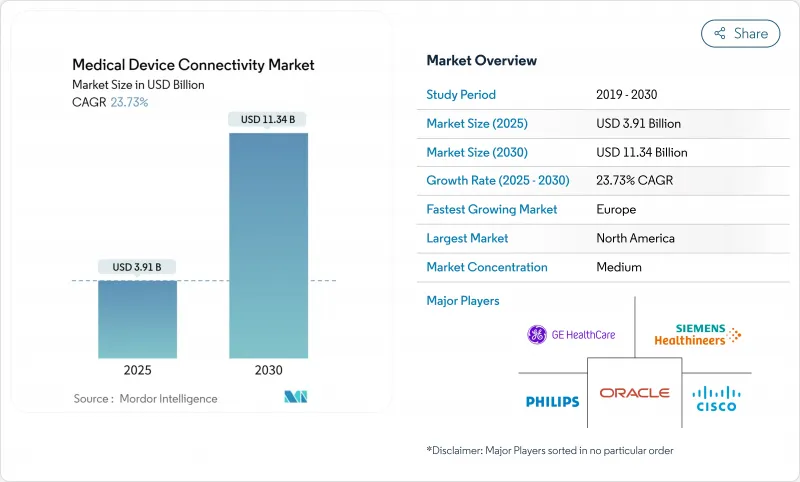

Medical Device Connectivity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global medical device connectivity market size will reach USD 3.91 billion in 2025 and is forecast to reach USD 11.34 billion by 2030, registering a 23.73% CAGR.

Rapid digitization of healthcare, mounting clinician workload, and the move to value-based reimbursement are driving demand for seamless device-to-system data exchange. Healthcare providers are replacing proprietary protocols with open standards to ease information blocking penalties and reduce documentation time. Rising specialist shortages are expanding Tele-ICU programs, while continuous monitoring across acute, ambulatory, and home settings is lowering readmissions and improving care coordination. Investments in secure connectivity architectures are accelerating as regulators tighten cybersecurity oversight and 6G research promises ultra-reliable, low-latency wireless links for critical care applications.

Global Medical Device Connectivity Market Trends and Insights

EMR interoperability mandates and digital-health policies

Standardized APIs mandated by the 21st Century Cures Act are forcing a shift from proprietary protocols to FHIR-based exchanges. Health systems completing compliance programs have cut documentation time by 13% and improved care coordination, encouraging broader deployment of connectivity engines. Device makers now design interoperability into new products to avoid costly retrofit cycles and to accelerate FDA clearance processes that increasingly weigh connectivity safeguards.

Outcome-based reimbursement demanding real-time data

CMS alternative payment models link revenue to clinical outcomes, pushing hospitals to instrument beds with continuous monitoring and edge analytics that flag patient deterioration early. Health systems using connected RPM platforms have reported 24% lower readmissions for heart failure, aligning financial and quality incentives. This business case is strongest in intensive care units, stroke wards, and oncology infusion centers, where preventable adverse events carry steep penalties.

Heterogeneous legacy device fleets without data standards

Hospitals often operate infusion pumps, ventilators, and monitors with life cycles exceeding eight years, many of which lack patchable operating systems. Interface engines must translate vendor-specific protocols, increasing project timelines and demanding continuous maintenance. Isolation networks protect vulnerable endpoints, yet duplicative wiring adds cost and complexity to expansion projects.

Other drivers and restraints analyzed in the detailed report include:

- Convergence of IoT cybersecurity frameworks

- Cloud-native analytics enabling predictive clinical insights

- High upfront integration and interface-engine costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Connectivity solutions held 63.67% of 2024 revenue, establishing them as the backbone for normalizing heterogeneous device data and enforcing rapidly evolving interoperability rules. These platforms translate HL7v2, FHIR, and proprietary streams into EHR-ready payloads that feed clinical decision support engines. Vendor neutral gateways such as Mirth Connect provide open-source flexibility, while enterprise suites bundle device libraries, alarm management, and analytics modules. Health systems deploy redundant server clusters to maintain near-zero downtime for high-acuity wards. As refresh cycles accelerate, the medical device connectivity market increasingly favors solutions offering out-of-the-box adapters for infusion pumps, anesthesia machines, and wireless telemetry packs.

Connectivity services are forecast to grow 26.12% annually as hospitals outsource implementation, maintenance, and cybersecurity patching. Managed-service contracts guarantee uptime, shield providers from staffing shortages, and ensure compliance documentation stays current. Small and mid-size facilities choose subscription models that convert capital expenditure into predictable operating costs. Service firms bundle interface tuning, 24 X 7 monitoring, and change-control governance across multi-vendor estates. This trend positions the services sub-segment as a key revenue accelerator within the broader medical device connectivity market.

Wired links represented 57.92% of 2024 sales, anchored by shielded Ethernet backbones in critical care and surgical suites. Real-time waveform fidelity and known latency profiles keep hard-wired networks indispensable for high-bandwidth, life-support devices. Replacement cycles are slow because rewiring operating theatres disrupts clinical throughput and requires rigorous validation. Even so, hospitals upgrading core switches to support power-over-Ethernet enable future device classes without additional outlets, extending the relevance of wired infrastructure within the medical device connectivity market.

Wireless technologies are expected to rise 25.86% CAGR on the back of 5G upgrades and forthcoming 6G research that promises sub-millisecond latency. Access point density is increasing in general wards to support telemetry belts, wearable ECG patches, and smart beds transmitting posture and falls data. Wi-Fi 6E deployments carve new spectrum free of legacy interference, while private 5G slices offer deterministic quality of service for mobile CT scanners and rapid response carts. Hospitals report smoother patient transfers when IV pumps automatically switch SSIDs, eliminating manual reconnection at ward boundaries. These innovations confirm wireless as the mobility engine of the medical device connectivity market.

The Medical Device Connectivity Market Report is Segmented by Component (Connectivity Solutions [Device Interface Modules and More] and Connectivity Services [Implementation & Integration and More]), Technology (Wired and More), Application (Continuous Patient Monitoring and More), End-User (Hospitals & Clinics and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 38.58% of 2024 revenue due to mature EHR penetration, strict interoperability enforcement, and early adoption of edge analytics. CMS penalties for information blocking and new API mandates compel providers to deploy standards-based gateways that seamlessly connect bedside devices with payer portals. Academic medical centers pilot AI-augmented surveillance that merges continuous monitoring with predictive scoring, accelerating procurement of high-throughput connectivity hubs. Venture investment in digital health startups further expands the regional footprint of the medical device connectivity market.

Asia Pacific is forecast to expand 26.73% annually between 2025-2030, the fastest worldwide. China scales smart hospital blueprints featuring private 5G, robotics, and cloud PACS integration, while India's production-linked incentive schemes nurture indigenous device manufacturers embedding open-standard interfaces from inception. Japan upgrades rural clinics with tele-stroke networks, leveraging government stimulus that reimburses cross-prefecture consults over encrypted VPNs. South Korea and Australia incentivize data-centric healthcare pilots, creating fertile ground for wireless telemetry and AI triage algorithms. These dynamics are positioning the region as a critical growth engine of the medical device connectivity market.

Europe grows at a projected 21.54% CAGR, supported by the Medical Device Regulation and General Data Protection Regulation, which jointly elevate interoperability and cybersecurity bars. Germany subsidizes hospital digital maturity upgrades under its Hospital Futures Act, accelerating HL7-FHIR gateway procurements. The United Kingdom mandates digital maturity assessments for NHS trusts, unlocking funding for secure device onboarding. Nordic countries pioneer 6G research testbeds for clinical use, and pan-EU initiatives encourage cross-border data exchange via the European Health Data Space. Strong attention to privacy and security shapes vendor selection, with hospitals favoring platforms offering zero-trust designs and granular consent management, reinforcing Europe's stature within the medical device connectivity market.

- Ascom

- Baxter

- Cisco Systems

- Digi International Inc.

- Dragerwerk

- GE HealthCare Technologies Inc.

- Honeywell International

- ICU Medical

- Koninklijke Philips

- Lantronix Inc.

- Masimo

- Medtronic

- Mindray

- NantHealth

- Nihon Kohden

- Oracle

- S3 Connected Health

- Siemens Healthineers

- Spectrum Medical Ltd

- Stryker

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EMR interoperability mandates and digital-health policies

- 4.2.2 Outcome-based reimbursement demanding real-time data

- 4.2.3 Expansion of remote and home-based chronic-care monitoring

- 4.2.4 Convergence of IoT cybersecurity frameworks

- 4.2.5 Proliferation of multi-parameter wearable & implantable devices

- 4.2.6 Cloud-native analytics enabling predictive clinical insights

- 4.3 Market Restraints

- 4.3.1 Heterogeneous legacy device fleets without data standards

- 4.3.2 High upfront integration and interface-engine costs

- 4.3.3 Persistent cybersecurity and patient-privacy vulnerabilities

- 4.3.4 Limited workflow alignment causing clinician resistance

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Component

- 5.1.1 Connectivity Solutions

- 5.1.1.1 Interface Engines & Integration Platforms

- 5.1.1.2 Connectivity Hubs & Gateways

- 5.1.1.3 Device Interface Modules

- 5.1.2 Connectivity Services

- 5.1.2.1 Implementation & Integration

- 5.1.2.2 Support & Maintenance

- 5.1.2.3 Consulting & Training

- 5.1.1 Connectivity Solutions

- 5.2 By Technology

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.2.3 Hybrid

- 5.3 By Application

- 5.3.1 Continuous Patient Monitoring

- 5.3.2 Tele-ICU & Tele-Stroke

- 5.3.3 Imaging & PACS Connectivity

- 5.3.4 Medication Administration & Smart IV Pumps

- 5.3.5 Anesthesia & Ventilator

- 5.3.6 Other Applications

- 5.4 By End-User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Ambulatory Surgery & Specialty Centers

- 5.4.3 Home Healthcare Settings

- 5.4.4 Other End-Users

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Ascom Holding AG

- 6.4.2 Baxter International Inc

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Digi International Inc.

- 6.4.5 Dragerwerk AG & Co. KGaA

- 6.4.6 GE HealthCare Technologies Inc.

- 6.4.7 Honeywell International Inc.

- 6.4.8 ICU Medical

- 6.4.9 Koninklijke Philips N.V.

- 6.4.10 Lantronix Inc.

- 6.4.11 Masimo Corporation

- 6.4.12 Medtronic plc

- 6.4.13 Mindray Medical International Limited

- 6.4.14 NantHealth, Inc.

- 6.4.15 Nihon Kohden Corporation

- 6.4.16 Oracle Corporation

- 6.4.17 S3 Connected Health

- 6.4.18 Siemens Healthineers AG

- 6.4.19 Spectrum Medical Ltd

- 6.4.20 Stryker Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment