PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850237

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850237

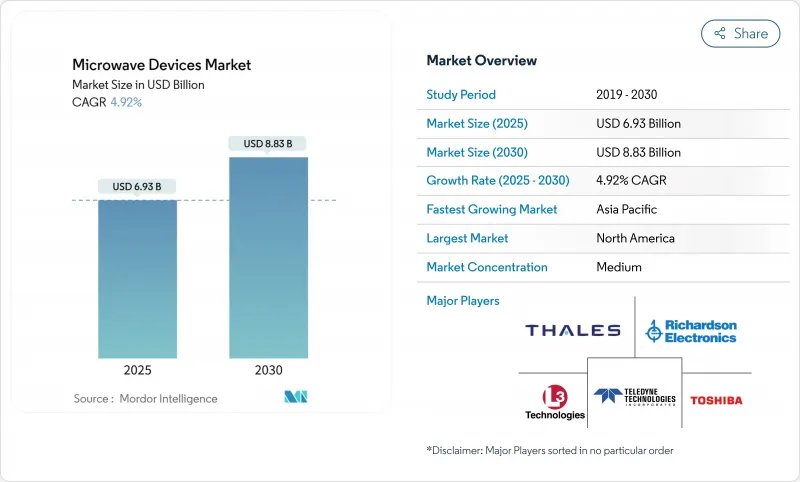

Microwave Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The microwave devices market reached a value of USD 6.93 billion in 2025 and is forecast to climb to USD 8.83 billion by 2030, reflecting a 4.92% CAGR.

Gains track a mature yet durable demand profile spanning defense, satellite communications, 5G back-haul, and emerging medical therapies. Gallium nitride (GaN) power devices continue to displace legacy gallium arsenide solutions, improving power density and efficiency while trimming system footprint and cooling loads. Ongoing defense modernization programs, highlighted by directed-energy weapon prototypes now on contract with the U.S. Department of Defense, underpin a robust baseline of high-power orders. Parallel roll-outs of 5G fixed-wireless access in the E- and V-bands sustain commercial momentum even as mass-tier handset volumes soften. Medical microwave ablation platforms round out a diversified demand stack, offering hospitals faster procedures and deeper lesion penetration than radiofrequency alternatives.

Global Microwave Devices Market Trends and Insights

Surge in Secure Military SATCOM Demand

Modern armed-forces networks require jam-resilient links and multi-band versatility. Recent U.S. Army fielding of modular VSAT terminals, backed by a USD 60 million contract with L3Harris, illustrates the shift toward compact systems that merge high data rates with quick deployment. GaN amplifiers enable the power levels and bandwidth now specified, speeding the retirement of vacuum tubes. Parallel Chinese investment in gigawatt-class high-power microwave (HPM) weapons fuels a technology race that keeps defense procurement pipelines active.

5G and FWA Backhaul Deployment in E- and V-Bands

Fixed-wireless backhaul offers gigabit-class throughput where fiber costs remain prohibitive. The FCC's USD 9 billion 5G Fund for Rural America anchors near-term demand for E- and V-band links. Satellites add another pull: a USD 19.7 million order from SpaceX for E-band solid-state power amplifiers affirms commercial scale for high-frequency microwave payloads.

High R&D Cost of Wide-Bandgap Devices

Epitaxial reactors for GaN and SiC run into the tens of millions of dollars, creating high entry barriers. Leading suppliers devote 15-20% of turnover to process optimization, a hurdle few new entrants can clear.

Other drivers and restraints analyzed in the detailed report include:

- Medical Microwave Ablation Adoption

- GaN-Based Solid-State PA Cost Declines

- Export Controls on Critical RF Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Active devices accounted for 62% of the microwave devices market in 2024 and advanced at a 7.57% CAGR to 2030. Size, weight, and reliability advantages are accelerating the swap from vacuum electron devices to GaN solid-state power amplifiers. The Microwave devices market size for active devices is on track to reach USD 5.3 billion by 2030. Integration trends fold beam-forming and gain-control logic into the amplifier die, enabling software-defined radio platforms. Vacuum tube products still serve ultra-high-power radar, but cede volume share as defense programs standardize on solid-state modules.

Second-level effects cascade into the passive segment, where discrete filters and couplers face pricing pressure as functions move on-chip. Medical ablation platforms prefer active solutions for millisecond-scale power modulation, reinforcing the segment's long-term growth trajectory. Product pipelines show rising demand for 24 V and 28 V GaN devices that align with emerging 5G macro radio architectures.

The Microwave Devices Market Report is Segmented by Device Type (Active [Solid-State, Vacuum Electron] and Passive [Filters, Couplers, Etc. ]), Frequency Band (L and S, C and X, and More), Application (Space and Communication, Defense [Radar, EW, DEW], , Medical [Ablation, Imaging] and More), and Geography.

Geography Analysis

North America retained a 38% stake in 2024, anchored by USD 9 billion in federal 5G subsidies and strong U.S. defense budgets. The microwave devices market continues to benefit from directed-energy weapon programs and rural broadband build-outs. Export-license compliance introduces cost friction, but established primes sustain local sourcing strategies that cushion supply disruptions.

Asia Pacific delivers the highest 7.24% CAGR to 2030. China controls 98% of mined gallium, giving domestic fabs cost leverage while exposing foreign integrators to price volatility. Regional governments fund 300 mm power-semiconductor fabs, and India's newly opened design houses add talent depth for RF front-end innovation. South Korea and Japan supply advanced test and packaging capacity, reinforcing a self-contained value chain.

Europe balances sovereign defense needs with commercial telecom expansion. EU policy incentives aim to localize GaN epitaxy and packaging capacity. Cross-Atlantic partnerships send European RF designs to North American fabs for pilot runs, then bring volume back to domestic lines, mitigating geopolitical risk. Sustainability directives further nudge network operators toward energy-efficient GaN platforms in new 5G and future 6G nodes.

- Communications and Power Industries (CPI)

- Teledyne Technologies

- Thales Group

- L3Harris Technologies

- Toshiba Corporation

- Qorvo Inc.

- Analog Devices Inc.

- Keysight Technologies

- TMD Technologies Ltd.

- Richardson Electronics Ltd.

- Northrop Grumman

- Raytheon Technologies

- MACOM Technology

- Microchip Technology

- Cobham Advanced Electronic Solutions

- NXP Semiconductors

- API Technologies (AEA Investors LP)

- Smiths Interconnect

- Ampleon

- MicroWave Technology Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in secure military SATCOM demand

- 4.2.2 5G and FWA backhaul deployment in E- and V-bands

- 4.2.3 Medical microwave ablation adoption

- 4.2.4 GaN-based solid-state PA cost declines

- 4.2.5 Regulatory incentives for rural broadband

- 4.2.6 Demand for high-power DEW systems

- 4.3 Market Restraints

- 4.3.1 High RandD cost of wide-bandgap devices

- 4.3.2 Export controls on critical RF components

- 4.3.3 Thermal management limits at >100 GHz

- 4.3.4 Competition from photonic links in X-haul

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Type

- 5.1.1 Active (Solid-state, Vacuum Electron)

- 5.1.2 Passive (Filters, Couplers, etc.)

- 5.2 By Frequency Band

- 5.2.1 L and S

- 5.2.2 C and X

- 5.2.3 Ku and Ka

- 5.2.4 V and E (mmWave)

- 5.3 By Application

- 5.3.1 Space and Communication

- 5.3.2 Defense (Radar, EW, DEW)

- 5.3.3 Medical (Ablation, Imaging)

- 5.3.4 Commercial and Industrial Heating

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 France

- 5.4.3.3 Germany

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Communications and Power Industries (CPI)

- 6.4.2 Teledyne Technologies

- 6.4.3 Thales Group

- 6.4.4 L3Harris Technologies

- 6.4.5 Toshiba Corporation

- 6.4.6 Qorvo Inc.

- 6.4.7 Analog Devices Inc.

- 6.4.8 Keysight Technologies

- 6.4.9 TMD Technologies Ltd.

- 6.4.10 Richardson Electronics Ltd.

- 6.4.11 Northrop Grumman

- 6.4.12 Raytheon Technologies

- 6.4.13 MACOM Technology

- 6.4.14 Microchip Technology

- 6.4.15 Cobham Advanced Electronic Solutions

- 6.4.16 NXP Semiconductors

- 6.4.17 API Technologies (AEA Investors LP)

- 6.4.18 Smiths Interconnect

- 6.4.19 Ampleon

- 6.4.20 MicroWave Technology Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment